12++ Bank secrecy act record retention information

Home » money laundering idea » 12++ Bank secrecy act record retention informationYour Bank secrecy act record retention images are available. Bank secrecy act record retention are a topic that is being searched for and liked by netizens today. You can Get the Bank secrecy act record retention files here. Get all free images.

If you’re looking for bank secrecy act record retention pictures information connected with to the bank secrecy act record retention interest, you have come to the right blog. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that match your interests.

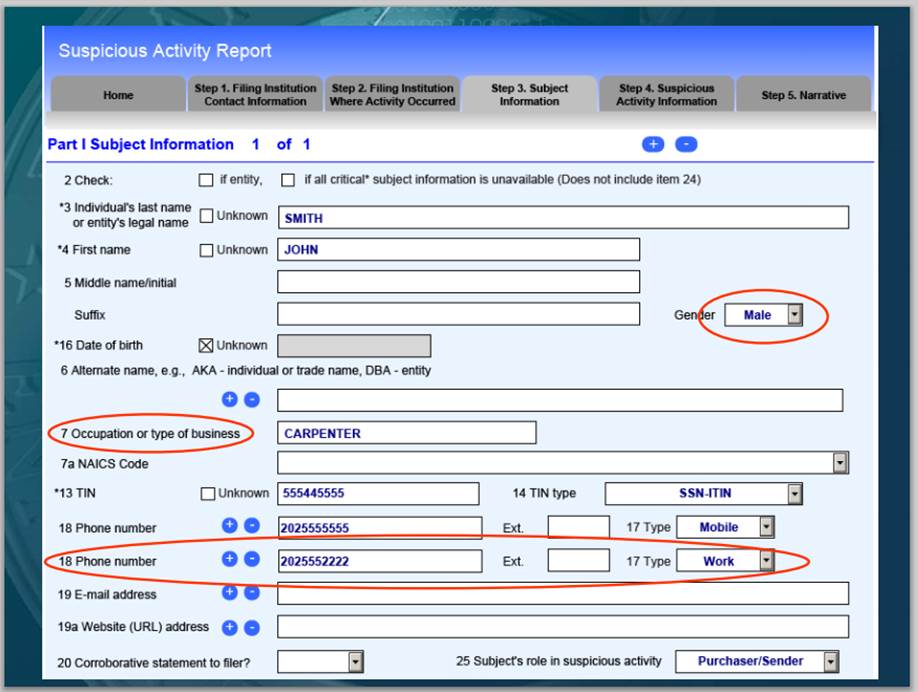

Bank Secrecy Act Record Retention. Copies of any Suspicious Activity Report filed with FinCEN must be retained with the original or business record equivalent of any supporting documentation. Bank Secrecy Act Retention Requirements The concept of cash laundering is essential to be understood for these working in the financial sector. Our Credit Union adopts the records retention schedule attached to. A wholly-owned domestic subsidiary of a domestic bank.

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035 From slideserve.com

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035 From slideserve.com

The Board of Directors of this Credit Union recognizes the importance of adopting a formal record retention policy. Records of every cashier and other official check of 3000 or more must be stored for 5 years after issuance. Bank Secrecy Act Retention Requirements The concept of cash laundering is essential to be understood for these working in the financial sector. These responsibilities which relate to the maintenance of records identifying purchasers of bank checks and drafts cashiers checks money. If a bank does not maintain records enumerated herein but maintains a similar record with equivalent information the banks records should be retained for the period of time specified herein as to the equivalent record. 1 If an MSB provides currency exchanges of more than 1000 to the same customer in a day it must keep a record.

If a record is not included in this schedule the applicable federal or state regulation would apply.

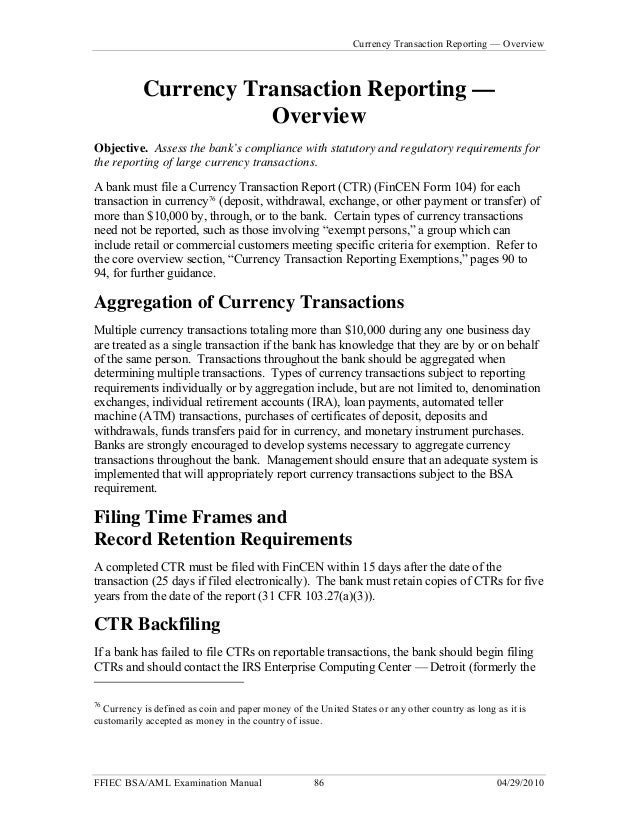

BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved. A number of additional recordkeeping and record retention responsibilities under the Bank Secrecy Act will become effective on August 13 1990. 5311 et seq is referred to as the Bank Secrecy Act BSA. CTRs filed CTR exemptions SARs filed Documentation of decisions to not file a SAR Records of monetary instruments purchased with currency in amounts between 3000 and 10000 Records of funds transfers greater than 3000. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal. All CTRs and SARs must be retained 5 years after filing.

Source: slideplayer.com

Source: slideplayer.com

All CTRs and SARs for 5 years after filing Records of every cashier and other official check of 3000 or more for 5 years after issuance. A wholly-owned domestic subsidiary of a domestic bank. Records of every cashier and other official check of 3000 or more must be stored for 5 years after issuance. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. A state or local government.

Source: blog.gao.gov

Source: blog.gao.gov

BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved. Because every crypto MSBmoney transmitter is required to keep specific documents for certain periods of time in order to stay in compliance with the Bank Secrecy Act BSA and anti-money laundering. INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. These responsibilities which relate to the maintenance of records identifying purchasers of bank checks and drafts cashiers checks money. If a record is not included in this schedule the applicable federal or state regulation would apply.

Source: slideserve.com

Source: slideserve.com

Also critical is any statute your state may have regarding the admissibility of copies in court proceedings. If a bank does not maintain records enumerated herein but maintains a similar record with equivalent information the banks records should be retained for the period of time specified herein as to the equivalent record. For each payment order that a bank accepts as an intermediary bank or a beneficiarys bank the bank must retain a record of the payment order. Because every crypto MSBmoney transmitter is required to keep specific documents for certain periods of time in order to stay in compliance with the Bank Secrecy Act BSA and anti-money laundering. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and.

Source: confidata.com

Source: confidata.com

Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. Our Credit Union adopts the records retention schedule attached to. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal. For each payment order that a bank accepts as an intermediary bank or a beneficiarys bank the bank must retain a record of the payment order. All CTRs and SARs must be retained 5 years after filing.

Source: slideserve.com

Source: slideserve.com

Also critical is any statute your state may have regarding the admissibility of copies in court proceedings. A federal state or local government agency or instrumentality. INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and. These responsibilities which relate to the maintenance of records identifying purchasers of bank checks and drafts cashiers checks money.

Source: docplayer.net

Source: docplayer.net

A broker or dealer in securities. A broker or dealer in securities. CTRs filed CTR exemptions SARs filed Documentation of decisions to not file a SAR Records of monetary instruments purchased with currency in amounts between 3000 and 10000 Records of funds transfers greater than 3000. The Board of Directors of this Credit Union recognizes the importance of adopting a formal record retention policy. All CTRs and SARs for 5 years after filing Records of every cashier and other official check of 3000 or more for 5 years after issuance.

These responsibilities which relate to the maintenance of records identifying purchasers of bank checks and drafts cashiers checks money. Our Credit Union adopts the records retention schedule attached to. 5311 et seq is referred to as the Bank Secrecy Act BSA. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. The Board of Directors of this Credit Union recognizes the importance of adopting a formal record retention policy.

Source: slideshare.net

Source: slideshare.net

CTRs filed CTR exemptions SARs filed Documentation of decisions to not file a SAR Records of monetary instruments purchased with currency in amounts between 3000 and 10000 Records of funds transfers greater than 3000. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and. Copies of any Suspicious Activity Report filed with FinCEN must be retained with the original or business record equivalent of any supporting documentation. Bank Secrecy Act Retention Requirements The concept of cash laundering is essential to be understood for these working in the financial sector. A federal state or local government agency or instrumentality.

Source: securitiesanalytics.com

Source: securitiesanalytics.com

It is a process by which soiled cash is converted into clean cash. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal. Each type of document has specific instructions with this act. All CTRs and SARs must be retained 5 years after filing. Copies of Currency Transaction Reports as required by and filed with FinCEN must be retained.

Source: slideplayer.com

Source: slideplayer.com

A broker or dealer in securities. A federal state or local government agency or instrumentality. If a record is not included in this schedule the applicable federal or state regulation would apply. Copies of any Suspicious Activity Report filed with FinCEN must be retained with the original or business record equivalent of any supporting documentation. Copies of Currency Transaction Reports as required by and filed with FinCEN must be retained.

Source: slideserve.com

Source: slideserve.com

The record keeping requirements are not required where the originator and beneficiary are any of the following. A broker or dealer in securities. The record keeping requirements are not required where the originator and beneficiary are any of the following. If a bank does not maintain records enumerated herein but maintains a similar record with equivalent information the banks records should be retained for the period of time specified herein as to the equivalent record. Documents must be retained for 5 years under the BSAAML requirements.

Source: slideplayer.com

Source: slideplayer.com

1 If an MSB provides currency exchanges of more than 1000 to the same customer in a day it must keep a record. A broker or dealer in securities. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. Records of every cashier and other official check of 3000 or more must be stored for 5 years after issuance. 1 If an MSB provides money transfers of 3000 or more to the same customer in a day regardless of the method of payment it must keep a record.

Source: slideplayer.com

Source: slideplayer.com

Because every crypto MSBmoney transmitter is required to keep specific documents for certain periods of time in order to stay in compliance with the Bank Secrecy Act BSA and anti-money laundering. A number of additional recordkeeping and record retention responsibilities under the Bank Secrecy Act will become effective on August 13 1990. Credit unions must retain the following records for five 5 years after the date the records was created. Records retention it may not be the most exciting topic but its definitely one of the most important for cryptocurrency businesses. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act record retention by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information