17+ Bsa aml training requirements information

Home » money laundering Info » 17+ Bsa aml training requirements informationYour Bsa aml training requirements images are available in this site. Bsa aml training requirements are a topic that is being searched for and liked by netizens now. You can Get the Bsa aml training requirements files here. Get all royalty-free images.

If you’re searching for bsa aml training requirements images information linked to the bsa aml training requirements topic, you have pay a visit to the right site. Our site always provides you with suggestions for downloading the maximum quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

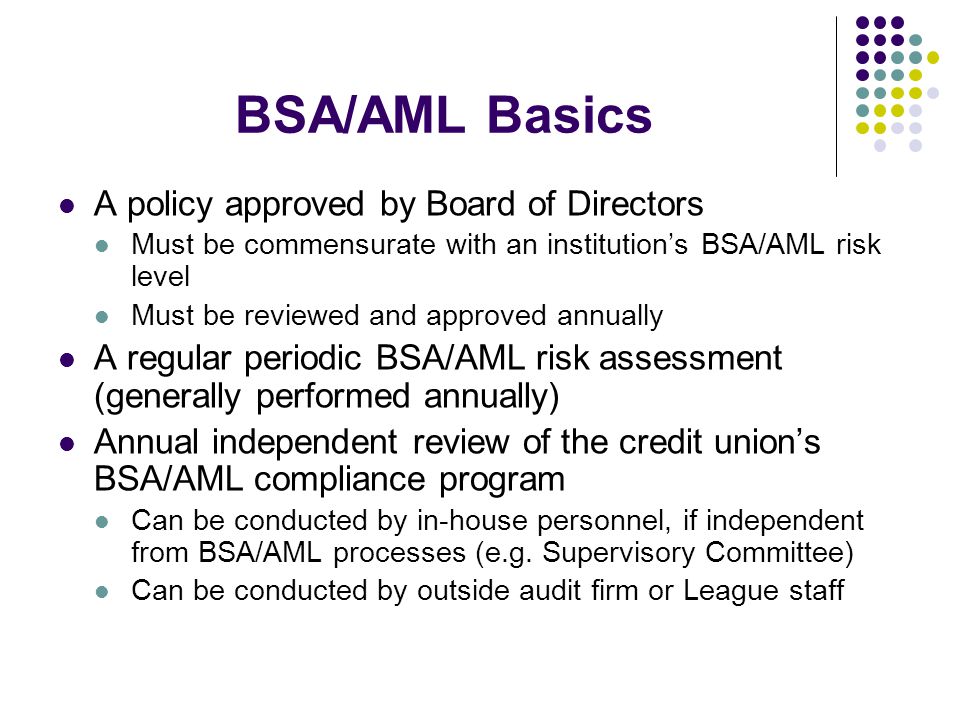

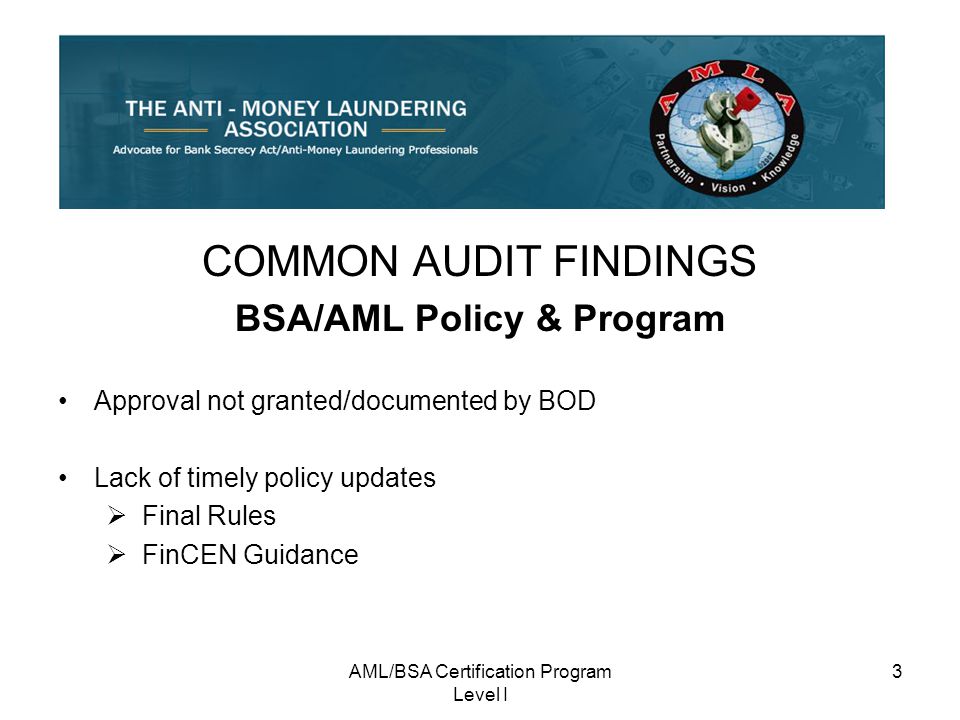

Bsa Aml Training Requirements. Training for appropriate personnel see BSAAML Training Requirement. BSAAML Risks Mitigation of Risks and Rewards - This course is designed. Good organization skills and attention to detail. Additional resources for learning more about BSAAML rules.

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download From slideplayer.com

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download From slideplayer.com

Latest news reports from the medical literature videos from the experts and more. The curriculum is designed to be a refresher for experienced financial crimes professionals who wish to take the Certified AML and Fraud Professional CAFP exam and may be required for those individuals with less than five years experience in the field. Training should cover BSA regulatory requirements supervisory guidance and the banks internal BSAAML policies procedures and processes. BSAAML Recordkeeping Requirements For Wire Transfers Money Orders And Other Transactions Webinar. The long-term goal of the InfoBase is to provide just-in-time training for new regulations and for other topics of specific concern to examiners within the FFIECs member agencies. ID 1039911 Live on 9152021 from 100pm till 200pm EST or via On-Demand.

ID 1039911 Live on 9152021 from 100pm till 200pm EST or via On-Demand.

BSAAML Recordkeeping Requirements For Wire Transfers Money Orders And Other Transactions Webinar. Your tasks MAY include. Top Training is a core requirement of a satisfactory Bank Secrecy Act and Anti-Money Laundering BSAAML compliance program. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. As a best practice initial training should include at least an overview of BSAAML introduction to the institutions own policies and procedures and training related specifically to the employees position. Training should cover BSA regulatory requirements supervisory guidance and the banks internal BSAAML policies procedures and processes.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Foundational research and analytical skills. The training should include the banks internal BSAAML policies procedures and processes and other regulatory requirements. Ad AML coverage from every angle. Your tasks MAY include. The training should be tailored to the requirements of the personnel according to their roles and responsibilities.

Source: compliancecohort.com

Source: compliancecohort.com

Additional resources for learning more about BSAAML rules. 9 rows Banking MSBs. Ad AML coverage from every angle. The long-term goal of the InfoBase is to provide just-in-time training for new regulations and for other topics of specific concern to examiners within the FFIECs member agencies. Your tasks MAY include.

The BSA officer is expected to be fully knowledgeable and the expert about BSA and all of the related regulations. As a best practice initial training should include at least an overview of BSAAML introduction to the institutions own policies and procedures and training related specifically to the employees position. 1 At a minimum a BSAAML training program must provide training for all personnel whose duties require knowledge of the BSAWhile BSAAML training is required banks have flexibility in the way they design the training. Good organization skills and attention to detail. Get training to meet your Bank Secrecy Act BSA training requirements.

Source: tcaregs.com

Source: tcaregs.com

Good oral and written communication skills. Training should cover BSA regulatory requirements supervisory guidance and the banks internal BSAAML policies procedures and processes. Banks should ensure that the required personnel are training in the aspects of BSAAML as applicable to them. Foundational research and analytical skills. Latest news reports from the medical literature videos from the experts and more.

Source: slideplayer.com

Source: slideplayer.com

BSAAML Recordkeeping Requirements For Wire Transfers Money Orders And Other Transactions Webinar. The training should be tailored to the requirements of the personnel according to their roles and responsibilities. The insurance carriers all have their own requirements and they differ from carrier to carrier. For new hires as a part of their orientationinduction an overview of AML requirements. Ad AML coverage from every angle.

Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. Foundational research and analytical skills. For new hires as a part of their orientationinduction an overview of AML requirements. Foundational knowledge of state and federal regulations. Banks should ensure that the required personnel are training in the aspects of BSAAML as applicable to them.

Source: compliancecohort.com

Source: compliancecohort.com

Most of these AML programs require producers to complete AML training every 24 months to satisfy these requirements but there are other specific guidelines you may not be aware of. Foundational research and analytical skills. Ad AML coverage from every angle. Your tasks MAY include. Foundational knowledge of BSAAML related regulations including terminology.

Source: slideplayer.com

Source: slideplayer.com

Training is a core requirement of a satisfactory Bank Secrecy Act and Anti-Money Laundering BSAAML compliance program. Your tasks MAY include. The BSA compliance program must be in writing and approved by the banks. Latest news reports from the medical literature videos from the experts and more. BSAAML Recordkeeping Requirements For Wire Transfers Money Orders And Other Transactions Webinar.

Foundational knowledge of state and federal regulations. The insurance carriers all have their own requirements and they differ from carrier to carrier. Top Training is a core requirement of a satisfactory Bank Secrecy Act and Anti-Money Laundering BSAAML compliance program. Foundational knowledge of BSAAML related regulations including terminology. Good organization skills and attention to detail.

Source: complianceonline.com

Source: complianceonline.com

Board of Governors of the Federal Reserve System Federal Deposit Insurance Corporation National Credit Union Administration Office of the Comptroller of the Currency Consumer Financial Protection Bureau and the State. Training is a core requirement of a satisfactory Bank Secrecy Act and Anti-Money Laundering BSAAML compliance program. Training should cover the aspects of the BSA that are relevant to the bank and its risk profile and appropriate personnel includes those whose duties require knowledge or involve some aspect of BSAAML compliance. The BSA officer is expected to be fully knowledgeable and the expert about BSA and all of the related regulations. Training should cover BSA regulatory requirements supervisory guidance and the banks internal BSAAML policies procedures and processes.

Source: slideplayer.com

Source: slideplayer.com

Training should cover the aspects of the BSA that are relevant to the bank and its risk profile and appropriate personnel includes those whose duties require knowledge or involve some aspect of BSAAML compliance. BSAAML Recordkeeping Requirements For Wire Transfers Money Orders And Other Transactions Webinar. Banks are required to have processes that determine which transactions are potentially suspicious and implement strong BSA compliance program that uses comprehensive Customer Due Diligence CDD policies procedures and processes for all customers particularly those that present a higher risk for money laundering and. The training should be tailored to the requirements of the personnel according to their roles and responsibilities. Ad AML coverage from every angle.

Source: slideshare.net

Source: slideshare.net

The BSA officer is expected to be fully knowledgeable and the expert about BSA and all of the related regulations. Latest news reports from the medical literature videos from the experts and more. Foundational knowledge of BSAAML related regulations including terminology. The curriculum is designed to be a refresher for experienced financial crimes professionals who wish to take the Certified AML and Fraud Professional CAFP exam and may be required for those individuals with less than five years experience in the field. Training for appropriate personnel see BSAAML Training Requirement.

Source: vdocuments.mx

Source: vdocuments.mx

Good oral and written communication skills. The long-term goal of the InfoBase is to provide just-in-time training for new regulations and for other topics of specific concern to examiners within the FFIECs member agencies. Foundational knowledge of state and federal regulations. Get training to meet your Bank Secrecy Act BSA training requirements. Foundational research and analytical skills.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa aml training requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas