19+ Bank secrecy act definition information

Home » money laundering Info » 19+ Bank secrecy act definition informationYour Bank secrecy act definition images are available in this site. Bank secrecy act definition are a topic that is being searched for and liked by netizens now. You can Download the Bank secrecy act definition files here. Download all royalty-free vectors.

If you’re searching for bank secrecy act definition images information related to the bank secrecy act definition interest, you have come to the right site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

Bank Secrecy Act Definition. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. Bank Secrecy Act means the Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Also known as the Currency and Foreign. Government in cases of suspected money laundering and fraud.

Bank Secrecy Act Bsa From mortgagesanalyzed.com

Bank Secrecy Act Bsa From mortgagesanalyzed.com

Also known as the Currency and Foreign. Definition of Bank Secrecy Act Noun Legislation requiring banks to document any transaction that is substantial in nature over 10000 so as to create a record for authorities to track suspicious transactions. The purpose of the BSA is to require United States US. Bank Secrecy Act United States legislation enacted in 1970 that mandates greater disclosures by banks on transfers of money. The Bank Secrecy Act BSA is US. 1051 et seq as the same may be amended supplemented modified replaced or otherwise in effect from time to time.

Bank Secrecy Act BSA Definition The Bank Secrecy Act BSA which was passed in 1970 and is sometimes referred to as the Currency and Foreign Transactions Reporting Act or the Anti-Money Laundering Act AML is a statute designed to curb money laundering events.

Financial institutions to work cooperatively with the government to prevent money laundering. BSA Related Regulations. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The banks act 1990 To provide for the regulation and supervision of the business of public companies taking deposits from the public. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

Source: sygna.io

Bank Secrecy Act means the Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. It also requires banks to inform the federal government of. Bank Secrecy Act BSA Definition The Bank Secrecy Act BSA which was passed in 1970 and is sometimes referred to as the Currency and Foreign Transactions Reporting Act or the Anti-Money Laundering Act AML is a statute designed to curb money laundering events. 1051 et seq as the same may be amended supplemented modified replaced or otherwise in effect from time to time. Financial institutions to work cooperatively with the government to prevent money laundering.

Source: americanbanker.com

Source: americanbanker.com

The Bank Secrecy Act BSA is US. Financial institutions to work cooperatively with the government to prevent money laundering. 1051 et seq as the same may be amended supplemented modified replaced or otherwise in effect from time to time. A recipients financial institution accepts a transmittal order by paying the recipient by notifying the recipient of the. Also known as the Currency and Foreign.

Source: mortgagesanalyzed.com

Source: mortgagesanalyzed.com

Bank Secrecy Act BSA Definition The Bank Secrecy Act BSA which was passed in 1970 and is sometimes referred to as the Currency and Foreign Transactions Reporting Act or the Anti-Money Laundering Act AML is a statute designed to curb money laundering events. Financial Institutions and Businesses Regulated by Bank Secrecy Act A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. Bank Secrecy Act United States legislation enacted in 1970 that mandates greater disclosures by banks on transfers of money. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. Financial institutions to work cooperatively with the government to prevent money laundering.

Source: complianceonline.com

Source: complianceonline.com

BANK SECRECY ACT DEFINITIONS Definitions BSA 31CFR103 Accept A receiving financial institution other than the recipients financial institution accepts a transmittal order by executing the transmittal order. Also known as the Currency and Foreign. Definition of Bank Secrecy Act Noun Legislation requiring banks to document any transaction that is substantial in nature over 10000 so as to create a record for authorities to track suspicious transactions. The law requires financial institutions to provide. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money.

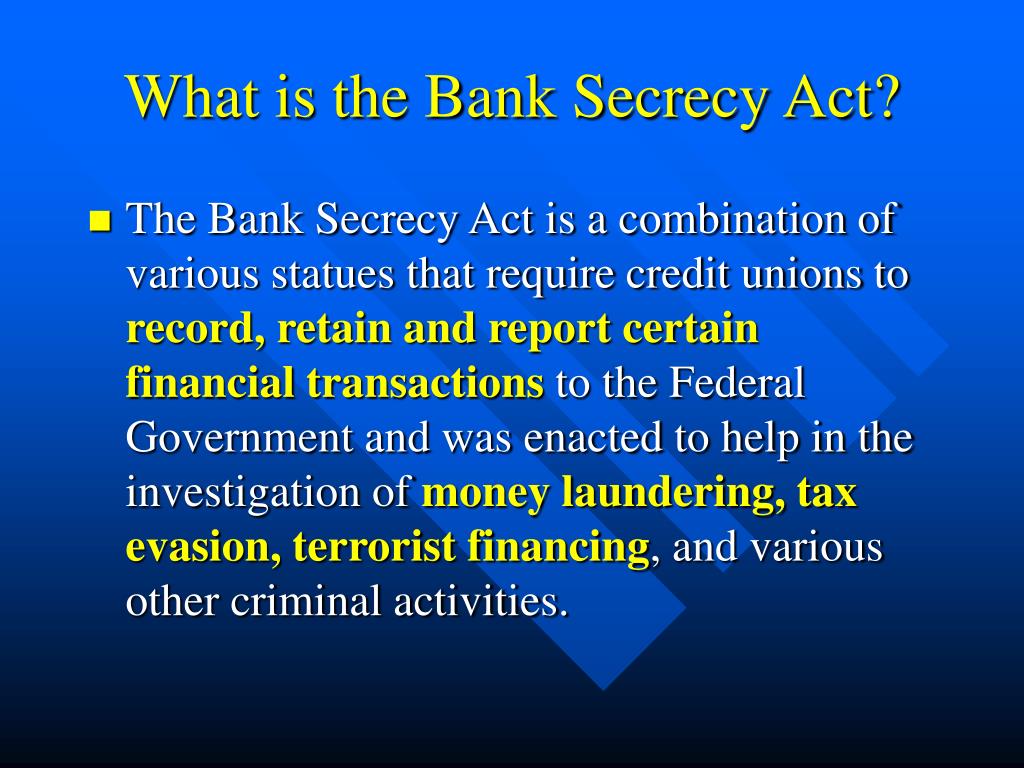

Source: slideserve.com

Source: slideserve.com

United States legislation enacted in 1970 that mandates greater disclosures by banks on transfers of money. The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US. BSA Related Regulations. Bank Secrecy Act BSA Definition The Bank Secrecy Act BSA which was passed in 1970 and is sometimes referred to as the Currency and Foreign Transactions Reporting Act or the Anti-Money Laundering Act AML is a statute designed to curb money laundering events. It also requires banks to inform the federal government of.

Source: slideplayer.com

Source: slideplayer.com

Also known as the Currency and Foreign. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND. Bank Secrecy Act BSA Definition The Bank Secrecy Act BSA which was passed in 1970 and is sometimes referred to as the Currency and Foreign Transactions Reporting Act or the Anti-Money Laundering Act AML is a statute designed to curb money laundering events. The purpose of the BSA is to require United States US. Bank Secrecy Act United States legislation enacted in 1970 that mandates greater disclosures by banks on transfers of money.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

Passed in 1970 the Bank Secrecy Act BSA requires US. 5311 et seq is referred to as the Bank Secrecy Act BSA. Specifically it requires banks to file reports on purchases of negotiable instruments like commercial paper for more than 10000 if they are bought with cash. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND. Financial institutions to collaborate with the US.

Source: slideserve.com

Source: slideserve.com

A recipients financial institution accepts a transmittal order by paying the recipient by notifying the recipient of the. Bank Secrecy Act United States legislation enacted in 1970 that mandates greater disclosures by banks on transfers of money. The law requires financial institutions to provide. The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. BANK SECRECY ACT DEFINITIONS Definitions BSA 31CFR103 Accept A receiving financial institution other than the recipients financial institution accepts a transmittal order by executing the transmittal order.

The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US. It also requires banks to inform the federal government of. Bank Secrecy Act means the Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Financial Institutions and Businesses Regulated by Bank Secrecy Act A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. Bank Secrecy Act BSA Definition The Bank Secrecy Act BSA which was passed in 1970 and is sometimes referred to as the Currency and Foreign Transactions Reporting Act or the Anti-Money Laundering Act AML is a statute designed to curb money laundering events.

Source: mossadams.com

Source: mossadams.com

1051 et seq as the same may be amended supplemented modified replaced or otherwise in effect from time to time. The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. A recipients financial institution accepts a transmittal order by paying the recipient by notifying the recipient of the. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. A recipients financial institution accepts a transmittal order by paying the recipient by notifying the recipient of the. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. The law requires financial institutions to provide.

Source: moneylaundry.vercel.app

Source: moneylaundry.vercel.app

The purpose of the BSA is to require United States US. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. Bank Secrecy Act United States legislation enacted in 1970 that mandates greater disclosures by banks on transfers of money. The BSA was amended to incorporate the.

Source: academia.edu

Source: academia.edu

Specifically it requires banks to file reports on purchases of negotiable instruments like commercial paper for more than 10000 if they are bought with cash. BANK SECRECY ACT DEFINITIONS Definitions BSA 31CFR103 Accept A receiving financial institution other than the recipients financial institution accepts a transmittal order by executing the transmittal order. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 must contain the name and address of the borrower the loan amount the nature or purpose of the loan and the date the loan was madeThe stated purpose can be very general such as a passbook loan. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas