13+ Bank secrecy act negotiable instruments info

Home » money laundering idea » 13+ Bank secrecy act negotiable instruments infoYour Bank secrecy act negotiable instruments images are available. Bank secrecy act negotiable instruments are a topic that is being searched for and liked by netizens now. You can Download the Bank secrecy act negotiable instruments files here. Get all free photos and vectors.

If you’re searching for bank secrecy act negotiable instruments images information connected with to the bank secrecy act negotiable instruments interest, you have come to the right blog. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

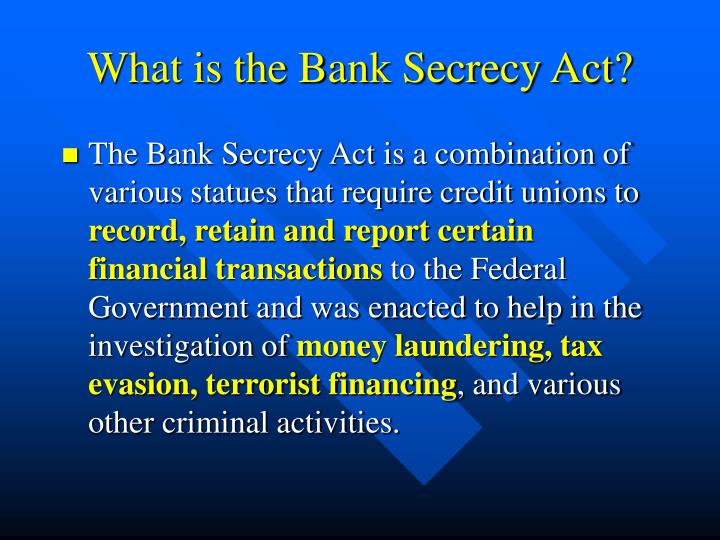

Bank Secrecy Act Negotiable Instruments. Under the Bank Secrecy Act BSA financial institutions are required to assist US. 5311 et seq is referred to as the Bank Secrecy Act BSA. Section 138 Negotiable Instruments Act 1881 An In Depth May 1st 2018 - This Paper Attempts To Delineate Various Aspects Of Section 138 Of The Negotiable Instruments Act Section 138 Is The Principal Section Dealing With Dishonor Of ChequesBanking Law Guide to Bank. TAB 100WORKPROGRAM Anti-Money Laundering Procedures.

Bank Secrecy Act Anti Money Laundering Examination Manual Ffiec From yumpu.com

Bank Secrecy Act Anti Money Laundering Examination Manual Ffiec From yumpu.com

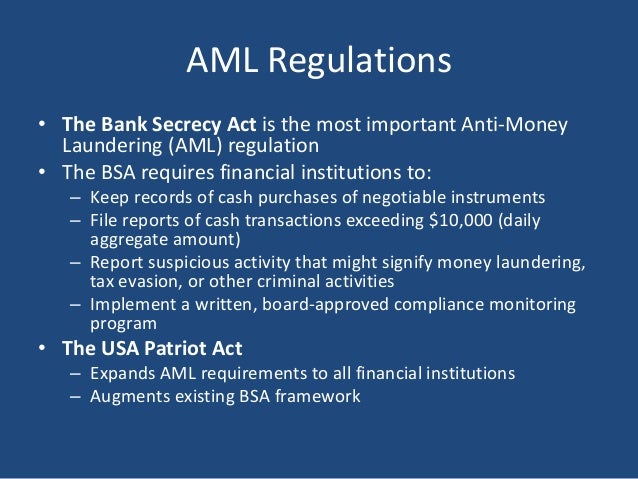

A Bank Secrecy Officer works within a bank credit union or other financial institution to ensure compliance with BSA laws and BSA regulations. The BSA is also commonly referred to as the Currency and Foreign. Cash purchases of negotiable instruments eg money orders cashiers checks travelers cheques totaling from 3000 to 10000 inclusive. Government agencies to detect and prevent money launderingSpecifically the act requires financial institutions to keep records of cash purchases of negotiable instruments and file reports of cash purchases of. Section 138 Negotiable Instruments Act 1881 An In Depth May 1st 2018 - This Paper Attempts To Delineate Various Aspects Of Section 138 Of The Negotiable Instruments Act Section 138 Is The Principal Section Dealing With Dishonor Of ChequesBanking Law Guide to Bank. Law used to detect deter and disrupt money laundering and terrorist financing networks.

3 The emergence of Bitcoin and follow-on decentralized crypto.

Essentially they develop implement and administer the Bank Secrecy Act compliance program then train and supervise the staff to help ensure compliance. The Bank Secrecy Act of 1970 or BSA or otherwise known as the Currency and Foreign Transactions Reporting Act requires financial institutions in the United States to assist US. Anti-money laundering AML law. Essentially they develop implement and administer the Bank Secrecy Act compliance program then train and supervise the staff to help ensure compliance. The BSA is essentially an act that specifies the financial transactions that must be recorded andor reported by financial institutions in order to prevent money laundering and fraud. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000.

Source: slideshare.net

Source: slideshare.net

The Bank Secrecy Act of 1970 or BSA for short is the primary US. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities. Government agencies in detecting and preventing money laundering such as. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. The BSA is essentially an act that specifies the financial transactions that must be recorded andor reported by financial institutions in order to prevent money laundering and fraud.

Source: elibrary.imf.org

Source: elibrary.imf.org

Government agencies in detecting and preventing money laundering such as. Law used to detect deter and disrupt money laundering and terrorist financing networks. The Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act or BSA is the primary US. Section 138 Negotiable Instruments Act 1881 An In Depth May 1st 2018 - This Paper Attempts To Delineate Various Aspects Of Section 138 Of The Negotiable Instruments Act Section 138 Is The Principal Section Dealing With Dishonor Of ChequesBanking Law Guide to Bank. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000.

Source: stevenlevyinvestigations.com

Source: stevenlevyinvestigations.com

Law used to detect deter and disrupt money laundering and terrorist financing networks. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Essentially they develop implement and administer the Bank Secrecy Act compliance program then train and supervise the staff to help ensure compliance. A Bank Secrecy Officer works within a bank credit union or other financial institution to ensure compliance with BSA laws and BSA regulations.

Source: yumpu.com

Source: yumpu.com

These are filed with the Internal Revenue Service. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000. Under the Bank Secrecy Act BSA financial institutions are required to assist US. 5311 et seq is referred to as the Bank Secrecy Act BSA. A Bank Secrecy Officer works within a bank credit union or other financial institution to ensure compliance with BSA laws and BSA regulations.

Source: elibrary.imf.org

The Bank Secrecy Act of 1970 or BSA or otherwise known as the Currency and Foreign Transactions Reporting Act requires financial institutions in the United States to assist US. Government agencies to detect and prevent money launderingSpecifically the act requires financial institutions to keep records of cash purchases of negotiable instruments and file reports of cash purchases of. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities. TAB 100WORKPROGRAM Anti-Money Laundering Procedures.

Source: present5.com

Source: present5.com

You may replace the entire con-tents according to Tabs. Specifically the Act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding a certain threshold and report suspicious activity that might signify money laundering tax evasion or other criminal activity. Law used to detect deter and disrupt money laundering and terrorist financing networks. The Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act or BSA is the primary US. Cash purchases of negotiable instruments eg money orders cashiers checks travelers cheques totaling from 3000 to 10000 inclusive.

Source: slideshare.net

Source: slideshare.net

TAB 100WORKPROGRAM Anti-Money Laundering Procedures. Specifically this anti-money laundering law requires regulated financial institutions to keep records of. We know that under Bank Secrecy Act provisions the bank must document negotiable instrument purchase information for instruments purchased with cash in amounts from 3000 to 10000 inclusive. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities. You may replace the entire con-tents according to Tabs.

Source: yumpu.com

Source: yumpu.com

The purpose of the BSA is to require United States US. Section 138 Negotiable Instruments Act 1881 An In Depth May 1st 2018 - This Paper Attempts To Delineate Various Aspects Of Section 138 Of The Negotiable Instruments Act Section 138 Is The Principal Section Dealing With Dishonor Of ChequesBanking Law Guide to Bank. Specifically this anti-money laundering law requires regulated financial institutions to keep records of. Law used to detect deter and disrupt money laundering and terrorist financing networks. A Bank Secrecy Officer works within a bank credit union or other financial institution to ensure compliance with BSA laws and BSA regulations.

Source: yumpu.com

Source: yumpu.com

Government agencies to detect and prevent money launderingSpecifically the act requires financial institutions to keep records of cash purchases of negotiable instruments and file reports of cash purchases of. You may replace the entire con-tents according to Tabs. Government agencies in detecting and preventing money laundering such as. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

Source: slideserve.com

Source: slideserve.com

The purpose of the BSA is to require United States US. Essentially they develop implement and administer the Bank Secrecy Act compliance program then train and supervise the staff to help ensure compliance. Bank Secrecy Act Wikipedia May 5th 2018 - The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a U S law requiring financial institutions in the United States to assist U S government agencies to detect and prevent money launderingACT NO 2031 ChanRobles and Associates Law Firm. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Anti-money laundering AML law.

Source: chaussureslouboutin-soldes.fr

Source: chaussureslouboutin-soldes.fr

The BSA is also commonly referred to as the Currency and Foreign. The Bank Secrecy Act of 1970 or BSA or otherwise known as the Currency and Foreign Transactions Reporting Act requires financial institutions in the United States to assist US. The Bank Secrecy Act of 1970 or BSA for short is the primary US. The BSA is also commonly referred to as the Currency and Foreign. Cash purchases of negotiable instruments eg money orders cashiers checks travelers cheques totaling from 3000 to 10000 inclusive.

Source: yumpu.com

Source: yumpu.com

We also know that if a customer purchases a negotiable instrument with cash over 10000 a. Cash purchases of negotiable instruments eg money orders cashiers checks travelers cheques totaling from 3000 to 10000 inclusive. The purpose of the BSA is to require United States US. 3 The emergence of Bitcoin and follow-on decentralized crypto. In order for the Bank Secrecy Act regulations and the Bank Secrecy Act training to help prevent money laundering in the financial industry the Act requires all financial institution to maintain detailed records regarding cash purchases as well as file reports regarding cash purchase of negotiable instruments that are no less than 10000.

Source:

The BSA is essentially an act that specifies the financial transactions that must be recorded andor reported by financial institutions in order to prevent money laundering and fraud. 5311 et seq is referred to as the Bank Secrecy Act BSA. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. Negotiable Instrument Log NIL. The Bank Secrecy Act of 1970 or BSA or otherwise known as the Currency and Foreign Transactions Reporting Act requires financial institutions in the United States to assist US.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act negotiable instruments by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information