11++ Bank secrecy act policy and procedures information

Home » money laundering idea » 11++ Bank secrecy act policy and procedures informationYour Bank secrecy act policy and procedures images are available in this site. Bank secrecy act policy and procedures are a topic that is being searched for and liked by netizens now. You can Get the Bank secrecy act policy and procedures files here. Download all free photos.

If you’re looking for bank secrecy act policy and procedures pictures information connected with to the bank secrecy act policy and procedures topic, you have visit the right site. Our website frequently provides you with hints for downloading the maximum quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Bank Secrecy Act Policy And Procedures. Provided by bank technology vendor AccuSystems. Policies and Procedures POLICY NUMBER 10710 EFFECTIVE DATE 11012018 COMPLIANCE R DATE 11012018 SUBJECT PAGES Bank Secrecy Act Page 5 of 10 10710 CTR requirements. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations.

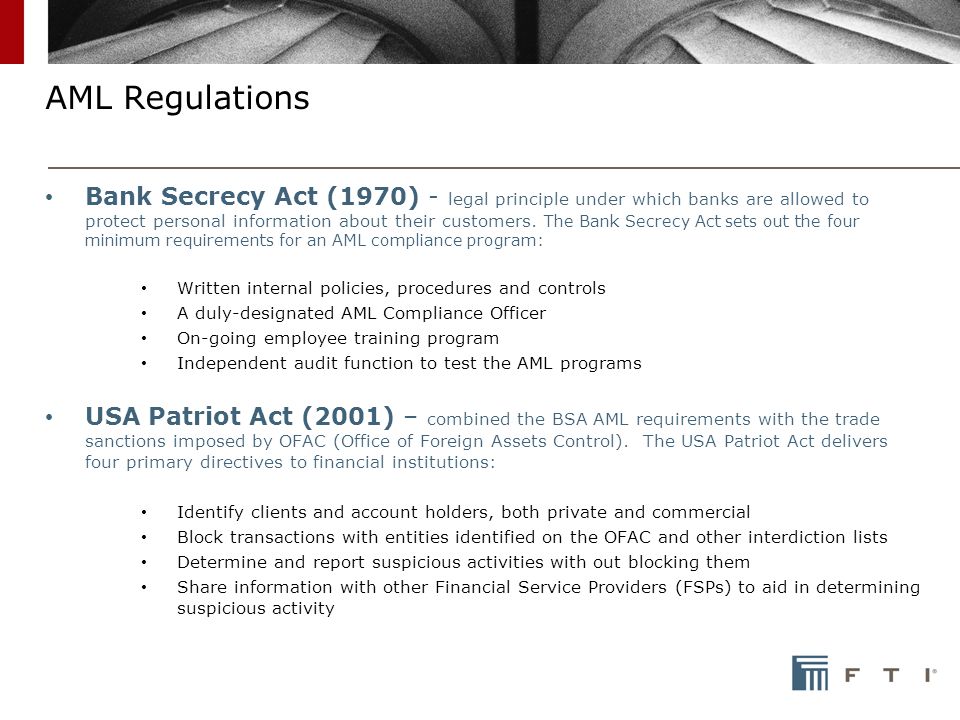

Ihde Resume From slideshare.net

Ihde Resume From slideshare.net

Bank Secrecy Act Policy And Procedures. The Compliance Officer must maintain a list of exemptions. The purpose of the BSA is to require United States US. The review should determine whether the business is operating in compliance with the requirements of the Bank Secrecy Act and the business own policies and procedures. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Government agencies in detecting and preventing money laundering.

FIL-26-2018 - PDF.

Policies and Procedures POLICY NUMBER 10710 EFFECTIVE DATE 11012018 COMPLIANCE R DATE 11012018 SUBJECT PAGES Bank Secrecy Act Page 5 of 10 10710 CTR requirements. Bank Secrecy Act Customer Due Diligence and Beneficial Ownership Examination Procedures Printable Format. Any property involved in the transaction or traceable to the proceeds of the criminal activity including loan collateral personal property. See more information about this product below. Banks must develop policies and procedures to ensure trust departments comply with provisions of the USA PATRIOT Act and other anti-money laundering AML regulations. It is a course of by which dirty cash is transformed into clear cash.

Source: complianceonline.com

Source: complianceonline.com

Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. The purpose of the BSA is to require United States US. Each money services business should identify and assess the money laundering risks that may be associated with its unique products services customers and geographic locations. Any property involved in the transaction or traceable to the proceeds of the criminal activity including loan collateral personal property. Businesses including banks and individuals face fines up to the greater of 500000 or twice the value of the transaction.

Source: slideplayer.com

Source: slideplayer.com

FIL-26-2018 - PDF. Approved by the board of directors and noted in the board minutes. 5311 et seq is referred to as the Bank Secrecy Act BSA. The Federal Financial Institutions Examination Council FFIEC is releasing the customer due diligence and beneficial ownership sections of the FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual. Government agencies in detecting and preventing money laundering such as.

Source: bankerscompliance.com

Source: bankerscompliance.com

Determine that program policies and procedures are. Government agencies in detecting and preventing money laundering. Businesses including banks and individuals face fines up to the greater of 500000 or twice the value of the transaction. Although no specific requirement exists for a policy on compliance with OFAC regulations the credit union must comply with the Definitions Credit Union Requirements BANK SECRECY ACT BSA - APPENDIX 18A regulations. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase.

Source: slideplayer.com

Source: slideplayer.com

Any property involved in the transaction or traceable to the proceeds of the criminal activity including loan collateral personal property. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. Government agencies in detecting and preventing money laundering. It is a course of by which dirty cash is transformed into clear cash. Part 748 of NCI-JAs Rules and Regulations requires a credit union to have a Bank Secrecy Act compliance program and procedures.

Source: slideplayer.com

Source: slideplayer.com

Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. The purpose of the BSA is to require United States US. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. And reporting requirements of the Bank Secrecy Act BSA and its anti-money laundering AML regulations. Bank Secrecy Act Policy Be it resolved that this is the policy of to maintain maximum compliance with the Bank Secrecy Act BSA its amendments laws and regulations.

Source: slideshare.net

Source: slideshare.net

Free Excel spreadsheet to help you track missing and expiring documents for credit and loans deposits trusts and more. The Compliance Officer must maintain a list of exemptions. Under the Bank Secrecy ActBSA financial institutions are required to assist US. The purpose of the BSA is to require United States US. For an exemption the credit union must file a Designation of Exempt Person Form TDF 90th-2253 by March 15of each year.

Source: tookitaki.ai

Source: tookitaki.ai

The purpose of this Bank Secrecy Act Policy Template Basic Version is to address measures used by a bank credit union or other type of financial institution to comply with the requirements of the Bank Secrecy Act BSA. Banks must develop policies and procedures to ensure trust departments comply with provisions of the USA PATRIOT Act and other anti-money laundering AML regulations. The sources of the money in precise are legal and the cash is invested in a way that makes it appear to be clear. Financial institutions to assist US. Provided by bank technology vendor AccuSystems.

Source: probank.com

Source: probank.com

Bank Secrecy Act 4 Comptrollers Handbook each money laundering transaction. Any property involved in the transaction or traceable to the proceeds of the criminal activity including loan collateral personal property. FIL-26-2018 - PDF. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. It is a course of by which dirty cash is transformed into clear cash.

Source: acamstoday.org

Source: acamstoday.org

The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs1 In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. Reaffirmed annually as required by policy. The review should determine whether the business is operating in compliance with the requirements of the Bank Secrecy Act and the business own policies and procedures. See more information about this product below.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

FIL-26-2018 - PDF. Reaffirmed annually as required by policy. Bank Secrecy Act 4 Comptrollers Handbook each money laundering transaction. Government agencies in detecting and preventing money laundering such as. Any property involved in the transaction or traceable to the proceeds of the criminal activity including loan collateral personal property.

Source: complianceonline.com

Source: complianceonline.com

It specifically requires financial institutions to. Government agencies in detecting and preventing money laundering such as. 5311 et seq is referred to as the Bank Secrecy Act BSA. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. Visualize your exception data in interactive charts and graphs.

Although no specific requirement exists for a policy on compliance with OFAC regulations the credit union must comply with the Definitions Credit Union Requirements BANK SECRECY ACT BSA - APPENDIX 18A regulations. Government agencies in detecting and preventing money laundering such as. The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign Transactions. Any property involved in the transaction or traceable to the proceeds of the criminal activity including loan collateral personal property. The review should determine whether the business is operating in compliance with the requirements of the Bank Secrecy Act and the business own policies and procedures.

Source:

The sources of the money in precise are legal and the cash is invested in a way that makes it appear to be clear. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. Determine that program policies and procedures are. Keep records of cash purchases of negotiable instruments File reports of cash transactions exceeding 10000 daily aggregate amount and. The sources of the money in precise are legal and the cash is invested in a way that makes it appear to be clear.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act policy and procedures by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information