12+ Bank negara malaysia objectives ideas

Home » money laundering Info » 12+ Bank negara malaysia objectives ideasYour Bank negara malaysia objectives images are available in this site. Bank negara malaysia objectives are a topic that is being searched for and liked by netizens today. You can Download the Bank negara malaysia objectives files here. Find and Download all royalty-free images.

If you’re searching for bank negara malaysia objectives pictures information connected with to the bank negara malaysia objectives keyword, you have come to the ideal blog. Our website always gives you hints for seeing the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

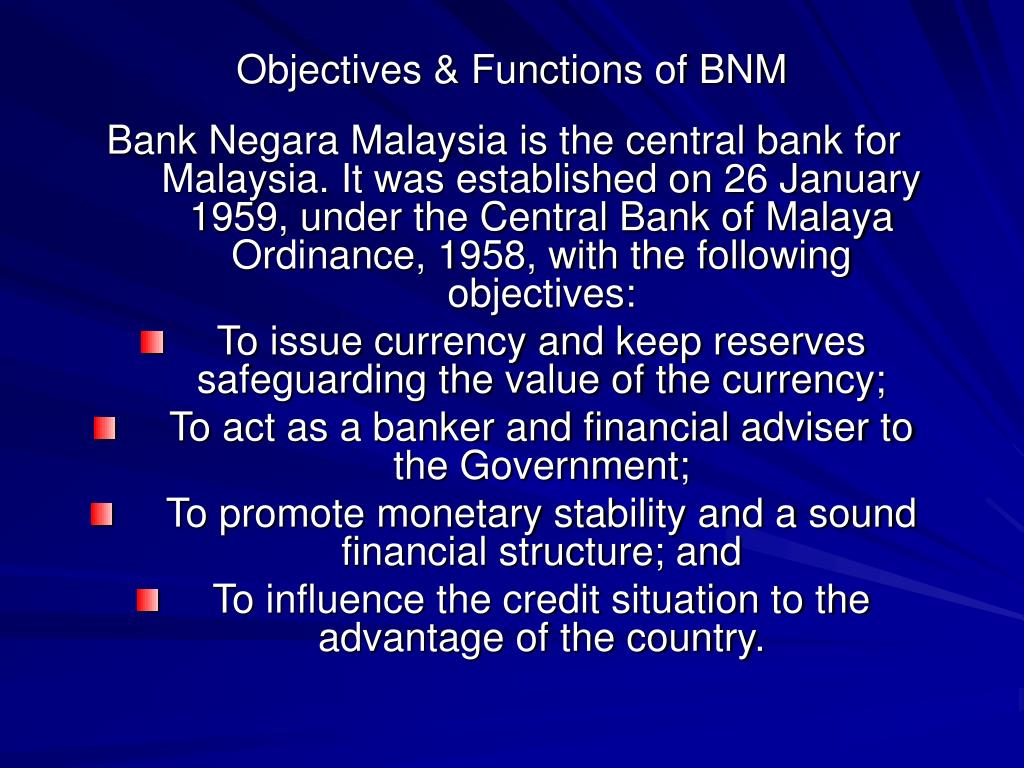

Bank Negara Malaysia Objectives. To promote monetary stability and a sound financial structure To act as a banker and financial adviser to the Government To issue currency and keep reserves safeguarding the value of the currency. Discuss in detail the objectives of Bank Negara Malaysia. This is aimed at providing a conducive environment for the sustainable growth of the Malaysian economy. As such the promotion of a safe secure and efficient payment system is an important objective of Bank Negara Malaysia.

The objectives of Bank Negara Malaysia is t o promote monetary stability and a sound financial structureMonetary stability refers to the stability of the value of the Malaysian currency the ringgit. Implemented under the Exchange Control Act 1953 with detailed policies and procedures being promulgated by BNM via Exchange Control Notices of Malaysia ECMs Ensure that the countrys limited financial resources are used for purposes that will benefit the Malaysian economy Able to increase the countrys productivity and earn foreign exchange Bank Negara Malaysia BNM monitor. Discuss in detail the objectives of Bank Negara Malaysia. C to promote monetary stability and a sound financial structure. When the economy is overheating and the threat of inflation is high Bank Negara Malaysia will increase the bank reserve such as reduce the rate for Statutory Reserve Requirement SRR or Statutory Liquidity Requirement SLR. As such the promotion of a safe secure and efficient payment system is an important objective of Bank Negara Malaysia.

To act as a.

Bank Negara Malaysia Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. This is aimed at providing a conducive environment for the sustainable growth of the Malaysian economy. When the economy is overheating and the threat of inflation is high Bank Negara Malaysia will increase the bank reserve such as reduce the rate for Statutory Reserve Requirement SRR or Statutory Liquidity Requirement SLR. It was established on 26 January 1959 under the Central Bank of Malaya Ordinance 1958 with the following objectives. As such the promotion of a safe secure and efficient payment system is an important objective of Bank Negara Malaysia. Generally the roles of Bank Negara Malaysia are.

Source: slideserve.com

Source: slideserve.com

Bank Negara Malaysia is the central bank for Malaysia. It was established on 26 January 1959 under the Central Bank of Malaya Ordinance 1958 with the following objectives. C to promote monetary stability and a sound financial structure. Generally the roles of Bank Negara Malaysia are. B to act as a banker and financial adviser or agent to the Government.

Source: academia.edu

Source: academia.edu

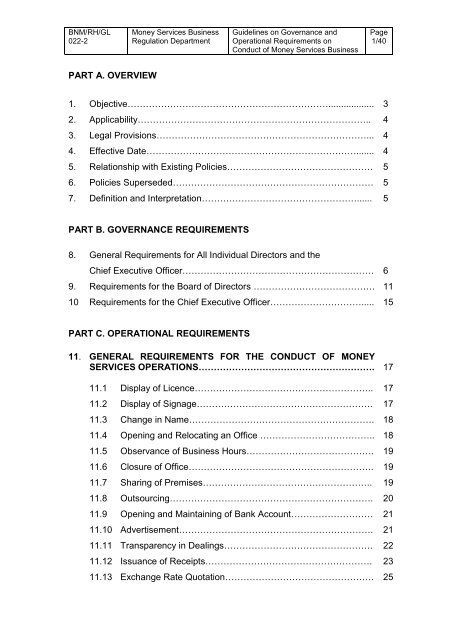

Objectives Functions. I Objectives of BNM The objectives of BNM are. The Role of Bank Negara Malaysia in. In particular the Bank ensures that the availability and cost of money and credit in the economy are consonant with national Macroeconomic objectives. The central bank of Malaysia or Bank Negara is the heart of Malaysian banking.

Source: slideshare.net

Source: slideshare.net

Bank Negara Malaysia conducts its monetary policy by influencing the level of interest rates. Discuss in detail the objectives of Bank Negara Malaysia. Tutorial 3- Bank Negara Malaysia 1. Bank Negara Malaysia Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. To act as a.

Source: yumpu.com

Source: yumpu.com

To act as a. In this respect the Bank acts as the banker for currency issue keeper of Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. C to promote monetary stability and a sound financial structure. A to issue currency and keep reserves while safeguarding the value of the currency. It was established on 26 January 1959 under the Central Bank of Malaya Ordinance 1958 with the following objectives.

Source: slideserve.com

Source: slideserve.com

Bank Negara Malaysia is governed by the Central Bank of Malaysia Act 2009. Implemented under the Exchange Control Act 1953 with detailed policies and procedures being promulgated by BNM via Exchange Control Notices of Malaysia ECMs Ensure that the countrys limited financial resources are used for purposes that will benefit the Malaysian economy Able to increase the countrys productivity and earn foreign exchange Bank Negara Malaysia BNM monitor. To promise monetary stability and a sound financial structure To act banker and financial adviser to the government To issue currency and keep reserves safeguarding the value of the currency. Bank Negara Malaysia plays an important role in regulating and supervising the financial institutions. A well-functioning payment system is crucial for the efficient operation of the financial market as well as to support the Malaysian economy.

Source: massa.net.my

Source: massa.net.my

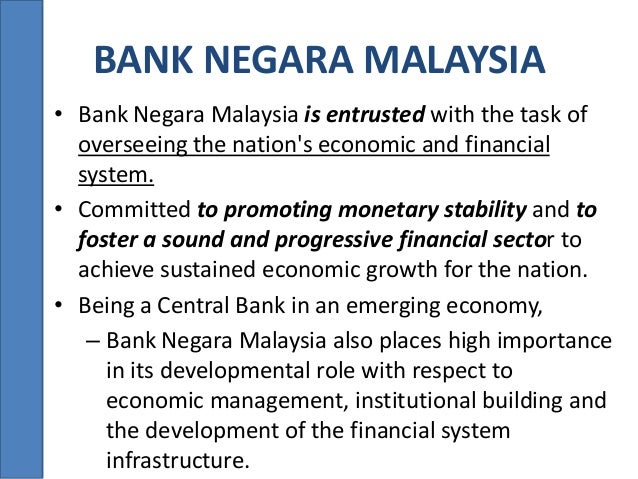

Bank Negara Malaysia is the central bank for Malaysia. Bank Negara Malaysia is the central bank for Malaysia. The principal objective of the bank is to promote monetary and financial stability that is conducive to the sustainable growth of the Malaysian economy. In particular the Bank ensures that the availability and cost of money and credit in the economy are consonant with national Macroeconomic objectives. In this respect the Bank acts as the banker for currency issue keeper of Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959.

Source: bnm.gov.my

Source: bnm.gov.my

Bank Negara Malaysias objectives include issuing currency and keeping reserves safeguarding the value of the currency acting as a banker and economic and financial adviser to the Government promoting the reliable efficient and smooth operation of national payment and settlement systems and to ensure that the national payment and settlement. Generally the roles of Bank Negara Malaysia are. In particular the Bank ensures that the availability and cost of money and credit in the economy are consonant with national Macroeconomic objectives. Bank Negara Malaysias objectives include issuing currency and keeping reserves safeguarding the value of the currency acting as a banker and economic and financial adviser to the Government promoting the reliable efficient and smooth operation of national payment and settlement systems and to ensure that the national payment and settlement. Bank Negara Malaysia is also responsible for financial system stability.

Source: researchgate.net

Source: researchgate.net

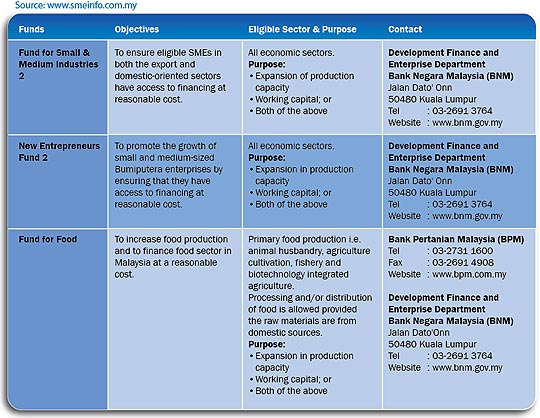

Bank Negara Malaysia Bank Negara Malaysia the Central Bank of Malaysia is a statutory body which started operations on 26 January 1959. It also aims to ensure that the DFIs policies and objectives are consistent with the Governments initiatives and policy direction in developing and promoting the identified targeted sectors to support the national economic development agenda. Generally the roles of Bank Negara Malaysia are. This can be seen in terms of its role in setting the required reserves and capital requirement that each institutions should have. Bank Negara Malaysias monetary policy stance is to maintain price stability while remaining supportive of growth.

Source: bnm.gov.my

Source: bnm.gov.my

Bank Negara Malaysia conducts its monetary policy by influencing the level of interest rates. Implemented under the Exchange Control Act 1953 with detailed policies and procedures being promulgated by BNM via Exchange Control Notices of Malaysia ECMs Ensure that the countrys limited financial resources are used for purposes that will benefit the Malaysian economy Able to increase the countrys productivity and earn foreign exchange Bank Negara Malaysia BNM monitor. The objectives of Bank Negara Malaysia is t o promote monetary stability and a sound financial structureMonetary stability refers to the stability of the value of the Malaysian currency the ringgit. Generally the roles of Bank Negara Malaysia are. It was established on 26 January 1959 under the Central Bank of Malaya Ordinance 1958 with the following objectives.

Bank Negara Malaysia is also responsible for financial system stability. Placement of DFIs under Bank Negara Malaysia. Bank Negara Malaysia is the central bank for Malaysia. Bank Negara Malaysia plays an important role in regulating and supervising the financial institutions. A well-functioning payment system is crucial for the efficient operation of the financial market as well as to support the Malaysian economy.

Source: bnm.gov.my

Source: bnm.gov.my

To promote monetary stability and a sound financial structure To act as a banker and financial adviser to the Government To issue currency and keep reserves safeguarding the value of the currency. The objectives of Bank Negara Malaysia as outlined in the CBA are. Generally the roles of Bank Negara Malaysia are. To issue currency and keep reserves safeguarding the value of the currency. I Objectives of BNM The objectives of BNM are.

B to act as a banker and financial adviser or agent to the Government. This can be seen in terms of its role in setting the required reserves and capital requirement that each institutions should have. To promise monetary stability and a sound financial structure To act banker and financial adviser to the government To issue currency and keep reserves safeguarding the value of the currency. A well-functioning payment system is crucial for the efficient operation of the financial market as well as to support the Malaysian economy. Generally the roles of Bank Negara Malaysia are.

Source: slideshare.net

Source: slideshare.net

Activities regulated by Bank Negara Malaysia Key regulatory objective Safety and soundness of financial services provider is key to maintaining consumer trust and confidence in the financial system. Tutorial 3- Bank Negara Malaysia 1. A well-functioning payment system is crucial for the efficient operation of the financial market as well as to support the Malaysian economy. The objectives of Bank Negara Malaysia is t o promote monetary stability and a sound financial structureMonetary stability refers to the stability of the value of the Malaysian currency the ringgit. Bank Negara Malaysias monetary policy stance is to maintain price stability while remaining supportive of growth.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank negara malaysia objectives by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas