18+ Bsa aml structuring info

Home » money laundering Info » 18+ Bsa aml structuring infoYour Bsa aml structuring images are available. Bsa aml structuring are a topic that is being searched for and liked by netizens now. You can Get the Bsa aml structuring files here. Get all free vectors.

If you’re looking for bsa aml structuring images information related to the bsa aml structuring topic, you have come to the right site. Our site always provides you with suggestions for seeing the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

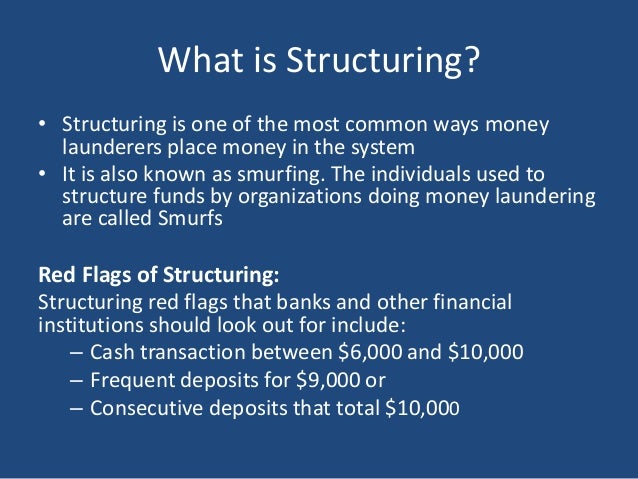

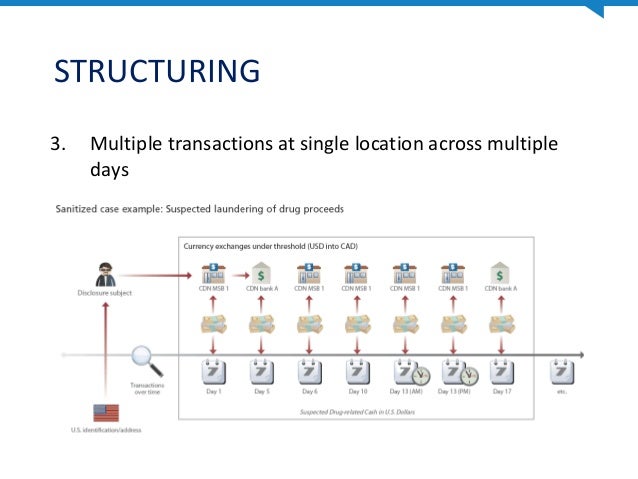

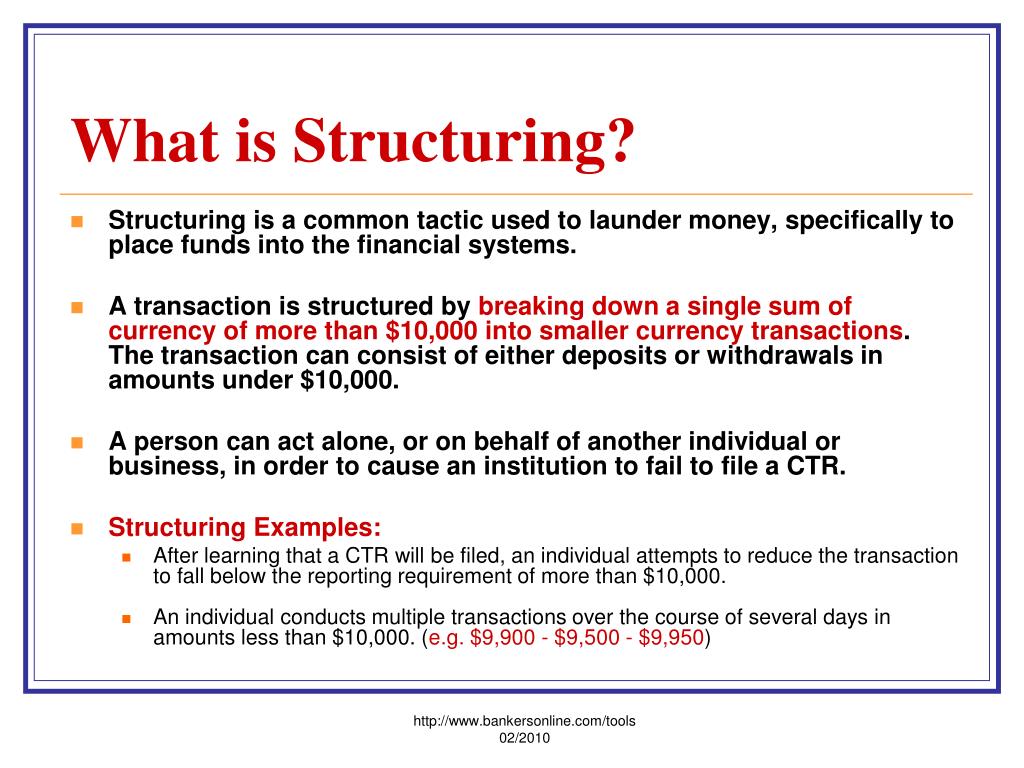

Bsa Aml Structuring. Structuring as it happens is a term that is defined in the Treasury Departments Recordkeeping and Reporting regulation affectionately called the BSA Reg at 31 CFR 10311 gg. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. Structuring is the practice of conducting financial transactions in a specific pattern calculated to avoid the creation of certain records and reports required by the Bank Secrecy Act BSA andor IRC 6050I Returns relating to cash received in trade or business etc. Structuring FFIEC BSAAML Examination Manual G2 2272015V2 necessary to determine the nature of the transactions prior account history and other relevant customer information to assess whether the activity is suspicious.

How Well Do You Really Know Your Customers Ppt Download From slideplayer.com

How Well Do You Really Know Your Customers Ppt Download From slideplayer.com

Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement. A BSAAML compliance program may be structured in a variety of ways and an examiner should perform procedures based on the structure of the organization. Established on October 26 1970 it has become one of the most important anti-money laundering AML tools in the United States and has set the pace for worldwide AML efforts. The Audit Narrative is the tool for full. A person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more.

B is intended or conducted in order to hide or disguise funds or assets derived from illegal activity or to disguise the ownership nature source location or control of funds or assets derived from illegal activity.

In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. In addition to the requirement of the Bank Secrecy Act BSA the analysis of transactions allows you to clearly identify any suspicious activity that could be taking place in your business such as wires to a person from drug trafficking collections by several people the payment of coyotes or simply structuring. A structured transaction is a series of smaller transactions which are broken up to avoid the 10000 reporting requirements for the Bank Secrecy Act BSA. Completion of these procedures may require communication with other regulators. Financial system against illicit foreign actors. Lets take a look at how its changed over the five decades since its inception to keep up with the.

Source: taxcontroversy.com

Source: taxcontroversy.com

It represents a detailed walkthrough of each BSAAML process and results in the assessment of the applicable control designs. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. A transaction is suspicious if the transaction. Money Laundering Opinions of Note. It represents a detailed walkthrough of each BSAAML process and results in the assessment of the applicable control designs.

Source: slideshare.net

Source: slideshare.net

Review the structure and management of the BSAAML compliance program. In addition to the requirement of the Bank Secrecy Act BSA the analysis of transactions allows you to clearly identify any suspicious activity that could be taking place in your business such as wires to a person from drug trafficking collections by several people the payment of coyotes or simply structuring. Government in cases of suspected money laundering and fraud. Money Laundering Opinions of Note. The Bank Secrecy Act BSA is celebrating its 50th birthday today.

Source: slideplayer.com

Source: slideplayer.com

Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. Federal banking regulators efforts to ease industry concerns about overly aggressive Anti-Money Laundering AMLBank Secrecy Act BSA enforcement and limit the 2016 Year End Review. Review the structure and management of the BSAAML compliance program. B is intended or conducted in order to hide or disguise funds or assets derived from illegal activity or to disguise the ownership nature source location or control of funds or assets derived from illegal activity. Even if structuring has not occurred the bank should review the transactions for suspicious activity.

Source: goldinglawyers.com

Source: goldinglawyers.com

BSAAML Compliance and Management Strengthen regulatory compliance and enhance your ability to detect investigate and report potentially suspicious activity with Verafins targeted analytics and end-to-end BSAAML solutions. Structuring is the practice of conducting financial transactions in a specific pattern calculated to avoid the creation of certain records and reports required by the Bank Secrecy Act BSA andor IRC 6050I Returns relating to cash received in trade or business etc. Government in cases of suspected money laundering and fraud. Money Laundering Opinions of Note. Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA.

Source: pinterest.com

Source: pinterest.com

31 USC 5324 Structuring transactions to evade reporting requirement prohibited is self-implementing meaning that penalties can be assessed against a structured transaction without having an implementing regulation. Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. The Bank Secrecy Act BSA is celebrating its 50th birthday today. The Audit Narrative is an essential component of our work.

Source: slideshare.net

Source: slideshare.net

As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. Lets take a look at how its changed over the five decades since its inception to keep up with the. Established on October 26 1970 it has become one of the most important anti-money laundering AML tools in the United States and has set the pace for worldwide AML efforts. Structuring FFIEC BSAAML Examination Manual G2 2272015V2 necessary to determine the nature of the transactions prior account history and other relevant customer information to assess whether the activity is suspicious. Even if structuring has not occurred the bank should review the transactions for suspicious activity.

Source: slideplayer.com

Source: slideplayer.com

Federal banking regulators efforts to ease industry concerns about overly aggressive Anti-Money Laundering AMLBank Secrecy Act BSA enforcement and limit the 2016 Year End Review. Money Laundering Opinions of Note. Lets take a look at how its changed over the five decades since its inception to keep up with the. In addition to the requirement of the Bank Secrecy Act BSA the analysis of transactions allows you to clearly identify any suspicious activity that could be taking place in your business such as wires to a person from drug trafficking collections by several people the payment of coyotes or simply structuring. A involves funds derived from illegal activity.

Source: present5.com

Source: present5.com

Government in cases of suspected money laundering and fraud. B is intended or conducted in order to hide or disguise funds or assets derived from illegal activity or to disguise the ownership nature source location or control of funds or assets derived from illegal activity. The consumer has a large balance with the Bank. Structuring as it happens is a term that is defined in the Treasury Departments Recordkeeping and Reporting regulation affectionately called the BSA Reg at 31 CFR 10311 gg. As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US.

Source: slideshare.net

Source: slideshare.net

In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. Money Laundering Opinions of Note. BSAAML Compliance and Management Strengthen regulatory compliance and enhance your ability to detect investigate and report potentially suspicious activity with Verafins targeted analytics and end-to-end BSAAML solutions. Financial system against illicit foreign actors. Structuring as it happens is a term that is defined in the Treasury Departments Recordkeeping and Reporting regulation affectionately called the BSA Reg at 31 CFR 10311 gg.

Source: slideserve.com

Source: slideserve.com

31 USC 5324 Structuring transactions to evade reporting requirement prohibited is self-implementing meaning that penalties can be assessed against a structured transaction without having an implementing regulation. These laws are part of the Bank Secrecy Act discussed below. Completion of these procedures may require communication with other regulators. As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US. STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement.

Source: slideserve.com

Source: slideserve.com

A BSAAML compliance program may be structured in a variety of ways and an examiner should perform procedures based on the structure of the organization. A transaction is suspicious if the transaction. Money Laundering Opinions of Note. Government in cases of suspected money laundering and fraud. As we have blogged the Anti-Money Laundering Act of 2020 AMLA contains major changes to the Bank Secrecy Act BSA coupled with other changes relating to money laundering anti-money laundering AML counter-terrorism financing CTF and protecting the US.

Source: slideplayer.com

Source: slideplayer.com

Structuring as it happens is a term that is defined in the Treasury Departments Recordkeeping and Reporting regulation affectionately called the BSA Reg at 31 CFR 10311 gg. The Bank Secrecy Act BSA is celebrating its 50th birthday today. Bank Secrecy Act BSA Anti-Laundering Money AML The Bank Secrecy Act BSA also known as the Currency and Foreign Transactions Reporting Act is legislation passed by the United States Congress in 1970 that requires US. A transaction is suspicious if the transaction. Government in cases of suspected money laundering and fraud.

Source: slideplayer.com

Source: slideplayer.com

Federal banking regulators efforts to ease industry concerns about overly aggressive Anti-Money Laundering AMLBank Secrecy Act BSA enforcement and limit the 2016 Year End Review. The Audit Narrative is the tool for full. In addition to the requirement of the Bank Secrecy Act BSA the analysis of transactions allows you to clearly identify any suspicious activity that could be taking place in your business such as wires to a person from drug trafficking collections by several people the payment of coyotes or simply structuring. A transaction is suspicious if the transaction. Lets take a look at how its changed over the five decades since its inception to keep up with the.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml structuring by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas