16+ Bank secrecy act how does it work ideas

Home » money laundering idea » 16+ Bank secrecy act how does it work ideasYour Bank secrecy act how does it work images are available in this site. Bank secrecy act how does it work are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act how does it work files here. Download all free photos.

If you’re looking for bank secrecy act how does it work pictures information related to the bank secrecy act how does it work keyword, you have visit the ideal site. Our site frequently provides you with suggestions for viewing the highest quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

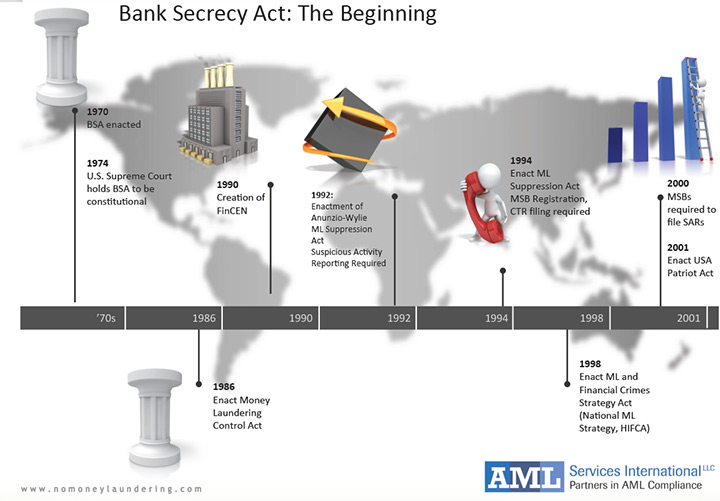

Bank Secrecy Act How Does It Work. Due diligence processes where we need them most. Government agencies in detecting and preventing money laundering such as. Among other things it requires banks to report large currency transactions in excess of 10000 to the Justice Department. Under the Bank Secrecy Act US.

Bsa Aml Compliance What Is The Bank Secrecy Act From complyadvantage.com

Bsa Aml Compliance What Is The Bank Secrecy Act From complyadvantage.com

Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. Government in cases o. Sarah walks into a bank with 11000 in cash and wants to make a deposit. In 1970 10000 was a lot of money – enough to buy a house in some parts of the country. Bank secrecy act how does it work. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

Even in cases where FinTechs are given a good degree of autonomy they should still work closely with their partner bank to ensure that both remain on the same page in terms of risk appetite.

The bank teller with a quick review of Sarahs account knows that Sarah does not normally deposit such large sums of cash into her account. This means keeping the partner bank up to date on any new product developments target customer segments and geographic expansion plans as all of these would impact the FinTechs financial crime. In 1970 10000 was a lot of money – enough to buy a house in some parts of the country. The sources of the cash in precise are legal and the cash is invested in a means that makes it appear to be clean cash and hide the identification of the felony a part of the cash earned. A Bank Secrecy Officer works within a bank credit union or similar financial institution to ensure compliance with laws and regulations pertaining to the United States Bank Secrecy Act. The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US.

Source: probank.com

Source: probank.com

Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The Bank Secrecy Act BSA is US. In 1970 10000 was a lot of money – enough to buy a house in some parts of the country. A federal law the Bank Secrecy Act BSA mandates that financial institutions must collect and retain information about their customers and their identities and share that information with the Financial Crimes Enforcement Network FinCEN a bureau within the Department of Treasury. The two initial statements made in the 2013 guidelines were confusing.

Source: complyadvantage.com

Source: complyadvantage.com

For an example of the Bank Secrecy Act at work consider the following. Even in cases where FinTechs are given a good degree of autonomy they should still work closely with their partner bank to ensure that both remain on the same page in terms of risk appetite. Government in cases o. Under the Bank Secrecy ActBSA financial institutions are required to assist US. The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US.

Source: pinterest.com

Source: pinterest.com

The two initial statements made in the 2013 guidelines were confusing. Sarah walks into a bank with 11000 in cash and wants to make a deposit. To help government agencies identify and prevent money laundering with a specific focus on the recording and reporting of cash purchases of things like bank notes checks demand drafts etcetera collectively referred to as negotiable instruments of more than 10000 as a daily aggregate amount. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. It required financial institutions in the US.

Source: pinterest.com

Source: pinterest.com

The sources of the cash in precise are legal and the cash is invested in a means that makes it appear to be clean cash and hide the identification of the felony a part of the cash earned. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. Also known as the Currency and Foreign Transactions Reporting Act the BSA is primarily concerned with preventing money laundering although it has been amended over the years by legislation such as the Patriot Act which expanded its scope to include. The Bank Secrecy Act does apply to currency exchangers people and entities that take virtual decentralized currency from one party and give it to another in exchange for more virtual currency funds or real currency. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and.

Source: complianceonline.com

Source: complianceonline.com

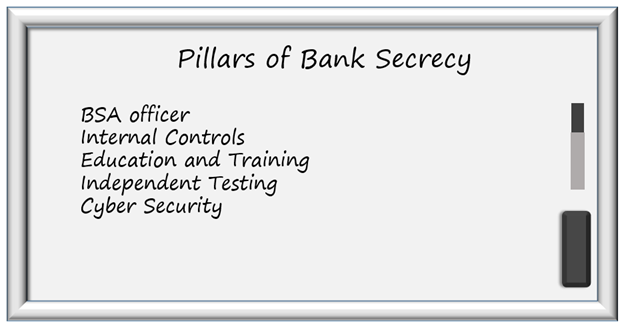

In 2017 however an average financially disciplined middle-class family. Financial institutions to collaborate with the US. A Bank Secrecy Officer works within a bank credit union or similar financial institution to ensure compliance with laws and regulations pertaining to the United States Bank Secrecy Act. To help government agencies identify and prevent money laundering with a specific focus on the recording and reporting of cash purchases of things like bank notes checks demand drafts etcetera collectively referred to as negotiable instruments of more than 10000 as a daily aggregate amount. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

Source: pinterest.com

Source: pinterest.com

It required financial institutions in the US. Among other things it requires banks to report large currency transactions in excess of 10000 to the Justice Department. The idea of money laundering is very important to be understood for these working in the financial sector. This means keeping the partner bank up to date on any new product developments target customer segments and geographic expansion plans as all of these would impact the FinTechs financial crime. In 2017 however an average financially disciplined middle-class family.

Source: pinterest.com

Source: pinterest.com

Therefore FinCEN updated the guidelines with additional. To help government agencies identify and prevent money laundering with a specific focus on the recording and reporting of cash purchases of things like bank notes checks demand drafts etcetera collectively referred to as negotiable instruments of more than 10000 as a daily aggregate amount. A Bank Secrecy Officer works within a bank credit union or other financial institution to ensure compliance with BSA laws and BSA regulations. The Bank Secrecy Act BSA has been in place in the United States since 1970 and is administered by the Financial Crimes Enforcement Network FinCen. Therefore FinCEN updated the guidelines with additional.

Source: brb-bi.net

Source: brb-bi.net

A federal law the Bank Secrecy Act BSA mandates that financial institutions must collect and retain information about their customers and their identities and share that information with the Financial Crimes Enforcement Network FinCEN a bureau within the Department of Treasury. Under the Bank Secrecy ActBSA financial institutions are required to assist US. The sources of the cash in precise are legal and the cash is invested in a means that makes it appear to be clean cash and hide the identification of the felony a part of the cash earned. Sarah walks into a bank with 11000 in cash and wants to make a deposit. This includes explicit instructions regarding identifying beneficial owners of legal entity customers.

Source: pinterest.com

Source: pinterest.com

Bank secrecy act how does it work. Bank secrecy act how does it work. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Government in cases o.

Source: forbes.com

Source: forbes.com

The Bank Secrecy Act BSA is US. Even in cases where FinTechs are given a good degree of autonomy they should still work closely with their partner bank to ensure that both remain on the same page in terms of risk appetite. A Bank Secrecy Officer works within a bank credit union or similar financial institution to ensure compliance with laws and regulations pertaining to the United States Bank Secrecy Act. This includes explicit instructions regarding identifying beneficial owners of legal entity customers. Sarah walks into a bank with 11000 in cash and wants to make a deposit.

Source: pinterest.com

Source: pinterest.com

The two initial statements made in the 2013 guidelines were confusing. Government agencies in detecting and preventing money laundering such as. To help government agencies identify and prevent money laundering with a specific focus on the recording and reporting of cash purchases of things like bank notes checks demand drafts etcetera collectively referred to as negotiable instruments of more than 10000 as a daily aggregate amount. Bank secrecy act how does it work. A federal law the Bank Secrecy Act BSA mandates that financial institutions must collect and retain information about their customers and their identities and share that information with the Financial Crimes Enforcement Network FinCEN a bureau within the Department of Treasury.

Source: acamstoday.org

Source: acamstoday.org

Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Sarah walks into a bank with 11000 in cash and wants to make a deposit. A federal law the Bank Secrecy Act BSA mandates that financial institutions must collect and retain information about their customers and their identities and share that information with the Financial Crimes Enforcement Network FinCEN a bureau within the Department of Treasury. It required financial institutions in the US.

Source: acamstoday.org

Source: acamstoday.org

The sources of the cash in precise are legal and the cash is invested in a means that makes it appear to be clean cash and hide the identification of the felony a part of the cash earned. The Bank Secrecy Act of 1970 was designed to detect money laundering by organized criminals. The two initial statements made in the 2013 guidelines were confusing. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. Under the Bank Secrecy ActBSA financial institutions are required to assist US.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act how does it work by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information