19+ Bank secrecy act jurisdiction ideas in 2021

Home » money laundering idea » 19+ Bank secrecy act jurisdiction ideas in 2021Your Bank secrecy act jurisdiction images are ready. Bank secrecy act jurisdiction are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act jurisdiction files here. Download all royalty-free images.

If you’re searching for bank secrecy act jurisdiction pictures information related to the bank secrecy act jurisdiction keyword, you have visit the ideal site. Our site frequently provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

Bank Secrecy Act Jurisdiction. While most of the provisions under the Bank Secrecy Act were created as requirements for foreign banks to comply with the Fbar is an individual filing requirement. Or iii the Uniting and Strengthening of America by Providing Appropriate Tools Required to Intercept and Obstruct. The Bank Secrecy Act BSA is the common title of the Currency and Foreign Transactions Reporting Act of 1970 which Congress passed to assist federal law enforcement agencies to detect money laundering. As a matter of fact Switzerland is one of the.

Bank Secrecy Act Bsa Anti Money Laundering From slideshare.net

Bank Secrecy Act Bsa Anti Money Laundering From slideshare.net

As a matter of fact Switzerland is one of the. The Bank Secrecy Act and its implementing regulation require a financial institution to maintain records andor report certain transactions to federal government agencies. I the Bank Secrecy Act of 1970 as amended. In these agreements the banks had expressly consented to jurisdiction by US federal courts in any US government proceeding initiated under the Bank Secrecy Act. A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore Ireland Lebanon and the Cayman Islands.

In the light of current events the relevance enforcement and application of bank secrecy laws such as Law on the Secrecy of Bank Deposits Rep.

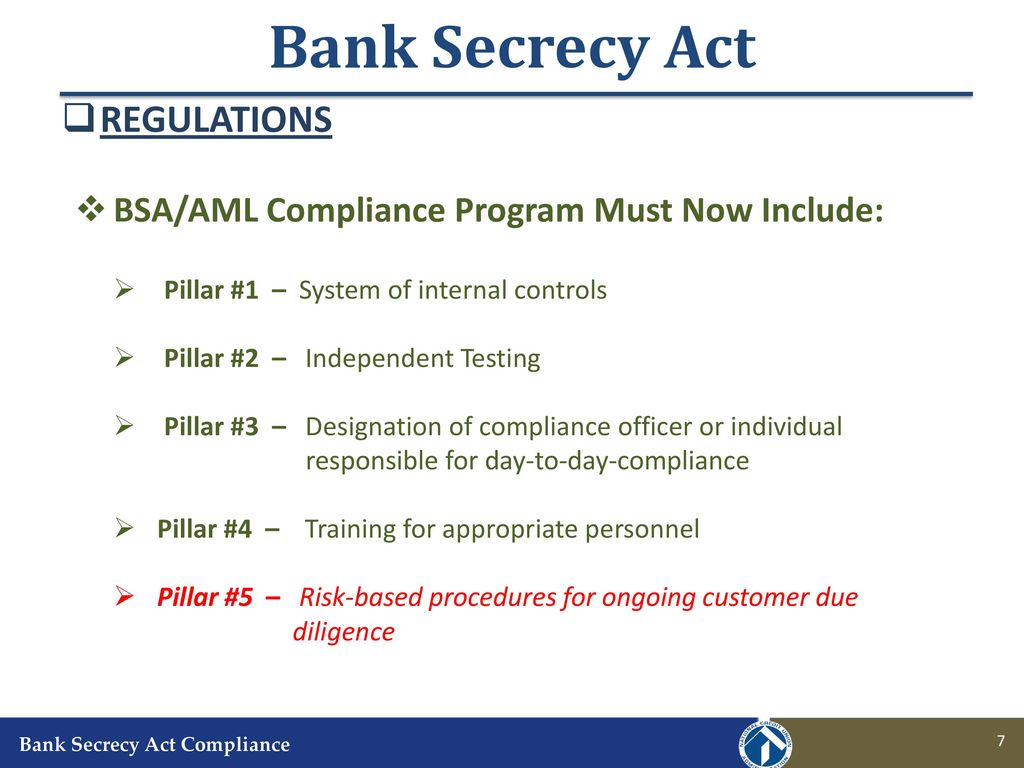

Or iii the Uniting and Strengthening of America by Providing Appropriate Tools Required to Intercept and Obstruct. A list of countries where you can expect a high level of bank secrecy without Switzerland is an incomplete list. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. As a matter of fact Switzerland is one of the. In these agreements the banks had expressly consented to jurisdiction by US federal courts in any US government proceeding initiated under the Bank Secrecy Act. The act and regulation have been amended periodically and focus on issues such as anti-money laundering and anti-terrorist financing.

Source:

A financial institution subject to regulation under the BSA is a term of art that covers a much wider array of businesses and institutions than what one would normally think of as a financial institution. One exception is Bermuda which never officially adopted a secrecy act as Bermudas common law and isolated jurisdiction had always served it well. Book Three Special Banking Laws is in the works and will be released this year. Any subsidiary other than a bank of any listed entity that is organized under the laws of the United States or of any state and at least 51 percent of whose common stock or analogous equity interest is owned by the listed entity provided that a person that is a financial institution other than a bank is an exempt person only to the. Note that the 2012 HSBC settlement of BSA charges was with HSBC North America and not its London-based parent company.

Source: slideplayer.com

Source: slideplayer.com

Or iii the Uniting and Strengthening of America by Providing Appropriate Tools Required to Intercept and Obstruct. Banking secrecy alternately known as financial privacy banking discretion or bank safety is a conditional agreement between a bank and its clients that all foregoing activities remain secure confidential and private. The growth of the Cayman Islands into the top offshore banking center was spurred on originally by their Secrecy Act. Violations of the Bank Secrecy Act Can Be The Basis of Large Bounty Actions. As a matter of fact Switzerland is one of the.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act BSA the United States federal AML statute under which previous financial institutions have entered settlements is a domestic-based statute. Whats on Practical Law. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Violations of the Bank Secrecy Act Can Be The Basis of Large Bounty Actions. I the Bank Secrecy Act of 1970 as amended.

Source: slideplayer.com

Source: slideplayer.com

One exception is Bermuda which never officially adopted a secrecy act as Bermudas common law and isolated jurisdiction had always served it well. More specifically the Act requires FCMs and IBs to maintain and implement a written anti-money laundering AML policy. Any subsidiary other than a bank of any listed entity that is organized under the laws of the United States or of any state and at least 51 percent of whose common stock or analogous equity interest is owned by the listed entity provided that a person that is a financial institution other than a bank is an exempt person only to the. The Bank Secrecy Act BSA the United States federal AML statute under which previous financial institutions have entered settlements is a domestic-based statute. The Bank Secrecy Act and its implementing regulations require financial institutions to implement a broad range of compliance measures designed to.

Source: itep.org

Source: itep.org

Brazilian Bank Secrecy Act official Portuguese text. In order to find out more about these places check our list of 12 countries with best bank secrecy. In the light of current events the relevance enforcement and application of bank secrecy laws such as Law on the Secrecy of Bank Deposits Rep. Fifty years after its birth the Bank Secrecy Act along with the long-forgotten role it played in breaking open the Watergate scandal continues to have an increasing influence on the. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore Ireland Lebanon and the Cayman Islands.

Source: slideshare.net

Source: slideshare.net

In these agreements the banks had expressly consented to jurisdiction by US federal courts in any US government proceeding initiated under the Bank Secrecy Act. Book Three Special Banking Laws is in the works and will be released this year. In light of these agreements the Court held that the investigation into the North Korean sanctions violations was a proceeding that had arisen under the Bank Secrecy Act and thus it established jurisdiction over the two banks. Banking secrecy alternately known as financial privacy banking discretion or bank safety is a conditional agreement between a bank and its clients that all foregoing activities remain secure confidential and private. Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970.

Source: slideplayer.com

Source: slideplayer.com

In these agreements the banks had expressly consented to jurisdiction by US federal courts in any US government proceeding initiated under the Bank Secrecy Act. Or iii the Uniting and Strengthening of America by Providing Appropriate Tools Required to Intercept and Obstruct. The act and regulation have been amended periodically and focus on issues such as anti-money laundering and anti-terrorist financing. More specifically the Act requires FCMs and IBs to maintain and implement a written anti-money laundering AML policy. I the Bank Secrecy Act of 1970 as amended.

Source: slideshare.net

Source: slideshare.net

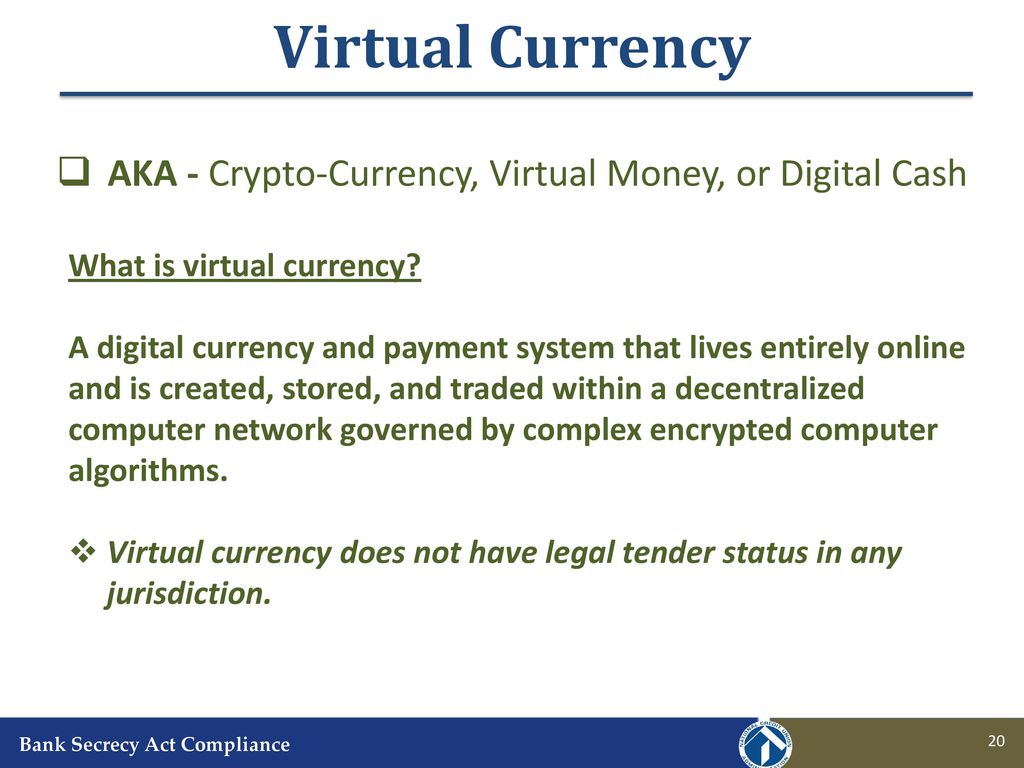

Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. Today all the tax havens have Secrecy or Confidentiality Ordinances. 1405 and Foreign Currency Deposit Act Rep. Banking secrecy alternately known as financial privacy banking discretion or bank safety is a conditional agreement between a bank and its clients that all foregoing activities remain secure confidential and private. More specifically the Act requires FCMs and IBs to maintain and implement a written anti-money laundering AML policy.

Source: researchgate.net

Source: researchgate.net

Fifty years after its birth the Bank Secrecy Act along with the long-forgotten role it played in breaking open the Watergate scandal continues to have an increasing influence on the. 1405 and Foreign Currency Deposit Act Rep. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore Ireland Lebanon and the Cayman Islands. I the Bank Secrecy Act of 1970 as amended. In these agreements the banks had expressly consented to jurisdiction by US federal courts in any US government proceeding initiated under the Bank Secrecy Act.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act and its implementing regulations require financial institutions to implement a broad range of compliance measures designed to. Neither the Company nor to the Company s knowledge any officer director or Initial Stockholder has violated. Financial Institutions and Businesses Regulated by Bank Secrecy Act. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore Ireland Lebanon and the Cayman Islands. The Bank Secrecy Act and its implementing regulation require a financial institution to maintain records andor report certain transactions to federal government agencies.

Source: elibrary.imf.org

Source: elibrary.imf.org

The Bank Secrecy Act BSA is the common title of the Currency and Foreign Transactions Reporting Act of 1970 which Congress passed to assist federal law enforcement agencies to detect money laundering. The growth of the Cayman Islands into the top offshore banking center was spurred on originally by their Secrecy Act. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore Ireland Lebanon and the Cayman Islands. The Bank Secrecy Act BSA the United States federal AML statute under which previous financial institutions have entered settlements is a domestic-based statute. The act and regulation have been amended periodically and focus on issues such as anti-money laundering and anti-terrorist financing.

I the Bank Secrecy Act of 1970 as amended. Neither the Company nor to the Company s knowledge any officer director or Initial Stockholder has violated. The Bank Secrecy Act requires domestic banks to report any transactions of more than 1000000 as well as any transactions that appear to have been structured to avoid the 1000000 reporting requirement. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Violations of the Bank Secrecy Act Can Be The Basis of Large Bounty Actions.

Source: slideshare.net

Source: slideshare.net

In order to find out more about these places check our list of 12 countries with best bank secrecy. Form FinCEN 114 formerly Treasury Department Form 90-221 Report of Foreign Bank and Financial Accounts FBAR is a reporting requirement under the Bank Secrecy Act of 1970. Attorneys Office claimed jurisdiction over the funds based on the fact that the brokers bank had branches in Brooklyn. The growth of the Cayman Islands into the top offshore banking center was spurred on originally by their Secrecy Act. A list of countries where you can expect a high level of bank secrecy without Switzerland is an incomplete list.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act jurisdiction by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information