18+ Bsa aml red flags info

Home » money laundering Info » 18+ Bsa aml red flags infoYour Bsa aml red flags images are available in this site. Bsa aml red flags are a topic that is being searched for and liked by netizens today. You can Find and Download the Bsa aml red flags files here. Download all free vectors.

If you’re searching for bsa aml red flags images information connected with to the bsa aml red flags keyword, you have visit the ideal blog. Our website always provides you with hints for seeking the highest quality video and picture content, please kindly search and find more informative video content and images that match your interests.

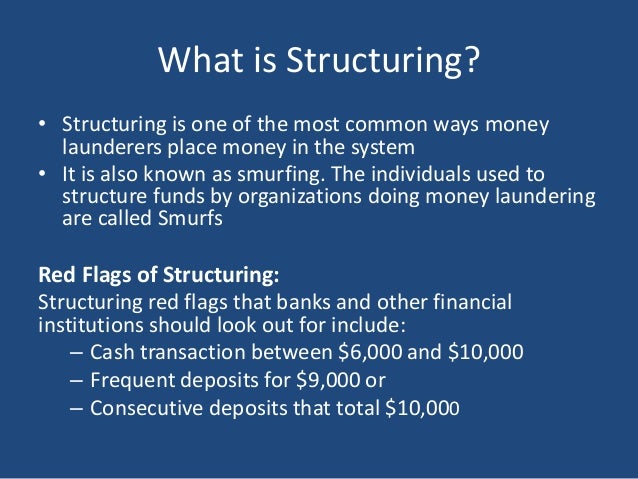

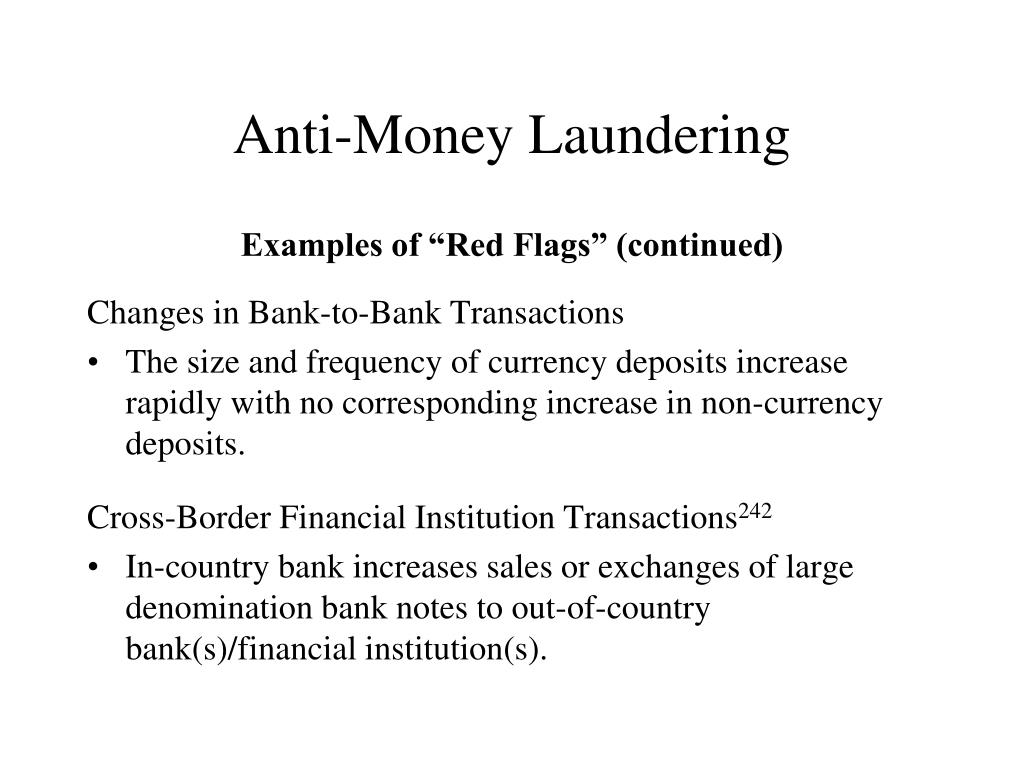

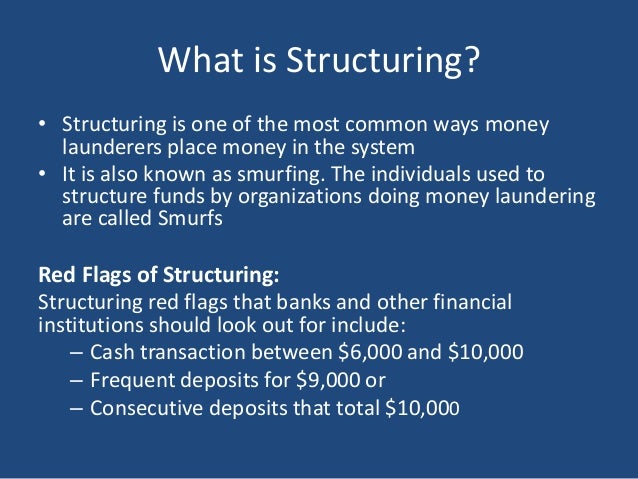

Bsa Aml Red Flags. A third party attempts to fill out paperwork without consulting the customer. FFIEC MANUAL RED FLAGS DOWNLOAD FFIEC MANUAL RED FLAGS READ ONLINE Based on the FFIEC BSAAML Examination Manual Appendix F here are examples of red flags of which you need to be aware as you work with loan customers 12 Mar 2008 During a prior AMLA event in September 2007 I provided a document which lists the changes made on August 24 2007 to Appendix F Red. BSA COMPLIANCE RED FLAGS Behavior-Based System Is Ineffective in Anti-Money Laundering Monitoring The Bank Secrecy Act BSA and Anti-Money Laundering AML have been the most important compliance matters in the financial industry since 911. Rather the presence of a red flag should prompt additional investigation and scrutiny in order to determine whether a SAR should be filed.

Red Flags Of Money Laundering From slideshare.net

Red Flags Of Money Laundering From slideshare.net

FFIEC MANUAL RED FLAGS DOWNLOAD FFIEC MANUAL RED FLAGS READ ONLINE Based on the FFIEC BSAAML Examination Manual Appendix F here are examples of red flags of which you need to be aware as you work with loan customers 12 Mar 2008 During a prior AMLA event in September 2007 I provided a document which lists the changes made on August 24 2007 to Appendix F Red. This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. A third party speaks on behalf of the customer a third party may insist on being present andor translating. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Red Flags of Money Laundering. Latest news reports from the medical literature videos from the experts and more.

Many financial institutions have invested.

Use of cashiers checks or money orders from different banks to make policy payments or other payment methods unusual for that particular customer. Rather the presence of a red flag should prompt additional investigation and scrutiny in order to determine whether a SAR should be filed. A third party speaks on behalf of the customer a third party may insist on being present andor translating. FIS E-Funds- Red Flags. However if a red flag is triggered it doesnt automatically mean that the transaction it flags is criminal. A third party attempts to fill out paperwork without consulting the customer.

Source: slideserve.com

Source: slideserve.com

Employee at a bank 449MUSA Looking to connect with other users of the FIS E-Funds Red Flags history to discuss how you track and log for CIP purposes. FIS E-Funds- Red Flags. Company transactions both deposits and withdrawals that are denominated by unusually large amounts of cash rather than by way of debits and credits normally associated with the normal commercial operations of the company eg. However if a red flag is triggered it doesnt automatically mean that the transaction it flags is criminal. Cheques letters of credit bills of exchange.

Source: store.lexisnexis.com

Source: store.lexisnexis.com

The Basel Committee on Banking Supervision is a committee of central banks and bank supervisors and regulators from numerous jurisdictions that meets at the Bank for International Settlements BIS in Basel Switzerland to discuss issues related to prudential banking supervision. The following patterns of customer behavior are red flags for potentially suspicious activity. Cheques letters of credit bills of exchange. Rather the presence of a red flag should prompt additional investigation and scrutiny in order to determine whether a SAR should be filed. I have been told in the past that the Qualifile product previously known as Chexsystems does not meet the CIP requirements but the ID verification IDV and Red Flags.

Source: elliptic.co

Source: elliptic.co

FFIEC MANUAL RED FLAGS DOWNLOAD FFIEC MANUAL RED FLAGS READ ONLINE Based on the FFIEC BSAAML Examination Manual Appendix F here are examples of red flags of which you need to be aware as you work with loan customers 12 Mar 2008 During a prior AMLA event in September 2007 I provided a document which lists the changes made on August 24 2007 to Appendix F Red. A third party speaks on behalf of the customer a third party may insist on being present andor translating. I have been told in the past that the Qualifile product previously known as Chexsystems does not meet the CIP requirements but the ID verification IDV and Red Flags. Many financial institutions have invested. Depositing cash by means of numerous credit slips by a customer such.

Source: acamstoday.org

Source: acamstoday.org

Cheques letters of credit bills of exchange. BSA COMPLIANCE RED FLAGS Behavior-Based System Is Ineffective in Anti-Money Laundering Monitoring The Bank Secrecy Act BSA and Anti-Money Laundering AML have been the most important compliance matters in the financial industry since 911. A third party attempts to fill out paperwork without consulting the customer. Ad AML coverage from every angle. However if a red flag is triggered it doesnt automatically mean that the transaction it flags is criminal.

Source: slideshare.net

Source: slideshare.net

Many financial institutions have invested. A third party attempts to fill out paperwork without consulting the customer. Latest news reports from the medical literature videos from the experts and more. The twenty new Red Flags include the following behavioral indicators. Cheques letters of credit bills of exchange.

Source: shuftipro.com

Source: shuftipro.com

However if a red flag is triggered it doesnt automatically mean that the transaction it flags is criminal. A third party insists on being present for every aspect of the transaction. Ad AML coverage from every angle. Red Flags of Money Laundering. Use of cashiers checks or money orders from different banks to make policy payments or other payment methods unusual for that particular customer.

Source: pinterest.com

Source: pinterest.com

Red Flags of Money Laundering. However if a red flag is triggered it doesnt automatically mean that the transaction it flags is criminal. Use of cashiers checks or money orders from different banks to make policy payments or other payment methods unusual for that particular customer. Company transactions both deposits and withdrawals that are denominated by unusually large amounts of cash rather than by way of debits and credits normally associated with the normal commercial operations of the company eg. Rather the presence of a red flag should prompt additional investigation and scrutiny in order to determine whether a SAR should be filed.

Source: slideshare.net

Source: slideshare.net

This webinar will explain what money laundering is various types of money laundering including structuring micro-structuring and cuckoo smurfing. Two the presence of a red flag is not conclusive evidence of criminal activity. The following patterns of customer behavior are red flags for potentially suspicious activity. Ad AML coverage from every angle. A red flag simply warns you your employees and your BSA Compliance Officer that suspicious activity has occurred and requires further investigation and possibly reporting to.

Source: regtechconsulting.net

Source: regtechconsulting.net

Latest news reports from the medical literature videos from the experts and more. Company transactions both deposits and withdrawals that are denominated by unusually large amounts of cash rather than by way of debits and credits normally associated with the normal commercial operations of the company eg. I have been told in the past that the Qualifile product previously known as Chexsystems does not meet the CIP requirements but the ID verification IDV and Red Flags. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Ad AML coverage from every angle.

Source: amlology.org

Source: amlology.org

Cheques letters of credit bills of exchange. Depositing cash by means of numerous credit slips by a customer such. A red flag simply warns you your employees and your BSA Compliance Officer that suspicious activity has occurred and requires further investigation and possibly reporting to. 2002 red flag 1 The customer exhibits unusual concern regarding the firms compliance with government reporting requirements and the firms AML policies particularly with respect to his or her identity type of business and assets or is reluctant or refuses to reveal any information concerning business activities or furnishes unusual or suspect identification or business documents. FFIEC MANUAL RED FLAGS DOWNLOAD FFIEC MANUAL RED FLAGS READ ONLINE Based on the FFIEC BSAAML Examination Manual Appendix F here are examples of red flags of which you need to be aware as you work with loan customers 12 Mar 2008 During a prior AMLA event in September 2007 I provided a document which lists the changes made on August 24 2007 to Appendix F Red.

Source: issuu.com

Source: issuu.com

The Basel Committee on Banking Supervision is a committee of central banks and bank supervisors and regulators from numerous jurisdictions that meets at the Bank for International Settlements BIS in Basel Switzerland to discuss issues related to prudential banking supervision. Cheques letters of credit bills of exchange. Two the presence of a red flag is not conclusive evidence of criminal activity. FFIEC MANUAL RED FLAGS DOWNLOAD FFIEC MANUAL RED FLAGS READ ONLINE Based on the FFIEC BSAAML Examination Manual Appendix F here are examples of red flags of which you need to be aware as you work with loan customers 12 Mar 2008 During a prior AMLA event in September 2007 I provided a document which lists the changes made on August 24 2007 to Appendix F Red. A third party speaks on behalf of the customer a third party may insist on being present andor translating.

Source: shuftipro.com

Source: shuftipro.com

Purchase of an insurance product inconsistent with the customers needs. A third party speaks on behalf of the customer a third party may insist on being present andor translating. Attendees will learn how to identify the red flags of money laundering in an account within your institution. I have been told in the past that the Qualifile product previously known as Chexsystems does not meet the CIP requirements but the ID verification IDV and Red Flags. FFIEC BSA-AML Examination Manual Terrorist Financing Red Flags Verafin is the industry leader in enterprise Financial Crime Management solutions providing a cloud-based secure software platform for Fraud Detection and Management BSAAML Compliance and Management High-Risk Customer Management and Information Sharing.

Source: arcriskandcompliance.com

Source: arcriskandcompliance.com

The twenty new Red Flags include the following behavioral indicators. A third party attempts to fill out paperwork without consulting the customer. 2002 red flag 1 The customer exhibits unusual concern regarding the firms compliance with government reporting requirements and the firms AML policies particularly with respect to his or her identity type of business and assets or is reluctant or refuses to reveal any information concerning business activities or furnishes unusual or suspect identification or business documents. Avoiding Recordkeeping and Reporting Requirements Member asks about record-keeping or reporting requirements. A third party insists on being present for every aspect of the transaction.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml red flags by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas