13++ Bank secrecy act non listed business ideas

Home » money laundering Info » 13++ Bank secrecy act non listed business ideasYour Bank secrecy act non listed business images are available. Bank secrecy act non listed business are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act non listed business files here. Get all royalty-free images.

If you’re looking for bank secrecy act non listed business pictures information related to the bank secrecy act non listed business topic, you have pay a visit to the right blog. Our website always gives you suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

Bank Secrecy Act Non Listed Business. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Almost 50 years ago concerns about large amounts of cash coming into the country from the drug trade led Congress to pass whats become known as the Bank Secrecy Act BSA. I has maintained a transaction account at the bank for at least 12 months ii frequently engages in transactions in currency in excess of 10000 and iii does business in the United States. The law does not require every transaction exceeding 10000 to be documented.

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore From bookstore.gpo.gov

Bank Secrecy Act Anti Money Laundering Examination Manual U S Government Bookstore From bookstore.gpo.gov

Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report. 3 is incorporated or organized under the laws of the United States or a state or is registered. A business engaged in marijuana-related activity may not be treated as a non-listed business under 31 CFR 1020315e8 and therefore is not eligible for consideration for an exemption with respect to a banks CTR obligations. A non-listed business is one that is not publicly traded on a major stock exchange. The law does not require every transaction exceeding 10000 to be documented. Eligible Non-Listed business A business which 1 has had a transaction account at the credit union for at least 12 months.

Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity.

In order to be eligible for exemption the company must maintain a transaction account for two months have at least eight large currency transactions over a year and must be eligible to. 3 is incorporated or organized under the laws of the United States or a state or is registered. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. The law does not require every transaction exceeding 10000 to be documented. A business that engages in multiple business activities may qualify for an exemption as a non-listed business as long as no more than 50 percent of gross revenues are. Cash-intensive businesses such as convenience stores restaurants retail stores and parking garages.

Source: probank.com

Source: probank.com

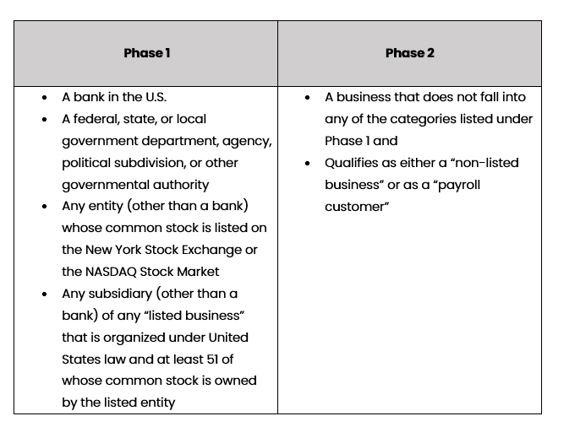

A non-listed business is defined as an enterprise that. NCUA monitors credit unions for compliance with the BSA and its implementing regulation 31 CFR 103. Eligible Non-Listed business A business which 1 has had a transaction account at the credit union for at least 12 months. A business that does not fall into any of the Phase I categories may still be exempted under the Phase II exemptions if it qualifies as either a non-listed business or as a payroll customer. I has maintained a transaction account at the bank for at least 12 months ii frequently engages in transactions in currency in excess of 10000 and iii does business in the United States.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

A non-listed business is one that is not publicly traded on a major stock exchange. Serving as a financial institution or as agents for a financial institution of any type. How the Bank Secrecy Act Works. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. 2 frequently engages in currency transactions greater than 10000.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Cash-intensive businesses such as convenience stores restaurants retail stores and parking garages. How the Bank Secrecy Act Works. Almost 50 years ago concerns about large amounts of cash coming into the country from the drug trade led Congress to pass whats become known as the Bank Secrecy Act BSA. Reflect what a business actually earns from an activity conducted by the business rather than the sales volume of such activity. I has maintained a transaction account at the bank for at least 12 months ii frequently engages in transactions in currency in excess of 10000 and iii does business in the United States.

Source: tier1fin.com

Source: tier1fin.com

Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report. A non-listed business is defined as an enterprise that. Almost 50 years ago concerns about large amounts of cash coming into the country from the drug trade led Congress to pass whats become known as the Bank Secrecy Act BSA. Reflect what a business actually earns from an activity conducted by the business rather than the sales volume of such activity. Bank Secrecy Act 12-04 81-2 DSC Risk Management Manual of Examination Policies.

Source: pinterest.com

Source: pinterest.com

Non-listed businesses must 2 Bank is defined in The US. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. In order to be eligible for exemption the company must maintain a transaction account for two months have at least eight large currency transactions over a year and must be eligible to. BSA Related Regulations. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121.

![]() Source: slideplayer.com

Source: slideplayer.com

Bank Secrecy Act BSA High-Risk Entities. BSA Related Regulations. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. Department of the Treasury Treasury Regulation 31 CFR 10311. A non-listed business is defined as an enterprise that.

Source: bankerscompliance.com

Source: bankerscompliance.com

Eligible Non-Listed business A business which 1 has had a transaction account at the credit union for at least 12 months. The definition of legal entity customer does not include. A business engaged in marijuana-related activity may not be treated as a non-listed business under 31 CFR 1020315e8 and therefore is not eligible for consideration for an exemption with respect to a banks CTR obligations. Transactions of Exempt Persons Phase II CTR Exemptions 4 Under Phase II exemptions there are two other categories of customers certain non-listed businesses a This is the FFIEC Bank Secrecy ActAnti-Money Laundering Examination BSAAML Manual. The law does not require every transaction exceeding 10000 to be documented.

Source: pinterest.com

Source: pinterest.com

In order to be eligible for exemption the company must maintain a transaction account for two months have at least eight large currency transactions over a year and must be eligible to. The definition of legal entity customer does not include. Bank Secrecy Act BSA High-Risk Entities. Transactions of Exempt Persons Phase II CTR Exemptions 4 Under Phase II exemptions there are two other categories of customers certain non-listed businesses a This is the FFIEC Bank Secrecy ActAnti-Money Laundering Examination BSAAML Manual. Banks may exempt to the extent of its domestic operations customers who are either non-listed businesses that regularly withdraw or deposit more than 10000 or payroll customers that regularly withdraw more than 10000 to meet payroll.

Source: amlrightsource.com

Source: amlrightsource.com

The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. 3 is incorporated or organized under the laws of the United States or a state or is registered. In order to be eligible for exemption the company must maintain a transaction account for two months have at least eight large currency transactions over a year and must be eligible to. How the Bank Secrecy Act Works. Cash-intensive businesses such as convenience stores restaurants retail stores and parking garages.

Source: slideplayer.com

Source: slideplayer.com

The BSA was designed to help. Bank Secrecy Act 12-04 81-2 DSC Risk Management Manual of Examination Policies. A business that engages in multiple business activities may qualify for an exemption as a non-listed business as long as no more than 50 percent of gross revenues are. BSA Related Regulations. 3 is incorporated or organized under the laws of the United States or a state or is registered.

![]() Source: adiconsulting.com

Source: adiconsulting.com

To be compliant with BSA requirements banks should also monitor transactions for Non-Bank Financial Institution NBFI and Money Services Business MSB customers. I has maintained a transaction account at the bank for at least 12 months ii frequently engages in transactions in currency in excess of 10000 and iii does business in the United States. Unincorporated associations such as a local Girl Scout troop or a neighborhood association. NCUA monitors credit unions for compliance with the BSA and its implementing regulation 31 CFR 103. A business that engages in multiple business activities may qualify for an exemption as a non-listed business as long as no more than 50 percent of gross revenues are derived from one or more of the ineligible business activities listed in the regulation24 FinCEN guidance states that.

Source: blog.flexcutech.com

Source: blog.flexcutech.com

The definition of legal entity customer does not include. Transactions of Exempt Persons Phase II CTR Exemptions 4 Under Phase II exemptions there are two other categories of customers certain non-listed businesses a This is the FFIEC Bank Secrecy ActAnti-Money Laundering Examination BSAAML Manual. Serving as a financial institution or as agents for a financial institution of any type. Almost 50 years ago concerns about large amounts of cash coming into the country from the drug trade led Congress to pass whats become known as the Bank Secrecy Act BSA. A business engaged in marijuana-related activity may not be treated as a non-listed business under 31 CFR 1020315e8 and therefore is not eligible for consideration for an exemption with respect to a banks CTR obligations.

Source: nizaricu.org

Source: nizaricu.org

A non-listed business is one that is not publicly traded on a major stock exchange. Transactions of Exempt Persons Phase II CTR Exemptions 4 Under Phase II exemptions there are two other categories of customers certain non-listed businesses a This is the FFIEC Bank Secrecy ActAnti-Money Laundering Examination BSAAML Manual. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Cash-intensive businesses such as convenience stores restaurants retail stores and parking garages. The definition of legal entity customer does not include.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act non listed business by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas