17+ Bank secrecy act high risk businesses ideas in 2021

Home » money laundering idea » 17+ Bank secrecy act high risk businesses ideas in 2021Your Bank secrecy act high risk businesses images are ready in this website. Bank secrecy act high risk businesses are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act high risk businesses files here. Get all royalty-free vectors.

If you’re looking for bank secrecy act high risk businesses images information related to the bank secrecy act high risk businesses keyword, you have come to the ideal blog. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Bank Secrecy Act High Risk Businesses. Outside of your own Annual Independent Review for BSA compliance we can. And include such relationships in appropriate monitoring for unusual or suspicious activity. The Bank Secrecy Act and Your Business. Identifying geographic locations that may pose a higher risk is essential to a credit unions BSAAML compliance program.

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office From blog.gao.gov

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office From blog.gao.gov

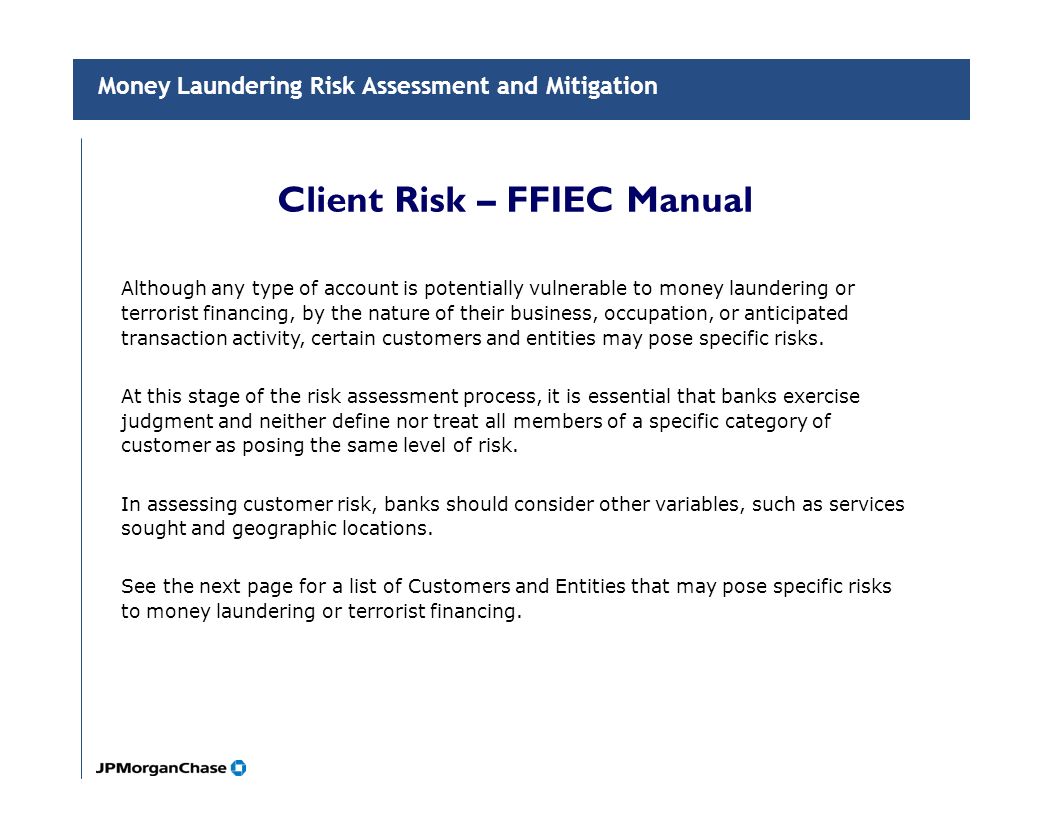

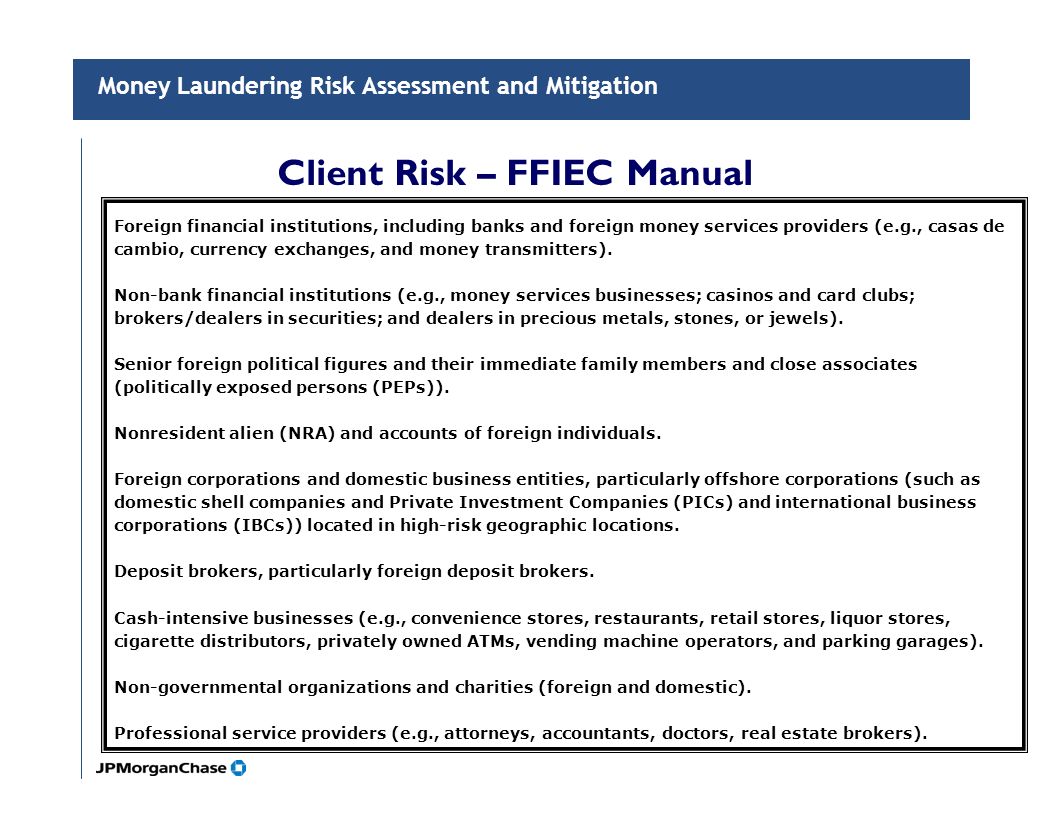

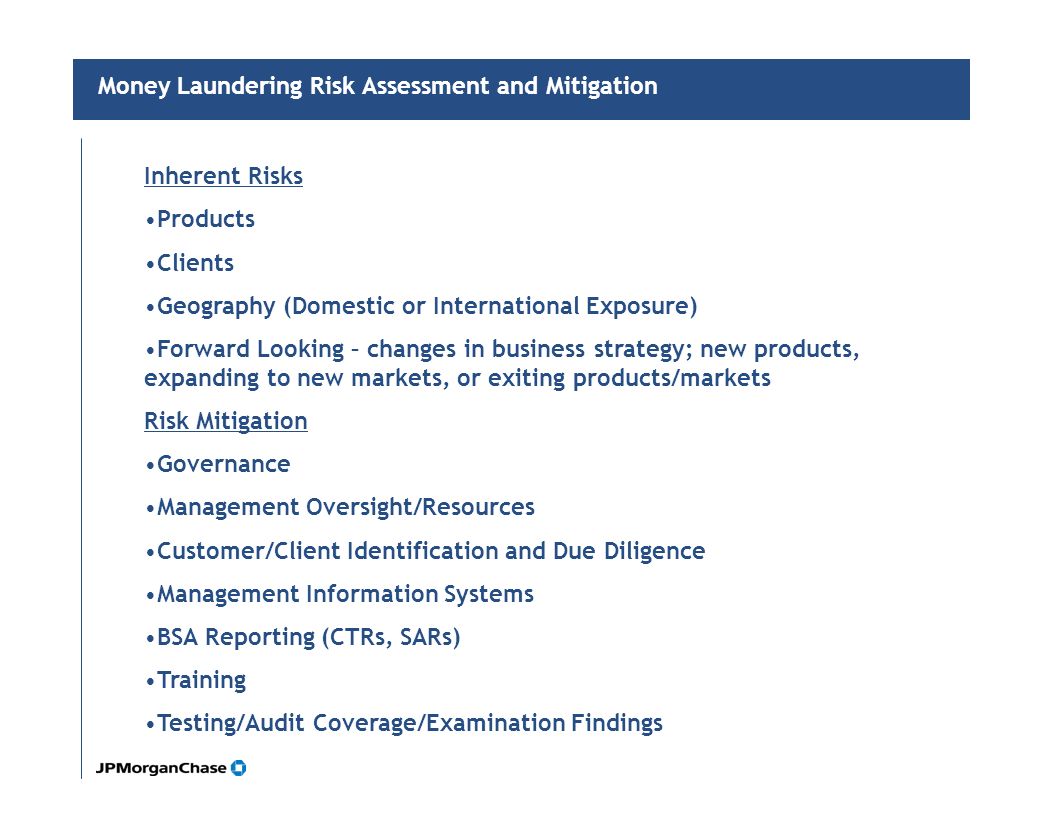

Businesses Nontraditional financial entities such as. Ineligible Businesses There are several higher-risk businesses that may not be exempted from CTR filings. When establishing and maintaining relationships with cash-intensive businesses banks should establish policies procedures and processes to identify higher-risk relationships. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. Asre and Ofer were trained in anti-money laundering compliance and procedures and represented to the financial institutions that because of their experience and training they understood the risks associated with the high-risk business lines and would conduct appropriate anti-money laundering oversight as required by the Bank Secrecy Act. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

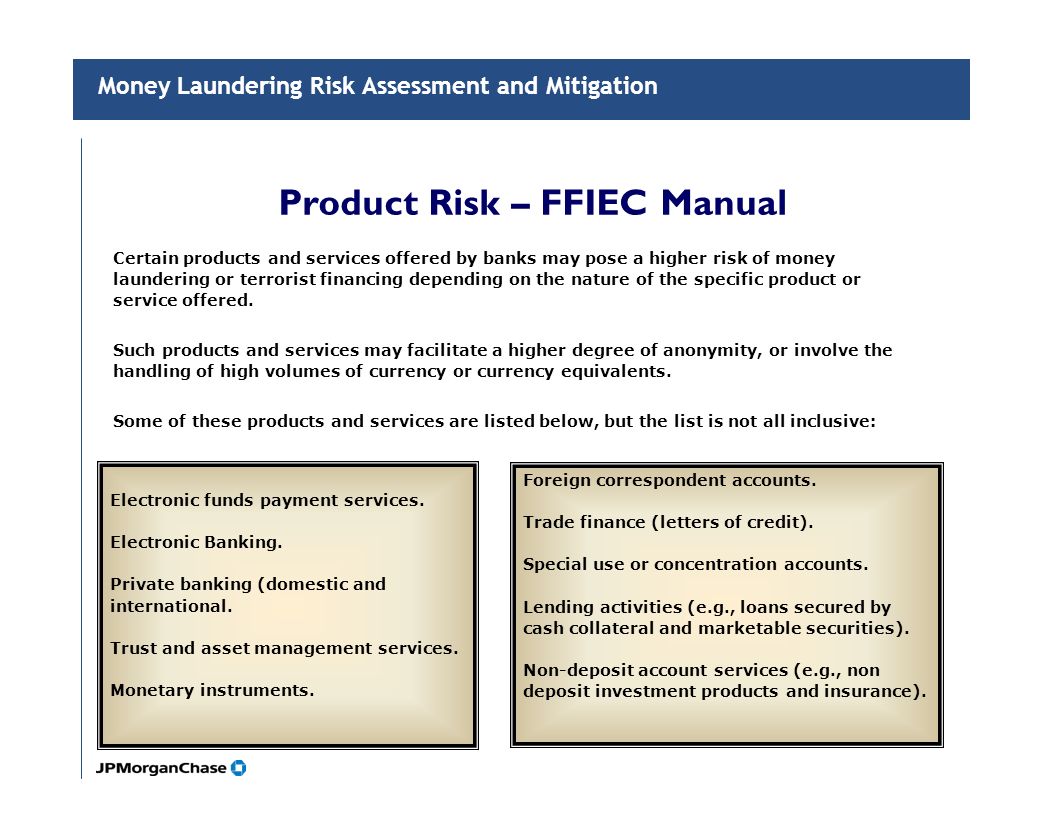

The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. Identify high-risk business activities businesses and foreign countries associated with money laundering. And include such relationships in appropriate monitoring for unusual or suspicious activity. Complete due diligence at account opening and periodically throughout the relationship. Businesses Nontraditional financial entities such as. Areas that may pose a higher risk such as funds transfers private banking trust and monetary instruments should be a primary focus of the transaction review.

Source: slideplayer.com

Source: slideplayer.com

Government has amended the original Act imposing many legislative and regulatory standards to help deter money laundering as one way to fight. Unsophisticated inadequate risk management Tons of cash. The scoping and planning process enables examiners to understand the money laundering terrorist financing MLTF and other illicit financial. Bankers Concerns in Serving MSBs High Degree of Risk and Exposure Associated with MSBs Risky Business. Areas that may pose a higher risk such as funds transfers private banking trust and monetary instruments should be a primary focus of the transaction review.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act BSA is the common title of the Currency and Foreign Transactions Reporting Act of 1970 which Congress. The Bank Secrecy Act and Your Business. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. Entities Included andor High-Risk Entities Excluded accordingly. Non-bank financial institutions or agents thereof this.

Ineligible Businesses There are several higher-risk businesses that may not be exempted from CTR filings. Identify high-risk business activities businesses and foreign countries associated with money laundering. This guidance explains how financial institutions 1 1. The agency which is a department of the US. Entities Included andor High-Risk Entities Excluded accordingly.

Source: slideplayer.com

Source: slideplayer.com

Perform detailed MSB file reviews. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. Unknown Vague Shady source of cash Criminals can abuse MSBs Difficult to understand monitor and manage the MSB relationships. What is the Bank Secrecy Act. Unsophisticated inadequate risk management Tons of cash.

![]() Source: adiconsulting.com

Source: adiconsulting.com

Bank Secrecy Act for Hemp-Related Business Customers The Financial Crimes Enforcement Network FinCEN is issuing this guidance to address questions related to Bank Secrecy ActAnti-Money Laundering BSAAML regulatory requirements for hemp-related business customers. Nontraditional financial entities such as. Complete due diligence at account opening and periodically throughout the relationship. The agency which is a department of the US. The nature of these businesses increases the likelihood that they can be used to facilitate money laundering and other illicit activities.

Source: complianceonline.com

Source: complianceonline.com

Non-bank financial institutions or agents thereof this. Generally corporate credit unions are required to establish and maintain procedures reasonably designed to assure compliance with the Bank Secrecy Act and the Department of Treasurys implementing regulations. The Bank Secrecy Act and Your Business. Youll be able to maintain these profitable relationships and sleep well knowing that your risk is being managed effectively. Nontraditional financial entities such as.

![]() Source: adiconsulting.com

Source: adiconsulting.com

Complete due diligence at account opening and periodically throughout the relationship. Bankers Concerns in Serving MSBs High Degree of Risk and Exposure Associated with MSBs Risky Business. Unknown Vague Shady source of cash Criminals can abuse MSBs Difficult to understand monitor and manage the MSB relationships. What is the Bank Secrecy Act. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121.

Source: slideplayer.com

Source: slideplayer.com

Bank Secrecy Act 4 Comptrollers Handbook each money laundering transaction. Youll be able to maintain these profitable relationships and sleep well knowing that your risk is being managed effectively. The scoping and planning process enables examiners to understand the money laundering terrorist financing MLTF and other illicit financial. Currency exchange houses also known as giros or casas de cambio. Credit unions should understand and evaluate the specific risks associated with doing business in opening accounts for customers from or facilitating transactions involving certain geographic locations.

Source: slideplayer.com

Source: slideplayer.com

Bank Secrecy Act 4 Comptrollers Handbook each money laundering transaction. Non-bank financial institutions or agents thereof this. The Act is actually made up of several statutes including the Money. Areas that may pose a higher risk such as funds transfers private banking trust and monetary instruments should be a primary focus of the transaction review. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity.

Source: acamstoday.org

Source: acamstoday.org

Nontraditional financial entities such as. Any property involved in the transaction or traceable to the proceeds of the criminal activity including loan collateral personal property. Credit unions should understand and evaluate the specific risks associated with doing business in opening accounts for customers from or facilitating transactions involving certain geographic locations. Treasury said the proposals under consideration will provide financial institutions with additional flexibility in addressing evolving AML. Perform detailed MSB file reviews.

Source: blog.gao.gov

Source: blog.gao.gov

Generally corporate credit unions are required to establish and maintain procedures reasonably designed to assure compliance with the Bank Secrecy Act and the Department of Treasurys implementing regulations. Casinos and card clubs. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. The scoping and planning process enables examiners to understand the money laundering terrorist financing MLTF and other illicit financial. What is the Bank Secrecy Act.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

BSA Related Regulations. Treasury said the proposals under consideration will provide financial institutions with additional flexibility in addressing evolving AML. The Bank Secrecy Act BSA is the common title of the Currency and Foreign Transactions Reporting Act of 1970 which Congress. Examiners assess the adequacy of the banks Bank Secrecy Actanti-money laundering BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes.

Source: slideplayer.com

Source: slideplayer.com

Offshore corporations and banks located in tax andor secrecy havens. Currency exchange houses also known as giros or casas de cambio. Government has amended the original Act imposing many legislative and regulatory standards to help deter money laundering as one way to fight. However geographic risk alone does not necessarily determine a customers or. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act high risk businesses by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information