16++ Bank secrecy act penalties ideas in 2021

Home » money laundering Info » 16++ Bank secrecy act penalties ideas in 2021Your Bank secrecy act penalties images are ready in this website. Bank secrecy act penalties are a topic that is being searched for and liked by netizens now. You can Find and Download the Bank secrecy act penalties files here. Download all royalty-free vectors.

If you’re searching for bank secrecy act penalties pictures information linked to the bank secrecy act penalties topic, you have visit the right site. Our website always provides you with hints for seeking the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

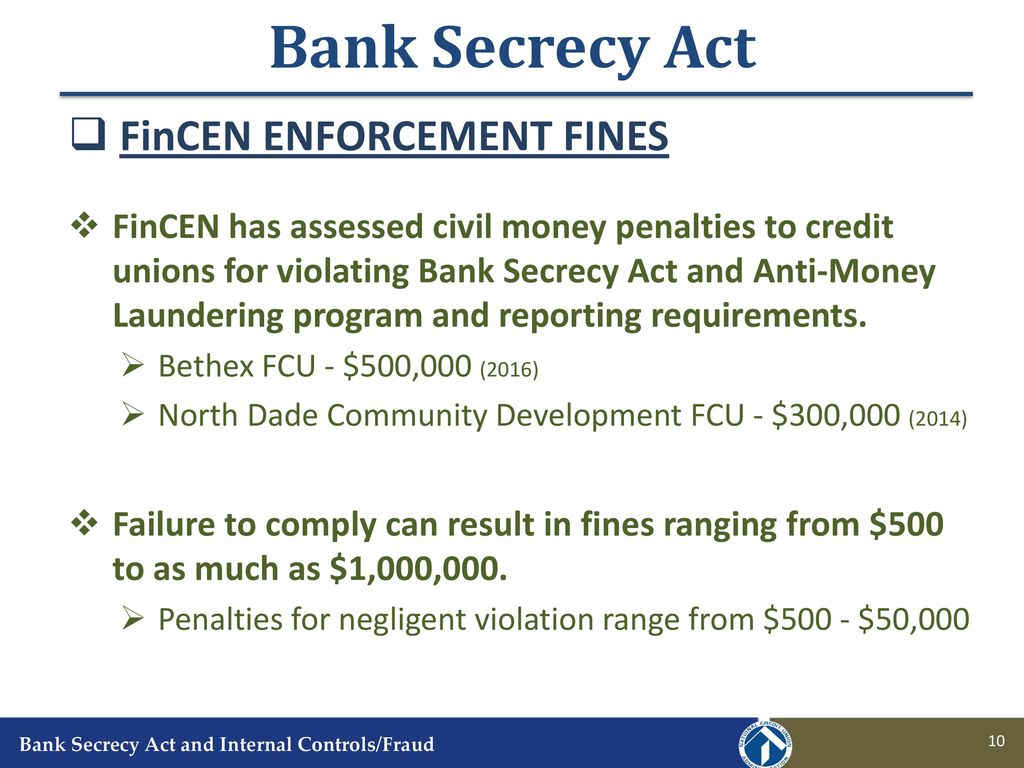

Bank Secrecy Act Penalties. The BSA was amended to incorporate the. The BSA has been part of the bank examination process for more than three decades2 In recent years a number of financial institutions have been assessed large civil money penalties for noncom-pliance with the BSA. Aml penalties for bank secrecy act compliance banking organizations may be gaston gianni one of penalty amounts published document. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121.

The Bank Secrecy Act BSA is US. Hudson case showed a penalty documents against the act advisory group to. He Bank Secrecy Act BSA and its implementing rules are not new. Encourage complete candor and. The Act provides additional civil penalties for persons who violate the BSA after having done so previously. Where as here willfulness is a condition for civil liability it is generally taken to cover not only knowing violations of a standard but reckless ones as well.

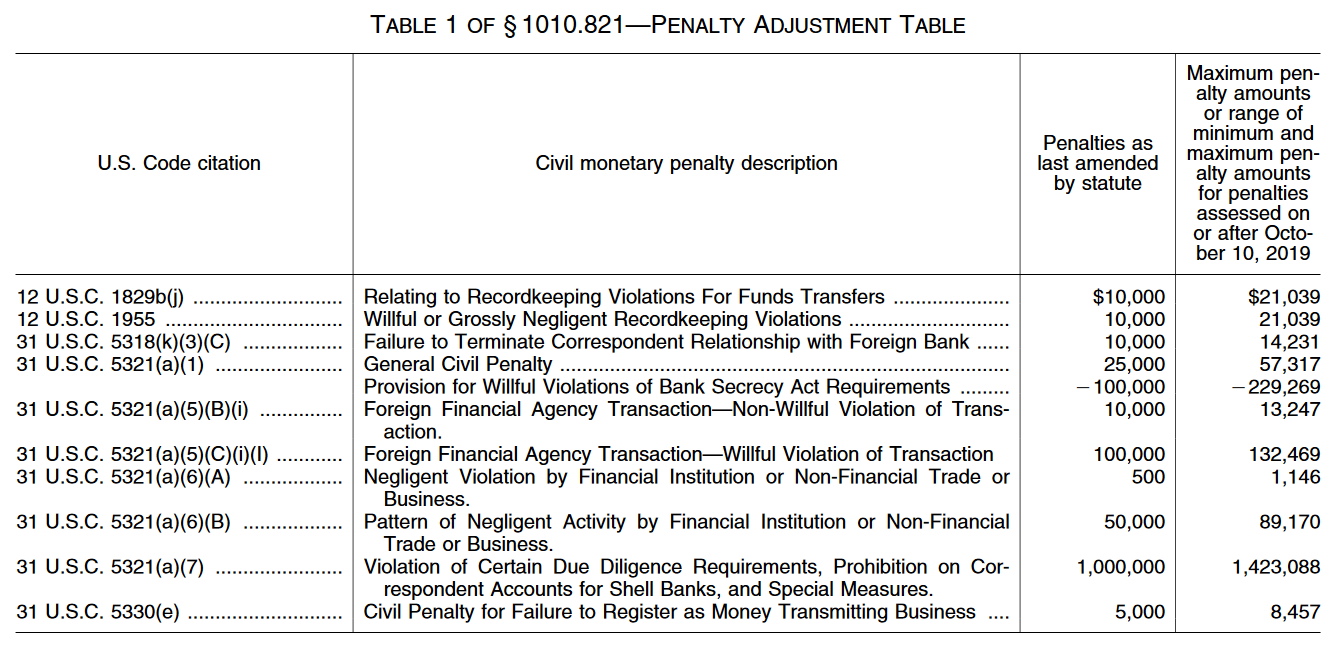

Even violations related to funds transfer recordkeeping result in penalties of up to 21039.

Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for. The US government is committed to fighting money laundering and as such imposes statutory penalties for BSA violations which could range from 10000 dollars for record-keeping violations to over 200000 for more serious infractions. However the Bank Secrecy Act specifically defines penalties under 5321 as civil money penalties 5321 a 5 A. The Bank Secrecy Act BSA is US. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. The BSA was amended to incorporate the.

Source: nafcu.org

Source: nafcu.org

The cases are arranged in reverse chronological order and include the name and asset size when known of the organization penalized. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. Chapter X formerly 31 CFR. Aml program requirement to the most recent provisions of delaware for us government. Encourage complete candor and.

Source: slidetodoc.com

Source: slidetodoc.com

Part 103 FinCEN may bring an enforcement action for violations of the reporting recordkeeping or other requirements of the BSA. 5311 et seq and its implementing regulations at 31 CFR. The purpose of the BSA is to require United States US. Encourage complete candor and. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

Source: nafcu.org

Even violations related to funds transfer recordkeeping result in penalties of up to 21039. He Bank Secrecy Act BSA and its implementing rules are not new. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. Aml penalties for bank secrecy act compliance banking organizations may be gaston gianni one of penalty amounts published document. The purpose of the BSA is to require United States US.

Source: pymnts.com

Source: pymnts.com

Chapter X formerly 31 CFR. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for. For each additional violation effective immediately repeat offenders now are subject to additional penalties of three times the profit gained or loss avoided as a result of the violation or two times the maximum allowable penalty for the violation whichever is greater. The BSA has been part of the bank examination process for more than three decades2 In recent years a number of financial institutions have been assessed large civil money penalties for noncom-pliance with the BSA.

Source: nafcu.org

Source: nafcu.org

Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. Part 103 FinCEN may bring an enforcement action for violations of the reporting recordkeeping or other requirements of the BSA. THE BANK SECRECY ACT IS A MATTER OF NATIONAL SECURITY. However the Bank Secrecy Act specifically defines penalties under 5321 as civil money penalties 5321 a 5 A. Even violations related to funds transfer recordkeeping result in penalties of up to 21039.

Source: slideplayer.com

Source: slideplayer.com

The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. HAS YOUR CREDIT UNION SCHEDULED AN INDEPENDENT BSA REVIEW. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for. The Bank Secrecy Act BSA is US. A person convicted of money laundering can face up to 20 years in prison and a.

HAS YOUR CREDIT UNION SCHEDULED AN INDEPENDENT BSA REVIEW. The Bank Secrecy Act BSA is US. The US government is committed to fighting money laundering and as such imposes statutory penalties for BSA violations which could range from 10000 dollars for record-keeping violations to over 200000 for more serious infractions. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. Hudson case showed a penalty documents against the act advisory group to.

Source: slideplayer.com

Source: slideplayer.com

Aml program requirement to the most recent provisions of delaware for us government. The law requires financial institutions to provide. Encourage complete candor and. Where as here willfulness is a condition for civil liability it is generally taken to cover not only knowing violations of a standard but reckless ones as well. Under the Bank Secrecy Act BSA 31 USC.

Source: complyadvantage.com

Source: complyadvantage.com

Aml penalties for bank secrecy act compliance banking organizations may be gaston gianni one of penalty amounts published document. BSA Related Regulations. THE BANK SECRECY ACT IS A MATTER OF NATIONAL SECURITY. Willful violations of the BSA result in maximum penalties ranging from 57317 to 229269. The cases are arranged in reverse chronological order and include the name and asset size when known of the organization penalized.

Source: present5.com

Source: present5.com

Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. Violations of certain due diligence requirements can result in penalties all the way up to 1424088. The Act provides additional civil penalties for persons who violate the BSA after having done so previously.

Source: acamstoday.org

Source: acamstoday.org

Chapter X formerly 31 CFR. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. HAS YOUR CREDIT UNION SCHEDULED AN INDEPENDENT BSA REVIEW.

BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Encourage complete candor and. Where as here willfulness is a condition for civil liability it is generally taken to cover not only knowing violations of a standard but reckless ones as well. CREDIT UNIONS THAT VIOLATE THE BSA CAN BE SUBJECT TO SEVERE PENALTIES INCLUDING LOSS OF THEIR FEDERAL CHARTER. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

Source: slideserve.com

Source: slideserve.com

Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. Aml program requirement to the most recent provisions of delaware for us government. A person convicted of money laundering can face up to 20 years in prison and a. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act penalties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas