20+ Bank secrecy act record retention requirements info

Home » money laundering Info » 20+ Bank secrecy act record retention requirements infoYour Bank secrecy act record retention requirements images are ready. Bank secrecy act record retention requirements are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act record retention requirements files here. Download all royalty-free photos.

If you’re looking for bank secrecy act record retention requirements images information related to the bank secrecy act record retention requirements keyword, you have pay a visit to the right site. Our site frequently gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

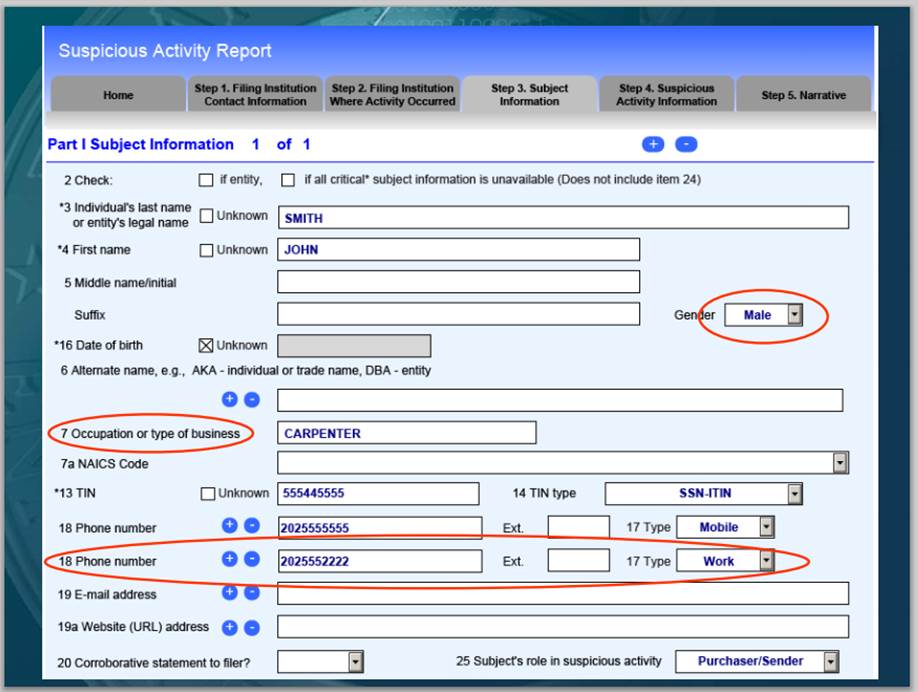

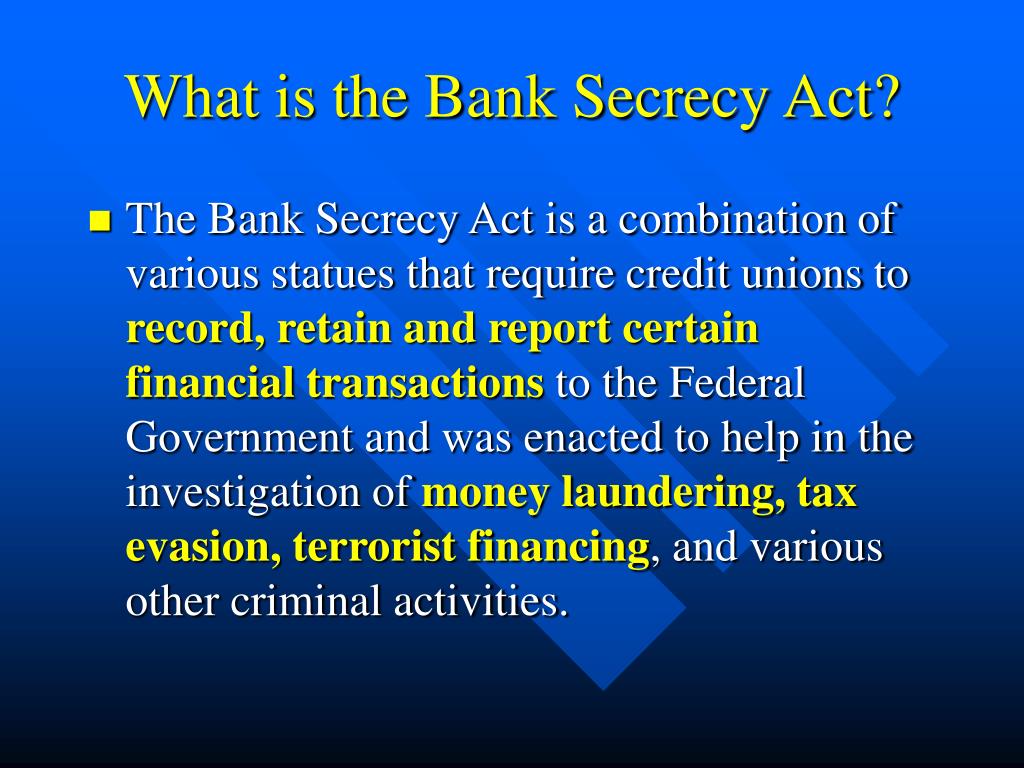

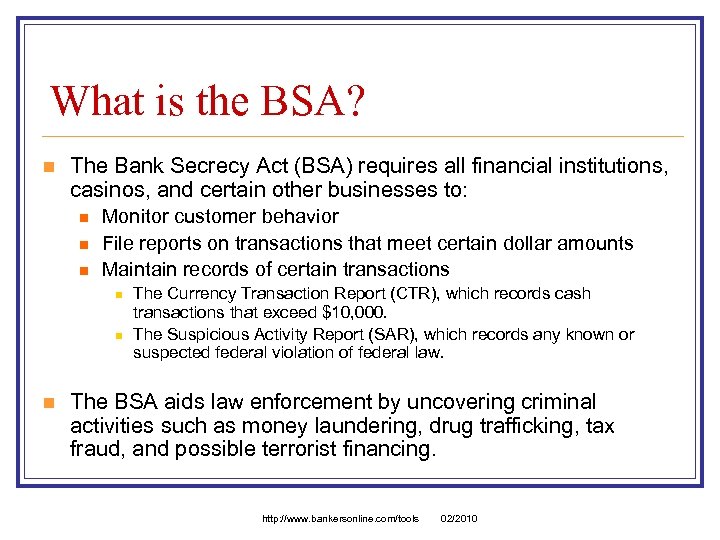

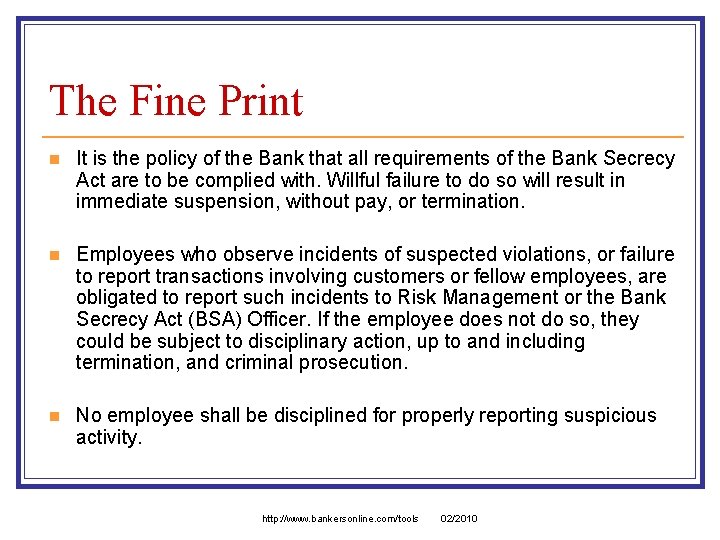

Bank Secrecy Act Record Retention Requirements. Originators bank the bank must obtain and retain a record of the following information. BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved. Ii Retention of records. The bank must retain the information in paragraph a 3 i A of this section for five years after the date the account is closed or in the case of credit card accounts five years after the account is closed or becomes dormant.

Complianceonline Bank Secrecy Act Quiz Proprofs Quiz From proprofs.com

Complianceonline Bank Secrecy Act Quiz Proprofs Quiz From proprofs.com

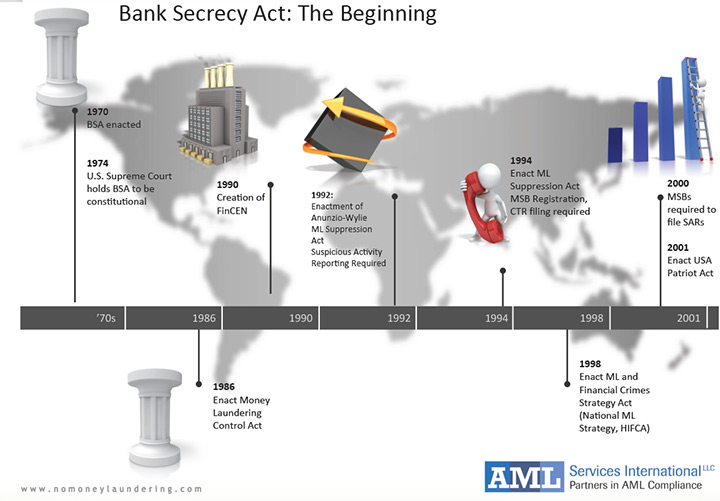

An institution is required to retain either the original microfilm copy or other reproduction of the relevant documents. These responsibilities which relate to the maintenance of records identifying purchasers of bank checks and drafts cashiers checks money. Part 3268b1 of the FDIC Rules and Regulations. 1 In its original form subchapter II of chapter 53 of title 31 United States Code was part of Pub. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. 200 Has the credit union received correspondence from law.

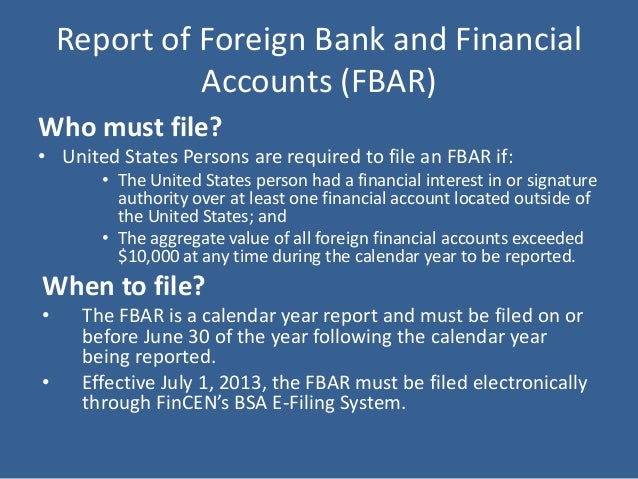

Copies of Currency Transaction Reports as required by and filed with FinCEN must be retained.

511 Records to Retain The Bank Secrecy Act record requirements include the following. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. 31 CFR 10334 b Each bank shall in addition retain either the original or a microfilm or other copy or reproduction of each of the following. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years. A national bank shall maintain a copy of any SAR filed and the original or business record equivalent of any supporting documentation for a. 200 Has the credit union received correspondence from law.

Source: securitiesanalytics.com

Source: securitiesanalytics.com

The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. In general the BSA requires that a bank maintain most records for at least five years. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. These records can be maintained in many forms including original microfilm electronic copy or a reproduction. G Retention of records.

Source: acamstoday.org

Source: acamstoday.org

Originators bank the bank must obtain and retain a record of the following information. All CTRs and SARs must be retained 5 years after filing. Name and address of originator. General Record Retention Requirements Ensure that the extensive record retention requirements particularly 10333 34 and 121 pertaining to financial institutions are implemented. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive.

Source: slideplayer.com

Source: slideplayer.com

Each type of document has specific instructions with this act. BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved. Copies of Currency Transaction Reports as required by and filed with FinCEN must be retained. The bank must retain the information in paragraph a 3 i A of this section for five years after the date the account is closed or in the case of credit card accounts five years after the account is closed or becomes dormant. Copies of any Suspicious Activity Report filed with FinCEN must be retained with the original or business record equivalent of any supporting documentation.

Source: blog.gao.gov

Source: blog.gao.gov

The bank must retain the information in paragraph a 3 i A of this section for five years after the date the account is closed or in the case of credit card accounts five years after the account is closed or becomes dormant. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. All CTRs and SARs for 5 years after filing. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. It is a process by which soiled cash is converted into clean cash.

Source: slideserve.com

Source: slideserve.com

An institution is required to retain either the original microfilm copy or other reproduction of the relevant documents. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. All CTRs and SARs must be retained 5 years after filing. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal. These records can be maintained in many forms including original microfilm electronic copy or a reproduction.

Source: slideshare.net

Source: slideshare.net

Records are required to be retained at least 5 years in most. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. These records can be maintained in many forms including original microfilm electronic copy or a reproduction.

Source: proprofs.com

Source: proprofs.com

Records are required to be retained at least 5 years in most. All CTRs and SARs must be retained 5 years after filing. 91–508 which requires recordkeeping for and reporting of currency transactions by banks and others and is commonly known as the Bank Secrecy Act. BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved. Bank Secrecy Act Retention Requirements The concept of cash laundering is essential to be understood for these working in the financial sector.

Source: tookitaki.ai

Source: tookitaki.ai

Part 3268b1 of the FDIC Rules and Regulations. General Record Retention Requirements Ensure that the extensive record retention requirements particularly 10333 34 and 121 pertaining to financial institutions are implemented. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years. Each type of document has specific instructions with this act. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications.

Source: slideshare.net

Source: slideshare.net

General Record Retention Requirements Ensure that the extensive record retention requirements particularly 10333 34 and 121 pertaining to financial institutions are implemented. Part 3268b1 of the FDIC Rules and Regulations. G Retention of records. An institution is required to retain either the original microfilm copy or other reproduction of the relevant documents. 1 In its original form subchapter II of chapter 53 of title 31 United States Code was part of Pub.

Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. The loan is satisfied and the requirements for retention in Regulations Z B C the Real Estate Settlement Procedures Act Flood Disaster Protection Act and the Fair Credit Reporting Act the Bank Secrecy Act or any other applicable law or regulation are satisfied. How to record a money transfer of 3000 or more for money transfer senders and receivers. It is a process by which soiled cash is converted into clean cash. Copies of any Suspicious Activity Report filed with FinCEN must be retained with the original or business record equivalent of any supporting documentation.

Source: slideserve.com

Source: slideserve.com

1 In its original form subchapter II of chapter 53 of title 31 United States Code was part of Pub. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. These responsibilities which relate to the maintenance of records identifying purchasers of bank checks and drafts cashiers checks money. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Records are required to be retained at least 5 years in most.

Source: present5.com

Source: present5.com

A bank is not required to keep a separate system of records for each of the BSA requirements. 91–508 which requires recordkeeping for and reporting of currency transactions by banks and others and is commonly known as the Bank Secrecy Act. How to record a money transfer of 3000 or more for money transfer senders and receivers. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

Source: slidetodoc.com

Source: slidetodoc.com

Records of every cashier and other official check of 3000 or more for 5 years after issuance. General Record Retention Requirements Ensure that the extensive record retention requirements particularly 10333 34 and 121 pertaining to financial institutions are implemented. A national bank shall maintain a copy of any SAR filed and the original or business record equivalent of any supporting documentation for a. A number of additional recordkeeping and record retention responsibilities under the Bank Secrecy Act will become effective on August 13 1990. Bank Secrecy Act Retention Requirements The concept of cash laundering is essential to be understood for these working in the financial sector.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act record retention requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas