16+ Breach of money laundering regulations punishment information

Home » money laundering Info » 16+ Breach of money laundering regulations punishment informationYour Breach of money laundering regulations punishment images are ready in this website. Breach of money laundering regulations punishment are a topic that is being searched for and liked by netizens today. You can Download the Breach of money laundering regulations punishment files here. Find and Download all royalty-free photos.

If you’re searching for breach of money laundering regulations punishment images information connected with to the breach of money laundering regulations punishment interest, you have pay a visit to the right blog. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Breach Of Money Laundering Regulations Punishment. AN ACT DEFINING THE CRIME OF MONEY LAUNDERING PROVIDING PENALTIES THEREFOR AND FOR OTHER PURPOSES. 28 What are the maximum penalties for failure to comply with the regulatoryadministrative anti-money laundering requirements and what failures are subject to the penalty provisions. 124 In cases where criminal proceedings have commenced or will be commenced the. The monetary value of a penalty issued under the 2017 regulations may be part of a larger penalty that incorporates breaches of the 2007 regulations as well.

Hong Kong Fx Broker Clsa Faces New Zealand Aml Probe Anti Money Laundering Law Fx Broker New Zealand From pinterest.com

Hong Kong Fx Broker Clsa Faces New Zealand Aml Probe Anti Money Laundering Law Fx Broker New Zealand From pinterest.com

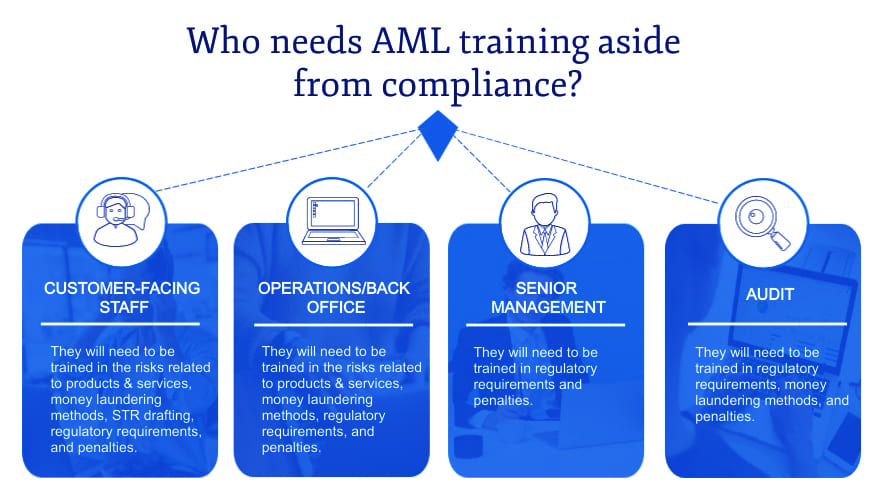

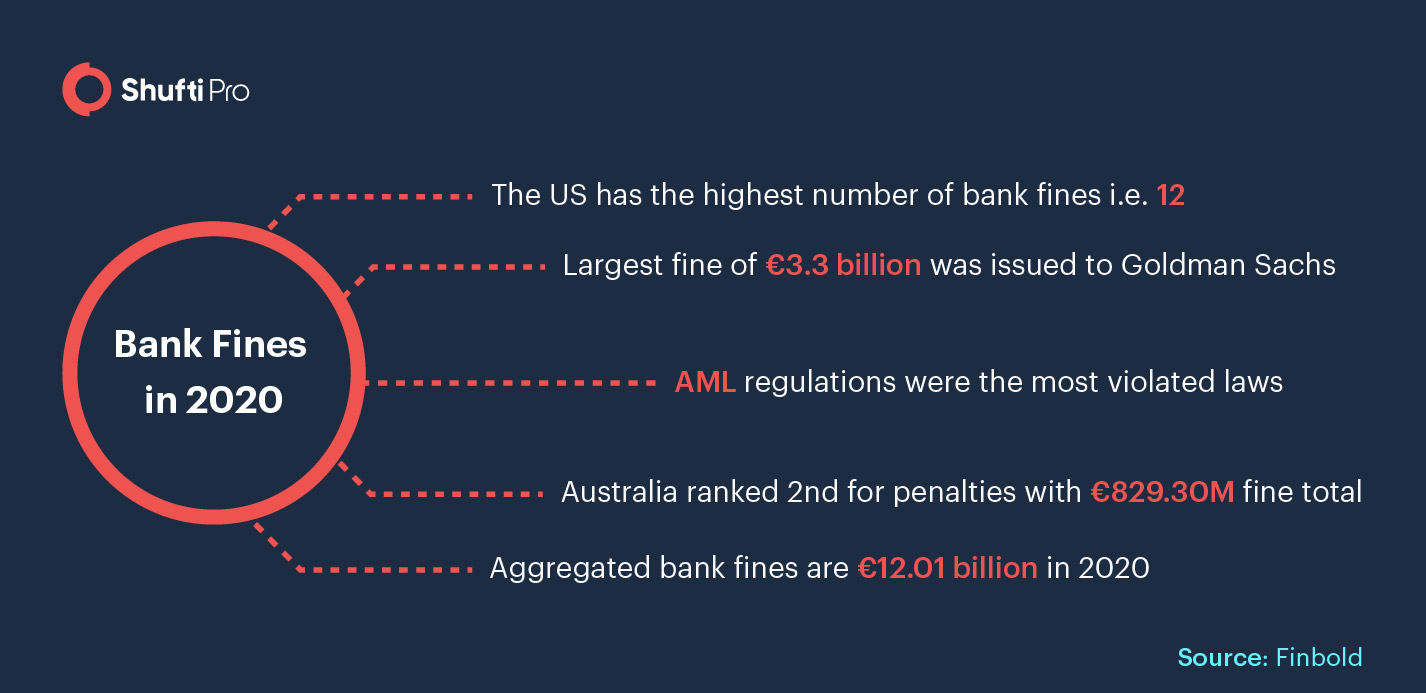

The government has changed its mind over scrapping more than two dozen money laundering offences that can penalise lawyers for minor rule breaches but has emphasised that minor failures should not lead to prosecution. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. 28 What are the maximum penalties for failure to comply with the regulatoryadministrative anti-money laundering requirements and what failures are subject to the penalty provisions. 124 In cases where criminal proceedings have commenced or will be commenced the. Anti-money laundering AML regulations Anti-Money LaunderingAML Fines audits and penalties continued to rise in 2020Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially. The Money Laundering Regulations 2007 the Regulations impose duties upon institutions firms and individuals in respect of customer due diligence CDD and the Financial Conduct Authority the Authority has powers at its disposal under the Regulations which are also used by other government organisations to sanction those.

There is a time limit for the CDPP to bring proceedings one year after the commission of a money laundering offence where the maximum term of imprisonment for an individual is six months or less or the maximum penalty for a body corporate is 150 penalty units or less these are generally money laundering offences where the value of the money or property dealt with is low and the fault.

This Act shall be known as the Anti-Money Laundering Act of 2001 SEC. Whereas it is expedient and necessary to reenact a law regarding the prevention of money laundering and other offences connected therewith including punishment thereof and the matters ancillary thereto by repealing the existing Act and Ordinance relating thereto. It is a member of the Moneyval Committee of the Council of Europe which is an associated member of the FATF. The Penalties for Money Laundering Offences Act is the legal framework covering crimes such as money laundering and terrorist financing. If the committed crime is serious the sentence is imprisonment for a maximum of six years but not less than six months. The Money Laundering Regulations 2007 the Regulations impose duties upon institutions firms and individuals in respect of customer due diligence CDD and the Financial Conduct Authority the Authority has powers at its disposal under the Regulations which are also used by other government organisations to sanction those.

Source: pinterest.com

Source: pinterest.com

For money laundering the sentence is imprisonment for a maximum of two years. The government has changed its mind over scrapping more than two dozen money laundering offences that can penalise lawyers for minor rule breaches but has emphasised that minor failures should not lead to prosecution. This Act shall be known as the Anti-Money Laundering Act of 2001 SEC. 28 What are the maximum penalties for failure to comply with the regulatoryadministrative anti-money laundering requirements and what failures are subject to the penalty provisions. Failure to report and tipping off are punishable on conviction by a maximum of five years imprisonment andor a fine.

Source: pinterest.com

Source: pinterest.com

There is a time limit for the CDPP to bring proceedings one year after the commission of a money laundering offence where the maximum term of imprisonment for an individual is six months or less or the maximum penalty for a body corporate is 150 penalty units or less these are generally money laundering offences where the value of the money or property dealt with is low and the fault. 124 In cases where criminal proceedings have commenced or will be commenced the. Failing to comply with Regulation 201 of the ML Regulations and other relevant Regulations particularly anti-money laundering AML controls over its commercial banking activities including in connection with PEPs. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Money Laundering Regulations 2007.

Source: pinterest.com

Source: pinterest.com

When considering whether to prosecute a breach of the Money Laundering Regulations the FCA will also have regard to whether the person concerned has followed the Guidance for the UK financial sector issued by the Joint Money Laundering Steering Group. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. USD 8800 under the FTRA. There is a time limit for the CDPP to bring proceedings one year after the commission of a money laundering offence where the maximum term of imprisonment for an individual is six months or less or the maximum penalty for a body corporate is 150 penalty units or less these are generally money laundering offences where the value of the money or property dealt with is low and the fault. Money Laundering Regulations 2007.

Source: singaporelegaladvice.com

Source: singaporelegaladvice.com

The government has changed its mind over scrapping more than two dozen money laundering offences that can penalise lawyers for minor rule breaches but has emphasised that minor failures should not lead to prosecution. Failing to comply with Regulation 201 of the ML Regulations and other relevant Regulations particularly anti-money laundering AML controls over its commercial banking activities including in connection with PEPs. If the committed crime is serious the sentence is imprisonment for a maximum of six years but not less than six months. An individual responsible for false reporting ie STR andor CTR or a tipping-offence is subject to imprisonment of up to one year andor a criminal fine of up to KRW 10 million approx. Whereas it is expedient and necessary to reenact a law regarding the prevention of money laundering and other offences connected therewith including punishment thereof and the matters ancillary thereto by repealing the existing Act and Ordinance relating thereto.

Source: pinterest.com

Source: pinterest.com

It is a member of the Moneyval Committee of the Council of Europe which is an associated member of the FATF. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. Civil penalty of 7640400reduced by 30 for stage 1 settlement without the. Secondary regulation is provided by the Money Laundering Regulations 2007. Anti-money laundering AML regulations Anti-Money LaunderingAML Fines audits and penalties continued to rise in 2020Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially.

Source: pinterest.com

Source: pinterest.com

Anti-money laundering AML regulations Anti-Money LaunderingAML Fines audits and penalties continued to rise in 2020Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially. 28 What are the maximum penalties for failure to comply with the regulatoryadministrative anti-money laundering requirements and what failures are subject to the penalty provisions. The monetary value of a penalty issued under the 2017 regulations may be part of a larger penalty that incorporates breaches of the 2007 regulations as well. Failing to comply with Regulation 201 of the ML Regulations and other relevant Regulations particularly anti-money laundering AML controls over its commercial banking activities including in connection with PEPs. AN ACT DEFINING THE CRIME OF MONEY LAUNDERING PROVIDING PENALTIES THEREFOR AND FOR OTHER PURPOSES.

Source: pideeco.be

Source: pideeco.be

Anti-money laundering AML regulations Anti-Money LaunderingAML Fines audits and penalties continued to rise in 2020Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially. An individual responsible for false reporting ie STR andor CTR or a tipping-offence is subject to imprisonment of up to one year andor a criminal fine of up to KRW 10 million approx. 28 What are the maximum penalties for failure to comply with the regulatoryadministrative anti-money laundering requirements and what failures are subject to the penalty provisions. There is a time limit for the CDPP to bring proceedings one year after the commission of a money laundering offence where the maximum term of imprisonment for an individual is six months or less or the maximum penalty for a body corporate is 150 penalty units or less these are generally money laundering offences where the value of the money or property dealt with is low and the fault. For money laundering the sentence is imprisonment for a maximum of two years.

Source: bitblogger.org

Source: bitblogger.org

Failure to report and tipping off are punishable on conviction by a maximum of five years imprisonment andor a fine. Therefore it is hereby enacted as follows-. When considering whether to prosecute a breach of the Money Laundering Regulations the FCA will also have regard to whether the person concerned has followed the Guidance for the UK financial sector issued by the Joint Money Laundering Steering Group. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches.

Source: amlintelligence.com

Source: amlintelligence.com

Anti-money laundering AML regulations Anti-Money LaunderingAML Fines audits and penalties continued to rise in 2020Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially. Whereas it is expedient and necessary to reenact a law regarding the prevention of money laundering and other offences connected therewith including punishment thereof and the matters ancillary thereto by repealing the existing Act and Ordinance relating thereto. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020. When considering whether to prosecute a breach of the Money Laundering Regulations the FCA will also have regard to whether the person concerned has followed the Guidance for the UK financial sector issued by the Joint Money Laundering Steering Group. Civil penalty of 7640400reduced by 30 for stage 1 settlement without the.

Source: shuftipro.com

Source: shuftipro.com

Government u-turn on scrapping criminal sanctions for breaches of money laundering regulations. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. There is a time limit for the CDPP to bring proceedings one year after the commission of a money laundering offence where the maximum term of imprisonment for an individual is six months or less or the maximum penalty for a body corporate is 150 penalty units or less these are generally money laundering offences where the value of the money or property dealt with is low and the fault. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing.

Source: pinterest.com

Source: pinterest.com

The maximum penalty for the s327 offence of money laundering is 14 years imprisonment. The Money Laundering Regulations 2007 the Regulations impose duties upon institutions firms and individuals in respect of customer due diligence CDD and the Financial Conduct Authority the Authority has powers at its disposal under the Regulations which are also used by other government organisations to sanction those. For money laundering the sentence is imprisonment for a maximum of two years. The maximum penalty for the s327 offence of money laundering is 14 years imprisonment. Whereas it is expedient and necessary to reenact a law regarding the prevention of money laundering and other offences connected therewith including punishment thereof and the matters ancillary thereto by repealing the existing Act and Ordinance relating thereto.

![]() Source: pinterest.com

Source: pinterest.com

AN ACT DEFINING THE CRIME OF MONEY LAUNDERING PROVIDING PENALTIES THEREFOR AND FOR OTHER PURPOSES. Businesses carrying out certain cryptoasset activities also need to comply with the MLRs in relation to those activities from 10 January 2020 and to register with us during 2020. This uptick published in Duff Phelps 7th annual Global Enforcement Review suggests that after a short lull regulators are continuing their clamp down on anti-money laundering breaches. The maximum penalty for the s327 offence of money laundering is 14 years imprisonment. Anti-money laundering AML regulations Anti-Money LaunderingAML Fines audits and penalties continued to rise in 2020Money laundering terrorist financing corruption bribery and all other financial crimes have many negative consequences both economically and socially.

Source: newsoncompliance.com

Source: newsoncompliance.com

Failure to report and tipping off are punishable on conviction by a maximum of five years imprisonment andor a fine. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. USD 8800 under the FTRA. Fines for anti-money laundering AML rule breaches hit 706m 547m in the first six months of 2020 an increase of 59 on the total for the whole of 2019 444 m. Money Laundering Regulations 2007.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title breach of money laundering regulations punishment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas