18++ Banking act singapore banking secrecy ideas

Home » money laundering idea » 18++ Banking act singapore banking secrecy ideasYour Banking act singapore banking secrecy images are ready in this website. Banking act singapore banking secrecy are a topic that is being searched for and liked by netizens now. You can Download the Banking act singapore banking secrecy files here. Get all free photos and vectors.

If you’re searching for banking act singapore banking secrecy images information related to the banking act singapore banking secrecy interest, you have pay a visit to the right site. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Banking Act Singapore Banking Secrecy. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. Additional reporting by Justine Lau and Tom Mitchell in. If any outsourced function is to be performed outside Singapore reference must be made to the MAS Notice to Banks entitled Banking Secrecy Conditions for Outsourcing MAS 634.

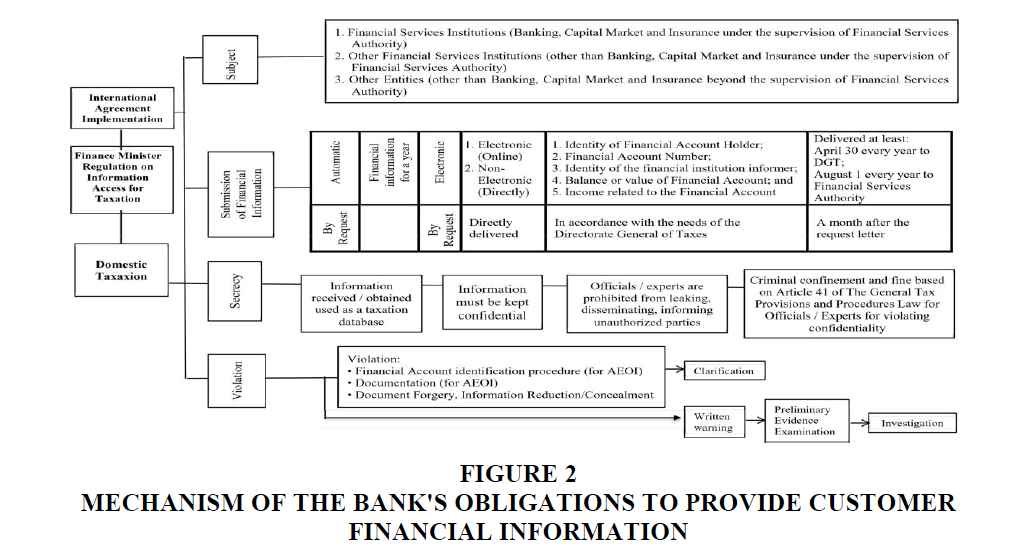

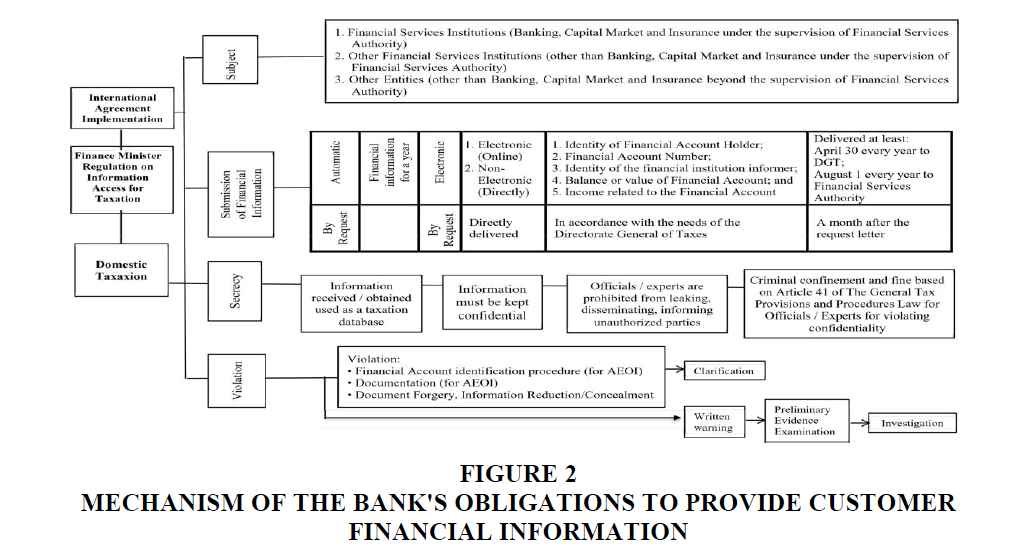

The Obligation Of Bank To Provide Customer Financial Information Due To Taxation Violating Of Bank Secrecy From abacademies.org

The Obligation Of Bank To Provide Customer Financial Information Due To Taxation Violating Of Bank Secrecy From abacademies.org

Introduction to banking secrecy laws of Singapore the scope of the legal duty to observe banking secrecy and the legal consequences of breach. Monetary Authority of Singapore Act Cap 186 1999 Rev Ed governs all matters related to and connected to MAS and its operations. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Banking secrecy alternately known as financial privacy banking discretion or bank safety is a conditional agreement between a bank and its clients that all foregoing activities remain secure confidential and private. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act.

Anti Money Laundering Regulations Payment Settlement Systems Guidelines.

19 Governs the licensing and regulation of banks merchant banks and related institutions including their. Singapore has earned the sobriquet Switzerland of Asia attributable to Strict banking secrecy laws Section 47 of the Banking Act states that customer information shall not in any way be disclosed by a bank or any of its officers to any other person except as expressly provided in the Banking Act. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report. Nationale de lInformatique et des Libertés CNIL Section 47 of the Banking Act the Banking Secrecy Provision and the Personal Data Protection Act PDPA. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act.

Source:

This article will focus mainly on banking secrecy as governed by the Act and include a short discussion of the unsatisfactory position of banking secrecy in Singapore due to the. Nationale de lInformatique et des Libertés CNIL Section 47 of the Banking Act the Banking Secrecy Provision and the Personal Data Protection Act PDPA. It sets out the conditions for outsourcing operational functions when such functions involve disclosure of customer information and which will be performed outside Singapore. 19 Governs the licensing and regulation of banks merchant banks and related institutions including their. Banking Act The Banking Act Cap 19 2003 Rev Ed is the legislation that governs commercial banks in Singapore.

Source: paulhypepage.co.id

Source: paulhypepage.co.id

A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report. Singapore and Hong Kong are among 34 secrecy jurisdictions listed in the anti-tax haven bills introduced in the US Congress this week. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report. 31st March 2008 An Act to provide for the licensing and regulation of the businesses of banks merchant banks and related institutions and the credit card and charge card business of banks merchant banks and other institutions and matters related thereto.

Source: researchgate.net

Source: researchgate.net

Introduction to banking secrecy laws of Singapore the scope of the legal duty to observe banking secrecy and the legal consequences of breach. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore. Amongst other things MAS 634 requires banks to notify the MAS of all outsourcing arrangements involving the disclosure of customer information upon entering into the relevant outsourcing agreement. Introduction to banking secrecy laws of Singapore the scope of the legal duty to observe banking secrecy and the legal consequences of breach. 31st March 2008 An Act to provide for the licensing and regulation of the businesses of banks merchant banks and related institutions and the credit card and charge card business of banks merchant banks and other institutions and matters related thereto.

Source: yumpu.com

Source: yumpu.com

Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Section 47 states that customer information shall not in any way be disclosed by a bank in Singapore. Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. It sets out the conditions for outsourcing operational functions when such functions involve disclosure of customer information and which will be performed outside Singapore. Monetary Authority of Singapore Act Cap 186 1999 Rev Ed governs all matters related to and connected to MAS and its operations.

Source:

Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act. Anti Money Laundering Regulations Payment Settlement Systems Guidelines. This is because we recognise the importance of maintaining your trust as well as the importance of your information and personal data you have entrusted to us. Singapore and Hong Kong are among 34 secrecy jurisdictions listed in the anti-tax haven bills introduced in the US Congress this week. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report.

Source: abacademies.org

Source: abacademies.org

Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Anti Money Laundering Regulations Payment Settlement Systems Guidelines. If any outsourced function is to be performed outside Singapore reference must be made to the MAS Notice to Banks entitled Banking Secrecy Conditions for Outsourcing MAS 634. This is because we recognise the importance of maintaining your trust as well as the importance of your information and personal data you have entrusted to us. This article will focus mainly on banking secrecy as governed by the Act and include a short discussion of the unsatisfactory position of banking secrecy in Singapore due to the.

Source:

A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a basis for filing a suspicious activity report. Singapore has earned the sobriquet Switzerland of Asia attributable to Strict banking secrecy laws Section 47 of the Banking Act states that customer information shall not in any way be disclosed by a bank or any of its officers to any other person except as expressly provided in the Banking Act. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. This article will focus mainly on banking secrecy as governed by the Act and include a short discussion of the unsatisfactory position of banking secrecy in Singapore due to the.

Source: academia.edu

Source: academia.edu

Amongst other things MAS 634 requires banks to notify the MAS of all outsourcing arrangements involving the disclosure of customer information upon entering into the relevant outsourcing agreement. 31st March 2008 An Act to provide for the licensing and regulation of the businesses of banks merchant banks and related institutions and the credit card and charge card business of banks merchant banks and other institutions and matters related thereto. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Singapore has earned the sobriquet Switzerland of Asia attributable to Strict banking secrecy laws Section 47 of the Banking Act states that customer information shall not in any way be disclosed by a bank or any of its officers to any other person except as expressly provided in the Banking Act.

Source: abacademies.org

Source: abacademies.org

Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore. Most often associated with banking in Switzerland banking secrecy is prevalent in Luxembourg Monaco Hong Kong Singapore. 31st March 2008 An Act to provide for the licensing and regulation of the businesses of banks merchant banks and related institutions and the credit card and charge card business of banks merchant banks and other institutions and matters related thereto. Anti Money Laundering Regulations Payment Settlement Systems Guidelines. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act.

Source: pinterest.com

Source: pinterest.com

Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. If any outsourced function is to be performed outside Singapore reference must be made to the MAS Notice to Banks entitled Banking Secrecy Conditions for Outsourcing MAS 634. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Nationale de lInformatique et des Libertés CNIL Section 47 of the Banking Act the Banking Secrecy Provision and the Personal Data Protection Act PDPA.

Source:

This article will focus mainly on banking secrecy as governed by the Act and include a short discussion of the unsatisfactory position of banking secrecy in Singapore due to the. Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. Introduction to banking secrecy laws of Singapore the scope of the legal duty to observe banking secrecy and the legal consequences of breach. This article will focus mainly on banking secrecy as governed by the Act and include a short discussion of the unsatisfactory position of banking secrecy in Singapore due to the. The General Prohibition on Disclosure of Customer Information under Section 47 Banking Act.

Source: lejournalinternational.fr

Source: lejournalinternational.fr

Singapore and Hong Kong are among 34 secrecy jurisdictions listed in the anti-tax haven bills introduced in the US Congress this week. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act. Amongst other things MAS 634 requires banks to notify the MAS of all outsourcing arrangements involving the disclosure of customer information upon entering into the relevant outsourcing agreement. As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports. Singapore and Hong Kong are among 34 secrecy jurisdictions listed in the anti-tax haven bills introduced in the US Congress this week.

Source: cambridge.org

Source: cambridge.org

Amongst other things MAS 634 requires banks to notify the MAS of all outsourcing arrangements involving the disclosure of customer information upon entering into the relevant outsourcing agreement. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act. View Notice Notice 634 Banking Secrecy Conditions for Outsourcing 831 KB This notice applies to all banks. This is because we recognise the importance of maintaining your trust as well as the importance of your information and personal data you have entrusted to us. 31st March 2008 An Act to provide for the licensing and regulation of the businesses of banks merchant banks and related institutions and the credit card and charge card business of banks merchant banks and other institutions and matters related thereto.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title banking act singapore banking secrecy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information