20++ Bank secrecy act training ideas information

Home » money laundering Info » 20++ Bank secrecy act training ideas informationYour Bank secrecy act training ideas images are available in this site. Bank secrecy act training ideas are a topic that is being searched for and liked by netizens today. You can Download the Bank secrecy act training ideas files here. Find and Download all free vectors.

If you’re looking for bank secrecy act training ideas pictures information linked to the bank secrecy act training ideas interest, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

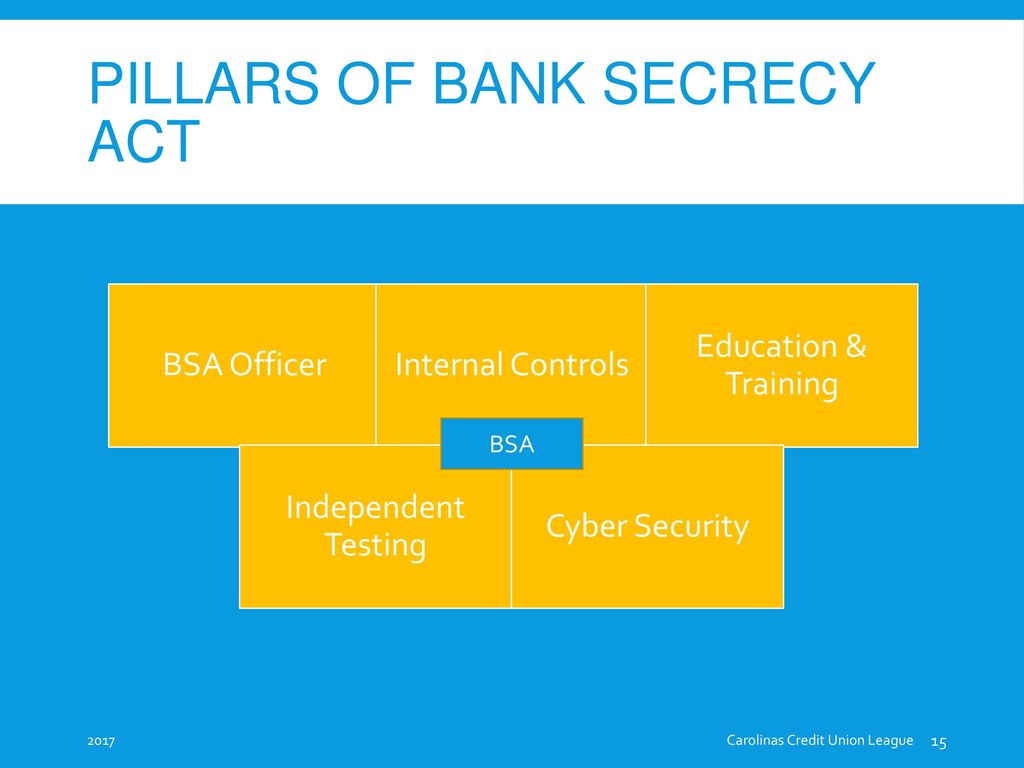

Bank Secrecy Act Training Ideas. Definitions and building blocks for your BSA. What is a dont when preparing for or during a regulatory exam. The Bank Secrecy Act requires financial institutions to assist US. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime.

Bsa Aml Ofac Staff Training Ppt Download From slideplayer.com

Bsa Aml Ofac Staff Training Ppt Download From slideplayer.com

In this Back to Basics installment well cover the requirements imposed upon your financial institution by the Currency and Foreign Transactions Reporting Act of 1970 also known as the Bank Secrecy Act. The Bank Secrecy Act requires financial institutions to assist US. Definitions and building blocks for your BSA. Government agencies in the detection and prevention of money laundering and in preventing the financing of terrorist activities. The training program for BSA needs to be formatted to address the unique. Is designed to be a foundational and comprehensive online course on the Bank Secrecy Act and anti-money laundering AML rules.

The Bank Secrecy Act was originally passed in 1970 with the goal of combatting money-laundering activity in the United States.

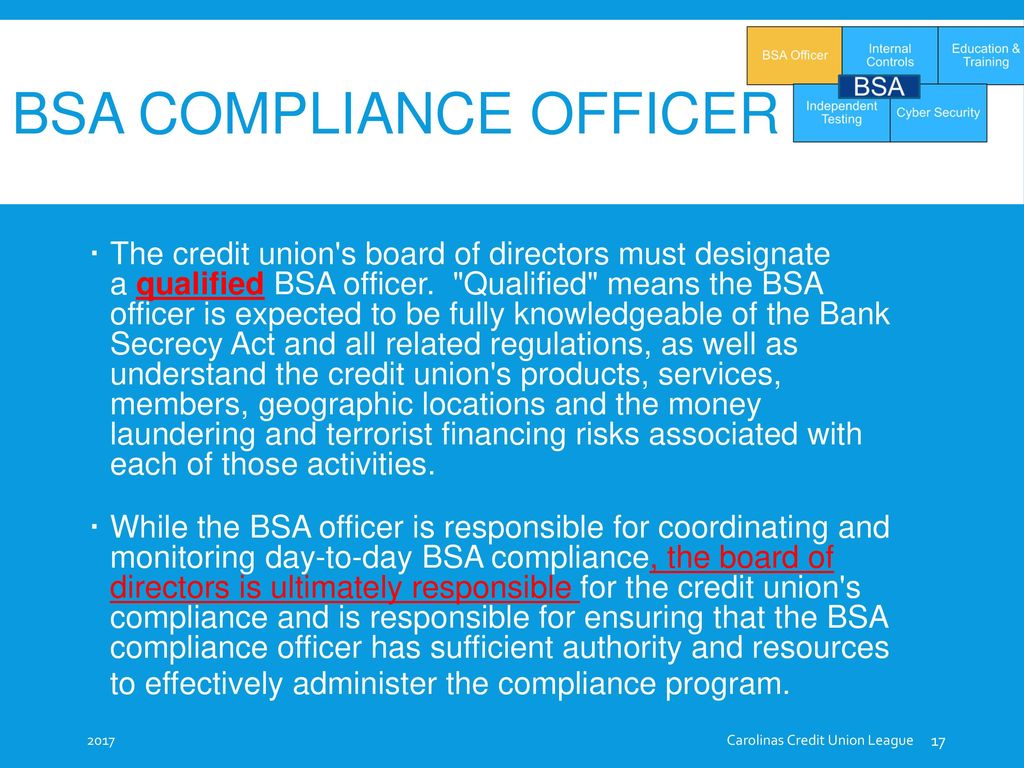

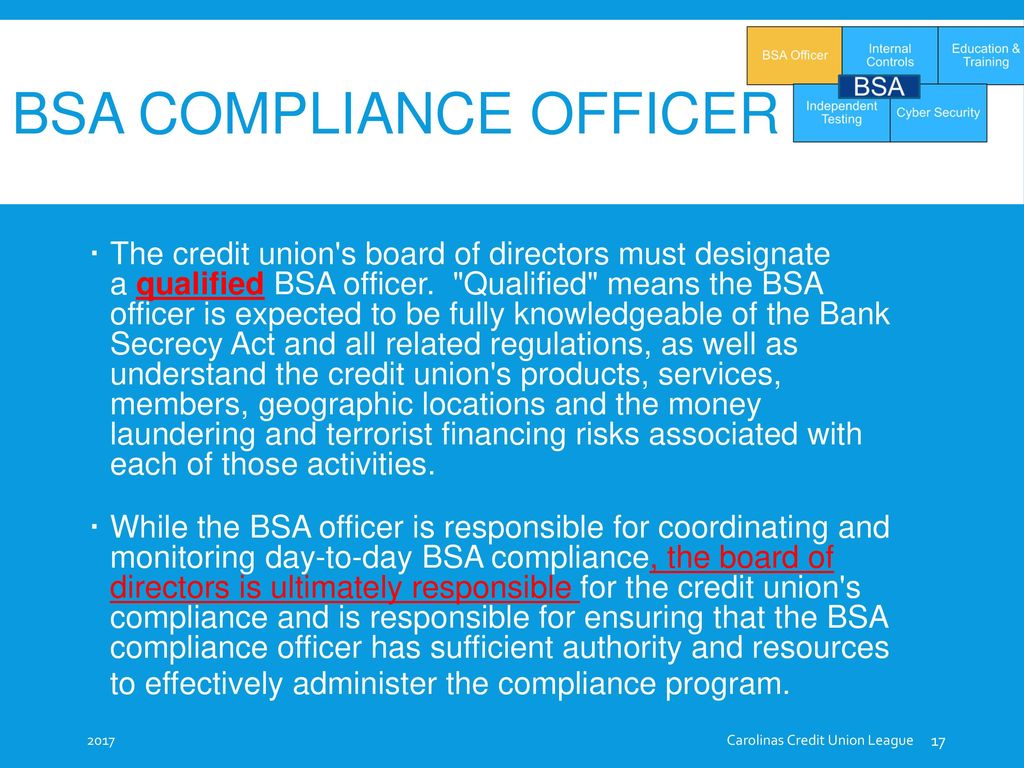

2017 Bank Secrecy Act Training for Volunteers 1 Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA. It can be used as a Train the Trainer course or as annual training for all employees. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. Twice the length of a typical webinar this Compliance Class runs. BSA Bank Secrecy Act Training for New Staff 2020-10-20 This webinar provides a new to BSA training that takes attendees through the most important facets of BSA go through terminology of BSA regulatory guidance and how-to prepare for this new specialized role. What is a dont when preparing for or during a regulatory exam.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. It can be used as a Train the Trainer course or as annual training for all employees. This video training will provide an overview of the history of BSA other organization and acts involved in BSA and the necessary components of a BSA program. What is the rule on tolerance of what the lender is allowed to change on. Definitions and building blocks for your BSA.

Source: slideplayer.com

Source: slideplayer.com

How do banks track disclosures. It can be used as a Train the Trainer course or as annual training for all employees. The law originally required banks to maintain certain records and to report large currency transactions. This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy Act. What is a dont when preparing for or during a regulatory exam.

Source: compliancecohort.com

Source: compliancecohort.com

Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. In this Back to Basics installment well cover the requirements imposed upon your financial institution by the Currency and Foreign Transactions Reporting Act of 1970 also known as the Bank Secrecy Act. Our BSA banking courses provide bank secrecy act training covering BSA regulations Bank Secrecy Act requirements the BSA reporting requirements and other Bank Secrecy Act compliance requirements including. 2017 Bank Secrecy Act Training for Volunteers 1 Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA. Government agencies in the detection and prevention of money laundering and in preventing the financing of terrorist activities.

Source: slideplayer.com

Source: slideplayer.com

Banks are required to have bank secrecy act training processes that determine which transactions are potentially suspicious and implement strong BSA compliance program so click through to better understand your BSA training and reporting requirements. How do banks track disclosures. BSA and OFAC Compliance - Staff Training. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. BSA and OFAC Compliance - Board of Directors Training.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

This video training will provide an overview of the history of BSA other organization and acts involved in BSA and the necessary components of a BSA program. Bank Secrecy Act. 2017 Bank Secrecy Act Training for Volunteers 1 Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA. Over the years the law has been amended a number of times adding requirements to report suspicious activities and. It can be used as a Train the Trainer course or as annual training for all employees.

Source: blog.gao.gov

Source: blog.gao.gov

The training program for BSA needs to be formatted to address the unique. What is a dont when preparing for or during a regulatory exam. This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy Act. This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy Act. 2017 Bank Secrecy Act Training for Volunteers 1 Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA.

Source: acamstoday.org

Source: acamstoday.org

Rule on Tolerance After Closing of Loan. This video training will provide an overview of the history of BSA other organization and acts involved in BSA and the necessary components of a BSA program. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Red Flags for money laundering. What is the rule on tolerance of what the lender is allowed to change on.

Source: complianceonline.com

Source: complianceonline.com

It can be used as a Train the Trainer course or as annual training for all employees. Red Flags for money laundering. Twice the length of a typical webinar this Compliance Class runs. It can be used as a Train the Trainer course or as annual training for all employees. In this Back to Basics installment well cover the requirements imposed upon your financial institution by the Currency and Foreign Transactions Reporting Act of 1970 also known as the Bank Secrecy Act.

The Bank Secrecy Act BSA. Over the years the law has been amended a number of times adding requirements to report suspicious activities and. FEDERAL DEPOSIT INSURANCE CORPORATION Evolution Of The BSA Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986 Annunzio-Wylie Anti-Money Laundering Act 1992 USA PATRIOT Act 2001. It can be used as a Train the Trainer course or as annual training for all employees. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime.

Source: bankerscompliance.com

Source: bankerscompliance.com

BSA and OFAC Compliance - Board of Directors Training. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. The law originally required banks to maintain certain records and to report large currency transactions. Our BSA banking courses provide bank secrecy act training covering BSA regulations Bank Secrecy Act requirements the BSA reporting requirements and other Bank Secrecy Act compliance requirements including. Rule on Tolerance After Closing of Loan.

Source: banktrainingcenter.com

Source: banktrainingcenter.com

What is the rule on tolerance of what the lender is allowed to change on. How do banks track disclosures. The Bank Secrecy Act was originally passed in 1970 with the goal of combatting money-laundering activity in the United States. What is the rule on tolerance of what the lender is allowed to change on. Is designed to be a foundational and comprehensive online course on the Bank Secrecy Act and anti-money laundering AML rules.

Source: slideplayer.com

Source: slideplayer.com

FEDERAL DEPOSIT INSURANCE CORPORATION Evolution Of The BSA Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986 Annunzio-Wylie Anti-Money Laundering Act 1992 USA PATRIOT Act 2001. Is designed to be a foundational and comprehensive online course on the Bank Secrecy Act and anti-money laundering AML rules. It has evolved over time to keep pace with new and emerging threats related to financial crime. This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy Act. Also called The Currency and Foreign Transactions Reporting Act of 1970 the BSA was initially adopted in 1970.

Source: slideserve.com

Source: slideserve.com

This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy Act. The Bank Secrecy Act requires financial institutions to assist US. The law originally required banks to maintain certain records and to report large currency transactions. BSA Bank Secrecy Act Training for New Staff 2020-10-20 This webinar provides a new to BSA training that takes attendees through the most important facets of BSA go through terminology of BSA regulatory guidance and how-to prepare for this new specialized role. In this Back to Basics installment well cover the requirements imposed upon your financial institution by the Currency and Foreign Transactions Reporting Act of 1970 also known as the Bank Secrecy Act.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank secrecy act training ideas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas