11+ Bank secrecy act training for board of directors ideas in 2021

Home » money laundering idea » 11+ Bank secrecy act training for board of directors ideas in 2021Your Bank secrecy act training for board of directors images are available in this site. Bank secrecy act training for board of directors are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act training for board of directors files here. Download all royalty-free vectors.

If you’re searching for bank secrecy act training for board of directors pictures information related to the bank secrecy act training for board of directors keyword, you have pay a visit to the ideal blog. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

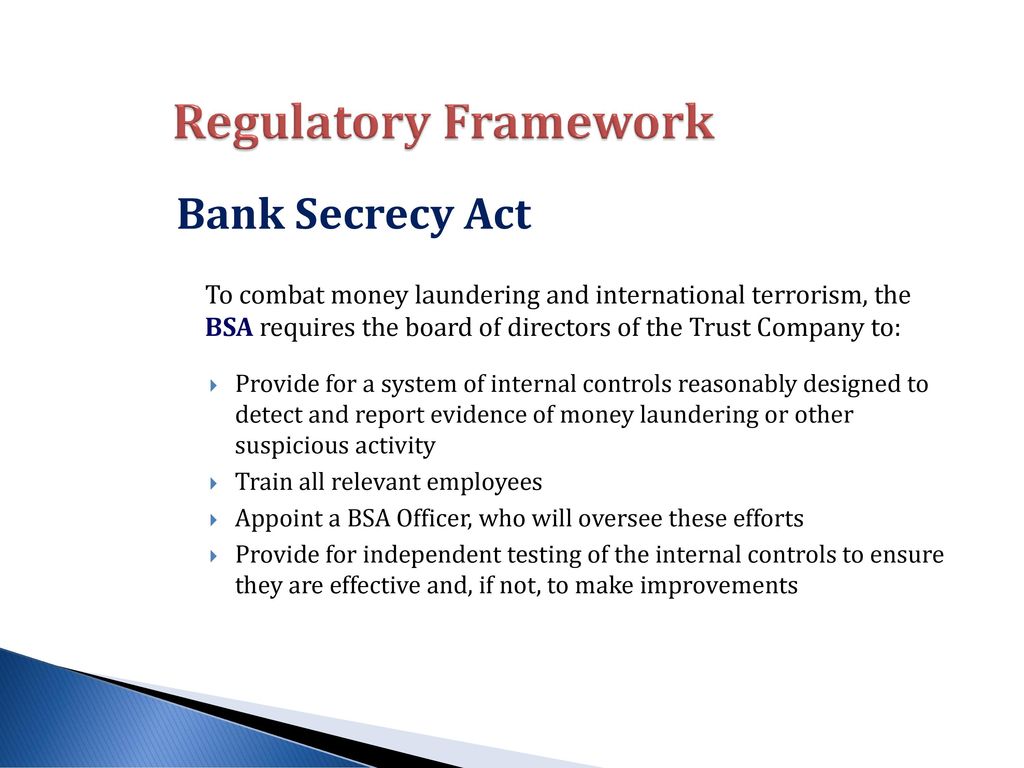

Bank Secrecy Act Training For Board Of Directors. This webinar covers Bank Secrecy Act BSA training for your organizations Board of Directors. Click here to find out more about our board of directors compliance training. While the board of directors may not require the same degree of training as banking operations personnel they need to understand the importance of BSAAML regulatory requirements the ramifications of noncompliance and the risks posed to the credit union. For BOD and Supervisory Committee.

Bank Secrecy Act Workshop Bsa Aml Training For Banks From probank.com

Bank Secrecy Act Workshop Bsa Aml Training For Banks From probank.com

Want to discover more about our Bank Secrecy Act online training. This suite of 15 videos presents need-to-know fundamentals about bank board responsibilities strategies and best practices for diversifying the members and the importance of recruiting women to join. Select modules in the Board of Directors Online Training Subscription. Bank Secrecy Act BSA Training for the Board of Directors Susan Costonis She specializes in compliance management along with deposit and lending regulatory training. Bank B SAR filed for unexplained multiple wire transfers to Charles Smith at Bank D Suspects. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime.

EZ Convenience Mart Chuck Joseph authorized signer.

The Bank Secrecy Act Board of Directors 2018 Presented by Devon Lyon NAFCU Director of Education Todays Topics How did we get here. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. The board of directors and senior management should receive foundational training and be informed of changes and new developments in the BSA including its implementing regulations the federal banking. To sign up for exclusive access to this online bank board resource please contact Bank Services at 615-777-8461 or bankservices. Our Bank Secrecy Act Training for Board of Directors program is designed to provide a overview of Bank Secrecy Act and anti-money laundering risks from the perspective of what a Director needs to know in order to have appropriate oversight of this high-risk area.

Source: probank.com

Source: probank.com

Our Bank Secrecy Act Training for Board of Directors program is designed to provide a overview of Bank Secrecy Act and anti-money laundering risks from the perspective of what a Director needs to know in order to have appropriate oversight of this high-risk area. Her past positions include teller. BSA and OFAC Compliance - Board of Directors Training. Bank B SAR filed for unexplained multiple wire transfers to Charles Smith at Bank D Suspects. To sign up for exclusive access to this online bank board resource please contact Bank Services at 615-777-8461 or bankservices.

Source: nafcu.org

Source: nafcu.org

The Bank Secrecy Act Board of Directors 2018 Presented by Devon Lyon NAFCU Director of Education Todays Topics How did we get here. If want a higher resolution you can find it on Google Images. The board of directors and senior management should receive foundational training and be informed of changes and new developments in the BSA including its implementing regulations the federal banking. Bank secrecy act training for board of directors. What topics should be covered in BSA training sessions for the Board of Directors.

Credit union volunteers are required to complete annual BSA training. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. While the board of directors may not require the same degree of training as banking operations personnel they need to understand the importance of BSAAML regulatory requirements the ramifications of noncompliance and the risks posed to the credit union. Much is expected today of bank boards which provide both strategic direction and oversight of critical functions. Want to discover more about our Bank Secrecy Act online training.

Source: slideplayer.com

Source: slideplayer.com

BSA and OFAC Compliance - Board of Directors Training. Internal communication best practices and tips. The Bank Secrecy Act Board of Directors 2018 Presented by Devon Lyon NAFCU Director of Education Todays Topics How did we get here. If want a higher resolution you can find it on Google Images. Bank B SAR filed for unexplained multiple wire transfers to Charles Smith at Bank D Suspects.

Source: troutman.com

Source: troutman.com

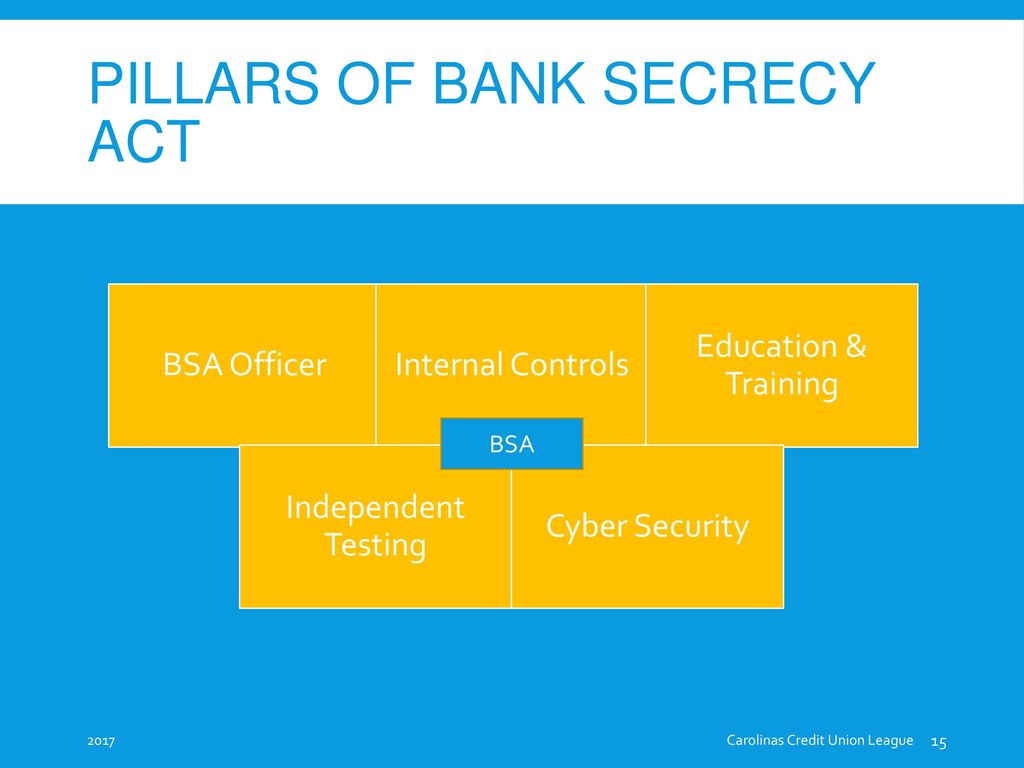

Select modules in the Board of Directors Online Training Subscription. Compliance BSA Compliance Officer Must be designated by the board of directors May delegate BSA operations but is ultimately responsible for all BSA compliance Should be fully knowledgeable of the BSA and all related regulations Lines of. What are the four best practices for Boards of Directors to show compliance with an effective BSAAML anti-money laundering program. It helps answer questions such as. Bank A SAR filed for cash deposit structuring with no apparent business purpose Suspects.

Bank Secrecy Act and OFAC Compliance Staff Training. Bank secrecy act training for board of directors. Copyright of all images in bank secrecy act training for board of directors. While the board of directors may not require the same degree of training as banking operations personnel they need to understand the importance of BSAAML regulatory requirements the ramifications of noncompliance and the risks posed to the credit union. Credit union volunteers are required to complete annual BSA training.

Source: slideserve.com

Source: slideserve.com

NAFCU offers BSA training certificates of attendance for board members for participation in. What are the four best practices for Boards of Directors to show compliance with an effective BSAAML anti-money laundering program. The Bank Secrecy Act Board of Directors 2018 Presented by Devon Lyon NAFCU Director of Education Todays Topics How did we get here. The Board of Directors The BSA Compliance Officer BSA and OFAC Compliance - Staff Training. Click to learn more.

Source: slideplayer.com

Source: slideplayer.com

You can access all contents by clicking the download button. Bank A SAR filed for cash deposit structuring with no apparent business purpose Suspects. From how-to articles director training videos key interviews with industry leaders and more Bank Services provides bank executives and directors with the tools to help grow their financial institutions. BSAAMLOFAC Board Training Devil Queen and Empress EGB combined their resources and created two versions of PowerPoint programs that you can use to train your board of directors for the Bank Secrecy ActAnti-Money Laundering and OFAC. Compliance BSA Compliance Officer Must be designated by the board of directors May delegate BSA operations but is ultimately responsible for all BSA compliance Should be fully knowledgeable of the BSA and all related regulations Lines of.

Source: slideplayer.com

Source: slideplayer.com

Deb joined Bankers Compliance Consulting with twenty years of experience in the banking industry. Our Bank Secrecy Act Training for Board of Directors program is designed to provide a overview of Bank Secrecy Act and anti-money laundering risks from the perspective of what a Director needs to know in order to have appropriate oversight of this high-risk area. To sign up for exclusive access to this online bank board resource please contact Bank Services at 615-777-8461 or bankservices. The board of directors and senior management should receive foundational training and be informed of changes and new developments in the BSA including its implementing regulations the federal banking. If want a higher resolution you can find it on Google Images.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

While the board of directors may not require the same degree of training as banking operations personnel they need to understand the importance of BSAAML regulatory requirements the ramifications of noncompliance and the risks posed to the credit union. Bank Secrecy Act BSA Training for the Board of Directors Susan Costonis She specializes in compliance management along with deposit and lending regulatory training. For BOD and Supervisory Committee. The contents of this presentation are intended to. BSAAMLOFAC Board Training Devil Queen and Empress EGB combined their resources and created two versions of PowerPoint programs that you can use to train your board of directors for the Bank Secrecy ActAnti-Money Laundering and OFAC.

Source: acamstoday.org

Source: acamstoday.org

Click here to find out more about our board of directors compliance training. This webinar covers Bank Secrecy Act BSA training for your organizations Board of Directors. For BOD and Supervisory Committee. Click here to find out more about our board of directors compliance training. Bank B SAR filed for unexplained multiple wire transfers to Charles Smith at Bank D Suspects.

Source: compliancecohort.com

Source: compliancecohort.com

Click to learn more. Our Bank Secrecy Act Training for Board of Directors program is designed to provide a overview of Bank Secrecy Act and anti-money laundering risks from the perspective of what a Director needs to know in order to have appropriate oversight of this high-risk area. Her past positions include teller. If want a higher resolution you can find it on Google Images. The Board of Directors The BSA Compliance Officer BSA and OFAC Compliance - Staff Training.

Source: bankerscompliance.com

Source: bankerscompliance.com

BSAAMLOFAC Board Training Devil Queen and Empress EGB combined their resources and created two versions of PowerPoint programs that you can use to train your board of directors for the Bank Secrecy ActAnti-Money Laundering and OFAC. Bank secrecy act training for board of directors. BSA and OFAC Compliance - Board of Directors Training. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. Click to learn more.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act training for board of directors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information