12+ Bank secrecy act risk assessment ideas

Home » money laundering Info » 12+ Bank secrecy act risk assessment ideasYour Bank secrecy act risk assessment images are available in this site. Bank secrecy act risk assessment are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act risk assessment files here. Get all royalty-free vectors.

If you’re searching for bank secrecy act risk assessment pictures information linked to the bank secrecy act risk assessment interest, you have visit the right site. Our site frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Bank Secrecy Act Risk Assessment. Examiners assess the adequacy of a banks BSAAML compliance. JavaScript must be enabled in your browser in order to use some functions. When the Federal Banking Regulators started to focus on this risk-based approach in 2005 this is the focus of all regulators now the FIs started documenting their Bank Secrecy ActAnti-Money Laundering BSAAML Risk Assessments. Examiners use risk assessments and independent testing when planning and conducting examinations.

Https Indianabankers Org Sites Default Files Events Files Part 203 20bsa 20grad 20sch 20 20risk 20assess 20iba 20final 202017 Pdf From

Bank Secrecy ActAnti-Money Laundering Self-Assessment Tool. The Bank Secrecy Act and its promulgating regulations require banks to identify risks assess the risks and create a compliance program based on the risk assessment. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate. The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. This is one more risk assessment tool being distributed to national banks as part of the OCCs exam process.

DSC Risk Management Manual of Examination Policies 81-3 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 More than one of these factors must typically be present in order to provide sufficient evidence that the corporate veil has been pierced.

Bank Secrecy Act Total Official Checks including Travelers Cashier Checks Compliance Testing Operational Testing Last Tested Year Freq. The banks BSAAML risk assessment process should address the varying degrees of risk associated with its products services customers and geographic locations as appropriate. For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. Bank Secrecy ActAnti-Money Laundering Self-Assessment Tool. DSC Risk Management Manual of Examination Policies 81-3 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 More than one of these factors must typically be present in order to provide sufficient evidence that the corporate veil has been pierced. In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act2 which established requirements for recordkeeping and reporting by private individuals banks3 and other financial institutions.

Source:

When the Federal Banking Regulators started to focus on this risk-based approach in 2005 this is the focus of all regulators now the FIs started documenting their Bank Secrecy ActAnti-Money Laundering BSAAML Risk Assessments. DSC Risk Management Manual of Examination Policies 81-3 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 More than one of these factors must typically be present in order to provide sufficient evidence that the corporate veil has been pierced. The banks BSAAML risk assessment process should address the varying degrees of risk associated with its products services customers and geographic locations as appropriate. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate. CSBS and a group of state BSAAML subject-matter experts developed the BSAAML Self-Assessment Tool to be used at the discretion of a financial institution to help in the BSAAML risk assessment process.

Source: acamstoday.org

Source: acamstoday.org

The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions. The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign Transactions. Any institution may find this form helpful. 0 denotes not applicable to the specific category. It is also a good practice to list high risk account types or activities in the risk assessment whether or not you are holding performing any of them.

Source: capitalcomplianceexperts.com

Source: capitalcomplianceexperts.com

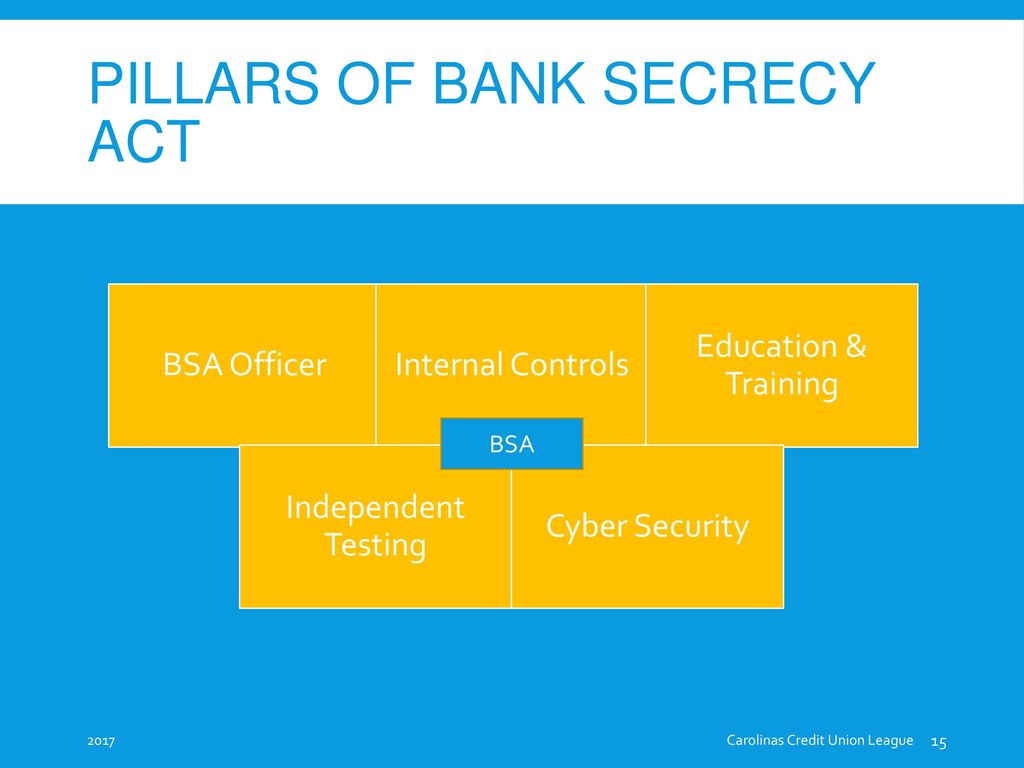

The Self-Assessment Tool is designed to support banks communicate the results of this risk assessment process. Examiners use risk assessments and independent testing when planning and conducting examinations. Bank Secrecy ActAnti-Money Laundering Self-Assessment Tool. Though the risk assessments of a few institutions are still not analytical andor detailed enough to enable a true assessment whether the AML Program is aligned to institutions risks the overall BSAAML risk assessments. The BSA was designed to help identify the source volume and movement.

Source:

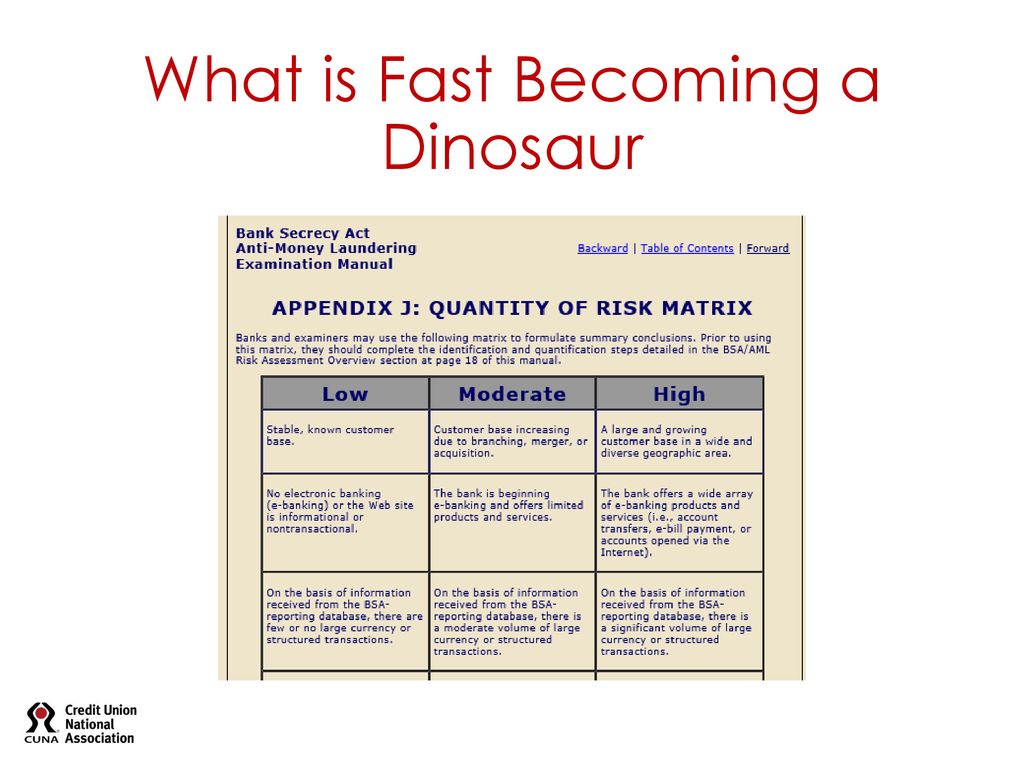

The FFIEC Bank Secrecy Act Anti-Money Laundering Examination Manual further states there are many effective methods and formats used in completing a BSAAML Risk Assessment and that credit union management should decide the appropriate method and format. In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act2 which established requirements for recordkeeping and reporting by private individuals banks3 and other financial institutions. When the Federal Banking Regulators started to focus on this risk-based approach in 2005 this is the focus of all regulators now the FIs started documenting their Bank Secrecy ActAnti-Money Laundering BSAAML Risk Assessments. JavaScript must be enabled in your browser in order to use some functions. Any institution may find this form helpful.

Source:

DSC Risk Management Manual of Examination Policies 81-3 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 More than one of these factors must typically be present in order to provide sufficient evidence that the corporate veil has been pierced. 0 denotes not applicable to the specific category. The Summary form is a gauge to assist in BSA risk analysis as it pertains to your products geographies services and customersThe OCC was careful to note that a banks final risk profile is not driven by the numbers alone. The Bank Secrecy Act and its promulgating regulations require banks to identify risks assess the risks and create a compliance program based on the risk assessment. The OCC prescribes regulations conducts supervisory activities and when necessary takes enforcement actions to ensure that national banks have the necessary controls in place and provide the requisite notices to law enforcement to deter and detect money laundering terrorist financing and other criminal acts and the misuse of our nations financial institutions.

Source: pt.slideshare.net

Source: pt.slideshare.net

Bank Secrecy Act Total Official Checks including Travelers Cashier Checks Compliance Testing Operational Testing Last Tested Year Freq. When the Federal Banking Regulators started to focus on this risk-based approach in 2005 this is the focus of all regulators now the FIs started documenting their Bank Secrecy ActAnti-Money Laundering BSAAML Risk Assessments. Any institution may find this form helpful. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program.

Source:

Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. Any institution may find this form helpful. The Self-Assessment Tool is designed to support banks communicate the results of this risk assessment process. For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. The BSA was designed to help identify the source volume and movement.

Source: rgsglobaladvisors.com

Source: rgsglobaladvisors.com

This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate. Any institution may find this form helpful. For example the risk assessment should include money services businesses correspondent accounts private banking accounts foreign accounts or NRA accounts third party senders and pay through accounts. The Self-Assessment Tool is designed to support banks communicate the results of this risk assessment process. Input managements assessment of the level of risk to the bank associated with each category with 1 as low risk 3 as average risk and 5 high risk.

Source: slideplayer.com

Source: slideplayer.com

Risk-focused BSAAML examinations consider a banks unique risk profile. Though the risk assessments of a few institutions are still not analytical andor detailed enough to enable a true assessment whether the AML Program is aligned to institutions risks the overall BSAAML risk assessments. Overall Bank Secrecy Act and Anti-Money Laundering Risk Assessment Score High 61 to 75 Moderate 41 to 60 Low 25 to 40 31 HIDTAHIFCA High Intensity Drug Trafficking Area and High Intensity Financial Crime Area. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate. In 1970 Congress passed the Currency and Foreign Transactions Reporting Act commonly known as the Bank Secrecy Act2 which established requirements for recordkeeping and reporting by private individuals banks3 and other financial institutions.

Source: slideplayer.com

Source: slideplayer.com

Examiners assess the adequacy of a banks BSAAML compliance. It is also a good practice to list high risk account types or activities in the risk assessment whether or not you are holding performing any of them. View the FFIEC Bank Secrecy ActAnti-Money Laundering Manual Appendix I Risk Assessment Link to the BSAAML Compliance Program page under the Appendices section. Examiners use risk assessments and independent testing when planning and conducting examinations. Section provides information and procedures for examiners in determining whether the bank has developed a risk assessment process that adequately identifies the MLTF and other illicit financial activity risks within its banking operations.

Source:

Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. The BSA was designed to help identify the source volume and movement. Risk-focused BSAAML examinations consider a banks unique risk profile. View the FFIEC Bank Secrecy ActAnti-Money Laundering Manual Appendix I Risk Assessment Link to the BSAAML Compliance Program page under the Appendices section. This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate.

Source:

This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate. The Self-Assessment Tool is designed to support banks communicate the results of this risk assessment process. It is flexible and intended to be adapted to each institutions circumstances and. Examiners assess the adequacy of a banks BSAAML compliance. Examiners use risk assessments and independent testing when planning and conducting examinations.

Source: probank.com

Source: probank.com

DSC Risk Management Manual of Examination Policies 81-3 Bank Secrecy Act 12-04 Federal Deposit Insurance Corporation BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 More than one of these factors must typically be present in order to provide sufficient evidence that the corporate veil has been pierced. This is one more risk assessment tool being distributed to national banks as part of the OCCs exam process. Though the risk assessments of a few institutions are still not analytical andor detailed enough to enable a true assessment whether the AML Program is aligned to institutions risks the overall BSAAML risk assessments. Input managements assessment of the level of risk to the bank associated with each category with 1 as low risk 3 as average risk and 5 high risk. Any institution may find this form helpful.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas