15+ Bsa aml model validation information

Home » money laundering Info » 15+ Bsa aml model validation informationYour Bsa aml model validation images are available. Bsa aml model validation are a topic that is being searched for and liked by netizens now. You can Find and Download the Bsa aml model validation files here. Download all royalty-free photos.

If you’re looking for bsa aml model validation pictures information connected with to the bsa aml model validation topic, you have pay a visit to the ideal blog. Our site always gives you hints for downloading the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

Bsa Aml Model Validation. Manager at a bank 29BUSA following. Performed BSAAML and sanctions model validation and tuning. Upgrade or change to core systems. VP at a bank USA Does anyone have an AML Model Validation procedure or template theyd be willing to share.

Http Higherlogicdownload S3 Amazonaws Com Acams E91557e6 Bbb6 4fc9 9b7c Eef66256706a Uploadedimages Pdf 20downloads Chapters Ncalifornia Norcal 20acams 20 20model 20risk 20management Pdf From

AML Model Validation Procedures. This evaluation helps inform the board of directors and senior management of weakness or areas. Performed BSAAML and sanctions model validation and tuning. Backed by years of experience our team of experts knows how to stress test models and make them stronger. For example when validating a BSAAML model the person completing the validation should have sufficient knowledge of the requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. The independent testing should evaluate the overall adequacy of the banks BSAAML compliance program and the banks compliance with BSA regulatory requirements.

Requirements of BSAAML to be able to review transaction detail alerts and suspicious activity.

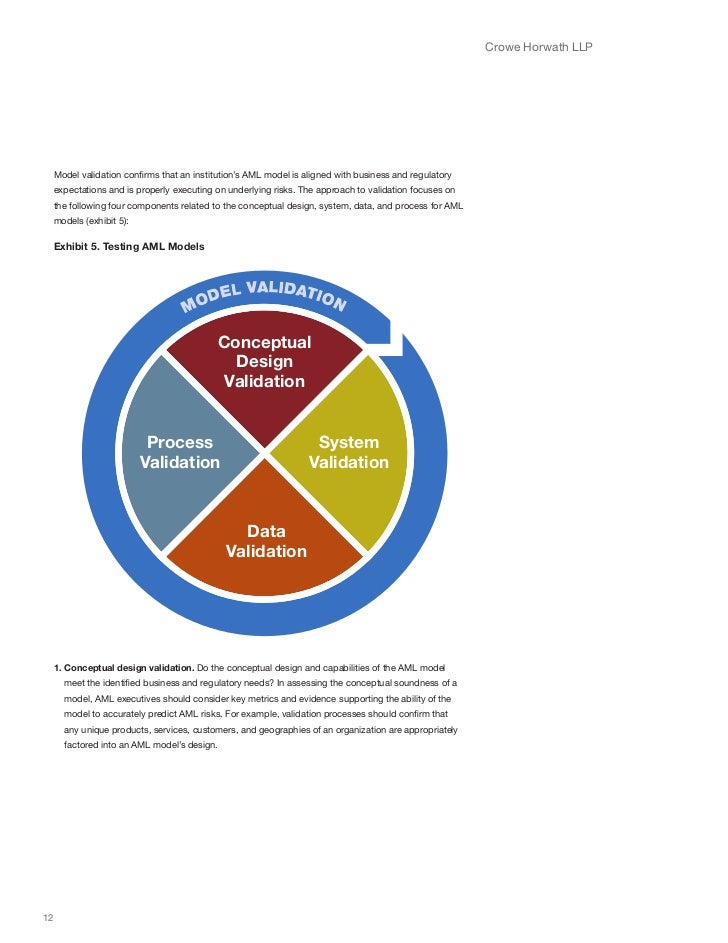

It is always best to complete the model validation in a test environment. The independent testing should evaluate the overall adequacy of the banks BSAAML compliance program and the banks compliance with BSA regulatory requirements. Model validations are a vital component of monitoring a financial institutions Bank Secrecy Actanti-money laundering BSAAML risk. Our BSAAML-related validation and advisory services include. This evaluation helps inform the board of directors and senior management of weakness or areas. An effective model validation of BSAAML software will verify if your processes and activities are performing as expected and are in line with your objectives and needs.

Source: stout.com

Source: stout.com

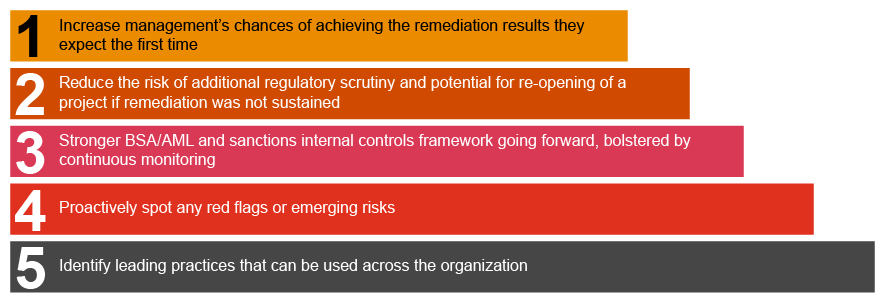

US regulators are more focused than ever on remediation related to Bank Secrecy ActAnti Money Laundering BSAAML and sanctions compliance programs. For example when validating a BSAAML model the person completing the validation should have sufficient knowledge of the requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. However many institutions dont know what a model is let alone when an independent third-party validation is required. Customer risk rating systems. The independent testing should evaluate the overall adequacy of the banks BSAAML compliance program and the banks compliance with BSA regulatory requirements.

Source: acamstoday.org

Source: acamstoday.org

This would eliminate the potential negative impact on actual customer information in the event there are issues. Its easy to make a model look good but ensuring it functions operationally to manage the risks that matter most to your business is a different exercise altogether. For example when validating a BSAAML model the person completing the validation should have sufficient knowledge of the requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. Requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. In addition the monitoring systems programming methodology and effectiveness should be independently validated to ensure that the models are detecting potentially suspicious activity.

Source: rmajournal.org

Source: rmajournal.org

Sheshunoff Consulting Solutions offers industry-leading independent BSAAML model validation services for community banks mid-sized regional banks and credit unions looking to maximize the effectiveness of their suspicious. The regulatory guidance states Banks. Requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. Examples of critical changes that may prompt an AML-system validation include the following. Customer due diligence enhanced due diligence models.

Source:

Customer risk rating systems. The frequency at which model validations need to be completed is based on the complexity of the institution and if thereve been any recent critical changes effecting the system. Its easy to make a model look good but ensuring it functions operationally to manage the risks that matter most to your business is a different exercise altogether. Sheshunoff Consulting Solutions offers industry-leading independent BSAAML model validation services for community banks mid-sized regional banks and credit unions looking to maximize the effectiveness of their suspicious. An effective model validation of BSAAML software will verify if your processes and activities are performing as expected and are in line with your objectives and needs.

Source: pwc.com

Source: pwc.com

However many institutions dont know what a model is let alone when an independent third-party validation is required. An effective model validation of BSAAML software will verify if your processes and activities are performing as expected and are in line with your objectives and needs. Change in the BSA or AML risk profile. However many institutions dont know what a model is let alone when an independent third-party validation is required. The frequency at which model validations need to be completed is based on the complexity of the institution and if thereve been any recent critical changes effecting the system.

Source: slideshare.net

Source: slideshare.net

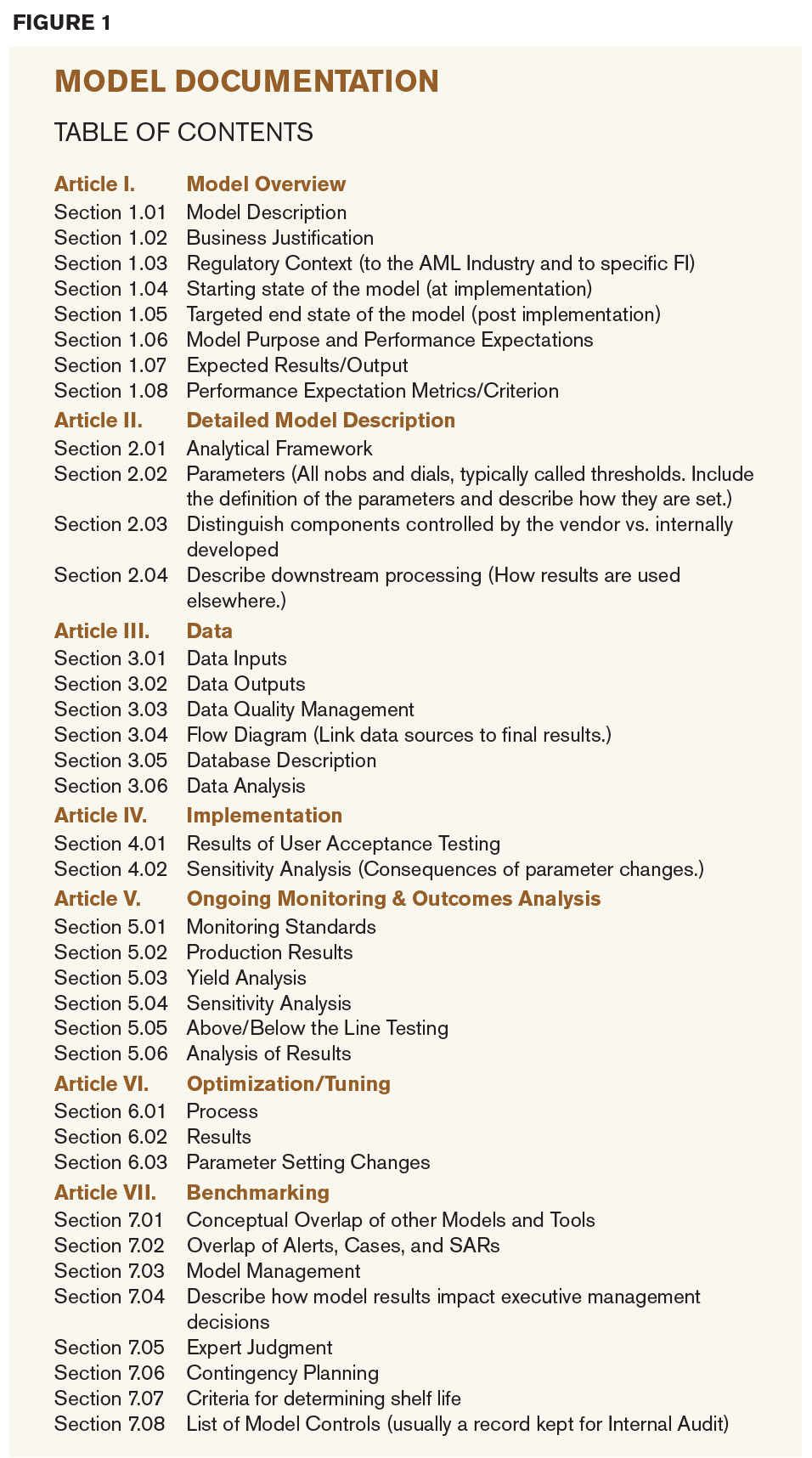

AML Model Validation Procedures. Model validations are a vital component of monitoring a financial institutions Bank Secrecy Actanti-money laundering BSAAML risk. Anything you can share would be greatly appreciated thank you. The independent testing should evaluate the overall adequacy of the banks BSAAML compliance program and the banks compliance with BSA regulatory requirements. In addition the monitoring systems programming methodology and effectiveness should be independently validated to ensure that the models are detecting potentially suspicious activity.

![]() Source: adiconsulting.com

Source: adiconsulting.com

The regulatory guidance states Banks. VP at a bank USA Does anyone have an AML Model Validation procedure or template theyd be willing to share. Change in the BSA or AML risk profile. This evaluation helps inform the board of directors and senior management of weakness or areas. Sheshunoff Consulting Solutions offers industry-leading independent BSAAML model validation services for community banks mid-sized regional banks and credit unions looking to maximize the effectiveness of their suspicious.

Source: youtube.com

Source: youtube.com

The independent testing should evaluate the overall adequacy of the banks BSAAML compliance program and the banks compliance with BSA regulatory requirements. For example when validating a BSAAML model the person completing the validation should have sufficient knowledge of the requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. Change in the BSA or AML risk profile. We were engaged by a regional bank to perform a model validation of their AML transaction monitoring and sanctions screening system which was used by the Bank to monitor transactions for unusual or suspicious activity and for possible sanctions matches. Model validations are a vital component of monitoring a financial institutions Bank Secrecy Actanti-money laundering BSAAML risk.

Source:

Requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. At Exiger we take a different approach to model validation. The frequency at which model validations need to be completed is based on the complexity of the institution and if thereve been any recent critical changes effecting the system. Additionally model validation is not a one and done process. The independent testing should evaluate the overall adequacy of the banks BSAAML compliance program and the banks compliance with BSA regulatory requirements.

Source:

AML Model Validation Procedures. The regulatory guidance states Banks. For example when validating a BSAAML model the person completing the validation should have sufficient knowledge of the requirements of BSAAML to be able to review transaction detail alerts and suspicious activity. DCGs BSAAML model validations are designed to help banks tackle these challenges head-on and mitigate their BSAAML-related risks. This would eliminate the potential negative impact on actual customer information in the event there are issues.

Source:

Upgrade or change to core systems. DCGs BSAAML model validations are designed to help banks tackle these challenges head-on and mitigate their BSAAML-related risks. Model validations are a vital component of monitoring a financial institutions Bank Secrecy Actanti-money laundering BSAAML risk. However many institutions dont know what a model is let alone when an independent third-party validation is required. Manager at a bank 29BUSA following.

Source:

The regulatory guidance states Banks. Customer risk rating systems. The independent testing should evaluate the overall adequacy of the banks BSAAML compliance program and the banks compliance with BSA regulatory requirements. Model validations are a vital component of monitoring a financial institutions Bank Secrecy Actanti-money laundering BSAAML risk. An effective model validation of BSAAML software will verify if your processes and activities are performing as expected and are in line with your objectives and needs.

Source: youtube.com

Source: youtube.com

An effective model validation of BSAAML software will verify if your processes and activities are performing as expected and are in line with your objectives and needs. It is always best to complete the model validation in a test environment. Change in the BSA or AML risk profile. At Exiger we take a different approach to model validation. Examples of critical changes that may prompt an AML-system validation include the following.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa aml model validation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas