17+ Bank secrecy act training materials ideas in 2021

Home » money laundering idea » 17+ Bank secrecy act training materials ideas in 2021Your Bank secrecy act training materials images are ready in this website. Bank secrecy act training materials are a topic that is being searched for and liked by netizens today. You can Get the Bank secrecy act training materials files here. Find and Download all royalty-free vectors.

If you’re looking for bank secrecy act training materials pictures information related to the bank secrecy act training materials keyword, you have come to the ideal blog. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Bank Secrecy Act Training Materials. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. The program includes an on-demand video with a download option a comprehensive manual and presentation slides Powerpoint that can all be used for. Definitions and building blocks for your BSA. The Bank Secrecy Act BSA.

Bank Secrecy Act Training Bsa Compliance Requirements Bank Tc From banktrainingcenter.com

Bank Secrecy Act Training Bsa Compliance Requirements Bank Tc From banktrainingcenter.com

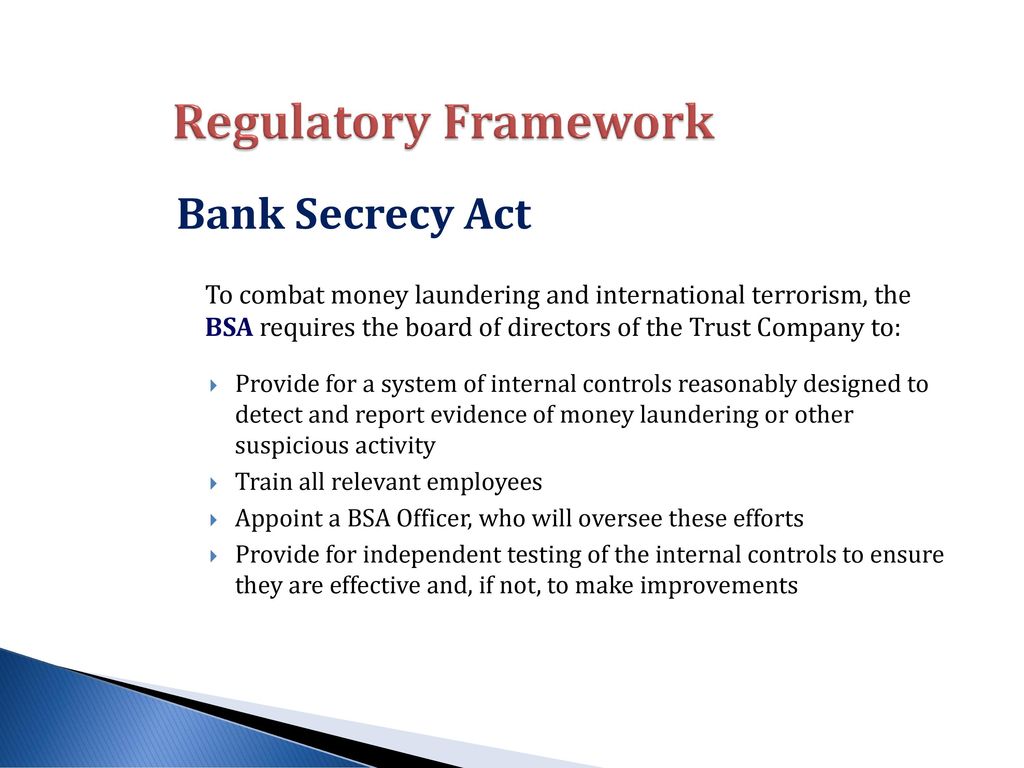

9 hours ago Our Bank Secrecy Act Training for Board of Directors is a comprehensive but quick and to-the-point program designed to assist in training the Board of Directors on the Bank Secrecy Act. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. EZ Convenience Mart Chuck Joseph authorized signer. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy ActIt can be used as a Train the Trainer course or as annual training for all employees.

The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information.

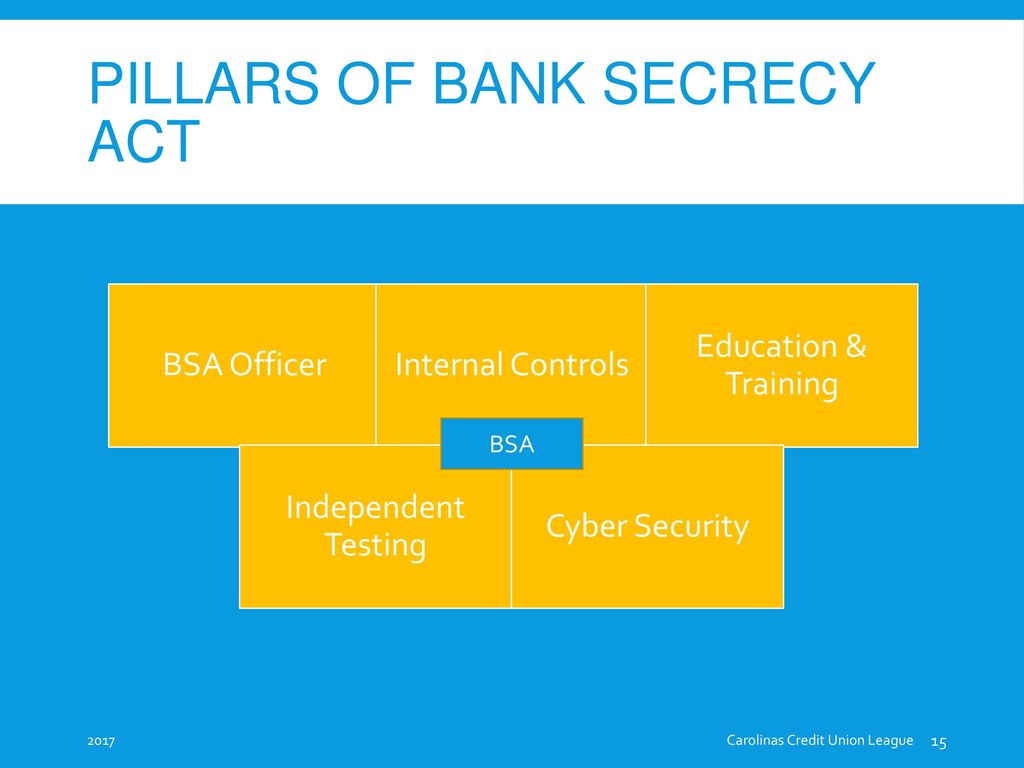

In addition to internal controls independent testing and the designation of a Bank Secrecy Act BSA officer training is one of the four pillars of a financial institutions BSA Program. EZ Convenience Mart Joe Charles owner DOB. The Bank Secrecy Act was originally passed in 1970 with the goal of combatting money-laundering activity in the United States. Bank A SAR filed for cash deposit structuring with no apparent business purpose Suspects. It has evolved over time to keep pace with new and emerging threats related to financial crime. 9 hours ago Our Bank Secrecy Act Training for Board of Directors is a comprehensive but quick and to-the-point program designed to assist in training the Board of Directors on the Bank Secrecy Act.

Source: probank.com

Source: probank.com

This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy ActIt can be used as a Train the Trainer course or as annual training for all employees. Our BSA banking courses provide bank secrecy act training covering BSA regulations Bank Secrecy Act requirements the BSA reporting requirements and other Bank Secrecy Act compliance requirements including. If you have any questions regarding MSB materials please contact the FinCEN Resource Center by calling 1-800-767-2825 or 703 905-3591 or by emailing your inquiry to FRCfincengov Monday thru Friday 800 am. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. The Bank Secrecy Act BSA.

Source: slideserve.com

Source: slideserve.com

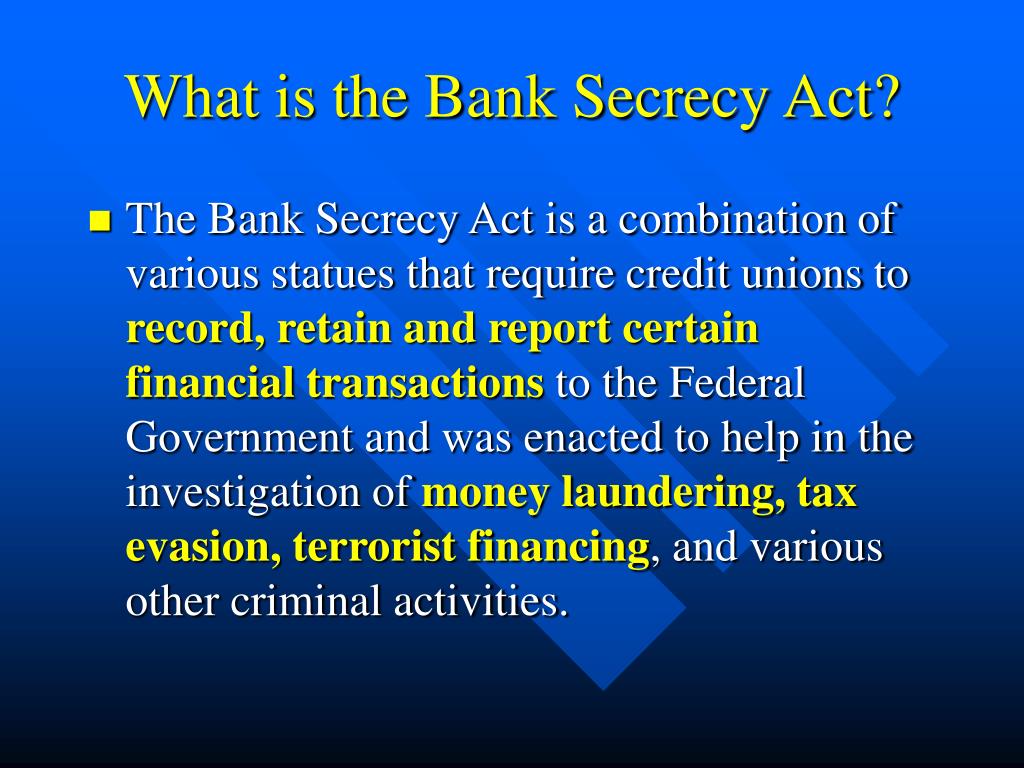

To that end this course provides an overview of the Bank Secrecy Act including specific actions that you. The Bank Secrecy Act BSA. Banks should document their training programs. The program includes an on-demand video with a download option a comprehensive manual and presentation slides Powerpoint that can all be used for. 2017 Bank Secrecy Act Training for Volunteers 1 Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA.

Bank B SAR filed for unexplained multiple wire transfers to Charles Smith at Bank D Suspects. Our Bank Secrecy Act Training for Board of Directors is a comprehensive but quick and to-the-point program designed to assist in training the Board of Directors on the Bank Secrecy Act. Bank Secrecy Act training is not a one size fits all endeavor. Banks should document their training programs. Bank B SAR filed for unexplained multiple wire transfers to Charles Smith at Bank D Suspects.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Definitions and building blocks for your BSA. Training and testing materials if training-related testing is used by the bank and the dates of training sessions should be maintained by the bank. It has evolved over time to keep pace with new and emerging threats related to financial crime. Bank B SAR filed for unexplained multiple wire transfers to Charles Smith at Bank D Suspects. Some credit unions operate Cashless Branches.

![]() Source: adiconsulting.com

Source: adiconsulting.com

She notes that users may want to customize the presentations with local news articles or customized content. This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy ActIt can be used as a Train the Trainer course or as annual training for all employees. BSA and OFAC Compliance - Board of. Banks should document their training programs. The training program for BSA needs to be formatted to address the unique make up of your credit union.

Source: bankerscompliance.com

Source: bankerscompliance.com

EZ Convenience Mart Joe Charles owner DOB. Therefore Bank Secrecy ActAnti-Money Laundering BSAAML. Ensure a recordkeeping and reporting system to prevent deter investigate and prosecute financial crime. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. The Bank Secrecy Act requires financial institutions not just banks to help the federal.

Source: banktrainingcenter.com

Source: banktrainingcenter.com

2017 Bank Secrecy Act Training for Volunteers 1 Purpose of the Bank Secrecy Act BSA To identify the source volume and movement of currency and monetary instruments among US financial institutions To aid in the investigation of money laundering tax evasion international terrorism and other criminal activity Background of the BSA. Definitions and building blocks for your BSA. Red Flags for money laundering. Our BSA banking courses provide bank secrecy act training covering BSA regulations Bank Secrecy Act requirements the BSA reporting requirements and other Bank Secrecy Act compliance requirements including. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs.

Source: slideplayer.com

Source: slideplayer.com

EZ Convenience Mart Chuck Joseph authorized signer. Welcome to CUNAs Bank Secrecy Act for Operations Staff Training on Demand course. 9 hours ago Our Bank Secrecy Act Training for Board of Directors is a comprehensive but quick and to-the-point program designed to assist in training the Board of Directors on the Bank Secrecy Act. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. EZ Convenience Mart Joe Charles owner DOB.

Source: slideserve.com

Source: slideserve.com

In addition to internal controls independent testing and the designation of a Bank Secrecy Act BSA officer training is one of the four pillars of a financial institutions BSA Program. The BSA Risk Assessment can be an invaluable tool in the development of your credit unions SA training program. The FFIEC InfoBase concept was developed by the FFIECs Task Force on Examiner Education and the Task Force on Supervision to provide field examiners at the financial institution regulatory agencies with an electronic source for training and distributing needed examination information. The Bank Secrecy Act requires financial institutions not just banks to help the federal. 9 hours ago Our Bank Secrecy Act Training for Board of Directors is a comprehensive but quick and to-the-point program designed to assist in training the Board of Directors on the Bank Secrecy Act.

Source: slideplayer.com

Source: slideplayer.com

BSA and OFAC Compliance - Board of. Goals of the Bank Secrecy Act Safeguard financial industry from threats of money laundering and illicit finance. Additionally training materials and records should be available for auditor or examiner review. To that end this course provides an overview of the Bank Secrecy Act including specific actions that you. The Bank Secrecy Act was originally passed in 1970 with the goal of combatting money-laundering activity in the United States.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

The program includes an on-demand video with a download option a comprehensive manual and presentation slides Powerpoint that can all be used for. Our Bank Secrecy Act Training for Board of Directors is a comprehensive but quick and to-the-point program designed to assist in training the Board of Directors on the Bank Secrecy Act. The Bank Secrecy Act is one of a few regulations with statutory training requirements. This Bank Secrecy Act BSA program training will guide attendees through the methods to train each segment of the banks or credit unions employees annually on Bank Secrecy ActIt can be used as a Train the Trainer course or as annual training for all employees. It has evolved over time to keep pace with new and emerging threats related to financial crime.

Source: complianceonline.com

Source: complianceonline.com

The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Recognizing that BSA training differs by job description she has provided six different PowerPoint files. The Bank Secrecy Act is one of a few regulations with statutory training requirements. Bank Secrecy Act training is not a one size fits all endeavor. The program includes an on-demand video with a download option a comprehensive manual and presentation slides Powerpoint that can all be used for.

Source: slideplayer.com

Source: slideplayer.com

Bank Secrecy Act training is not a one size fits all endeavor. 9 hours ago Our Bank Secrecy Act Training for Board of Directors is a comprehensive but quick and to-the-point program designed to assist in training the Board of Directors on the Bank Secrecy Act. Bank A SAR filed for cash deposit structuring with no apparent business purpose Suspects. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to conduct a review of their programs. Bank Secrecy Act training is not a one size fits all endeavor.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act training materials by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information