17+ Bank secrecy act forms information

Home » money laundering Info » 17+ Bank secrecy act forms informationYour Bank secrecy act forms images are available in this site. Bank secrecy act forms are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act forms files here. Download all royalty-free images.

If you’re looking for bank secrecy act forms images information linked to the bank secrecy act forms interest, you have pay a visit to the right blog. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

Bank Secrecy Act Forms. 17 04-19-11 21 Cash in amount for individual or entity listed in item 4 22 Cash out amount for individual or entity listed in item 4 a If entity b. The BSA E-Filing system supports electronic filing of Bank Secrecy Act BSA forms either individually or in batches by a filing organization to the BSA database through a FinCEN secure network. Bank Secrecy Act Forms. The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions.

4 26 14 Disclosure Internal Revenue Service From irs.gov

4 26 14 Disclosure Internal Revenue Service From irs.gov

FinCEN is no longer accepting legacy reports. How to complete any Form FinCEN 109 online. It also allows members of filing organizations to send and receive secure messages to and from FinCEN. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. BANK SECRECY ACT DEFINITIONS Definitions BSA 31CFR103 Accept A receiving financial institution other than the recipients financial institution accepts a transmittal order by executing the transmittal order. 5311 et seq is referred to as the Bank Secrecy Act BSA.

How to complete any Form FinCEN 109 online.

The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being used by criminals to hide their dirty money. Learn more about BSA E-Filing here. The BSA was amended to incorporate the. Under the Bank Secrecy Act US. FinCEN is no longer accepting legacy reports. This enables authorities to track suspicious banking activity.

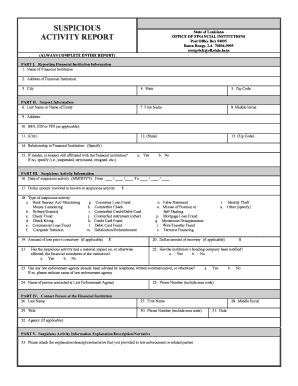

Source: pdffiller.com

Source: pdffiller.com

Detroit Computing Center Hotline 1-800-800-2877 FinCEN Regulatory Helpline 1-800-949-2732 To order free guidance materials 1-800-386-6329 To order BSA forms from the IRS Forms Distribution Center 1-800-829-3676. The Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act or BSA is the primary US. Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. Disclosure Form for Person Associated with a Financial Institution Government Securities Broker or Dealer. Law used to detect deter and disrupt money laundering and terrorist financing networks.

Source: irs.gov

Source: irs.gov

This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources. Legal Reference for Bank Secrecy Act Forms and Filing Requirements The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. Law used to detect deter and disrupt money laundering and terrorist financing networks. Add your own info and speak to data. The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being used by criminals to hide their dirty money.

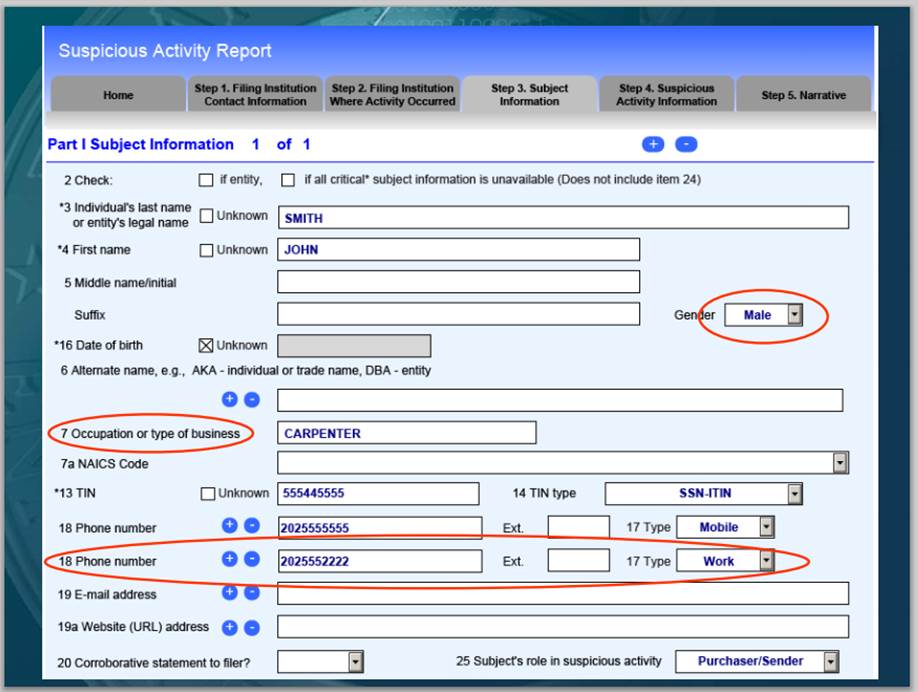

Source: acamstoday.org

Source: acamstoday.org

The BSA E-Filing System supports electronic filing of Bank Secrecy Act BSA forms either individually or in batches through a FinCEN secure network. Use your indications to submit established track record areas. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Bank Secrecy Act Forms. Department of the Treasurys Financial Crimes Enforcement Network FinCEN.

Source: securitiesanalytics.com

Source: securitiesanalytics.com

On the site with all the document click on Begin immediately along with complete for the editor. Bank Secrecy Act Currency Transaction Report For Paperwork Reduction Act Notice see page 4. Legal Reference for Bank Secrecy Act Forms and Filing Requirements The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions. It also allows members of filing organizations to send and receive secure messages to and from FinCEN. Add your own info and speak to data.

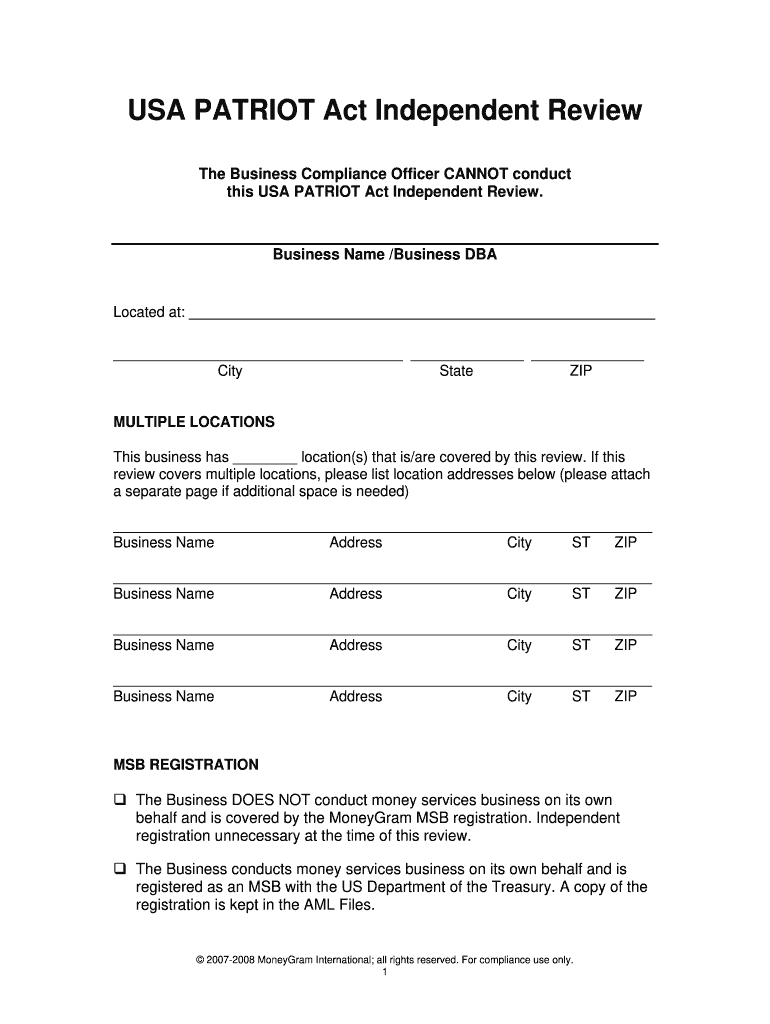

Source: aml-program-template.pdffiller.com

Source: aml-program-template.pdffiller.com

Disclosure Form for Person Associated with a Financial Institution Government Securities Broker or Dealer. BSA E-Filing provides a faster more convenient more secure and more cost-effective method for submitting BSA forms. The Bank Secrecy Act BSA requires many financial institutions including money services businesses MSB to keep records and file reports on certain transactions to the US. This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources. Legal Reference for Bank Secrecy Act Forms and Filing Requirements The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions.

Source: slideplayer.com

Source: slideplayer.com

First published on 03032013. POS ONE Bank Secrecy Act Online Forms United States federal anti money laundering laws require retail associates to complete PS Form 8105-A Funds Transaction Report FTR when selling financial instruments totaling 3000 or more to the same customer in the same day. 17 04-19-11 21 Cash in amount for individual or entity listed in item 4 22 Cash out amount for individual or entity listed in item 4 a If entity b. 5311 et seq is referred to as the Bank Secrecy Act BSA. This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources.

Source: irs.gov

Source: irs.gov

The purpose of the BSA is to require United States US. This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources. BANK SECRECY ACT REQUIREMENTS For answers to your questions about BSA reporting and recordkeeping requirements please visit wwwmsbgov. The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being used by criminals to hide their dirty money. A recipients financial institution accepts a transmittal order by paying the recipient by.

Source: pdffiller.com

Source: pdffiller.com

Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. A recipients financial institution accepts a transmittal order by paying the recipient by. The BSA E-Filing system supports electronic filing of Bank Secrecy Act BSA forms either individually or in batches by a filing organization to the BSA database through a FinCEN secure network. Use your indications to submit established track record areas. Department of the Treasurys Financial Crimes Enforcement Network FinCEN.

Source: irs.gov

Source: irs.gov

POS ONE Bank Secrecy Act Online Forms United States federal anti money laundering laws require retail associates to complete PS Form 8105-A Funds Transaction Report FTR when selling financial instruments totaling 3000 or more to the same customer in the same day. Detroit Computing Center Hotline 1-800-800-2877 FinCEN Regulatory Helpline 1-800-949-2732 To order free guidance materials 1-800-386-6329 To order BSA forms from the IRS Forms Distribution Center 1-800-829-3676. Department of the Treasurys Financial Crimes Enforcement Network FinCEN. Banks are required to submit documentation for any transactions that add up to 10000 or more. FinCEN is no longer accepting legacy reports.

Source: uslegalforms.com

Source: uslegalforms.com

The Bank Secrecy Act BSA requires many financial institutions including money services businesses MSB to keep records and file reports on certain transactions to the US. While most of the provisions under the Bank Secrecy Act were created as requirements for foreign banks to comply with the Fbar is an individual filing requirement. The Bank Secrecy Act Officer is responsible for developing implementing and administering all aspects of the Bank Secrecy Act Compliance Program for the Bank by performing various quality control reviews and monitoring in the areas of Bank Secrecy Act BSA USA Patriot Act Anti-Money Laundering AML Office of Foreign Assets Control OFAC and Customer Identification Program CIP compliance. A recipients financial institution accepts a transmittal order by paying the recipient by. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121.

Source: sygna.io

BSA E-Filing provides a faster more convenient more secure and more cost-effective method for submitting BSA forms. Disclosure Form for Person Associated with a Financial Institution Government Securities Broker or Dealer. Use your indications to submit established track record areas. How to complete any Form FinCEN 109 online. Learn more about BSA E-Filing here.

Source: irs.gov

Source: irs.gov

5311 et seq is referred to as the Bank Secrecy Act BSA. This page provides information regarding the Bank Secrecy Act BSA requirements forms publications and other BSA resources. Specifically this anti-money laundering law requires regulated financial institutions to keep records of. The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being used by criminals to hide their dirty money. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121.

Add your own info and speak to data. Bank Secrecy Act Currency Transaction Report For Paperwork Reduction Act Notice see page 4. Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. BSA E-Filing provides a faster more convenient more secure and more cost-effective method for submitting BSA forms. The BSA was amended to incorporate the.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act forms by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas