17++ Bank secrecy act training 2020 ideas

Home » money laundering idea » 17++ Bank secrecy act training 2020 ideasYour Bank secrecy act training 2020 images are available in this site. Bank secrecy act training 2020 are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank secrecy act training 2020 files here. Download all royalty-free photos and vectors.

If you’re looking for bank secrecy act training 2020 images information linked to the bank secrecy act training 2020 keyword, you have come to the right blog. Our site frequently gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

Bank Secrecy Act Training 2020. 2020 Bank Secrecy Act Training for Volunteers 5 Suspicious Activity Reporting Credit unions are required to file a Suspicious Activity Report SAR if the institution knows or suspects that a transaction. At the ABAABA Financial Crimes Enforcement Conference in December regulatory officials flagged deficiencies in risk assessments a need for more maturity in compliance systems and processes and data. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and.

Risk Based Bank Secrecy Act Anti Money Laundering Examinations Rgs Global Advisors From rgsglobaladvisors.com

Risk Based Bank Secrecy Act Anti Money Laundering Examinations Rgs Global Advisors From rgsglobaladvisors.com

BSA Bank Secrecy Act Training for New Staff 2020-07-15 This webinar provides a new to BSA training that takes attendees through the most important facets of BSA go through terminology of BSA regulatory guidance and how-to prepare for this. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. This video training will provide an overview of the history of BSA other organization and acts involved in BSA and the necessary components of a BSA program. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. 27500 - 1 login 30000 - 2 logins 32500 - 3 logins 35000 - 4 logins 37500 - 5 logins 47400 - 1 login CD ROM 29500 - Purchase CD ROM Only. The training is to be done in consultation with FinCEN and all levels of law enforcement including federal state tribal and local.

NJ bank director and BSA officer pay for BSA violations.

She specializes in the deposit side of the financial institution and is an instructor on IRAs BSA Deposit Regulations and opening account procedures. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being a place where criminal launder money. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. To that end this course provides an overview of the Bank Secrecy Act including specific actions that you.

Source: tookitaki.ai

Source: tookitaki.ai

Recorded on April 28 2021. Get training to meet your Bank Secrecy Act BSA training requirements. BSA Bank Secrecy Act Training for New Staff 2020-07-15 This webinar provides a new to BSA training that takes attendees through the most important facets of BSA go through terminology of BSA regulatory guidance and how-to prepare for this. Compliance with the Bank Secrecy Act otherwise known as the BSA is a critical task for each and every credit union in the United States so all credit union employees must be familiar with BSA requirements. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Anti Money Laundering Bank Secrecy Act Learn how to combat money laundering terrorism financing. BSA Bank Secrecy Act Training for New Staff 2020-07-15 This webinar provides a new to BSA training that takes attendees through the most important facets of BSA go through terminology of BSA regulatory guidance and how-to prepare for this. Presented by Deborah Crawford. Anti Money Laundering Bank Secrecy Act Learn how to combat money laundering terrorism financing. This anti-money laundering AML course is designed for financial institutions to help them prevent money laundering and terrorist financing and learn to.

Source: rgsglobaladvisors.com

Source: rgsglobaladvisors.com

BSA and OFAC Staff Annual Training - 2021. 2 hours ago BSA Bank Secrecy Act Training for New Staff 2020-10-20 This webinar provides a new to BSA training that takes attendees through the most important facets of BSA go through terminology of BSA regulatory guidance and how-to prepare for this new specialized role. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. To that end this course provides an overview of the Bank Secrecy Act including specific actions that you.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. Take this quiz and look at how much you know about the Bank Secrecy Act. Several agencies have identified other areas of Bank Secrecy Act BSAAnti-Money Laundering AML compliance as top priorities for 2020. She specializes in the deposit side of the financial institution and is an instructor on IRAs BSA Deposit Regulations and opening account procedures. Welcome to the FFIEC Bank Secrecy ActAnti-Money Laundering InfoBase.

Source: diehleducation.com

Source: diehleducation.com

She specializes in the deposit side of the financial institution and is an instructor on IRAs BSA Deposit Regulations and opening account procedures. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. NJ bank director and BSA officer pay for BSA violations. 2020 Bank Secrecy Act Training for Volunteers 5 Suspicious Activity Reporting Credit unions are required to file a Suspicious Activity Report SAR if the institution knows or suspects that a transaction.

Source: youtube.com

Source: youtube.com

Examiners assess the adequacy of the banks Bank Secrecy Actanti-money laundering BSAAML compliance program relative to its risk profile and the banks compliance with BSA regulatory requirements. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. BSA Bank Secrecy Act Training for New Staff 2020-07-15 This webinar provides a new to BSA training that takes attendees through the most important facets of BSA go through terminology of BSA regulatory guidance and how-to prepare for this. Take this quiz and look at how much you know about the Bank Secrecy Act. To that end this course provides an overview of the.

Source: qsstudy.com

Source: qsstudy.com

Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. Presented by Deborah Crawford. Recorded on April 28 2021. The program includes an on-demand video with a download option a comprehensive manual and presentation slides Powerpoint that can all be used for. The training is to be done in consultation with FinCEN and all levels of law enforcement including federal state tribal and local.

Source: blog.gao.gov

Source: blog.gao.gov

Get training to meet your Bank Secrecy Act BSA training requirements. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. Deborah Crawford is the President of Gettechnical Inc a Virginia based training company. BSA and OFAC Staff Annual Training - 2021.

![]() Source: adiconsulting.com

Source: adiconsulting.com

The training is to be done in consultation with FinCEN and all levels of law enforcement including federal state tribal and local. Presented by Deborah Crawford. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. The Bank Secrecy Act is a piece of legislation enacted in 1970 which is meant to keep banks from being a place where criminal launder money. She specializes in the deposit side of the financial institution and is an instructor on IRAs BSA Deposit Regulations and opening account procedures.

Source: blog.gao.gov

Source: blog.gao.gov

Under this act US banks are required to submit documentation for any transaction that is of 10000 or more. Deborah Crawford is the President of Gettechnical Inc a Virginia based training company. BSA and OFAC Staff Annual Training - 2021. 2020 Bank Secrecy Act Training for Volunteers 5 Suspicious Activity Reporting Credit unions are required to file a Suspicious Activity Report SAR if the institution knows or suspects that a transaction. To that end this course provides an overview of the Bank Secrecy Act including specific actions that you.

Source: probank.com

Source: probank.com

BSA and OFAC Compliance - Staff Training. BSA Bank Secrecy Act Training for New Staff 2020-10-20 This webinar provides a new to BSA training that takes attendees through the most important facets of BSA go through terminology of BSA regulatory guidance and how-to prepare for this new. Several agencies have identified other areas of Bank Secrecy Act BSAAnti-Money Laundering AML compliance as top priorities for 2020. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. 2020 Bank Secrecy Act Training for Volunteers 5 Suspicious Activity Reporting Credit unions are required to file a Suspicious Activity Report SAR if the institution knows or suspects that a transaction.

Source: compliancealert.org

Source: compliancealert.org

Under this act US banks are required to submit documentation for any transaction that is of 10000 or more. NJ bank director and BSA officer pay for BSA violations. Take this quiz and look at how much you know about the Bank Secrecy Act. Compliance with the Bank Secrecy Act otherwise known as the BSA is a critical task for each and every credit union in the United States so all credit union employees must be familiar with BSA requirements. April 2020 Updates to the Bank Secrecy ActAnti-Money Laundering Examination Manual.

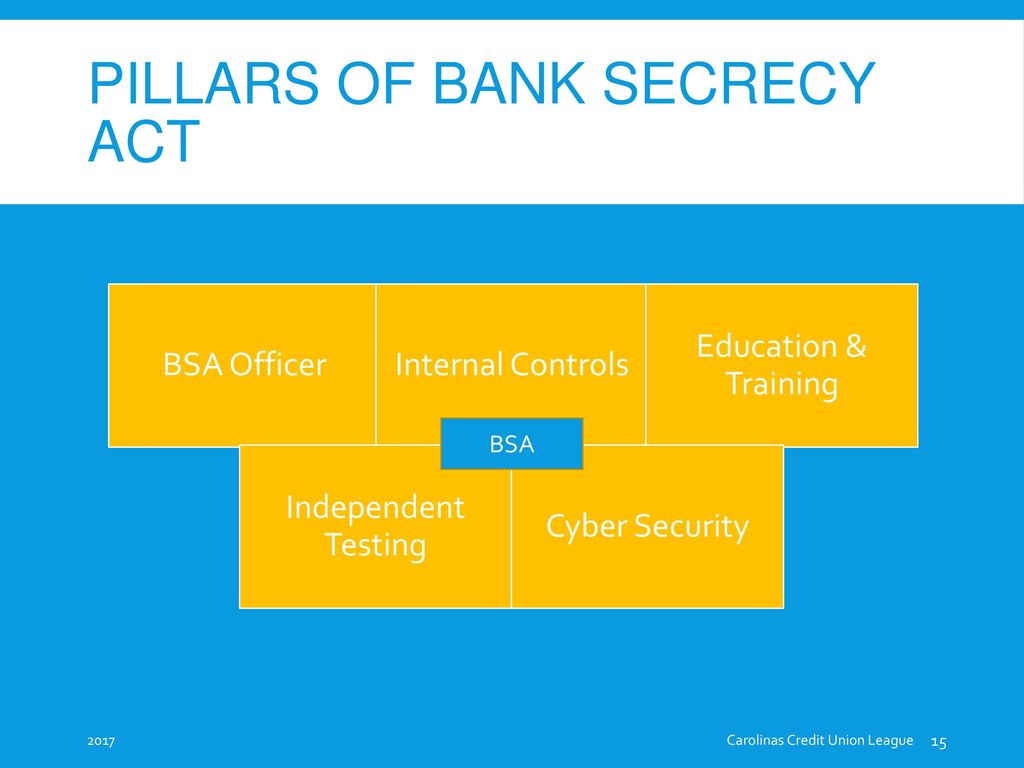

Source: slideplayer.com

Source: slideplayer.com

Under this act US banks are required to submit documentation for any transaction that is of 10000 or more. She specializes in the deposit side of the financial institution and is an instructor on IRAs BSA Deposit Regulations and opening account procedures. Anti Money Laundering Bank Secrecy Act Learn how to combat money laundering terrorism financing. Our Bank Secrecy Act Training for Board of Directors is a comprehensive but quick and to-the-point program designed to assist in training the Board of Directors on the Bank Secrecy Act. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act training 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information