15+ Bank secrecy act retention requirements information

Home » money laundering Info » 15+ Bank secrecy act retention requirements informationYour Bank secrecy act retention requirements images are available. Bank secrecy act retention requirements are a topic that is being searched for and liked by netizens now. You can Get the Bank secrecy act retention requirements files here. Get all royalty-free photos.

If you’re looking for bank secrecy act retention requirements pictures information connected with to the bank secrecy act retention requirements interest, you have come to the right site. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

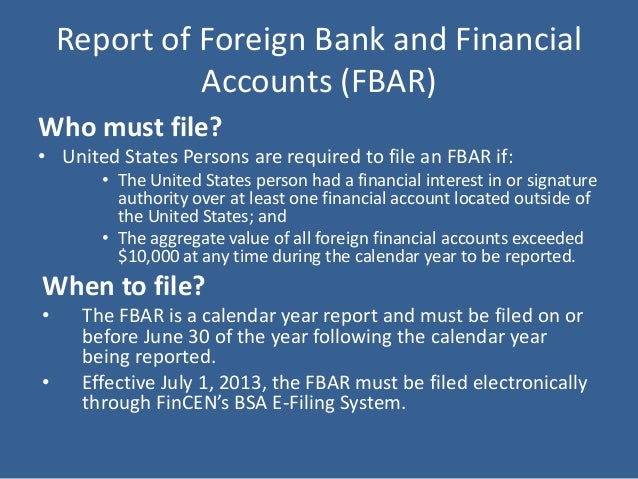

Bank Secrecy Act Retention Requirements. 5311 et seq is referred to as the Bank Secrecy Act BSA. It is a process by which soiled cash is converted into clean cash. Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. 5318 h 12 USC.

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office From blog.gao.gov

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office From blog.gao.gov

5311 et seq is referred to as the Bank Secrecy Act BSA. 1 Each document. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. Records of every cashier and other official check of 3000 or more must be stored for 5 years after issuance. Records are required to be retained at least 5 years in most cases. Bank Secrecy Act.

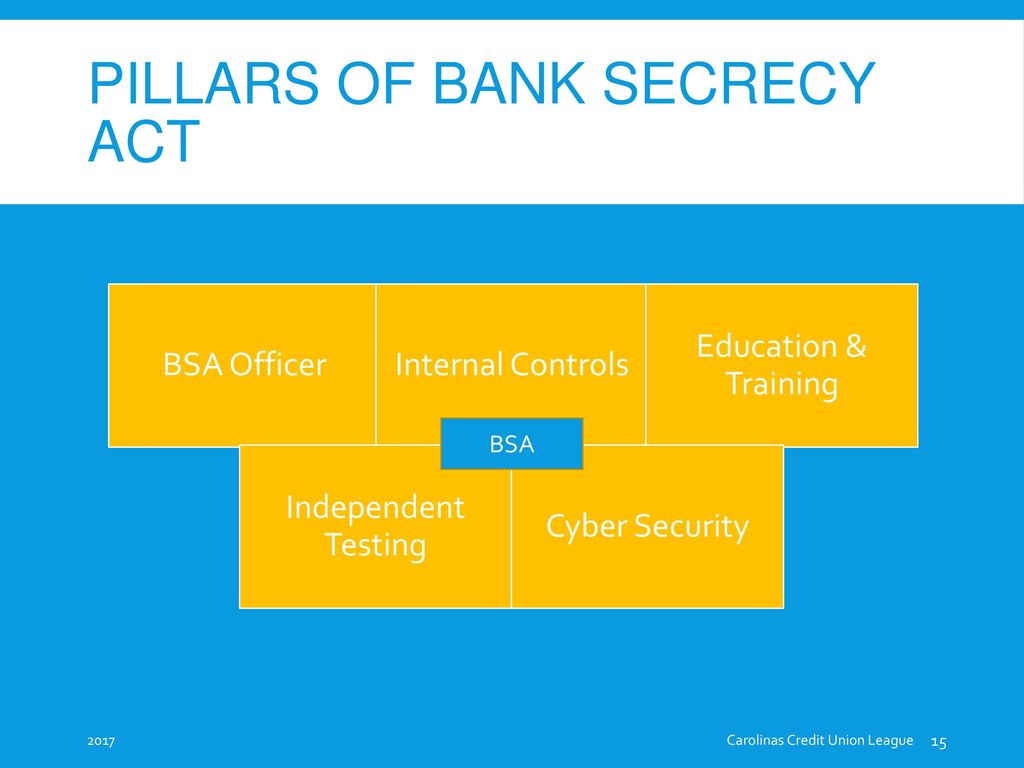

The independent testing should be conducted at least annually preferably by the internal audit department outside auditors or consultants.

Bank Secrecy Act Retention Requirements The concept of cash laundering is essential to be understood for these working in the financial sector. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal. Yes independent testing of Bank Secrecy Act Compliance is required by each of the bank regulatory agencies. All CTRs and SARs must be retained 5 years after filing. Record-retention requirements under other laws.

Source: slideserve.com

Source: slideserve.com

It is a process by which soiled cash is converted into clean cash. Record-retention requirements under other laws. All CTRs and SARs for 5 years after filing Records of every cashier and other official check of 3000 or more for 5 years after issuance. For comprehensive and current BSA record retention requirements refer to US. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA.

Source: slideshare.net

Source: slideshare.net

Government agencies in detecting and preventing money laundering. Part 3268b1 of the FDIC Rules and Regulations. Bank Secrecy Act Requirements - A Quick Reference Guide for MSBs FinCENgov. Records are required to be retained at least 5 years in most cases. BANK SECRECY ACT REQUIREMENTS For answers to your questions about BSA reporting and recordkeeping requirements please visit wwwmsbgov.

Source: proprofs.com

Source: proprofs.com

1818 s or 12 USC. Effective October 1 2003 the requirements contained in 10334a will be. For comprehensive and current BSA record retention requirements refer to US. It specifically requires financial institutions to. Record-retention requirements under other laws.

Source: slideplayer.com

Source: slideplayer.com

The independent testing should be conducted at least annually preferably by the internal audit department outside auditors or consultants. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. Policies and procedures for compliance with applicable laws in the states in which it does business. Government agencies in detecting and preventing money laundering. BANK SECRECY ACT REQUIREMENTS For answers to your questions about BSA reporting and recordkeeping requirements please visit wwwmsbgov.

Source: complyadvantage.com

Source: complyadvantage.com

Part 3268b1 of the FDIC Rules and Regulations. An institution is required to retain either the original microfilm copy or other reproduction of the relevant documents. Federal law Bank Secrecy Act regulations requires that you be able to reproduce the card for five years after the account is closed but indicates your copies are adequate. Bank Secrecy Act BSA Retention Requirements All Required Forms and Records 5 years Bank CardsDebit Cards Retention Requirements Account History 6 years AAC Applications. 1786 q 1 must implement a written Customer Identification Program CIP appropriate for the banks size and type of business that at a minimum includes each of the requirements of paragraphs a 1 through 5 of this section.

Source: blog.gao.gov

Source: blog.gao.gov

5318 h 12 USC. Government agencies in detecting and preventing money laundering. Treasury FinCEN regulations found at 31 CFR Chapter X. Financial institutions to assist US. The independent testing should be conducted at least annually preferably by the internal audit department outside auditors or consultants.

Source: slideplayer.com

Source: slideplayer.com

1818 s or 12 USC. BANK SECRECY ACTS REPORTING REQUIREMENTS J Mr. Independent testing for compliance with the BSA and 31 C. 31 CFR 10334 b Each bank shall in addition retain either the original or a microfilm or other copy or reproduction of each of the following. These BSA record retention requirements are independent of and in addition to record retention requirements under other laws.

Source: slideshare.net

Source: slideshare.net

Bank Secrecy Act Documents generally must be retained for 5 years under the BSAAML requirements but it is the type of documents that is so exhaustive. The independent testing should be conducted at least annually preferably by the internal audit department outside auditors or consultants. All CTRs and SARs must be retained 5 years after filing. Policies and procedures for compliance with applicable laws in the states in which it does business. 5311 et seq is referred to as the Bank Secrecy Act BSA.

Source: slideserve.com

Source: slideserve.com

Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. 51 Bank Secrecy Act The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. It is a process by which soiled cash is converted into clean cash. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. BANK SECRECY ACT REQUIREMENTS For answers to your questions about BSA reporting and recordkeeping requirements please visit wwwmsbgov.

5318 h 12 USC. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. Five-Year Retention for Records as Specified Below The BSA establishes recordkeeping requirements related to various types of records including. Chapter 4 Bank Secrecy Act The purpose of the Bank Secrecy Act 31 USC 53115332 12 CFR Part 21 is to require US. An institution is required to retain either the original microfilm copy or other reproduction of the relevant documents.

Source: slideplayer.com

Source: slideplayer.com

5311 et seq is referred to as the Bank Secrecy Act BSA. Approved 6 years AAC Denied 25 months Charged-off loan records Permanent Correspondence 3 years Credit files 3 years Disclosure statements 2 years. The sources of the money in actual are criminal and the cash is invested in a manner that makes it seem like clear money and conceal. 5311 et seq is referred to as the Bank Secrecy Act BSA. The independent testing should be conducted at least annually preferably by the internal audit department outside auditors or consultants.

Source: blog.gao.gov

Source: blog.gao.gov

All CTRs and SARs for 5 years after filing Records of every cashier and other official check of 3000 or more for 5 years after issuance. We initiated our review pursuant to your request at the conclusion of this Subcommittees. Detroit Computing Center Hotline 1-800-800-2877 FinCEN Regulatory Helpline 1-800-949-2732 To order free guidance materials 1-800-386-6329 To order BSA forms from the IRS Forms Distribution Center. BSA - Bank Secrecy Act INTRODUCTION AND PURPOSE REPORTS PENALTIES RECORD RETENTION REQUIREMENTS REGULATORY REFERENCES YesNoNA Comments Risk Assessment Scoping 100 Does review of the AIRES Compliance Violations module indicate that all prior violations are resolved. Bank Secrecy Act.

Source: pinterest.com

Source: pinterest.com

For comprehensive and current BSA record retention requirements refer to US. Bank Secrecy Act Requirements - A Quick Reference Guide for MSBs FinCENgov. 5311 et seq is referred to as the Bank Secrecy Act BSA. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103. Detroit Computing Center Hotline 1-800-800-2877 FinCEN Regulatory Helpline 1-800-949-2732 To order free guidance materials 1-800-386-6329 To order BSA forms from the IRS Forms Distribution Center.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act retention requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas