10+ Bsa customer risk rating ideas

Home » money laundering idea » 10+ Bsa customer risk rating ideasYour Bsa customer risk rating images are ready in this website. Bsa customer risk rating are a topic that is being searched for and liked by netizens today. You can Find and Download the Bsa customer risk rating files here. Find and Download all free photos.

If you’re searching for bsa customer risk rating pictures information connected with to the bsa customer risk rating keyword, you have visit the ideal site. Our site always gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

Bsa Customer Risk Rating. After each Category Products and Services Customers etc is completed the Assessment Tool will calculate an average for each category. In most cases after developing a risk rating methodology it needs to be approved by both the firms. Commonly referred to as the customer risk rating. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between.

Danske Bank Money Laundering Case Study The Finreg Blog From sites.law.duke.edu

Danske Bank Money Laundering Case Study The Finreg Blog From sites.law.duke.edu

The new CDD Chapter of FFIEC outlines the expectation to risk rate customers. Improper identification and assessment of risk can have a cascading effect creating deficiencies in multiple areas of internal controls and resulting in an overall weakened BSAAML compliance program. Average and Inherent Risk for Products and Services in red. Best Business Practices for 2020 2020-12-08 The new CDD Chapter of FFIEC outlines the expectation to risk rate customers. As these are sensitive data we are not able to fully disclose all characteristics of the dataset. The default rating is as follows.

The banks BSAAML risk assessment process should address the varying degrees of risk associated with its products services customers and geographic locations as appropriate.

The default rating is as follows. Calculate a risk score for each customer based on millions of combinations of risk factors including products services customers entities transactions and geographic locations etc. Establishing BSA Customer Risk Ratings and CDD Guidance. There are more questions to ask and more factors involved in risk rating accounts. Life Sciences BFSI OSHA Human Resource Trade. As these are sensitive data we are not able to fully disclose all characteristics of the dataset.

Source: slidetodoc.com

Source: slidetodoc.com

BOL user Oursisnottoreasonwhy and his bank created this worksheet to make the job easier and more consistent. Understanding the BSAAMLOFAC risk assessment and risk rating methodology. We have an automated questionnaire for personal and business accounts but not for loans. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile. BSA Risk Rating Tool Set.

![]() Source: complianceaid.pro

Source: complianceaid.pro

Establishing BSA Customer Risk Ratings and CDD Guidance. This form prints with all new business deposit account forms at his bankThe CSRs use this tool to risk rate business deposit accounts for BSA purposes and it contains away to gather info for Reg GG. As these are sensitive data we are not able to fully disclose all characteristics of the dataset. Determining the risk rating for each customer is a key component of a financial institutions Bank Secrecy ActAnti-Money Laundering BSAAML program. The bank should have an understanding of the money laundering and terrorist financing risks of its customers referred to in the rule as the customer risk profile.

Source: bankingexchange.com

Source: bankingexchange.com

There are more questions to ask and more factors involved in risk rating accounts. The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. The determination of High Risk Customers may involve a wide array of variables carefully rated and scored or a single variable that overrides all others. Determining the risk rating for each customer is a key component of a financial institutions Bank Secrecy ActAnti-Money Laundering BSAAML program. Life Sciences BFSI OSHA Human Resource Trade.

Source: protiviti.com

Source: protiviti.com

Determining the risk rating of a customer especially those seen as High Risk plays an important role in the construction of a complete and accurate BSAAML Risk Assessment. Understanding the BSAAMLOFAC risk assessment and risk rating methodology. These are excellent tools for any community bank to use when implementing and managing their risk assessments of products services and commercial customers. 315 632-0735 315 750-4379. BSA Risk Rating Tool Set.

Source: sec.gov

Source: sec.gov

The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. BOL user Oursisnottoreasonwhy and his bank created this worksheet to make the job easier and more consistent. 315 632-0735 315 750-4379.

The worksheets and instructions are. We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism. The default rating is as follows. Calculate a risk score for each customer based on millions of combinations of risk factors including products services customers entities transactions and geographic locations etc. BSA Risk Rating Tool Set.

Source: sites.law.duke.edu

Source: sites.law.duke.edu

The banks BSAAML risk assessment process should address the varying degrees of risk associated with its products services customers and geographic locations as appropriate. Establishing BSA Customer Risk Ratings and CDD Guidance. This form prints with all new business deposit account forms at his bankThe CSRs use this tool to risk rate business deposit accounts for BSA purposes and it contains away to gather info for Reg GG. These are excellent tools for any community bank to use when implementing and managing their risk assessments of products services and commercial customers. The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile.

Source: kroll.com

Source: kroll.com

We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism. The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. The new CDD Chapter of FFIEC outlines the expectation to risk rate customers. These are excellent tools for any community bank to use when implementing and managing their risk assessments of products services and commercial customers. We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism.

Source: sites.law.duke.edu

Source: sites.law.duke.edu

This form prints with all new business deposit account forms at his bankThe CSRs use this tool to risk rate business deposit accounts for BSA purposes and it contains away to gather info for Reg GG. The new CDD Chapter of FFIEC outlines the expectation to risk rate customers. The determination of High Risk Customers may involve a wide array of variables carefully rated and scored or a single variable that overrides all others. We have an automated questionnaire for personal and business accounts but not for loans. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating.

Source: slidetodoc.com

Source: slidetodoc.com

As required by the BSAAML Examination Manual. The new CDD Chapter of FFIEC outlines the expectation to risk rate customers. 3 See 31 CFR 1020210b5i This concept is also commonly referred to as the customer risk rating. Recent regulatory enforcement actions against financial institutions have cited the lack of a detailed and complete risk assessment related to Bank Secrecy Act BSA and anti-money laundering compliance AML compliance programs. Once a risk score of a customer is obtained through the Risk.

Source: slidetodoc.com

Source: slidetodoc.com

BOL user Oursisnottoreasonwhy and his bank created this worksheet to make the job easier and more consistent. We have an automated questionnaire for personal and business accounts but not for loans. Establishing BSA Customer Risk Ratings and CDD Guidance. Once a risk score of a customer is obtained through the Risk. Any customer account may be used for illicit purposes including money laundering or terrorist financing.

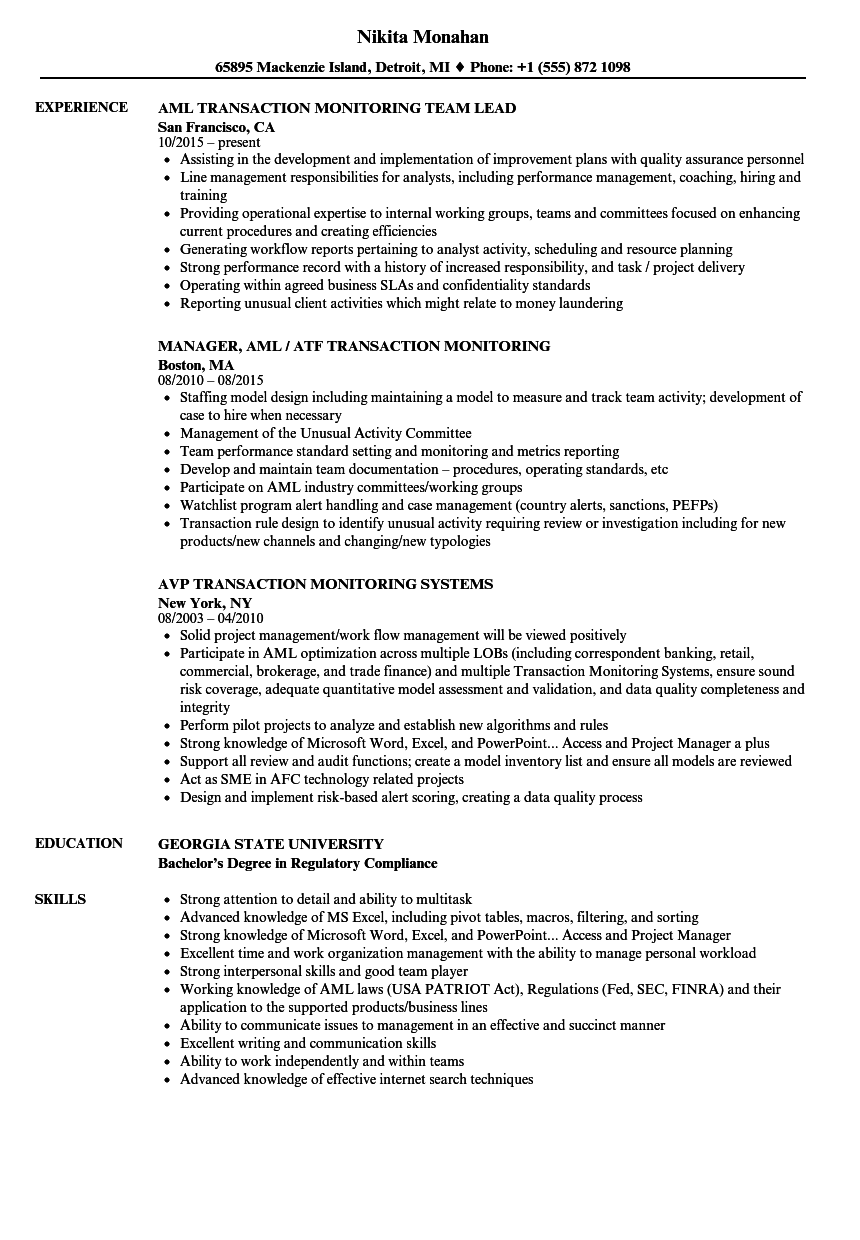

Source: velvetjobs.com

Source: velvetjobs.com

As required by the BSAAML Examination Manual. The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. Once a risk score of a customer is obtained through the Risk. As these are sensitive data we are not able to fully disclose all characteristics of the dataset. These are excellent tools for any community bank to use when implementing and managing their risk assessments of products services and commercial customers.

Source: riskspan.com

Source: riskspan.com

The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Any customer account may be used for illicit purposes including money laundering or terrorist financing. The bank should have an understanding of the money laundering and terrorist financing risk of its customers referred to in the rule as the customer risk profile. Determining the risk rating for each customer is a key component of a financial institutions Bank Secrecy ActAnti-Money Laundering BSAAML program.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsa customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information