19++ Bsa aml monetary penalties list ideas in 2021

Home » money laundering idea » 19++ Bsa aml monetary penalties list ideas in 2021Your Bsa aml monetary penalties list images are ready. Bsa aml monetary penalties list are a topic that is being searched for and liked by netizens now. You can Get the Bsa aml monetary penalties list files here. Get all royalty-free photos.

If you’re looking for bsa aml monetary penalties list pictures information connected with to the bsa aml monetary penalties list interest, you have come to the ideal site. Our site always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

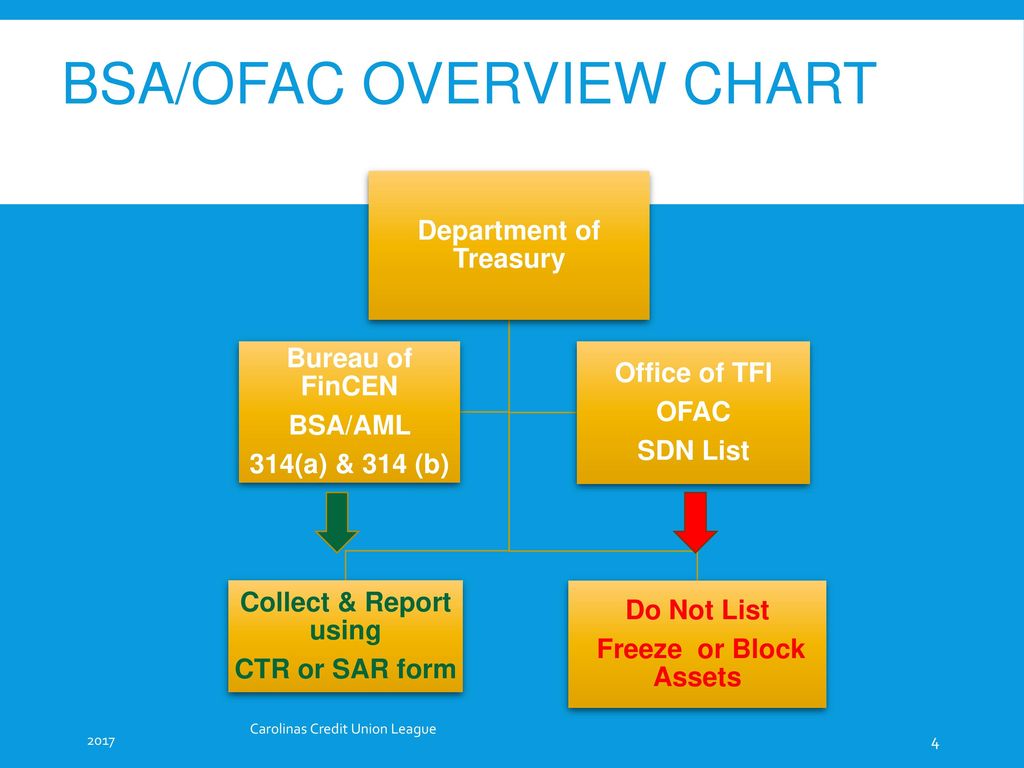

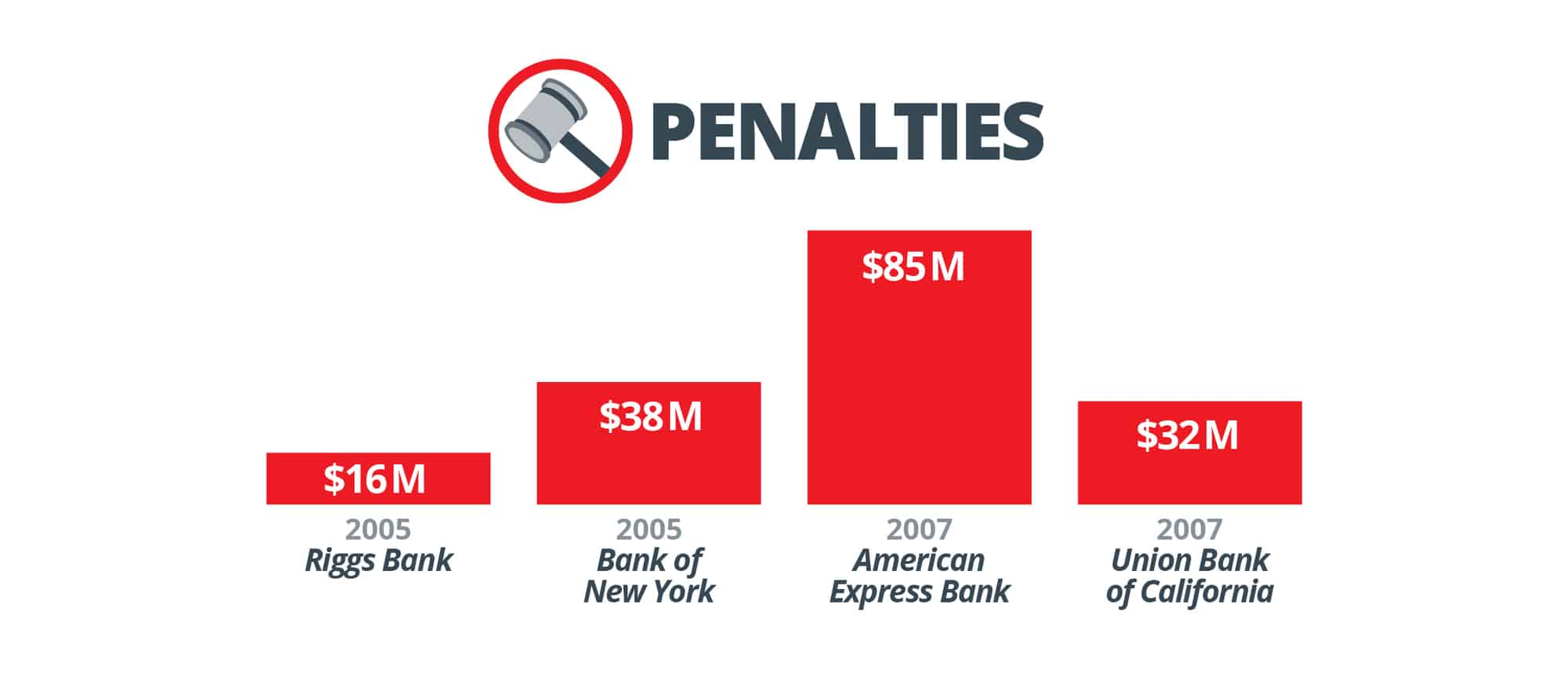

Bsa Aml Monetary Penalties List. The Bank entered into an NPA with BSA undertakings and agreed to pay over 30 million to resolve allegations that it helped launder bribes as part of the FIFA scandal. The OCCs implementing regulations are found at 12 CFR 2111and 12 CFR 2121. JPMC entered into a deferred prosecution agreement and was assessed over 2 billion in penalties in an action that gave rise to. Since the Patriot Act was enacted at the end of 2001 US regulators have imposed more than 5bn in monetary penalties against financial institutions in connection with alleged violations of Bank Secrecy Act BSA and Anti-Money Laundering AML regulations.

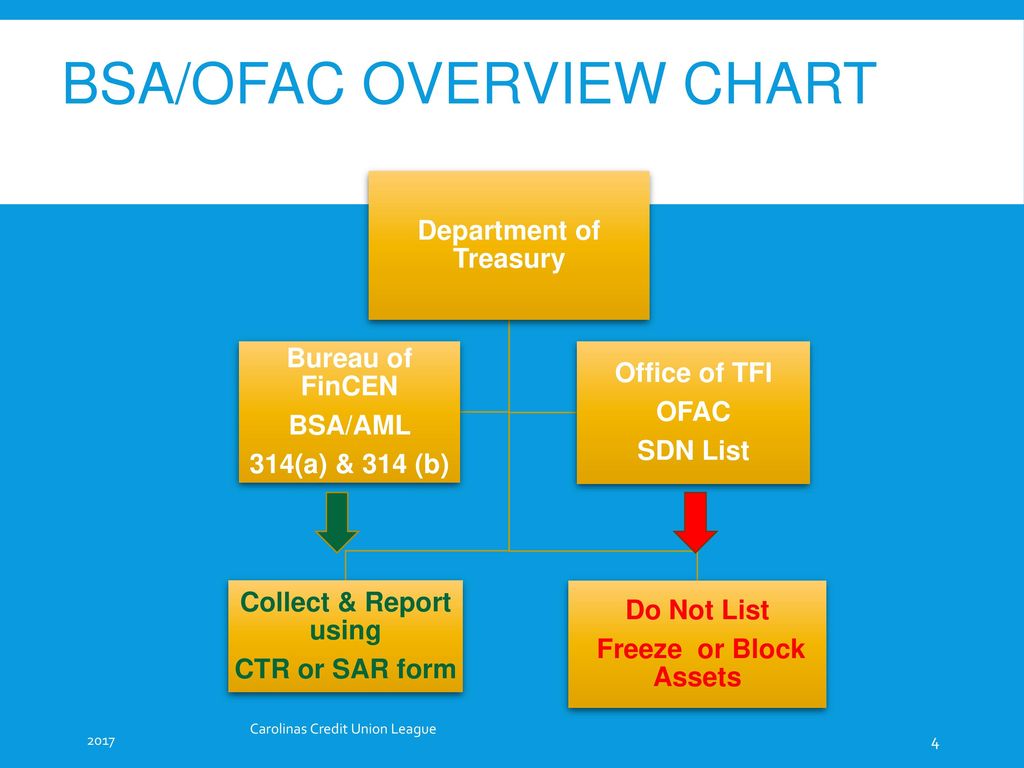

Bsa Aml Ofac Staff Training Ppt Download From slideplayer.com

Bsa Aml Ofac Staff Training Ppt Download From slideplayer.com

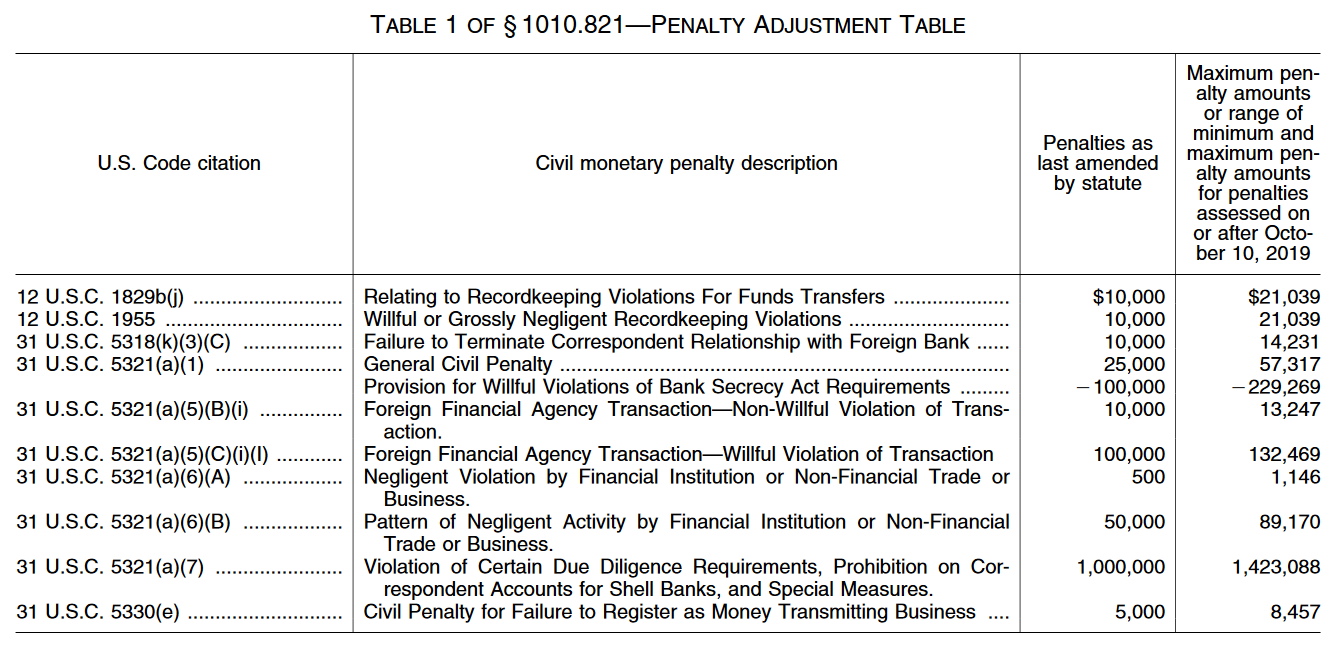

MoneyGrams DPA was extended and an additional 125 million forfeited for. UBS 2018. Four of these required the financial institution to admit the accuracy of government claims and accept responsibility for the actions. Penalty for these violations11 FinCEN determined that the maximum penalty in this matter is 20914455412 FinCEN may impose a civil money penalty of 57317 for each willful violation of AML program requirements assessed on or after October 10 201913 The BSA states tha Congress Passes the Anti-Money Laundering Act of 2020 Significant Changes to the Bank Secrecy Act Ahead to allow larger rewards for reporting violations that lead to civil penalties. To provide additional incentives for reporting BSAAML violations the Act enhances existing BSA whistleblower provisions which have never been implemented to allow larger rewards for reporting violations that lead to civil penalties or criminal fines exceeding 1000000. Penalties include heavy fines and prison sentences.

The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks.

Standard Chartered Bank 2019. Penalties include heavy fines and prison sentences. No BSAAML monetary penalty exceeded 1 of a financial institutions total equity capital in that period. To provide additional incentives for reporting BSAAML violations the Act enhances existing BSA whistleblower provisions which have never been implemented to allow larger rewards for reporting violations that lead to civil penalties or criminal fines exceeding 1000000. The six largest monetary penalties in connection with BSAAML violations were assessed in the last six years of this 14-year period ie 2010 through 2015. BSA-AML Civil Money Penalties.

Source: nafcu.org

Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. The Bank Secrecy Act BSA 31 USC 5311et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. Persons individuals corporations partnerships LLCs and trusts provide timely information regarding their foreign accounts otherwise a 10000 penalty.

Less than a week apart two major financial institutions FIs have been hit with penalties for failing to implement adequate anti-money laundering AML protections. Any subsidiary other than a bank of any listed entity that is organized under the laws of the United States or of any state and at least 51 percent of whose common stock or analogous equity interest is owned by the listed entity provided that a person that is a financial institution other than a bank is an exempt person only to the extent of its domestic operations. DOJ for repeated BSAAML failures. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA. The primary conclusions of the detailed Report are that i referrals by the IRS to the Financial Crimes Enforcement Network FinCEN for potential Title 31 penalty cases suffer lengthy delays and have little impact on BSA compliance.

Source: yumpu.com

Source: yumpu.com

The Bank entered into an NPA with BSA undertakings and agreed to pay over 30 million to resolve allegations that it helped launder bribes as part of the FIFA scandal. Negligence is further discussed in IRM 426741. Penalty for these violations11 FinCEN determined that the maximum penalty in this matter is 20914455412 FinCEN may impose a civil money penalty of 57317 for each willful violation of AML program requirements assessed on or after October 10 201913 The BSA states tha Congress Passes the Anti-Money Laundering Act of 2020 Significant Changes to the Bank Secrecy Act Ahead to allow larger rewards for reporting violations that lead to civil penalties. The penalty amount could not exceed 500. And iii although referrals regarding BSA.

Source: complianceonline.com

Source: complianceonline.com

FinCEN SEC and FINRA fined UBS for alleged BSAAML program deficiencies. JPMC entered into a deferred prosecution agreement and was assessed over 2 billion in penalties in an action that gave rise to. In the BSAAML sphere JPMorgan Chase Bank NA. Standard Chartered Bank 2019. The bank also settled civil charges on.

Source: regtechconsulting.net

Source: regtechconsulting.net

IRC 6038D requires that all US. There are heavy penalties for individuals and financial institutions that fail to file CTRs MILs or SARs. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA. The Bank entered into an NPA with BSA undertakings and agreed to pay over 30 million to resolve allegations that it helped launder bribes as part of the FIFA scandal. The cases are arranged in reverse chronological order and include the name and asset size when known of.

Source: nafcu.org

Source: nafcu.org

The bank also settled civil charges on. FinCEN SEC and FINRA fined UBS for alleged BSAAML program deficiencies. The BSA was amended to incorporate the. No BSAAML monetary penalty exceeded 1 of a financial institutions total equity capital in that period. Represented the first criminal BSA charge ever brought against a United States broker-dealer.

Source: complyadvantage.com

Source: complyadvantage.com

Since the Patriot Act was enacted at the end of 2001 US regulators have imposed more than 5bn in monetary penalties against financial institutions in connection with alleged violations of Bank Secrecy Act BSA and Anti-Money Laundering AML regulations. And iii although referrals regarding BSA. But the penalties imposed by the involved regulators are different. An effective BSAAML compliance program requires sound risk management. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs.

Source: slideplayer.com

Source: slideplayer.com

UBS 2018. BSA Related Regulations. Penalty for these violations11 FinCEN determined that the maximum penalty in this matter is 20914455412 FinCEN may impose a civil money penalty of 57317 for each willful violation of AML program requirements assessed on or after October 10 201913 The BSA states tha Congress Passes the Anti-Money Laundering Act of 2020 Significant Changes to the Bank Secrecy Act Ahead to allow larger rewards for reporting violations that lead to civil penalties. The primary conclusions of the detailed Report are that i referrals by the IRS to the Financial Crimes Enforcement Network FinCEN for potential Title 31 penalty cases suffer lengthy delays and have little impact on BSA compliance. The Bank entered into an NPA with BSA undertakings and agreed to pay over 30 million to resolve allegations that it helped launder bribes as part of the FIFA scandal.

Source: present5.com

Source: present5.com

This stance may have been in part an effort to avoid placing further strains on institutions weathering the financial crisis. BSA Related Regulations. To provide additional incentives for reporting BSAAML violations the Act enhances existing BSA whistleblower provisions which have never been implemented to allow larger rewards for reporting violations that lead to civil penalties or criminal fines exceeding 1000000. Four of these required the financial institution to admit the accuracy of government claims and accept responsibility for the actions. Represented the first criminal BSA charge ever brought against a United States broker-dealer.

Source: m.bankingexchange.com

Source: m.bankingexchange.com

On 11162012 the FDIC and FinCEN announced the assessment of concurrent CMPs of 15 million against the bank for violations of the BSA and AML laws and regulations. And iii although referrals regarding BSA. Therefore the manual also provides guidance on identifying and. UBS 2018. There are also penalties for a bank which discloses to its client that it has filed a SAR about the client.

Source: complyadvantage.com

Source: complyadvantage.com

Any subsidiary other than a bank of any listed entity that is organized under the laws of the United States or of any state and at least 51 percent of whose common stock or analogous equity interest is owned by the listed entity provided that a person that is a financial institution other than a bank is an exempt person only to the extent of its domestic operations. MoneyGram 2018. Therefore the manual also provides guidance on identifying and. I am preparing to teach a BSA class to bank employees. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs.

Source: slideplayer.com

Source: slideplayer.com

No BSAAML monetary penalty exceeded 1 of a financial institutions total equity capital in that period. Less than a week apart two major financial institutions FIs have been hit with penalties for failing to implement adequate anti-money laundering AML protections. Under the BSA penalties may be imposed on each branch or location found to be violation of AML regulations and for each day that the violation occurs. Below we have collected information on recent monetary penalties assessed and CD Orders imposed by FinCEN or federal and state financial institution regulators and others for deficiencies in BSAAML programs. FinCEN SEC and FINRA fined UBS for alleged BSAAML program deficiencies.

Source: verafin.com

Source: verafin.com

BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to. The penalty amount could not exceed 500. Persons individuals corporations partnerships LLCs and trusts provide timely information regarding their foreign accounts otherwise a 10000 penalty. FinCEN SEC and FINRA fined UBS for alleged BSAAML program deficiencies. Represented the first criminal BSA charge ever brought against a United States broker-dealer.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml monetary penalties list by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information