11+ Bank secrecy act definition of customer info

Home » money laundering Info » 11+ Bank secrecy act definition of customer infoYour Bank secrecy act definition of customer images are ready. Bank secrecy act definition of customer are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act definition of customer files here. Get all royalty-free photos and vectors.

If you’re looking for bank secrecy act definition of customer images information linked to the bank secrecy act definition of customer keyword, you have come to the ideal blog. Our website frequently gives you hints for seeing the maximum quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

Bank Secrecy Act Definition Of Customer. Financial institutions to collaborate with the US. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. The Bank Secrecy Act BSA is US.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

However it actually mandates that the Secretary of the Treasury require all banks and other financial. It specifically requires financial institutions to. Banking business means the business of receiving money on current or deposit account paying and collecting cheques drawn by or paid in by customers the making of advances to customers and includes such other business as the Authority may prescribe for the purposes of this Act. 1951 - 1959 18 USC. These statutes are codified at 12 USC. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US.

Government agencies in detecting and preventing money laundering.

BSA GLOSSARY 4 Ineligible Businesses A business engaged primarily in one or more of the following activities. The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. However it actually mandates that the Secretary of the Treasury require all banks and other financial. 1957 18 USC. 5311 - 5314 and. BSA GLOSSARY 4 Ineligible Businesses A business engaged primarily in one or more of the following activities.

However it actually mandates that the Secretary of the Treasury require all banks and other financial. The Currency and Foreign Transactions Reporting Act its amendments and the other statutes relating to the subject matter of that Act have come to be referred to as the Bank Secrecy Act. 1829b 12 USC. Bank Secrecy Act BSA Definition The Bank Secrecy Act BSA which was passed in 1970 and is sometimes referred to as the Currency and Foreign Transactions Reporting Act or the Anti-Money Laundering Act AML is a statute designed to curb money laundering events. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act.

Source: mortgagesanalyzed.com

Source: mortgagesanalyzed.com

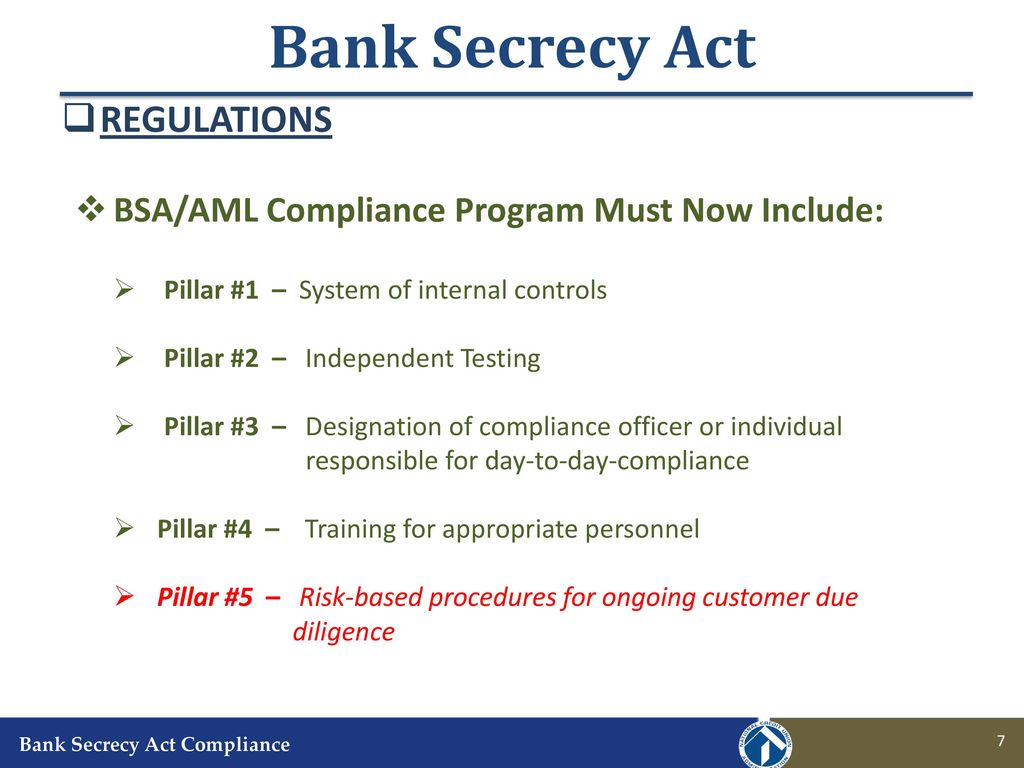

Banks are required to submit documentation for any transactions that add up to 10000 or more. 232001 2 A bank in Singapore or any of its officers may for such purpose as may be specified in the first column of the Third Schedule disclose customer information to. The cornerstone of a strong Bank Secrecy ActAnti-Money Laundering BSAAML compliance program is the adoption and implementation of internal controls which include comprehensive customer due diligence CDD policies procedures and processes for all customers particularly those that present a high risk for money. 5311 et seq is referred to as the Bank Secrecy Act BSA. The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

BSA GLOSSARY 4 Ineligible Businesses A business engaged primarily in one or more of the following activities. Banks are required to submit documentation for any transactions that add up to 10000 or more. And Foreign Transactions Act of 1970 31 USC. Most recent amendment to MLA brought the definition of consumer credit in line with the Truth in Lending Act and its implementing Regulation Z which. It specifically requires financial institutions to.

Source: complianceonline.com

Source: complianceonline.com

The USA PATRIOT Act requires CIPs for a broad category of companies that fall under the definition of financial institution a term defined by the Bank Secrecy Act to include the following institutions. An investment banker or investment company. Law requiring financial institutions in the United States to assist US. However it actually mandates that the Secretary of the Treasury require all banks and other financial. Financial institutions to collaborate with the US.

Source: slideserve.com

Source: slideserve.com

1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act. The examiner should review the appropriate subsections of IRM 4269 as part of the pre-planning process. It specifically requires financial institutions to. The cornerstone of a strong Bank Secrecy ActAnti-Money Laundering BSAAML compliance program is the adoption and implementation of internal controls which include comprehensive customer due diligence CDD policies procedures and processes for all customers particularly those that present a high risk for money. Financial institutions to assist US.

Source: slidetodoc.com

Source: slidetodoc.com

The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. An investment banker or investment company. It specifically requires financial institutions to. Banking business means the business of receiving money on current or deposit account paying and collecting cheques drawn by or paid in by customers the making of advances to customers and includes such other business as the Authority may prescribe for the purposes of this Act. The examiner should review the appropriate subsections of IRM 4269 as part of the pre-planning process.

Source: brb-bi.net

Source: brb-bi.net

Most recent amendment to MLA brought the definition of consumer credit in line with the Truth in Lending Act and its implementing Regulation Z which. The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. 5311 - 5314 and. Government agencies in detecting and preventing money laundering. Law requiring financial institutions in the United States to assist US.

Source: slideplayer.com

Source: slideplayer.com

Banks are required to submit documentation for any transactions that add up to 10000 or more. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. A broker or dealer in securities or commodities. Law requiring financial institutions in the United States to assist US. The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being used by criminals to hide their dirty money.

Source: slideplayer.com

Source: slideplayer.com

1957 18 USC. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. 1957 18 USC. The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions.

Source: slideserve.com

Source: slideserve.com

Black Attorney-at-Law in Telecommunications Law in the Internet Age 2002 Titles I-IVThe Bank Secrecy Act of 1970 120. The cornerstone of a strong Bank Secrecy ActAnti-Money Laundering BSAAML compliance program is the adoption and implementation of internal controls which include comprehensive customer due diligence CDD policies procedures and processes for all customers particularly those that present a high risk for money. Government agencies in detecting and preventing money laundering. The examiner should review the appropriate subsections of IRM 4269 as part of the pre-planning process. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US.

Source: slideplayer.com

Source: slideplayer.com

How transactions may be structured is dependent upon the specific financial services offered. 232001 2 A bank in Singapore or any of its officers may for such purpose as may be specified in the first column of the Third Schedule disclose customer information to. The CIP rule requires a bank to verify the identity of each customer Under the CIP rule a customer generally is defined as a person that opens a new account. The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US. The Bank Secrecy Act BSA is US.

Source: acamstoday.org

Source: acamstoday.org

5311 - 5314 and. Financial institutions to collaborate with the US. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act. Under the Bank Secrecy Act US. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships.

Source: slideplayer.com

Source: slideplayer.com

232001 2 A bank in Singapore or any of its officers may for such purpose as may be specified in the first column of the Third Schedule disclose customer information to. The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US. These statutes are codified at 12 USC. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. 5311 - 5314 and.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act definition of customer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas