17+ Bsa aml high risk countries information

Home » money laundering Info » 17+ Bsa aml high risk countries informationYour Bsa aml high risk countries images are available in this site. Bsa aml high risk countries are a topic that is being searched for and liked by netizens now. You can Download the Bsa aml high risk countries files here. Find and Download all free photos and vectors.

If you’re looking for bsa aml high risk countries pictures information related to the bsa aml high risk countries keyword, you have visit the ideal blog. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

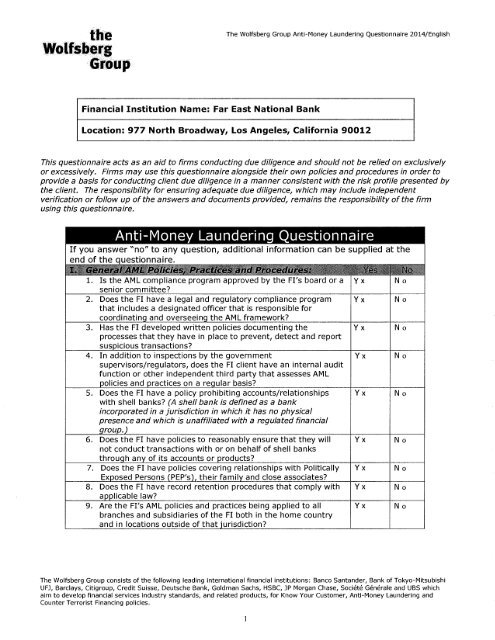

Bsa Aml High Risk Countries. Nevertheless the ability to send high-dollar and international transactions through the ACH may expose banks to higher BSAAML risks. A comprehensive list of scores and sub-indicators for 203 countries is available in the Expert Edition a subscription-based service used by companies and financial institutions as an MLTF country risk-rating tool for compliance and risk assessment purposes. Manager at a bank 2B USA Does anyone have a high risk country list for their BSA monitoring software. There are various AML factors that can cause a client to be classified as high risk.

Anti Money Laundering In Indonesia What You Need To Know From complyadvantage.com

Anti Money Laundering In Indonesia What You Need To Know From complyadvantage.com

Major money laundering countries and jurisdictions. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. High-Risk Countries Countries in which the production or transportation of illegal drugs may be taking place. Nevertheless the ability to send high-dollar and international transactions through the ACH may expose banks to higher BSAAML risks. There are various AML factors that can cause a client to be classified as high risk.

The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year.

Major money laundering countries and jurisdictions. Nevertheless the ability to send high-dollar and international transactions through the ACH may expose banks to higher BSAAML risks. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD. A comprehensive list of scores and sub-indicators for 203 countries is available in the Expert Edition a subscription-based service used by companies and financial institutions as an MLTF country risk-rating tool for compliance and risk assessment purposes. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. Manager at a bank 2B USA Does anyone have a high risk country list for their BSA monitoring software.

Source: financedigest.com

Source: financedigest.com

There are various AML factors that can cause a client to be classified as high risk. Do you include this list as an appendix to your risk assessment or do you keep separate procedures. The 24 high-risk third countries are. As of October 2018 the FATF has reviewed over 80 countries and publicly. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021.

Major money laundering countries and jurisdictions. Major money laundering countries and jurisdictions. Latest news reports from the medical literature videos from the experts and more. As of October 2018 the FATF has reviewed over 80 countries and publicly. Customers name is identified on a restricted person list ie OFACs SDN List Customer originates from a high-risk country.

Source: complyadvantage.com

Source: complyadvantage.com

Do you include this list as an appendix to your risk assessment or do you keep separate procedures. Ad AML coverage from every angle. Latest news reports from the medical literature videos from the experts and more. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk score. Jurisdiction Risk Type Jurisdiction Risk Type Afghanistan ML TF Madagascar TF Angola TF Mali ML TF Algeria TF Mozambique ML Bangladesh TF Myanmar ML Bolivia ML Nepal ML Burkina Faso ML.

Source: yumpu.com

Source: yumpu.com

Customers name is identified on a restricted person list ie OFACs SDN List Customer originates from a high-risk country. Manager at a bank 2B USA Does anyone have a high risk country list for their BSA monitoring software. High RIsk Country list. The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. Major money laundering countries and jurisdictions.

Source: complyadvantage.com

Source: complyadvantage.com

While banks should be alert to transactions involving higher-risk goods eg trade in weapons or nuclear equipment they need to be aware that goods may be over- or under-valued in an effort to evade anti-money laundering or customs regulations or to move funds or value across national borders. High-Risk Countries Countries in which the production or transportation of illegal drugs may be taking place. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. Countries identified in FinCEN advisories. High RIsk Country list.

Source: pinterest.com

Source: pinterest.com

While banks should be alert to transactions involving higher-risk goods eg trade in weapons or nuclear equipment they need to be aware that goods may be over- or under-valued in an effort to evade anti-money laundering or customs regulations or to move funds or value across national borders. A comprehensive list of scores and sub-indicators for 203 countries is available in the Expert Edition a subscription-based service used by companies and financial institutions as an MLTF country risk-rating tool for compliance and risk assessment purposes. Jurisdiction Risk Type Jurisdiction Risk Type Afghanistan ML TF Madagascar TF Angola TF Mali ML TF Algeria TF Mozambique ML Bangladesh TF Myanmar ML Bolivia ML Nepal ML Burkina Faso ML. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk score. Financial Institutions FIs are required to take a risk-based approach in their BSAAML compliance programs.

Source: fineksus.com

Source: fineksus.com

There are various AML factors that can cause a client to be classified as high risk. High RIsk Country list. Do you include this list as an appendix to your risk assessment or do you keep separate procedures. The risk-based approach provides FIs with a large degree of flexibility in determining their risk thresholds for certain types of customers. Nevertheless the ability to send high-dollar and international transactions through the ACH may expose banks to higher BSAAML risks.

Source: pinterest.com

Source: pinterest.com

Pose a higher risk of money laundering ML or terrorist financing TF. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Nevertheless the ability to send high-dollar and international transactions through the ACH may expose banks to higher BSAAML risks. High RIsk Country list. As of October 2018 the FATF has reviewed over 80 countries and publicly.

Source: ec.europa.eu

Source: ec.europa.eu

Ad AML coverage from every angle. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. The 24 high-risk third countries are. Nevertheless the ability to send high-dollar and international transactions through the ACH may expose banks to higher BSAAML risks. A customer may pose a higher AML risk because of any of the following.

Source: financialcrimeacademy.org

Source: financialcrimeacademy.org

The FATF has found the following countries although may be making progress and are committed to a strong AMLCFT regime are currently deficient in their programs. A comprehensive list of scores and sub-indicators for 203 countries is available in the Expert Edition a subscription-based service used by companies and financial institutions as an MLTF country risk-rating tool for compliance and risk assessment purposes. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. Manager at a bank 2B USA Does anyone have a high risk country list for their BSA monitoring software. Emerging countries that may be seeking hard currency investments.

Source: complyadvantage.com

Source: complyadvantage.com

High RIsk Country list. While banks should be alert to transactions involving higher-risk goods eg trade in weapons or nuclear equipment they need to be aware that goods may be over- or under-valued in an effort to evade anti-money laundering or customs regulations or to move funds or value across national borders. ACH transactions that are originated through a TPSP that is when the Originator is not a direct customer of the ODFI may increase BSAAML risks. The 24 high-risk third countries are. Do you include this list as an appendix to your risk assessment or do you keep separate procedures.

Source: acfcs.org

Source: acfcs.org

A comprehensive list of scores and sub-indicators for 203 countries is available in the Expert Edition a subscription-based service used by companies and financial institutions as an MLTF country risk-rating tool for compliance and risk assessment purposes. Under 4MLD the European Commission must from time to time draw up a list of such high-risk third countries. There are various AML factors that can cause a client to be classified as high risk. Latest news reports from the medical literature videos from the experts and more. The risk-based approach provides FIs with a large degree of flexibility in determining their risk thresholds for certain types of customers.

Source: slideshare.net

Source: slideshare.net

The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. While banks should be alert to transactions involving higher-risk goods eg trade in weapons or nuclear equipment they need to be aware that goods may be over- or under-valued in an effort to evade anti-money laundering or customs regulations or to move funds or value across national borders. Manager at a bank 2B USA Does anyone have a high risk country list for their BSA monitoring software. Employee at a bank 216MUSA Hi Does anyone have a country matrix they would be willing to share for their low medium and high risk countries. ACH transactions that are originated through a TPSP that is when the Originator is not a direct customer of the ODFI may increase BSAAML risks.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml high risk countries by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas