11++ Bank negara malaysia bond yield ideas in 2021

Home » money laundering idea » 11++ Bank negara malaysia bond yield ideas in 2021Your Bank negara malaysia bond yield images are available in this site. Bank negara malaysia bond yield are a topic that is being searched for and liked by netizens now. You can Get the Bank negara malaysia bond yield files here. Download all royalty-free images.

If you’re searching for bank negara malaysia bond yield pictures information connected with to the bank negara malaysia bond yield interest, you have visit the ideal blog. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Bank Negara Malaysia Bond Yield. Provides comprehensive Malaysias bonds market information and analysis yield curve for Malaysian Goverment Bond Malaysian Government Securities MGS Islamic Bond Cagamas Khazanah Bond and Corporate Bond. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018. The Security Industry Act 1983 regulates all matters related to dealing of securities in MalaysiaIn addition various rules and regulations were issued by Bank Negara Malaysia and Securities Commission to facilitate the smooth. Due to Malaysias investment grade credit rating progressive and inclusive financial market policies developed infrastructure and ample secondary market liquidity Malaysian bonds have been included in various global bond indices.

Credit Of Conventional And Islamic Banks In Malaysia Sources The Download Scientific Diagram From researchgate.net

Credit Of Conventional And Islamic Banks In Malaysia Sources The Download Scientific Diagram From researchgate.net

Introduction Malaysia has a well-developed regulatory framework that governed both the primary market issuance and secondary market trading of debt securities. BNM likely to cut OPR again. Cagamas kicks off 2021 with bonds sukuk issuances worth RM710mil. Economic and Financial Developments in the Malaysian Economy in the First Quarter of 2012 International Reserves of BNM as at 15 May 2012 Memorandum of Understanding between Bank Negara Malaysia and Central Bank of the Republic of Turkey. Total Volume RM million Daily change bps Tenure. Morgan Government Bond Index Emerging Markets GBI-EM.

Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009.

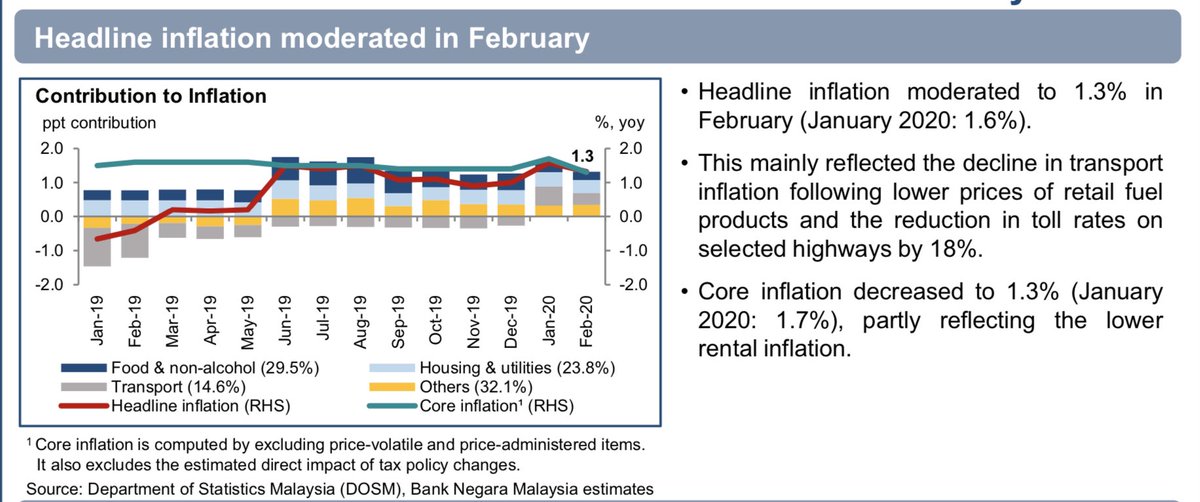

The domestic bond market experienced a temporary spike in bond yields with 10-year Malaysian Government Securities MGS and 10-year AAA corporate bond yields rising by 84 bps and 59 bps respectively amid significant NR outflows RM224 billion or USD52 billion between February and April. Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. It always has fix term maturity can bear a coupon and trades on the normal yield price relationship see attached appendix II on calculation method. The issuance of sukuk Ijarah added diversity of monetary instruments used by Bank Negara Malaysia in managing liquidity in the Islamic Money Market. Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009. For conventional investors the structuring of the bonds by the issuer is immaterial.

Source: researchgate.net

Source: researchgate.net

The inaugural issuance of RM400 million Bank Negara Malaysia Sukuk Ijarah which is a new Islamic monetary instrument based on the Al-Ijarah or sale and lease back concept that is globally accepted. Bank Negara Malaysias BNM unexpected overnight policy rate OPR cut and the Covid-19 outbreak have pushed Malaysian bond yields. Total Volume RM million Daily change bps Tenure. The inaugural issuance of RM400 million Bank Negara Malaysia Sukuk Ijarah which is a new Islamic monetary instrument based on the Al-Ijarah or sale and lease back concept that is globally accepted. KUALA LUMPUR March 20.

Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. 21 rows Trading Yields. BNM revised conventional overnight tender from RM322 billion to RM329 billion. BNM likely to cut OPR again. Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009.

Source: centralbanking.com

Source: centralbanking.com

The yields of 10-year Malaysia Government Securities spiked to 358 on Thursday from 284 at end-February according to RAM Rating Services Bhd RAM as investors flee to safe-haven assets on fears of a global recession even as central banks continue to cut rates and ease monetary policy. All offers must be submitted before 1630hrs. Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009. BNM revised conventional overnight tender from RM322 billion to RM329 billion. Bank Negara Malaysias BNM unexpected overnight policy rate OPR cut and the Covid-19 outbreak have pushed Malaysian bond yields.

Source: bnm.gov.my

Source: bnm.gov.my

Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. It always has fix term maturity can bear a coupon and trades on the normal yield price relationship see attached appendix II on calculation method. Even as central banks continue to cut rates and ease monetary policy a flight to safe-haven assets prevailed setting off a rapid spike in 10-year MGS yields to 358 on 19 March from 284 at end-February. Bank Negara Malaysias BNM unexpected overnight policy rate OPR cut and the Covid-19 outbreak have pushed Malaysian bond yields. RM32900 mil for 3 days.

Source: bloomberg.com

Source: bloomberg.com

RM32900 mil for 3 days. Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. Cagamas kicks off 2021 with bonds sukuk issuances worth RM710mil. Click here to view the Government Securities Yield for various tenures 2006-2018. 14 rows Bank Negara Malaysia.

Source: twitter.com

Source: twitter.com

Both Bank Negara Malaysia BNM and the. 21 rows Trading Yields. The Security Industry Act 1983 regulates all matters related to dealing of securities in MalaysiaIn addition various rules and regulations were issued by Bank Negara Malaysia and Securities Commission to facilitate the smooth. KUALA LUMPUR March 20. Both Bank Negara Malaysia BNM and the.

21 rows Trading Yields. MGS are issued via competitive auction by Bank Negara Malaysia on behalf of the Government. Provides comprehensive Malaysias bonds market information and analysis yield curve for Malaysian Goverment Bond Malaysian Government Securities MGS Islamic Bond Cagamas Khazanah Bond and Corporate Bond. The Security Industry Act 1983 regulates all matters related to dealing of securities in MalaysiaIn addition various rules and regulations were issued by Bank Negara Malaysia and Securities Commission to facilitate the smooth. Both Bank Negara Malaysia BNM and the.

Source: malaymail.com

Source: malaymail.com

Successful bidders are determined according to the lowest yields offered and the coupon rate is fixed at the weighted average yield of successful bids. Even as central banks continue to cut rates and ease monetary policy a flight to safe-haven assets prevailed setting off a rapid spike in 10-year MGS yields to 358 on 19 March from 284 at end-February. Introduction Malaysia has a well-developed regulatory framework that governed both the primary market issuance and secondary market trading of debt securities. The yields of 10-year Malaysia Government Securities spiked to 358 on Thursday from 284 at end-February according to RAM Rating Services Bhd RAM as investors flee to safe-haven assets on fears of a global recession even as central banks continue to cut rates and ease monetary policy. BNM likely to cut OPR again.

Source: malaywallpaper.blogspot.com

Source: malaywallpaper.blogspot.com

The inaugural issuance of RM400 million Bank Negara Malaysia Sukuk Ijarah which is a new Islamic monetary instrument based on the Al-Ijarah or sale and lease back concept that is globally accepted. The Security Industry Act 1983 regulates all matters related to dealing of securities in MalaysiaIn addition various rules and regulations were issued by Bank Negara Malaysia and Securities Commission to facilitate the smooth. The role of Bank Negara Malaysia is to promote monetary and financial stability. Bloomberg Barclays Global Aggregate Index. Morgan Government Bond Index Emerging Markets GBI-EM.

Source: nst.com.my

Source: nst.com.my

Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. RM32900 mil for 3 days. Total Volume RM million Daily change bps Tenure. Successful bidders are determined according to the lowest yields offered and the coupon rate is fixed at the weighted average yield of successful bids. For conventional investors the structuring of the bonds by the issuer is immaterial.

Source: centralbanking.com

Source: centralbanking.com

Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009. It always has fix term maturity can bear a coupon and trades on the normal yield price relationship see attached appendix II on calculation method. The domestic bond market experienced a temporary spike in bond yields with 10-year Malaysian Government Securities MGS and 10-year AAA corporate bond yields rising by 84 bps and 59 bps respectively amid significant NR outflows RM224 billion or USD52 billion between February and April. Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. Total Volume RM million Daily change bps Tenure.

Source: researchgate.net

Source: researchgate.net

Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. Introduction Malaysia has a well-developed regulatory framework that governed both the primary market issuance and secondary market trading of debt securities. The inaugural issuance of RM400 million Bank Negara Malaysia Sukuk Ijarah which is a new Islamic monetary instrument based on the Al-Ijarah or sale and lease back concept that is globally accepted. BNM revised conventional overnight tender from RM322 billion to RM329 billion. Malaysia rate outlook split amid lockdown.

RM15700 mil for 3 days. Cagamas kicks off 2021 with bonds sukuk issuances worth RM710mil. Both Bank Negara Malaysia BNM and the. Introduction Malaysia has a well-developed regulatory framework that governed both the primary market issuance and secondary market trading of debt securities. MGS are issued via competitive auction by Bank Negara Malaysia on behalf of the Government.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank negara malaysia bond yield by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information