16+ Bsa aml enforcement actions ideas in 2021

Home » money laundering idea » 16+ Bsa aml enforcement actions ideas in 2021Your Bsa aml enforcement actions images are ready in this website. Bsa aml enforcement actions are a topic that is being searched for and liked by netizens today. You can Download the Bsa aml enforcement actions files here. Get all royalty-free vectors.

If you’re looking for bsa aml enforcement actions images information connected with to the bsa aml enforcement actions interest, you have come to the right site. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

Bsa Aml Enforcement Actions. January 15 2021. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. Hunton Williams LLP. 951 East Byrd Street.

Responding To Bsa Aml Enforcement Don T Make Matters Worse With A Shoddy Action Plan Corporate Compliance Insights From corporatecomplianceinsights.com

Responding To Bsa Aml Enforcement Don T Make Matters Worse With A Shoddy Action Plan Corporate Compliance Insights From corporatecomplianceinsights.com

The Bank Secrecy ActAnti-Money Laundering BSAAML regime Remarks by Sigal Mandelker Undersecretary Terrorism and Financial Intelligence US. This first article of a two-part series on AML enforcement actions examines the potential deficiencies that can lead to these types of regulatory challenges. BSAAML Enforcement Actions. The DFS enforcement action asserted that Mashreqbanks AMLBSA program was deficient in a number of respects and that the New York branch had failed to remediate identified compliance issues. That document will help to define the relationship between the regulator and the organization and it may ultimately mark the difference between a slap on the wrist and a significant. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs.

The DFS enforcement action asserted that Mashreqbanks AMLBSA program was deficient in a number of respects and that the New York branch had failed to remediate identified compliance issues.

951 East Byrd Street. The enforcement action began with a DFS safety and soundness examine in 2016. The Year in Review and Lessons Learned. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. Enforcement actions for other BSAAML requirements. However and somewhat confusingly the joint statement explicitly states that the BSA.

Source: verafin.com

Source: verafin.com

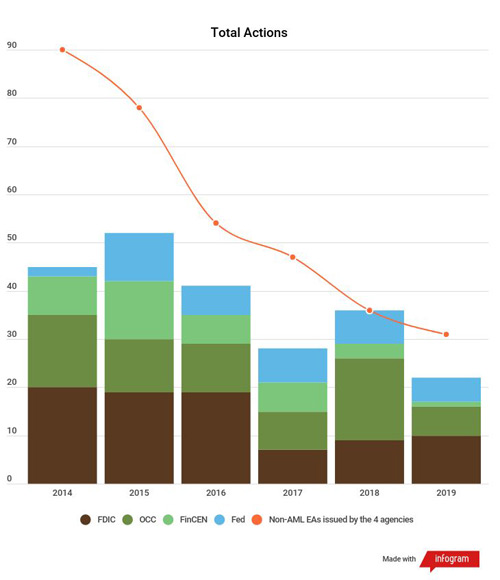

A recent flurry of enforcement actions highlight regulators expectation that financial institutions implement robust AMLBSA compliance programs. Enforcement Actions for BSAAML Compliance Program Failures. Identifying Possible Gaps Failure to establish and maintain a reasonably designed BSA AML compliance program is an issue that often piques regulatory and prosecutorial interest. Unsafe or unsound practices. Informal actions and formal actions.

Source: dandodiary.com

Source: dandodiary.com

The financial institution becomes the target of an enforcement action due to a faulty BSAAML compliance program. Informal actions and formal actions. An informal enforcement action is used when the BSAAML problems are limited in scope and bank management commits to and is capable of correcting the problems. However and somewhat confusingly the joint statement explicitly states that the BSA. The SEC and other regulators have brought a series of enforcement actions against financial institutions for failure to comply with AML requirements such as an August 2020 action in which a major brokerage agreed to pay over 38 million to resolve actions brought by the SEC Commodities Futures Trading Commission and Financial Industry Regulatory Authority for failure to file SARs and maintain adequate AML.

Source: jdsupra.com

Source: jdsupra.com

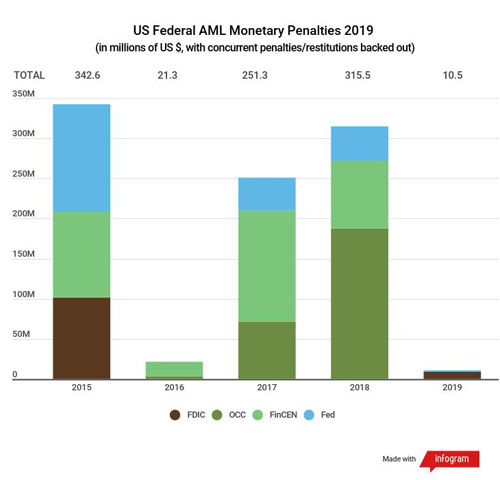

Enforcement Actions for BSAAML Compliance Program Failures. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. 951 East Byrd Street. On December 17 2018 FinCEN FINRA and the SEC fined UBS Financial Services 145 million for allegedly processing numerous foreign currency wires without sufficient oversight including wires to. An informal enforcement action is used when the BSAAML problems are limited in scope and bank management commits to and is capable of correcting the problems.

Source: dandodiary.com

Source: dandodiary.com

The financial institution then discloses the enforcement action which usually causes the stock price to drop. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. The financial institution then discloses the enforcement action which usually causes the stock price to drop. Thursday December 4 2014 330pm 630pm. Panel Discussion and Reception.

Source: corporatecomplianceinsights.com

Source: corporatecomplianceinsights.com

That document will help to define the relationship between the regulator and the organization and it may ultimately mark the difference between a slap on the wrist and a significant. The Bank Secrecy ActAnti-Money Laundering BSAAML regime Remarks by Sigal Mandelker Undersecretary Terrorism and Financial Intelligence US. The DFS enforcement action asserted that Mashreqbanks AMLBSA program was deficient in a number of respects and that the New York branch had failed to remediate identified compliance issues. A recent flurry of enforcement actions highlight regulators expectation that financial institutions implement robust AMLBSA compliance programs. January 15 2021.

Source: slideplayer.com

Source: slideplayer.com

Unsafe or unsound practices. January 15 2021. The DFS enforcement action asserted that Mashreqbanks AMLBSA program was deficient in a number of respects and that the New York branch had failed to remediate identified compliance issues. An informal enforcement action is used when the BSAAML problems are limited in scope and bank management commits to and is capable of correcting the problems. The financial institution becomes the target of an enforcement action due to a faulty BSAAML compliance program.

Source:

A recent flurry of enforcement actions highlight regulators expectation that financial institutions implement robust AMLBSA compliance programs. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. 1100 AM 1200 PM EST 400 PM 500 PM London 500PM 600PM Amsterdam Register Online 159 Recently there have been several big AML enforcement actions against banks for violations of the Bank Secrecy Act BSA confirming the. The Bank Secrecy ActAnti-Money Laundering BSAAML regime Remarks by Sigal Mandelker Undersecretary Terrorism and Financial Intelligence US. In accordance with sections 8s3 and 206q3 the appropriate Agency shall issue a cease and desist order against an institution for noncompliance with BSAAML compliance program requirements in the following situations based on.

Source: slideplayer.com

Source: slideplayer.com

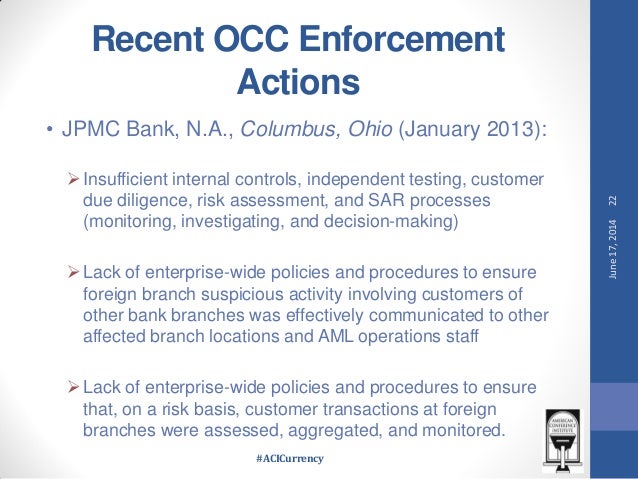

951 East Byrd Street. Identifying Possible Gaps Failure to establish and maintain a reasonably designed BSA AML compliance program is an issue that often piques regulatory and prosecutorial interest. When a financial institution incurs a Bank Secrecy Act BSA or anti-money laundering AML-related enforcement it needs to respond with an action plan detailing how it will resolve its wrongdoing. Enforcement actions for other BSAAML requirements. The OCC may take enforcement actions for violations of laws rules or regulations final orders or conditions imposed in writing.

Source: moneylaundering.com

Source: moneylaundering.com

951 East Byrd Street. Recent AML Enforcement Actions. This first article of a two-part series on AML enforcement actions examines the potential deficiencies that can lead to these types of regulatory challenges. Hunton Williams LLP. The OCC has two broad enforcement actions that can be applied to banks that have weak or non-compliant BSAAML programs.

Source: reedsmith.com

Source: reedsmith.com

The cases are arranged in reverse chronological order and include the name and asset size when known of. The enforcement action began with a DFS safety and soundness examine in 2016. The cases are arranged in reverse chronological order and include the name and asset size when known of. Unsafe or unsound practices. Hunton Williams LLP.

Source: moneylaundering.com

Source: moneylaundering.com

An informal enforcement action is used when the BSAAML problems are limited in scope and bank management commits to and is capable of correcting the problems. The OCC may take enforcement actions for violations of laws rules or regulations final orders or conditions imposed in writing. The heightened awareness related to BSAAML compliance has led some financial institutions to strengthen their programs while others have become the subject of BSA enforcement actions for failing to demonstrate they have implemented an effective BSAAML program. The enforcement action has either a to-do list for the financial institution or an assessed monetary fine. When a financial institution incurs a Bank Secrecy Act BSA or anti-money laundering AML-related enforcement it needs to respond with an action plan detailing how it will resolve its wrongdoing.

Source: slideshare.net

Source: slideshare.net

An informal enforcement action is used when the BSAAML problems are limited in scope and bank management commits to and is capable of correcting the problems. January 15 2021. Department of the Treasury December 3 2018 Focus on Innovation and Modernization Regulatory and Enforcement Trends. The financial institution becomes the target of an enforcement action due to a faulty BSAAML compliance program. The heightened awareness related to BSAAML compliance has led some financial institutions to strengthen their programs while others have become the subject of BSA enforcement actions for failing to demonstrate they have implemented an effective BSAAML program.

Source: slideplayer.com

Source: slideplayer.com

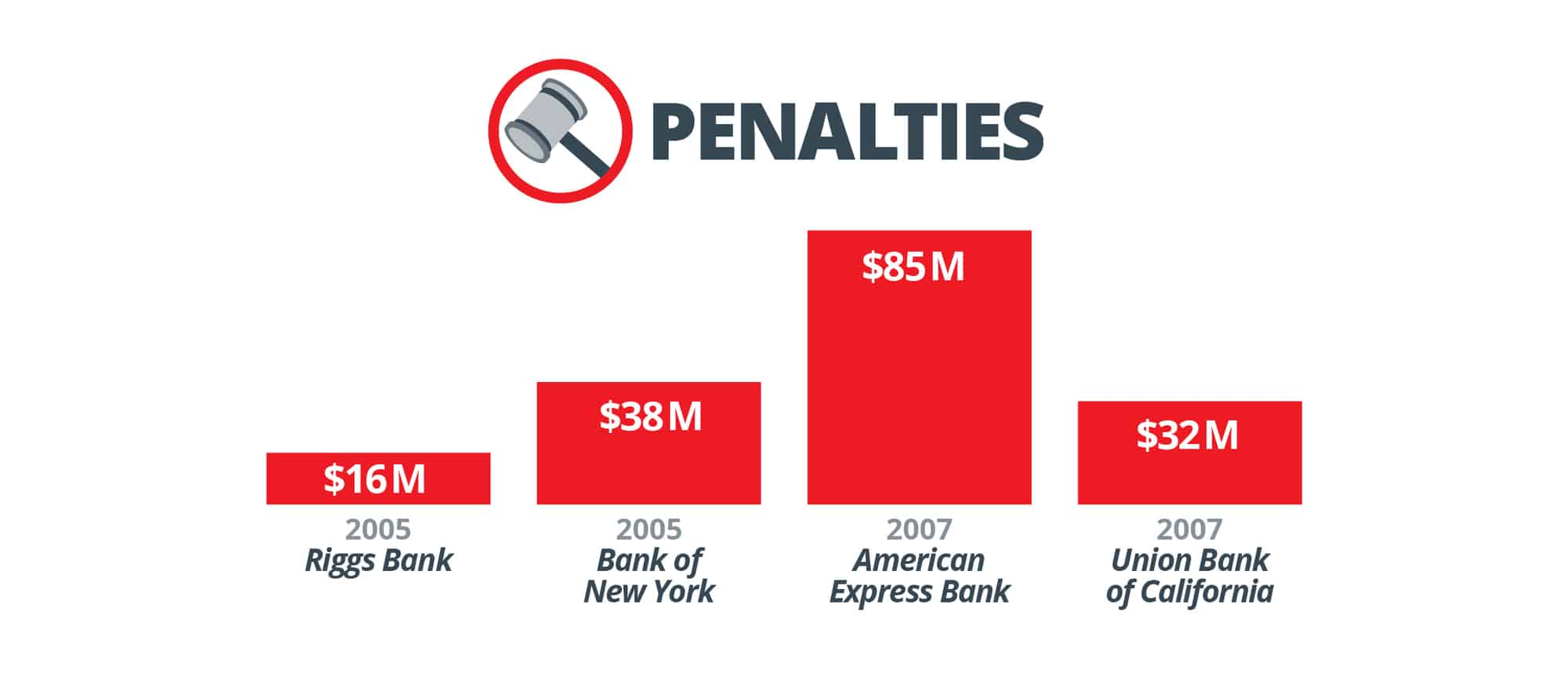

Department of the Treasury December 3 2018 Focus on Innovation and Modernization Regulatory and Enforcement Trends. 1100 AM 1200 PM EST 400 PM 500 PM London 500PM 600PM Amsterdam Register Online 159 Recently there have been several big AML enforcement actions against banks for violations of the Bank Secrecy Act BSA confirming the. BSA-AML Civil Money Penalties. A recent flurry of enforcement actions highlight regulators expectation that financial institutions implement robust AMLBSA compliance programs. The DFS enforcement action asserted that Mashreqbanks AMLBSA program was deficient in a number of respects and that the New York branch had failed to remediate identified compliance issues.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml enforcement actions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information