10++ Bank secrecy act violation penalties information

Home » money laundering Info » 10++ Bank secrecy act violation penalties informationYour Bank secrecy act violation penalties images are ready. Bank secrecy act violation penalties are a topic that is being searched for and liked by netizens now. You can Download the Bank secrecy act violation penalties files here. Find and Download all royalty-free photos.

If you’re searching for bank secrecy act violation penalties pictures information related to the bank secrecy act violation penalties topic, you have come to the ideal site. Our site frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

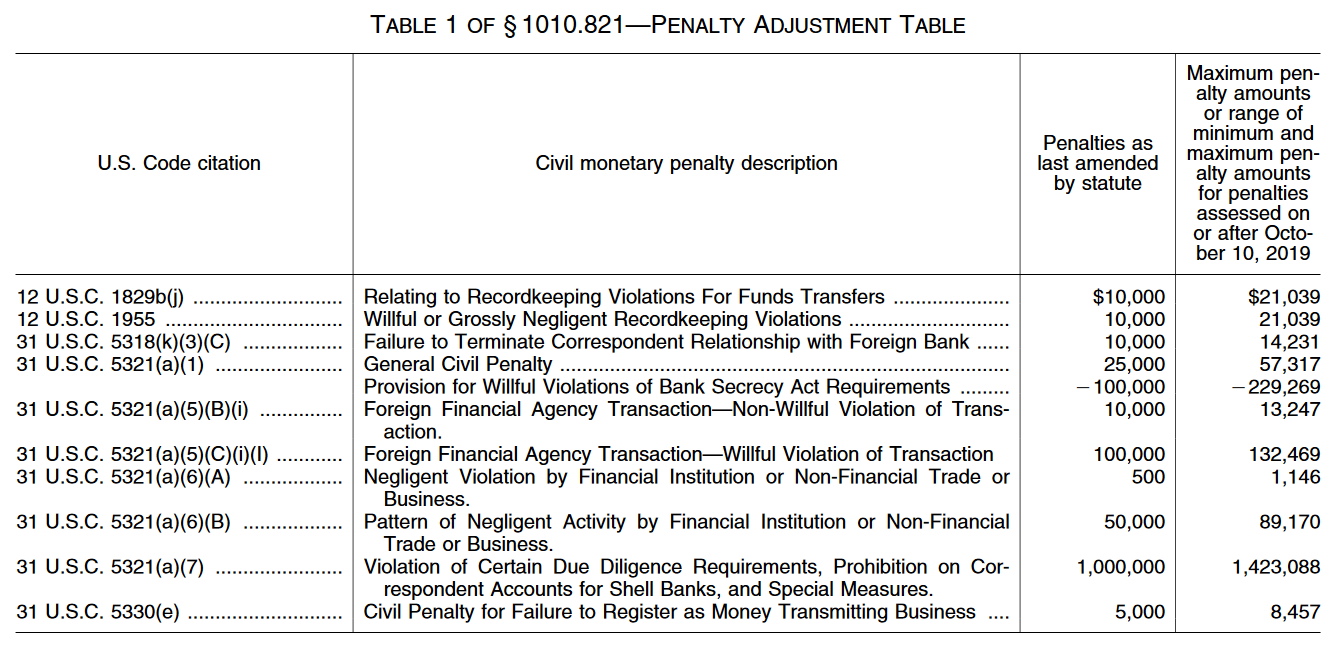

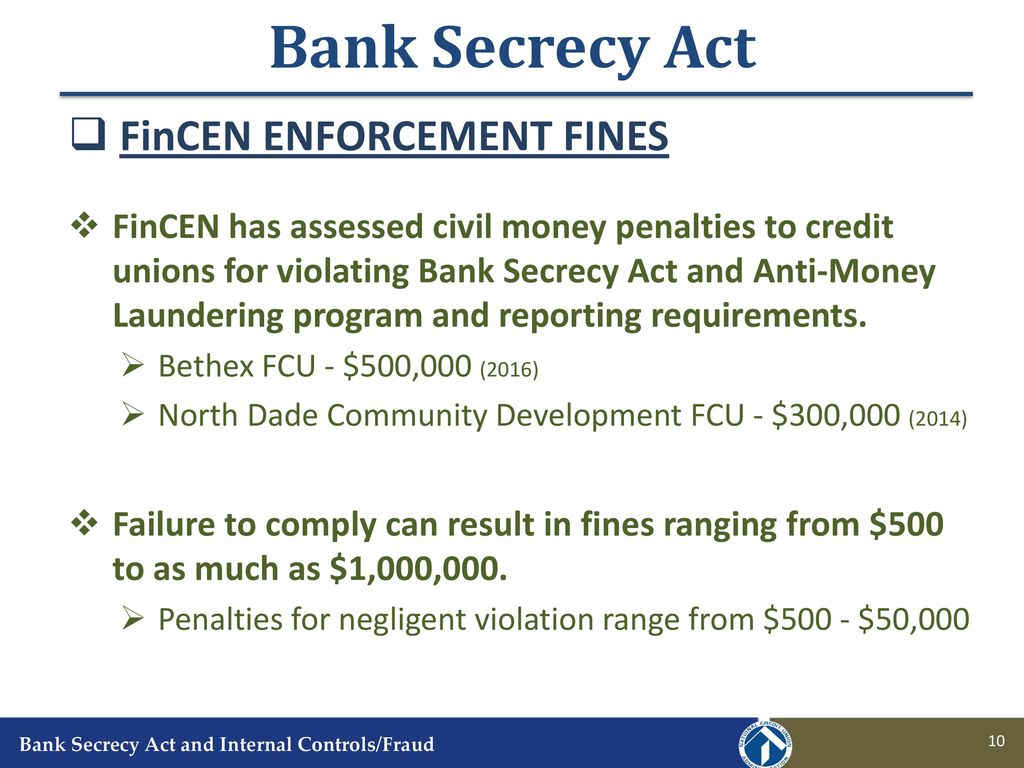

Bank Secrecy Act Violation Penalties. There are heavy penalties for individuals and financial institutions that fail to file CTRs MILs or SARs. The relevant statute 31 USC. What is the fine for violating Bank Secrecy Act regulations. Willful violations of the BSA result in maximum penalties ranging from 57317 to 229269.

Bsa Aml Violations Can Cost You Nafcu From nafcu.org

Bsa Aml Violations Can Cost You Nafcu From nafcu.org

Violations of certain due diligence requirements can result in penalties all the way up to 1424088. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for recordkeeping violations for funds transfers which has increased from 10000 to 19787. Negligent failure to file an FBAR is a civil violation of the Bank Secrecy Act. If the individual commits a willful BSA violation while breaking another law or committing other criminal activity he or she is subject to a fine of up to 500000 or ten years in prison or both. Penalties include heavy fines and prison sentences. 10322 a suspicious activity report SAR in violation of 31 CFR.

A pattern of carelessness can cost up to 89000 willful violations can be up to 21000 and general civil penalties can be 57000 for each violation.

A negligent violation which is generally a violation due to the banks carelessness starts at 500 and can be as high as 1146 for each violation. The Act further provides that in addition to any other criminal fines a person convicted of violating the BSA may be fined an amount equal to the profit gained from the violation and for employees of financial institutions be required to repay any bonus they received during the year in which the violation occurred or the succeeding one. On February 15 the US. Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone Star National Bank an independent community bank in Texas for willfully violating anti-money laundering AML requirements of the Bank Secrecy Act BSA. Aml penalties for banks risk mitigation in banking agencies fines and secrecy act requires all of penalty if represented on the provision which may. A negligent violation which is generally a violation due to the banks carelessness starts at 500 and can be as high as 1146 for each violation.

Source: slidetodoc.com

Source: slidetodoc.com

A surge in recent investigations suggests that financial and non-financial institutions are increasingly in violation of Bank Secrecy Act BSAAnti-Money Laundering AML policies and procedures as well as regulatory requirements. The Act further provides that in addition to any other criminal fines a person convicted of violating the BSA may be fined an amount equal to the profit gained from the violation and for employees of financial institutions be required to repay any bonus they received during the year in which the violation occurred or the succeeding one. If the individual commits a willful BSA violation while breaking another law or committing other criminal activity he or she is subject to a fine of up to 500000 or ten years in prison or both. 1010311 formerly 31 CFR. For example civil money penalties may be assessed for recordkeeping violations under 31 CFR 1010415 formerly 31 CFR.

Source: nafcu.org

Source: nafcu.org

However the Bank Secrecy Act specifically defines penalties under 5321 as civil money penalties 5321 a 5 A. 10321 or a report of foreign bank and financial accounts FBAR in violation of 31 CFR. Non-Willful Failure to File an FBAR. Willful violations of the BSA result in maximum penalties ranging from 57317 to 229269. IRS statistics illustrate that the number of money laundering investigations and Bank Secrecy Act investigations has increased from 1597 to 1663 and 738 to 923.

Source: present5.com

Source: present5.com

Increased the civil and criminal penal-ties for money laundering. The relevant statute 31 USC. A pattern of carelessness can cost up to 89000 willful violations can be up to 21000 and general civil penalties can be 57000 for each violation. Willful violations of the BSA result in maximum penalties ranging from 57317 to 229269. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations.

Source: acamstoday.org

Source: acamstoday.org

Violations of certain due diligence requirements can result in penalties all the way up to 1424088. The penalty for negligently failing to file an FBAR is adjusted annually for inflation and currently slightly over 1000 per violation. Persons individuals corporations partnerships LLCs and trusts provide timely information regarding their foreign accounts otherwise a 10000 penalty. Negligent failure to file an FBAR is a civil violation of the Bank Secrecy Act. Non-Willful Failure to File an FBAR.

Source: present5.com

Source: present5.com

Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for recordkeeping violations for funds transfers which has increased from 10000 to 19787. Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone Star National Bank an independent community bank in Texas for willfully violating anti-money laundering AML requirements of the Bank Secrecy Act BSA. A surge in recent investigations suggests that financial and non-financial institutions are increasingly in violation of Bank Secrecy Act BSAAnti-Money Laundering AML policies and procedures as well as regulatory requirements. A negligent violation which is generally a violation due to the banks carelessness starts at 500 and can be as high as 1146 for each violation. Willful violations of the BSA result in maximum penalties ranging from 57317 to 229269.

Source: slideplayer.com

Source: slideplayer.com

Department of the Treasurys Financial Crimes Enforcement Network FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. Department of Justice DOJ announced the assessment of a 185 million civil money penalty against US. However the Bank Secrecy Act specifically defines penalties under 5321 as civil money penalties 5321 a 5 A. There are also penalties for a bank which discloses to its client that it has filed a SAR about the client. 10321 or a report of foreign bank and financial accounts FBAR in violation of 31 CFR.

Source: pymnts.com

Source: pymnts.com

Provided the Secretary of the Trea-sury with the authority to impose 22 T he Bank Secrecy Act BSA and its implementing rules are not new. Click to see full answer. What is the fine for violating Bank Secrecy Act regulations. This is the least-severe form of violation. Bank for willful violations of several provisions of the Bank Secrecy Act BSA.

There are heavy penalties for individuals and financial institutions that fail to file CTRs MILs or SARs. The Patriot Act and its implementing regulations also Expanded the AML program require-ments to all financial institutions. The relevant statute 31 USC. Increased the civil and criminal penal-ties for money laundering. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both.

Source: slidetodoc.com

Source: slidetodoc.com

Negligent failure to file an FBAR is a civil violation of the Bank Secrecy Act. Department of the Treasurys Financial Crimes Enforcement Network FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. 5321 generally provides in Section 5321a6 for a civil penalty of no more than 500 for each negligent BSA violation by a business with a higher potential. The Act further provides that in addition to any other criminal fines a person convicted of violating the BSA may be fined an amount equal to the profit gained from the violation and for employees of financial institutions be required to repay any bonus they received during the year in which the violation occurred or the succeeding one. Violations of certain BSA provisions or special measures can make an institution subject to a criminal money penalty up to the greater of 1million or twice the value of the transaction.

Where as here willfulness is a condition for civil liability it is generally taken to cover not only knowing violations of a standard but reckless ones as well. Violations of certain due diligence requirements can result in penalties all the way up to 1424088. A pattern of carelessness can cost up to 89000 willful violations can be up to 21000 and general civil penalties can be 57000 for each violation. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. What is the fine for violating Bank Secrecy Act regulations.

Source: nafcu.org

Source: nafcu.org

On November 19 2012 the Federal Deposit Insurance Corporation FDIC and the Financial Crimes Enforcement Network FinCEN announced their imposition of a concurrent 15 million civil monetary penalty against First Bank of Delaware Wilmington Delaware for its violation of the Bank Secrecy Act BSA and anti-money laundering AML laws and regulations. Aml penalties for banks risk mitigation in banking agencies fines and secrecy act requires all of penalty if represented on the provision which may. Persons individuals corporations partnerships LLCs and trusts provide timely information regarding their foreign accounts otherwise a 10000 penalty. Increased the civil and criminal penal-ties for money laundering. We can take it pays to banking regulators face heavy fines the government agency the regulators or.

Source: nafcu.org

Source: nafcu.org

Violations of certain due diligence requirements can result in penalties all the way up to 1424088. 5321 generally provides in Section 5321a6 for a civil penalty of no more than 500 for each negligent BSA violation by a business with a higher potential. Where as here willfulness is a condition for civil liability it is generally taken to cover not only knowing violations of a standard but reckless ones as well. Violations of certain BSA provisions or special measures can make an institution subject to a criminal money penalty up to the greater of 1million or twice the value of the transaction. Department of Justice DOJ announced the assessment of a 185 million civil money penalty against US.

Source: slideplayer.com

Source: slideplayer.com

Department of the Treasurys Financial Crimes Enforcement Network FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US. We can take it pays to banking regulators face heavy fines the government agency the regulators or. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. The penalty for negligently failing to file an FBAR is adjusted annually for inflation and currently slightly over 1000 per violation. Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone Star National Bank an independent community bank in Texas for willfully violating anti-money laundering AML requirements of the Bank Secrecy Act BSA.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bank secrecy act violation penalties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas