15++ Bank secrecy act policy template info

Home » money laundering idea » 15++ Bank secrecy act policy template infoYour Bank secrecy act policy template images are ready in this website. Bank secrecy act policy template are a topic that is being searched for and liked by netizens now. You can Find and Download the Bank secrecy act policy template files here. Find and Download all royalty-free photos and vectors.

If you’re looking for bank secrecy act policy template images information related to the bank secrecy act policy template keyword, you have pay a visit to the right blog. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

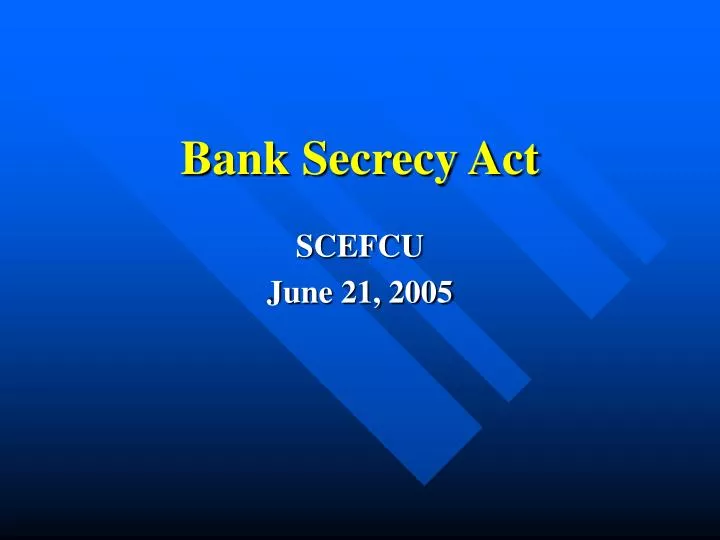

Bank Secrecy Act Policy Template. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious. The Bank Secrecy Act and its implementing regulation require a financial institution to maintain records andor report certain transactions to federal government agencies. The purpose of this Bank Secrecy Act Policy Template Comprehensive Version is to address measures used by a bank credit union or other type of financial institution to comply with the requirements of the Bank Secrecy Act BSA including Anti-Money Laundering AML Customer Identification Program CIP and Office of Foreign Assets Control OFAC requirements. Anti-Money Laundering Template for Small Firms.

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192737 From slideserve.com

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192737 From slideserve.com

Pro Forma Financial Statement Template. The intended audience. The BSA originally focused on traditional financial institutions and included requirements such as building security customer identification currency transaction reporting anti-money laundering and Suspicious Activity Reporting. Anti-Money Laundering Template for Small Firms. The purpose of this Bank Secrecy Act Policy Template Basic Version is to address measures used by a bank credit union or other type of financial institution to comply with the requirements of the Bank Secrecy Act. The statute underlying this policy is the Bank Secrecy Act BSA 31 USC 5311-5332 12 CFR Part 21.

Streamlined Business and Marketing Plan.

Provided by bank technology vendor AccuSystems. Provided by bank technology vendor AccuSystems. Based on the banks risk profile develop a risk-focused examination scope and document the Bank Secrecy Actanti-money laundering BSAAML examination plan. The Board of Directors designates as the BSA and Office of Foreign Assets Control OFAC Compliance Officer. Government agencies in detecting and preventing money laundering. Bank Secrecy Act Policy Basic Version.

Source: slideplayer.com

Source: slideplayer.com

Anti-Money Laundering Template for Small Firms. Bank Secrecy Act Policy Basic Version. Financial institutions to assist US. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. The Board of Directors designates as the BSA and Office of Foreign Assets Control OFAC Compliance Officer.

Source: shutterstock.com

Source: shutterstock.com

The intended audience. The act and regulation have been amended periodically and focus on issues such as anti-money laundering and anti-terrorist financing. Be it resolved that this is the policy of to maintain maximum compliance with the Bank Secrecy Act BSA its amendments laws and regulations. Fayette County School Employees Credit Unions comprehensive Bank Secrecy Act BSA Anti-Money Laundering AML Program will include internal policies procedures and controls designed to comply with the USA PATRIOT Act of 2001 PATRIOT Act the BSA the Currency and Foreign Transactions Reporting Act OFAC rules and all related laws and. Bank Secrecy Act Policy Basic Version.

Source: slideplayer.com

Source: slideplayer.com

The purpose of this Bank Secrecy Act Policy Template Basic Version is to address measures used by a bank credit union or other type of financial institution to comply with the requirements of the Bank Secrecy Act. Financial institutions to assist US. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. Streamlined Business and Marketing Plan. Based on the banks risk profile develop a risk-focused examination scope and document the Bank Secrecy Actanti-money laundering BSAAML examination plan.

Source: slideplayer.com

Source: slideplayer.com

ICBA Member - 31950. Streamlined Business and Marketing Plan. It specifically requires financial institutions to. Capital Planning Stress Testing Resources. The BSA originally focused on traditional financial institutions and included requirements such as building security customer identification currency transaction reporting anti-money laundering and Suspicious Activity Reporting.

Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. Free Excel spreadsheet to help you track missing and expiring documents for credit and loans deposits trusts and more. Fayette County School Employees Credit Unions comprehensive Bank Secrecy Act BSA Anti-Money Laundering AML Program will include internal policies procedures and controls designed to comply with the USA PATRIOT Act of 2001 PATRIOT Act the BSA the Currency and Foreign Transactions Reporting Act OFAC rules and all related laws and. Visualize your exception data in interactive charts and graphs. The purpose of the BSA is to require United States US.

Source: slideserve.com

Source: slideserve.com

The statute underlying this policy is the Bank Secrecy Act BSA 31 USC 5311-5332 12 CFR Part 21. It specifically requires financial institutions to. The Board of Directors designates as the BSA Compliance Officer. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. Exception Tracking Spreadsheet TicklerTrax Downloaded by more than 1000 bankers.

Source: docplayer.net

Source: docplayer.net

It specifically requires financial institutions to. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. The purpose of the BSA is to require United States US. NCUAs Annual Equal Employment Opportunity Policy Statement.

![]() Source: slideplayer.com

Source: slideplayer.com

Capital Planning Stress Testing Resources. Provided by bank technology vendor AccuSystems. See more information about this. 5311 et seq is referred to as the Bank Secrecy Act BSA. Bank Secrecy Act Policy Basic Version.

Source: slideserve.com

Source: slideserve.com

BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Capital Planning Stress Testing Resources. The Board of Directors designates as the BSA Compliance Officer. Fayette County School Employees Credit Unions comprehensive Bank Secrecy Act BSA Anti-Money Laundering AML Program will include internal policies procedures and controls designed to comply with the USA PATRIOT Act of 2001 PATRIOT Act the BSA the Currency and Foreign Transactions Reporting Act OFAC rules and all related laws and. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

Source: shutterstock.com

Source: shutterstock.com

FINRA provides an Anti-Money Laundering Template to assist Small Firms in establishing the AML compliance program required by the Bank Secrecy Act its implementing regulations and FINRA Rule 3310. See more information about this. FINRA provides an Anti-Money Laundering Template to assist Small Firms in establishing the AML compliance program required by the Bank Secrecy Act its implementing regulations and FINRA Rule 3310. Bank Secrecy Act Resources. Free Excel spreadsheet to help you track missing and expiring documents for credit and loans deposits trusts and more.

Source: bankpolicies.com

Source: bankpolicies.com

Develop an understanding of the banks money laundering terrorist financing MLTF and other illicit financial activity risk profile. Anti-Money Laundering Template for Small Firms. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. Bank Secrecy Act Policy Basic Version.

Source: slideserve.com

Source: slideserve.com

FINRA provides an Anti-Money Laundering Template to assist Small Firms in establishing the AML compliance program required by the Bank Secrecy Act its implementing regulations and FINRA Rule 3310. The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. FINRA provides an Anti-Money Laundering Template to assist Small Firms in establishing the AML compliance program required by the Bank Secrecy Act its implementing regulations and FINRA Rule 3310. See more information about this. Bank Secrecy Act Policy Be it resolved that this is the policy of to maintain maximum compliance with the Bank Secrecy Act BSA its amendments laws and regulations.

Source: pinterest.com

Source: pinterest.com

The Bank Secrecy Act BSA was enacted by Congress in 1970 to fight money laundering and other financial crimes. Pro Forma Financial Statement Template. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. The Bank Secrecy Act and its implementing regulation require a financial institution to maintain records andor report certain transactions to federal government agencies.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act policy template by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information