12++ Bank secrecy act requirements cip info

Home » money laundering Info » 12++ Bank secrecy act requirements cip infoYour Bank secrecy act requirements cip images are ready. Bank secrecy act requirements cip are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act requirements cip files here. Get all royalty-free photos.

If you’re searching for bank secrecy act requirements cip images information connected with to the bank secrecy act requirements cip keyword, you have pay a visit to the right blog. Our site always provides you with suggestions for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

Bank Secrecy Act Requirements Cip. Specifically this section covers. The CIP rule applies to any person who opens a new account. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. The program must be part of the banks Bank Secrecy Act policy and each affected employee must receive training.

Bank Secrecy Act Anti Money Laundering Examination Manual Ffiec From yumpu.com

Bank Secrecy Act Anti Money Laundering Examination Manual Ffiec From yumpu.com

The CIP rule applies to any person who opens a new account. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 Transactions regulations must be filed with the IRS. It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as. 5318 h 12 USC. Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. Who is a customer.

Regulatory Requirements for Customer Identification Programs This section outlines the regulatory requirements for banks in 12 CFR Chapters I through III and VII and 31 CFR Chapter X regarding CIPs.

The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Specifically this section covers. The goal behind this requirement is to prevent the funding of terrorism both inside and outside of the United States. Congress enacted the Bank Secrecy Act BSA to prevent credit unions from being used as intermediaries for the transfer or deposit of money derived from criminal activity. 5318 h 12 USC.

12 CFR 2121c2 12 CFR 20863b2 12 CFR 2115m2 12 CFR. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. The CIP rule applies to any person who opens a new account. The Bank Secrecy Act BSA requires financial institutions to assist US. The Patriot Act amended the Bank Secrecy Act to include a requirement for financial institutions to essentially make sure that their customers are who they are say are in order to.

Source: yumpu.com

Source: yumpu.com

The Order generally describes the CIP rules of the BSA which at a very high level require covered financial institutions to implement a CIP that includes risk-based verification procedures that enable the financial institution to form a reasonable belief that it knows the true identify of its customers. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. 5318 h 12 USC. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program. 18 If a bank.

Source: slideserve.com

Source: slideserve.com

Regulations established under BSA mandate that banks and other financial institutions establish Customer identification programs CIPs to verify the identities of their customers. Updated Bank Secrecy Act. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. Collectively the Federal Banking Agencies FBAs with the concurrence of the Financial Crimes Enforcement Network FinCEN have issued an Order granting an exemption from the requirements of the customer identification program CIP rules implementing section. The program must be designed for the size complexity and risk profile of.

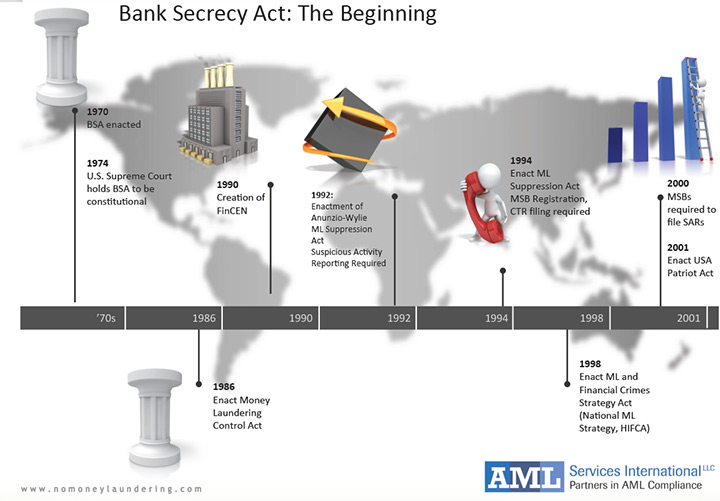

Source: acamstoday.org

Source: acamstoday.org

5318 h 12 USC. 12 CFR 2121c2 12 CFR 20863b2 12 CFR 2115m2 12 CFR. Customers and Accounts Under CIP All banks must have a written board approved Customer Identification Program CIP. The Order generally describes the CIP rules of the BSA which at a very high level require covered financial institutions to implement a CIP that includes risk-based verification procedures that enable the financial institution to form a reasonable belief that it knows the true identify of its customers. The program must be part of the banks Bank Secrecy Act policy and each affected employee must receive training.

Source: youtube.com

Source: youtube.com

The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. The CIP rule applies to any person who opens a new account. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. The Patriot Act amended the Bank Secrecy Act to include a requirement for financial institutions to essentially make sure that their customers are who they are say are in order to.

Source: slidetodoc.com

Source: slidetodoc.com

The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The program must be part of the banks Bank Secrecy Act policy and each affected employee must receive training. General CIP Requirements. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Updated Bank Secrecy Act.

Source: slidetodoc.com

Source: slidetodoc.com

12 CFR 2121c2 12 CFR 20863b2 12 CFR 2115m2 12 CFR. Collectively the Federal Banking Agencies FBAs with the concurrence of the Financial Crimes Enforcement Network FinCEN have issued an Order granting an exemption from the requirements of the customer identification program CIP rules implementing section. The Order generally describes the CIP rules of the BSA which at a very high level require covered financial institutions to implement a CIP that includes risk-based verification procedures that enable the financial institution to form a reasonable belief that it knows the true identify of its customers. Government agencies to detect and prevent money laundering. Prior to June 9 2003 the Bank Secrecy Act did not have a CIP component.

Source: slideserve.com

Source: slideserve.com

Each bank and credit union and other financial institutions must have a written Customer Identification Program CIP that is approved by the organizations Board of Directors. The CIP rule applies to any person who opens a new account. The OCCs implementing regulations are found at 12 CFR 2111 and 12 CFR 2121. The goal behind this requirement is to prevent the funding of terrorism both inside and outside of the United States. Bank Secrecy Act Requirements - A Quick Reference Guide for MSBs FinCENgov.

Source: present5.com

Source: present5.com

Customers and Accounts Under CIP All banks must have a written board approved Customer Identification Program CIP. 12 CFR 2121c2 12 CFR 20863b2 12 CFR 2115m2 12 CFR. Regulations established under BSA mandate that banks and other financial institutions establish Customer identification programs CIPs to verify the identities of their customers. 1818 s or 12 USC. 1786 q 1 must implement a written Customer Identification Program CIP appropriate for the banks size and type of business that at a minimum includes each of the requirements of paragraphs a 1 through 5 of this section.

Source: slideserve.com

Source: slideserve.com

The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. 12 CFR 2121c2 12 CFR 20863b2 12 CFR 2115m2 12 CFR. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. The goal behind this requirement is to prevent the funding of terrorism both inside and outside of the United States. It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as.

Source: slideserve.com

Source: slideserve.com

Prior to June 9 2003 the Bank Secrecy Act did not have a CIP component. Customers and Accounts Under CIP All banks must have a written board approved Customer Identification Program CIP. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Collectively the Federal Banking Agencies FBAs with the concurrence of the Financial Crimes Enforcement Network FinCEN have issued an Order granting an exemption from the requirements of the customer identification program CIP rules implementing section. The Patriot Act amended the Bank Secrecy Act to include a requirement for financial institutions to essentially make sure that their customers are who they are say are in order to.

Source: slideplayer.com

Source: slideplayer.com

Regulatory Requirements for Customer Identification Programs This section outlines the regulatory requirements for banks in 12 CFR Chapters I through III and VII and 31 CFR Chapter X regarding CIPs. Updated Bank Secrecy Act. The CIP requirements to identify and verify the identities of customers more clearly protect against some of the types of fraud previously identified by FinCEN and consequently it may be less appropriate to loosen such requirements at this time. The goal behind this requirement is to prevent the funding of terrorism both inside and outside of the United States. Collectively the Federal Banking Agencies FBAs with the concurrence of the Financial Crimes Enforcement Network FinCEN have issued an Order granting an exemption from the requirements of the customer identification program CIP rules implementing section.

Source: present5.com

Source: present5.com

Bank Secrecy Act Requirements - A Quick Reference Guide for MSBs FinCENgov. The Know Your Customer KYC provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003. Each bank and credit union and other financial institutions must have a written Customer Identification Program CIP that is approved by the organizations Board of Directors. A bank required to have an anti-money laundering compliance program under the regulations implementing 31 USC. According to the Bank Secrecy ActAnti-Money Laundering Examination Manual a banks CIP must contain account-opening procedures detailing the identifying information that must be obtained from each customer.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act requirements cip by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas