16+ Bank secrecy act compliance training ideas

Home » money laundering Info » 16+ Bank secrecy act compliance training ideasYour Bank secrecy act compliance training images are ready in this website. Bank secrecy act compliance training are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act compliance training files here. Download all free vectors.

If you’re searching for bank secrecy act compliance training images information related to the bank secrecy act compliance training keyword, you have visit the ideal site. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

Bank Secrecy Act Compliance Training. Anti Money Laundering Bank Secrecy Act Learn how to combat money laundering terrorism financing. Ad Learn Banking online at your own pace. Get Inspired With reedcouk. Join millions of learners from around the world already learning on Udemy.

Bank Secrecy Act Bsa Youtube From youtube.com

Bank Secrecy Act Bsa Youtube From youtube.com

CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements. The regulation requires each bank to implement minimum security procedures to discourage bank burglaries and robberies. BSA OFAC Training Agenda 1. Ad Learn Banking online at your own pace. BANK SECRECY ACT COMPLIANCE TRAINING FOR EXECUTIVES AND VOLUNTEERS Annual Meeting and Convention Ocean City MD June 3 2019 This program is intended to assist credit union volunteers in complying with BSAAML and to further provide guidance and resource information. This anti-money laundering AML course is designed for financial institutions to help them prevent money laundering and terrorist financing and learn.

Bank Secrecy Act training for the Board of.

Anti Money Laundering Bank Secrecy Act Learn how to combat money laundering terrorism financing. Anti Money Laundering Bank Secrecy Act Learn how to combat money laundering terrorism financing. By Nancy Castiglione CRCM A fill-in-the-blank training tool for use in Bank Secrecy ActAnti-Money Laundering training primarily aimed at management compliance and BSAAML personnel. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. Start today and improve your skills. Banks are required to have bank secrecy act training processes that determine which transactions are potentially suspicious and implement strong BSA compliance program so click through to better understand your BSA training.

Source: complianceonline.com

Source: complianceonline.com

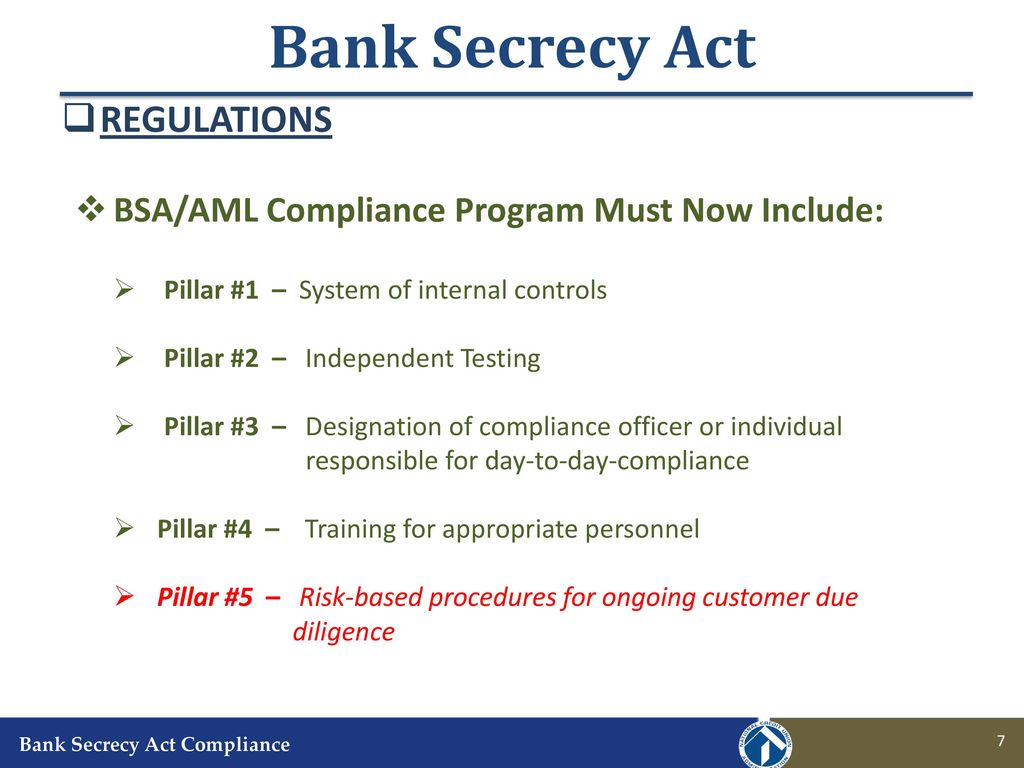

BSA OFAC Training Agenda 1. Training is a core requirement of a satisfactory Bank Secrecy Act and Anti-Money Laundering BSAAML compliance program. The regulation requires each bank to implement minimum security procedures to discourage bank burglaries and robberies. The training program may be used to reinforce the importance that the board of directors and senior management place on the banks compliance with the BSA and that all employees understand their role in maintaining an adequate BSAAML compliance program. Start today and improve your skills.

1 At a minimum a BSAAML training program must provide training for all personnel whose duties require knowledge of the BSA. Ad Learn Banking online at your own pace. The regulation requires each bank to implement minimum security procedures to discourage bank burglaries and robberies. History Overview of the Bank Secrecy Act 2. Get Inspired With reedcouk.

This online manual contains CUNA. Training is a core requirement of a satisfactory Bank Secrecy Act and Anti-Money Laundering BSAAML compliance program. Reporting Recordkeeping CTRs SARs Member Identification WiresFunds Transfers Sale of Monetary Instruments 4. CUNA is not engaged in rendering legal or other professional advice in presenting this information. Ad Learn Banking online at your own pace.

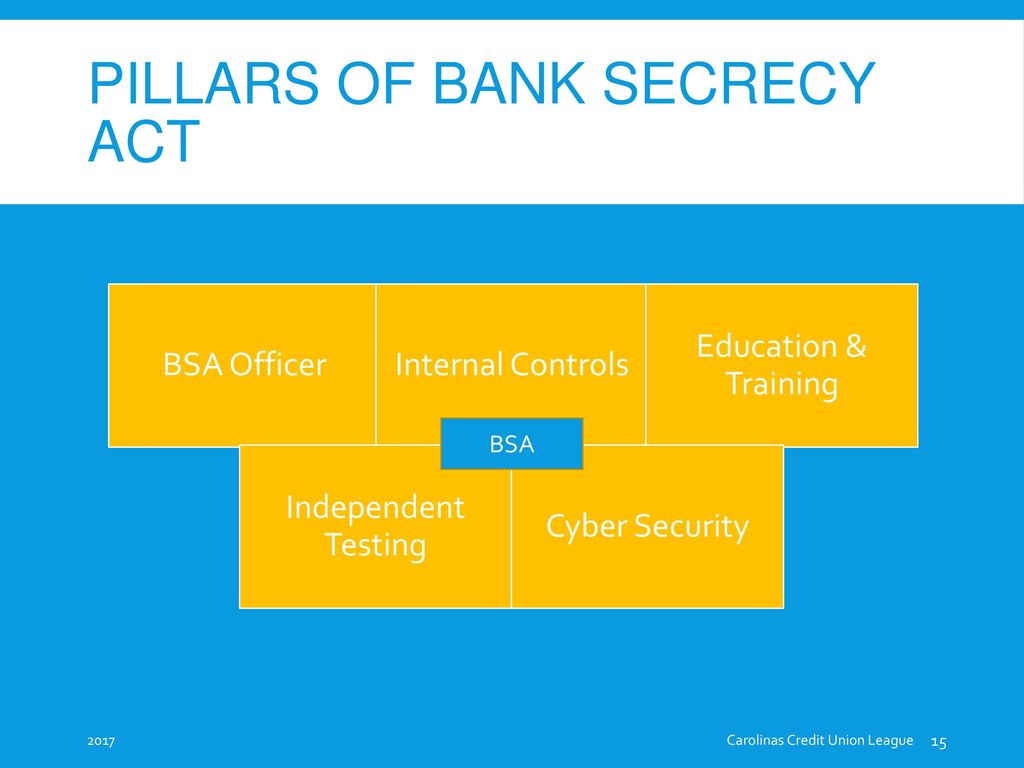

Source: slideplayer.com

Source: slideplayer.com

Ad Learn Banking online at your own pace. Join millions of learners from around the world already learning on Udemy. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. This anti-money laundering AML course is designed for financial institutions to help them prevent money laundering and terrorist financing and learn. BANK SECRECY ACT COMPLIANCE TRAINING FOR EXECUTIVES AND VOLUNTEERS Annual Meeting and Convention Ocean City MD June 3 2019 This program is intended to assist credit union volunteers in complying with BSAAML and to further provide guidance and resource information.

Source: blog.gao.gov

Source: blog.gao.gov

Bank Secrecy Act BSA Training BSA compiance is tough. 1 At a minimum a BSAAML training program must provide training for all personnel whose duties require knowledge of the BSA. In addition this part requires banks to implement a program to comply with the Bank Secrecy Act BSA as promulgated by the regulation issued by the Department of Treasury at 31 CFR Chapter X as part of the banks Anti-Money Laundering AML program. Anti Money Laundering Bank Secrecy Act Learn how to combat money laundering terrorism financing. CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements.

Source: probank.com

Source: probank.com

Compliance Requirements Risk Assessment Policies Programs Compliance Officer Internal Controls 3. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. Start today and improve your skills. History Overview of the Bank Secrecy Act 2. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance.

Source: youtube.com

Source: youtube.com

Bank Secrecy Act BSA Training BSA compiance is tough. The regulation requires each bank to implement minimum security procedures to discourage bank burglaries and robberies. Get Inspired With reedcouk. Get training to meet your Bank Secrecy Act BSA training requirements. Bank Secrecy Act BSA Training BSA compiance is tough.

Source: acamstoday.org

Source: acamstoday.org

Start today and improve your skills. CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements. History Overview of the Bank Secrecy Act 2. In addition this part requires banks to implement a program to comply with the Bank Secrecy Act BSA as promulgated by the regulation issued by the Department of Treasury at 31 CFR Chapter X as part of the banks Anti-Money Laundering AML program. CUNA is not engaged in rendering legal or other professional advice in presenting this information.

Source: bankerscompliance.com

Source: bankerscompliance.com

BANK SECRECY ACT COMPLIANCE TRAINING FOR EXECUTIVES AND VOLUNTEERS Annual Meeting and Convention Ocean City MD June 3 2019 This program is intended to assist credit union volunteers in complying with BSAAML and to further provide guidance and resource information. CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements. This anti-money laundering AML course is designed for financial institutions to help them prevent money laundering and terrorist financing and learn. Banks are required to have bank secrecy act training processes that determine which transactions are potentially suspicious and implement strong BSA compliance program so click through to better understand your BSA training. This online manual contains CUNA.

Source: slideplayer.com

Source: slideplayer.com

BSA OFAC Training Agenda 1. Ad Learn Banking online at your own pace. This anti-money laundering AML course is designed for financial institutions to help them prevent money laundering and terrorist financing and learn. The regulation requires each bank to implement minimum security procedures to discourage bank burglaries and robberies. Ad Easily Search Compare Our Compliance Courses Today.

Source: bankerscompliance.com

Source: bankerscompliance.com

Banks are required to have bank secrecy act training processes that determine which transactions are potentially suspicious and implement strong BSA compliance program so click through to better understand your BSA training. Training programs should include examples of money laundering and suspicious activity monitoring and reporting that are tailored as appropriate. Get Inspired With reedcouk. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. There has been an increasing trend where examiners are strongly encouraging financial institutions to increase their compliance training efforts for the Board of Directors especially in the area of the Bank Secrecy Act BSA.

Source: banktrainingcenter.com

Source: banktrainingcenter.com

One or more words may be used to fill-in the blanks Fill-in-the-Blank BSAAML Training Tool PDF Copyright 2021 Compliance Action. The training program may be used to reinforce the importance that the board of directors and senior management place on the banks compliance with the BSA and that all employees understand their role in maintaining an adequate BSAAML compliance program. Anti Money Laundering Bank Secrecy Act Learn how to combat money laundering terrorism financing. This online manual contains CUNA. Ad Easily Search Compare Our Compliance Courses Today.

Source: probank.com

Source: probank.com

Ad Easily Search Compare Our Compliance Courses Today. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. The training program may be used to reinforce the importance that the board of directors and senior management place on the banks compliance with the BSA and that all employees understand their role in maintaining an adequate BSAAML compliance program. Start today and improve your skills. Join millions of learners from around the world already learning on Udemy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act compliance training by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas