17++ Bank secrecy act information sharing info

Home » money laundering idea » 17++ Bank secrecy act information sharing infoYour Bank secrecy act information sharing images are ready in this website. Bank secrecy act information sharing are a topic that is being searched for and liked by netizens today. You can Get the Bank secrecy act information sharing files here. Download all free photos.

If you’re looking for bank secrecy act information sharing pictures information linked to the bank secrecy act information sharing topic, you have visit the right site. Our website always provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

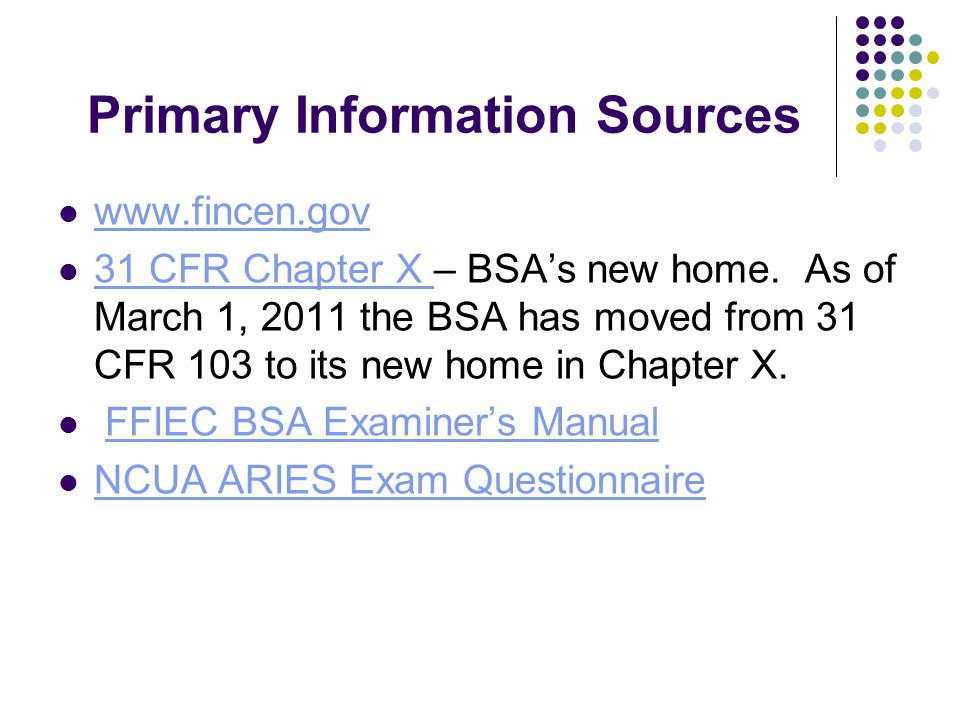

Bank Secrecy Act Information Sharing. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds 10000 and report suspicious activity that may signify money. Download Citation The Bank Secrecy Act. Additional Resources Currency Transaction Reports Customer Due Diligence and Beneficial Ownership Customer Identification Program FinCEN BSA Leadership Expectations Information Sharing Marijuana-Related and Hemp-Related Businesses Member Due Diligence Monetary Instruments OFAC Recordkeeping Report of Foreign Bank. In addition to the Bank Secrecy Actanti-money laundering BSAAML compliance program requirements banks must comply with other program reporting and recordkeeping requirements.

Bank Secrecy Act Bsa Youtube From youtube.com

Bank Secrecy Act Bsa Youtube From youtube.com

Government agencies in detecting and preventing money laundering. And special standards of diligence prohibitions and special measures set forth in. The BSA the Nations comprehensive anti-money laundering statute requires certain reporting and recordkeeping requirements by banks and other financial institutions including reporting suspicious activity reports. If the account holder chooses not to respond or the bank determines that the account holder is not compliant this information will be eventually provided to the foreign taxing authority which will in turn be disclosed to the IRS. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase.

Also what is a common BSA violation.

Government agencies in detecting and preventing money laundering. The Bank Secrecy Act requires financial institutions to report information to the federal government that law enforcement can use to investigate potential crimes like money laundering. And special standards of diligence prohibitions and special measures set forth in. Further Section 314b of the Act calls for financial institutions to share information among each other through the circulation of a Section 314b List and provides these institutions with immunity from private civil actions resulting from any disclosures in conformity with the Bank Secrecy Act BSA. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US.

Source: blog.gao.gov

Source: blog.gao.gov

Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. The Bank Secrecy Act defines financial institutions as insured banks licensed money transmitters insurance companies. In todays environment it is essential. Industry representatives told us that generating reports on suspicious activity can be labor intensive and that they would like more feedback on whether the reports they submitted were useful.

Source: slideplayer.com

Source: slideplayer.com

The BSA the Nations comprehensive anti-money laundering statute requires certain reporting and recordkeeping requirements by banks and other financial institutions including reporting suspicious activity reports. 1114 24 1970 codified as amended in scattered sections of 12 USC 18 USC and 31 USC. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. Government agencies in detecting and preventing money laundering. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

Source: complyadvantage.com

Source: complyadvantage.com

ZURICH Reuters - The era of mystery-cloaked numbered Swiss bank accounts has. CUNA is not engaged in. Government agencies in detecting and preventing money laundering. Law requiring financial institutions in the United States to assist US. Information Sharing The USA PATRIOT Act provides through Sections 314a and 314b mechanisms under which banks share information with each other or law enforcement agencies in an effort to deter money laundering and terrorist activity.

Source: slideplayer.com

Source: slideplayer.com

91 -508 84 Stat. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. The Bank Secrecy Act requires financial institutions to report information to the federal government that law enforcement can use to investigate potential crimes like money laundering. ZURICH Reuters - The era of mystery-cloaked numbered Swiss bank accounts has. Download Citation The Bank Secrecy Act.

Source: youtube.com

Source: youtube.com

The Bank Secrecy Act defines financial institutions as insured banks licensed money transmitters insurance companies. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Bank Secrecy Act Overview Bank Secrecy Act Compliance Program Bank Secrecy Act. Special information sharing procedures. Industry representatives told us that generating reports on suspicious activity can be labor intensive and that they would like more feedback on whether the reports they submitted were useful.

Source: slideserve.com

Source: slideserve.com

Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds 10000 and report suspicious activity that may signify money. Bank Secrecy Act Overview Bank Secrecy Act Compliance Program Bank Secrecy Act. Era of bank secrecy ends as Swiss start sharing account data. 1 may decide to enter into collaborative arrangements to share resources to manage their Bank Secrecy Act BSA and anti-money laundering AML obligations more efficiently and effectively. 31 CFR Chapter X Part 1020.

Source: abbreviationfinder.org

Source: abbreviationfinder.org

Law requiring financial institutions in the United States to assist US. ZURICH Reuters - The era of mystery-cloaked numbered Swiss bank accounts has. The value of collaboration In a 2016 Verafin survey of AMLBank Secrecy Act compliance professionals on the topic of cross-institutional information sharing more than two-thirds of active collaborators believed information sharing helped them resolve investigations more quickly. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. 1114 24 1970 codified as amended in scattered sections of 12 USC 18 USC and 31 USC.

Source: blog.gao.gov

Source: blog.gao.gov

314a and 314b Information Sharing Responding to Law Enforcement Requests Money Services Businesses Recordkeeping Requirements CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements. 314a and 314b Information Sharing Responding to Law Enforcement Requests Money Services Businesses Recordkeeping Requirements CUNAs Bank Secrecy Act Compliance Guide is intended to provide useful information to assist credit unions in complying with the Bank Secrecy Act and Office of Foreign Assets Control requirements. Government agencies in detecting and preventing money laundering. The value of collaboration In a 2016 Verafin survey of AMLBank Secrecy Act compliance professionals on the topic of cross-institutional information sharing more than two-thirds of active collaborators believed information sharing helped them resolve investigations more quickly. 31 CFR Chapter X Part 1020.

Source: proprofs.com

Source: proprofs.com

Further Section 314b of the Act calls for financial institutions to share information among each other through the circulation of a Section 314b List and provides these institutions with immunity from private civil actions resulting from any disclosures in conformity with the Bank Secrecy Act BSA. 91 -508 84 Stat. CUNA is not engaged in. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Era of bank secrecy ends as Swiss start sharing account data.

Source: complyadvantage.com

Source: complyadvantage.com

Era of bank secrecy ends as Swiss start sharing account data. The programs purpose is to ensure the effective collection retrieval and sharing of the highly sensitive and confidential information collected under the Bank Secrecy Act BSA. 31 CFR Chapter X Part 1020. ZURICH Reuters - The era of mystery-cloaked numbered Swiss bank accounts has. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

Source: slideplayer.com

Source: slideplayer.com

Regulations implementing the Bank Secrecy Act primarily appear in 31 CFR. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Further Section 314b of the Act calls for financial institutions to share information among each other through the circulation of a Section 314b List and provides these institutions with immunity from private civil actions resulting from any disclosures in conformity with the Bank Secrecy Act BSA. If the account holder chooses not to respond or the bank determines that the account holder is not compliant this information will be eventually provided to the foreign taxing authority which will in turn be disclosed to the IRS. The programs purpose is to ensure the effective collection retrieval and sharing of the highly sensitive and confidential information collected under the Bank Secrecy Act BSA.

Source: tookitaki.ai

Source: tookitaki.ai

The Bank Secrecy Act defines financial institutions as insured banks licensed money transmitters insurance companies. Law requiring financial institutions in the United States to assist US. 31 CFR Chapter X Part 1020. 1114 24 1970 codified as amended in scattered sections of 12 USC 18 USC and 31 USC. Collaborative arrangements as described in this statement generally are most suitable for banks with a community focus less complex.

Source: bankerscompliance.com

Source: bankerscompliance.com

Special information sharing procedures. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. 31 CFR Chapter X Part 1020. CUNA is not engaged in. Further Section 314b of the Act calls for financial institutions to share information among each other through the circulation of a Section 314b List and provides these institutions with immunity from private civil actions resulting from any disclosures in conformity with the Bank Secrecy Act BSA.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act information sharing by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information