17+ Bsa aml penalties information

Home » money laundering idea » 17+ Bsa aml penalties informationYour Bsa aml penalties images are available in this site. Bsa aml penalties are a topic that is being searched for and liked by netizens now. You can Download the Bsa aml penalties files here. Download all royalty-free vectors.

If you’re searching for bsa aml penalties images information linked to the bsa aml penalties topic, you have come to the ideal blog. Our website always provides you with suggestions for viewing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

Bsa Aml Penalties. Latest news reports from the medical literature videos from the experts and more. Personal liability for BSAAML deficiencies. BSA program violations must be supported by at least one pillar violation. Ad AML coverage from every angle.

Moneylaundering Com Changes In Bank Regulations Financial Compliance Regulations Regulation Banks Money Laundering Cases Anti Money Laundering Money Laundering Training From moneylaundering.com

Moneylaundering Com Changes In Bank Regulations Financial Compliance Regulations Regulation Banks Money Laundering Cases Anti Money Laundering Money Laundering Training From moneylaundering.com

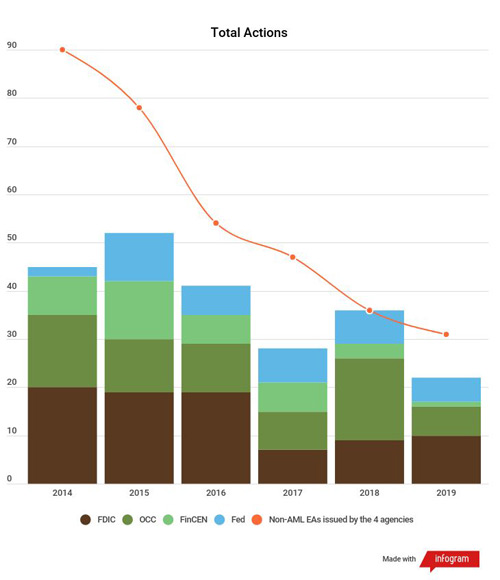

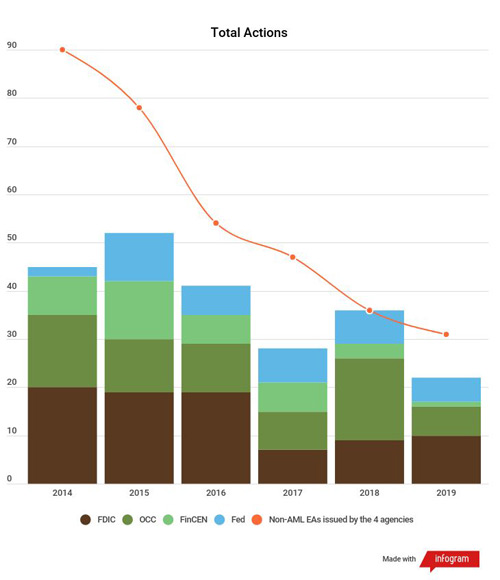

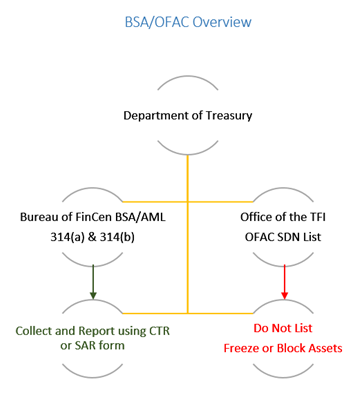

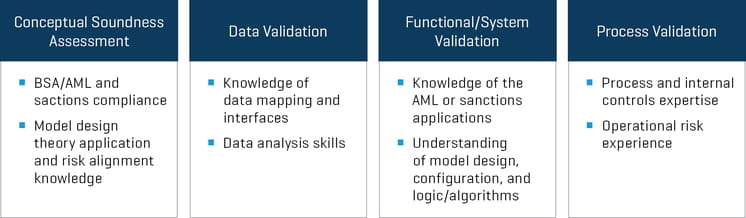

Violations of individual pillars might or might not lead to the conclusion that the bank has suffered an overall BSAAML program violation. BSA program violations must be supported by at least one pillar violation. Civil penalties except for penalties assessed on requirements of the Report of Foreign Bank and Financial Accounts FBAR are assessed by the Financial Crimes Enforcement Network FinCEN. The FDICs BSAAML program rule are cited when failureoccurs in the over-all BSAAML program. Under the Bank Secrecy Act BSA the most onerous civil penalties will be applied for willful violations. BSA penalties depend on the type of entity the type of Anti-Money Laundering program reporting or recordkeeping violation involved and the degree of intent.

Likewise the Financial Crimes Enforcement Network FinCEN has independent authority to assess civil money penalties under the BSA.

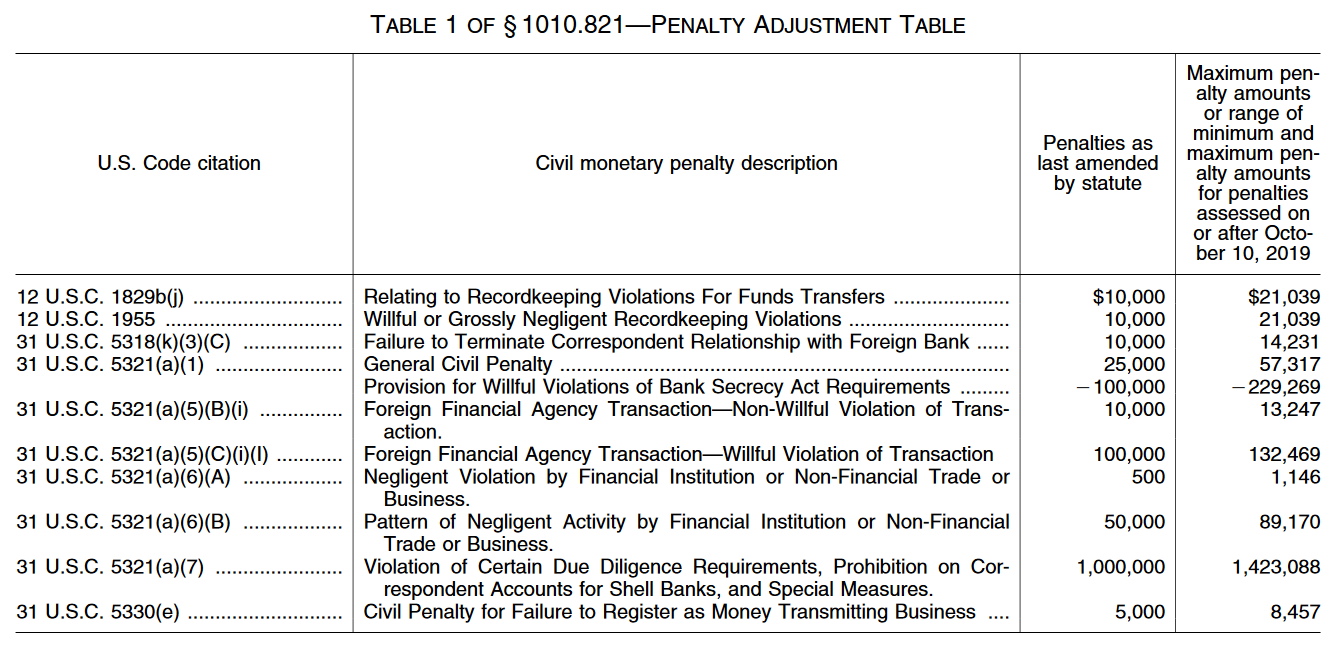

Willful BSA violation penalties range from 57317 to 229269. Under the BSA penalties may be imposed on each branch or location found to be violation of AML regulations and for each day that the violation occurs. Civil penalties except for penalties assessed on requirements of the Report of Foreign Bank and Financial Accounts FBAR are assessed by the Financial Crimes Enforcement Network FinCEN. Specifically repeat BSA violators may be subject to civil penalties. BSA-AML Civil Money Penalties The cases are arranged in reverse chronological order and include the name and asset size when known of the organization penalized stated penalty amount agencies involved and key shortcomings noted in the organizations AML or BSA compliance program. For example in criminal and civil tax fraud cases under the Internal Revenue Code willfulness is defined to mean a voluntary and intentional violation of a known legal duty a very demanding showing.

Source: moneylaundering.com

Source: moneylaundering.com

Civil penalties except for penalties assessed on requirements of the Report of Foreign Bank and Financial Accounts FBAR are assessed by the Financial Crimes Enforcement Network FinCEN. BSA penalties depend on the type of entity the type of Anti-Money Laundering program reporting or recordkeeping violation involved and the degree of intent. SEC found COR Clearing failed to report suspicious sales of penny stock shares as required by the BSA. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. Civil money penalty for alleged BSAAML deficiencies.

Willful violations of the BSA result in maximum penalties ranging from 57317 to 229269. Under the Bank Secrecy Act BSA the most onerous civil penalties will be applied for willful violations. Department of Justice DOJ the Office of the Comptroller of the Currency OCC and the Federal Reserve for a combined 613 million in financial penaltiesmarks the first time FinCEN has imposed a penalty on a bank compliance officer for his role in failing to prevent BSAAML compliance program. Ad AML coverage from every angle. Even violations related to funds transfer recordkeeping result in penalties of up to 21039.

Source: nafcu.org

Source: nafcu.org

Even violations related to funds transfer recordkeeping result in penalties of up to 21039. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. Likewise the Financial Crimes Enforcement Network FinCEN has independent authority to assess civil money penalties under the BSA. Banks 2018 BSAAML-related resolution with FinCEN the US. LPL Financial LLC.

Source: nafcu.org

Source: nafcu.org

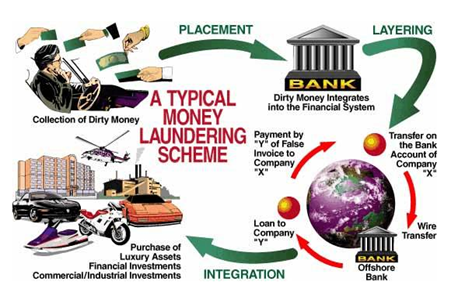

The FDICs BSAAML program rule are cited when failureoccurs in the over-all BSAAML program. FINRA fined LPL Financial a 275 million fine after it found among other things it failed to file SARs on cyber events. Likewise the Financial Crimes Enforcement Network FinCEN has independent authority to assess civil money penalties under the BSA. LPL Financial LLC. Risks Associated with Money Laundering and Terrorist Financing.

Source: slideplayer.com

Source: slideplayer.com

This statement does not address the assessment of civil money penalties for violations of the BSA or its implementing regulations. LPL Financial LLC. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. But this is not the only sign of higher penalties for BSAAML violations. State banking agencies can impose similar penalties.

Source: nafcu.org

Source: nafcu.org

Violating certain due diligence requirements can result in penalties of up to 1423088. 1786k2 and 1818i2. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. For example in criminal and civil tax fraud cases under the Internal Revenue Code willfulness is defined to mean a voluntary and intentional violation of a known legal duty a very demanding showing. The Agencies have such authority under their general enforcement statutes.

Source: verafin.com

Source: verafin.com

Specifically repeat BSA violators may be subject to civil penalties. State banking agencies can impose similar penalties. Latest news reports from the medical literature videos from the experts and more. Under the Bank Secrecy Act BSA the most onerous civil penalties will be applied for willful violations. Office of Foreign Assets Control.

Source: verafin.com

Source: verafin.com

COR Clearing LLC. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to. SEC found COR Clearing failed to report suspicious sales of penny stock shares as required by the BSA. FINRA fined LPL Financial a 275 million fine after it found among other things it failed to file SARs on cyber events. Civil money penalty for alleged BSAAML deficiencies.

Office of Foreign Assets Control. BSA-AML Civil Money Penalties The cases are arranged in reverse chronological order and include the name and asset size when known of the organization penalized stated penalty amount agencies involved and key shortcomings noted in the organizations AML or BSA compliance program. Violations of individual pillars might or might not lead to the conclusion that the bank has suffered an overall BSAAML program violation. COR Clearing LLC. Banks 2018 BSAAML-related resolution with FinCEN the US.

Assessing Compliance with BSA Regulatory Requirements. This actionwhich follows US. But again no mention of CCG and late CTRs. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to. Latest news reports from the medical literature videos from the experts and more.

Source: complianceonline.com

Source: complianceonline.com

That mental state standard might sound hard for the government to prove. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. BSA fines may range from 10000 per day for failures to report foreign financial agency transactions to. Ad AML coverage from every angle. The OCCs October 2018 civil penalty of 100000000 provided that the July 2015 Order had been violated because they were a year late in doing the remediation that there were additional violations missed SARs after 2015 more SARs from a lookback and a Travel Rule violation on wires.

Source: complianceonline.com

Source: complianceonline.com

For example in criminal and civil tax fraud cases under the Internal Revenue Code willfulness is defined to mean a voluntary and intentional violation of a known legal duty a very demanding showing. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. Under the Bank Secrecy Act BSA the most onerous civil penalties will be applied for willful violations. Department of Justice DOJ the Office of the Comptroller of the Currency OCC and the Federal Reserve for a combined 613 million in financial penaltiesmarks the first time FinCEN has imposed a penalty on a bank compliance officer for his role in failing to prevent BSAAML compliance program. The OCCs October 2018 civil penalty of 100000000 provided that the July 2015 Order had been violated because they were a year late in doing the remediation that there were additional violations missed SARs after 2015 more SARs from a lookback and a Travel Rule violation on wires.

Source: stout.com

Source: stout.com

COR Clearing LLC. - The BSA requires financial institutions to have an anti -money laundering compliance program and comply with a number of reporting and recordkeeping requirements. Violations of certain due diligence requirements can result in penalties all the way up to 1424088. Office of Foreign Assets Control. This statement does not address the assessment of civil money penalties for violations of the BSA or its implementing regulations.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml penalties by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information