13+ Banking secrecy act singapore customer information ideas in 2021

Home » money laundering Info » 13+ Banking secrecy act singapore customer information ideas in 2021Your Banking secrecy act singapore customer information images are ready. Banking secrecy act singapore customer information are a topic that is being searched for and liked by netizens now. You can Find and Download the Banking secrecy act singapore customer information files here. Get all royalty-free images.

If you’re looking for banking secrecy act singapore customer information pictures information linked to the banking secrecy act singapore customer information keyword, you have visit the ideal blog. Our website always gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Banking Secrecy Act Singapore Customer Information. It sets out the conditions for outsourcing operational functions when such functions involve disclosure of customer information and which will be performed outside Singapore. Customer Due Diligence and Beneficial Ownership Requirements for Legal Entity Customers Overviews and Examination Procedures. Bank Secrecy ActAnti-Money Laundering. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

2233 Section 47 provides that customer information shall not in any way be disclosed by a bank as defined in the Banking Act that is a bank incorporated in Singapore or the branches and offices located within Singapore of a bank incorporated outside Singapore or any of its officers to any other person except as expressly provided in the Banking Act and elaborated on in the Third Schedule. Customer Due Diligence and Beneficial Ownership Requirements for Legal Entity Customers Overviews and Examination Procedures. Treasury publishes National Money Laundering and Terrorist Financing Risk Assessments. Bank Secrecy ActAnti-Money Laundering. Banking business means the business of receiving money on current or deposit account paying and collecting cheques drawn by or paid in by customers the making of advances to customers and includes such other business as the Authority may prescribe for the purposes of this Act. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act.

Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act.

Singapore has earned the sobriquet Switzerland of Asia attributable to Strict banking secrecy laws Section 47 of the Banking Act states that customer information shall not in any way be disclosed by a bank or any of its officers to any other person except as expressly provided in the Banking Act. Section 47 of the Act provides that customer information shall not in any way be disclosed by a bank holding a valid banking licence in Singapore or. Bank Secrecy ActAnti-Money Laundering. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. 232001 2 A bank in Singapore or any of its officers may for such purpose as may be specified in the first column of the Third Schedule disclose customer information to. Banking secrecy in Singapore.

Source: tookitaki.ai

Source: tookitaki.ai

Secrecy act singapore. Secrecy act singapore. The purpose is to maintain customers trust to banks. It is regulated in Law N10 of 1998 concerning Amendments to Law No7 of 1992 concerning Banking and. Banking secrecy in Singapore is regulated pursuant to section 47 of the Banking Act.

Source: acamstoday.org

Source: acamstoday.org

Revised FFIEC BSAAML Examination Manual. A bank in Singapore has a contractual duty of confidentiality as implied from the banker and customer relationship while a statutory duty of confidentiality is imposed by section 47 of the Banking Act. Disclosure must not be made to any auditor referred to in paragraph aiv of the second column other than an auditor appointed or engaged by the bank in Singapore unless the auditor has given to the bank a written undertaking that the auditor will not disclose any customer information obtained by the auditor in the course of the performance of audit to any person other than. It sets out the conditions for outsourcing operational functions when such functions involve disclosure of customer information and which will be performed outside Singapore. Customer Due Diligence and Beneficial Ownership Requirements for Legal Entity Customers Overviews and Examination Procedures.

Source: academia.edu

Source: academia.edu

232001 2 A bank in Singapore or any of its officers may for such purpose as may be specified in the first column of the Third Schedule disclose customer information to. Disclosure must not be made to any auditor referred to in paragraph aiv of the second column other than an auditor appointed or engaged by the bank in Singapore unless the auditor has given to the bank a written undertaking that the auditor will not disclose any customer information obtained by the auditor in the course of the performance of audit to any person other than. 1 Customer information shall not in any way be disclosed by a bank in Singapore or any of its officers to any other person except as expressly provided in this Act. Introduction to banking secrecy laws of Singapore the scope of the legal duty to observe banking secrecy and the legal consequences of breach. Banking business means the business of receiving money on current or deposit account paying and collecting cheques drawn by or paid in by customers the making of advances to customers and includes such other business as the Authority may prescribe for the purposes of this Act.

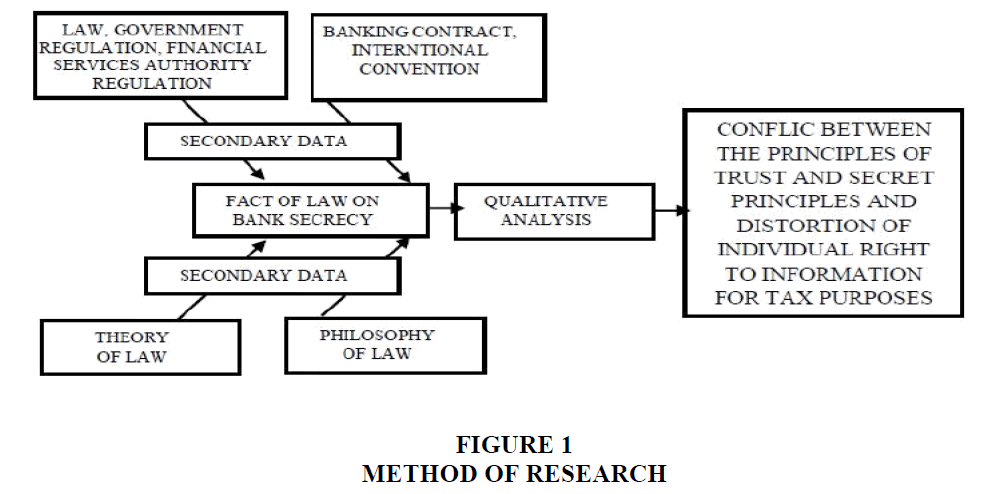

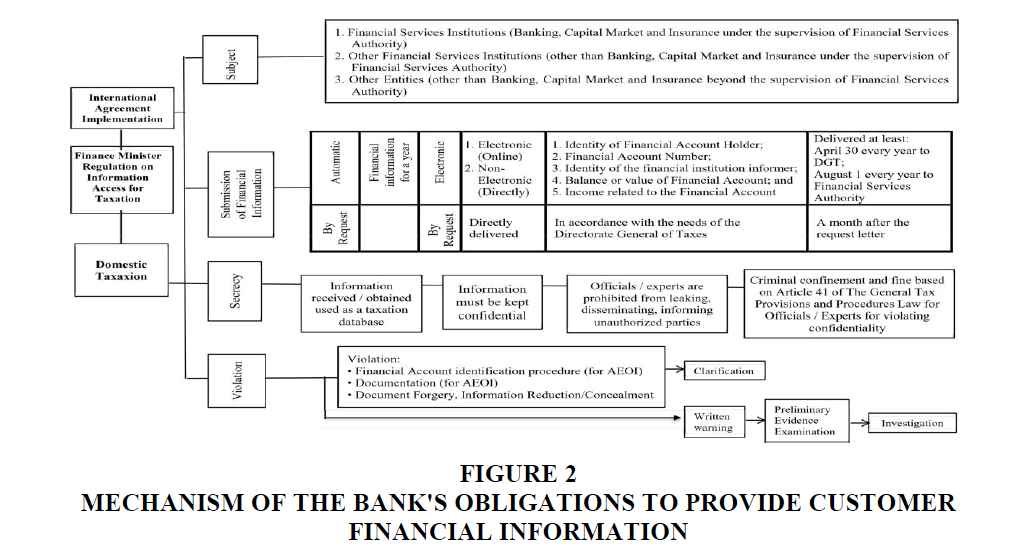

Source: abacademies.org

Source: abacademies.org

The principle of bank secrecy provides an obligation for banks to maintain customer confidentiality. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. 19 BANKING SECRECY. Treasury publishes National Money Laundering and Terrorist Financing Risk Assessments. Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS.

Source: slideplayer.com

Source: slideplayer.com

Bank Secrecy ActAnti-Money Laundering. The General Prohibition on Disclosure of Customer Information under Section 47 Banking Act. Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. A bank in Singapore has a contractual duty of confidentiality as implied from the banker and customer relationship while a statutory duty of confidentiality is imposed by section 47 of the Banking Act. Customer Due Diligence and Beneficial Ownership Requirements for Legal Entity Customers Overviews and Examination Procedures.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Customer Due Diligence and Beneficial Ownership Requirements for Legal Entity Customers Overviews and Examination Procedures. 232001 2 A bank in Singapore or any of its officers may for such purpose as may be specified in the first column of the Third Schedule disclose customer information to. It is regulated in Law N10 of 1998 concerning Amendments to Law No7 of 1992 concerning Banking and. 19 Governs the licensing and regulation of banks merchant banks and related institutions including their. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act.

Source:

2233 Section 47 provides that customer information shall not in any way be disclosed by a bank as defined in the Banking Act that is a bank incorporated in Singapore or the branches and offices located within Singapore of a bank incorporated outside Singapore or any of its officers to any other person except as expressly provided in the Banking Act and elaborated on in the Third Schedule. Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. Section 47 states that customer information shall not in any way be disclosed by a bank in Singapore. Section 47 of the Act provides that customer information shall not in any way be disclosed by a bank holding a valid banking licence in Singapore or. 2233 Section 47 provides that customer information shall not in any way be disclosed by a bank as defined in the Banking Act that is a bank incorporated in Singapore or the branches and offices located within Singapore of a bank incorporated outside Singapore or any of its officers to any other person except as expressly provided in the Banking Act and elaborated on in the Third Schedule.

![]() Source: slideplayer.com

Source: slideplayer.com

The General Prohibition on Disclosure of Customer Information under Section 47 Banking Act. The General Prohibition on Disclosure of Customer Information under Section 47 Banking Act. Disclosure of customer information as defined in section 40A of the Banking Act to the service provider is involved all banks in Singapore relying on the exception provided in paragraph 3 of Part II of the Third Schedule of the Banking Act are. The purpose is to maintain customers trust to banks. It sets out the conditions for outsourcing operational functions when such functions involve disclosure of customer information and which will be performed outside Singapore.

Source:

Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. It is regulated in Law N10 of 1998 concerning Amendments to Law No7 of 1992 concerning Banking and. Bank Secrecy ActAnti-Money Laundering. 19 Governs the licensing and regulation of banks merchant banks and related institutions including their.

Source: abacademies.org

Source: abacademies.org

Banking business means the business of receiving money on current or deposit account paying and collecting cheques drawn by or paid in by customers the making of advances to customers and includes such other business as the Authority may prescribe for the purposes of this Act. Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS. Singapore has earned the sobriquet Switzerland of Asia attributable to Strict banking secrecy laws Section 47 of the Banking Act states that customer information shall not in any way be disclosed by a bank or any of its officers to any other person except as expressly provided in the Banking Act. The principle of bank secrecy provides an obligation for banks to maintain customer confidentiality. Secrecy act singapore.

Source: paulhypepage.co.id

Source: paulhypepage.co.id

Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. The principle of bank secrecy provides an obligation for banks to maintain customer confidentiality. View Notice Notice 634 Banking Secrecy Conditions for Outsourcing 831 KB This notice applies to all banks. Banking secrecy in Singapore is governed by section 47 of the Banking Act Chapter 19 which prohibits banks incorporated in Singapore or foreign banks with branches in Singapore from disclosing any customer information to any other person except as expressly provided by the Third Schedule of the Act. Singapore has in place an anti-commingling policy to segregate financial and non-financial businesses of banks in Singapore banks in Singapore are generally restricted to conducting banking and financial businesses and businesses incidental thereto unless otherwise authorised by MAS.

Source: researchgate.net

Source: researchgate.net

It is regulated in Law N10 of 1998 concerning Amendments to Law No7 of 1992 concerning Banking and. Section 47 of the Act provides that customer information shall not in any way be disclosed by a bank holding a valid banking licence in Singapore or. Revised FFIEC BSAAML Examination Manual. Secrecy act singapore. Banking secrecy in Singapore.

Source: pinterest.com

Source: pinterest.com

Bank Secrecy ActAnti-Money Laundering. 2 A bank in Singapore or any of its officers may for such purpose as may be specified in the first column of the Third Schedule disclose customer information to such persons or class of persons as may be specified in the second column of that Schedule and in compliance with such conditions as may be specified in the third column of that Schedule. 19 BANKING SECRECY. Bank Secrecy ActAnti-Money Laundering. Secrecy act singapore.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title banking secrecy act singapore customer information by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas