19++ Bsa structuring money laundering ideas

Home » money laundering Info » 19++ Bsa structuring money laundering ideasYour Bsa structuring money laundering images are available. Bsa structuring money laundering are a topic that is being searched for and liked by netizens today. You can Get the Bsa structuring money laundering files here. Find and Download all royalty-free photos and vectors.

If you’re searching for bsa structuring money laundering images information linked to the bsa structuring money laundering keyword, you have pay a visit to the right blog. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

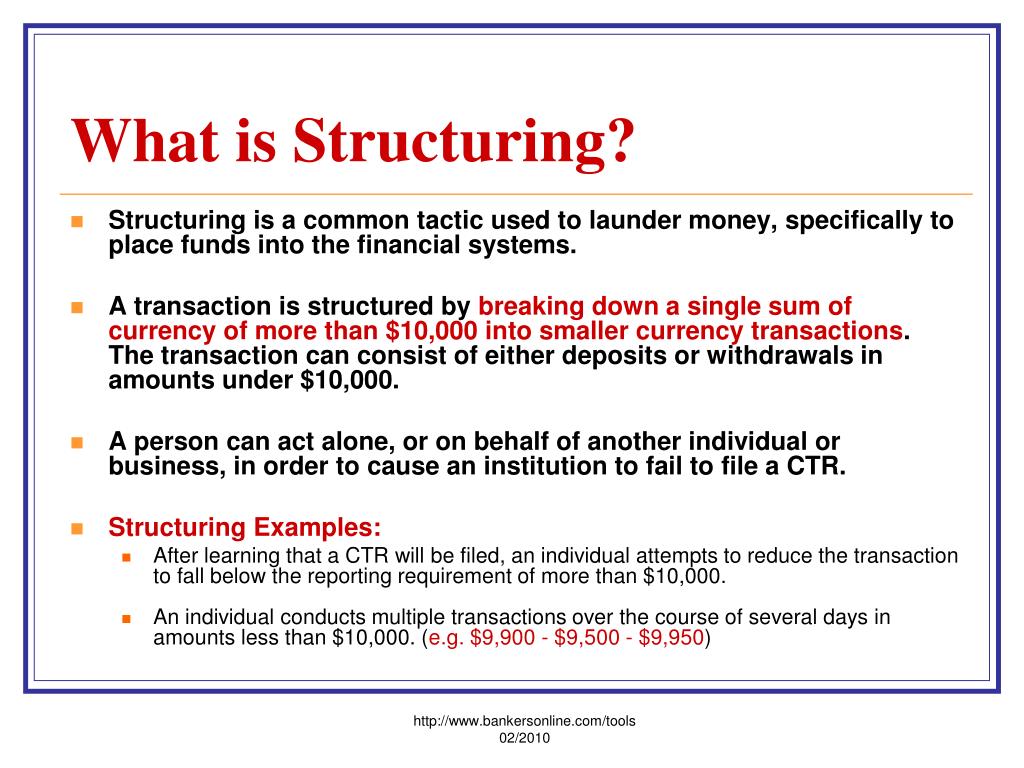

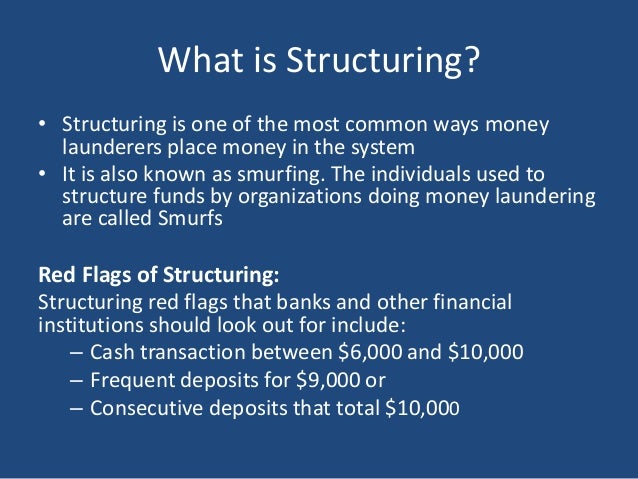

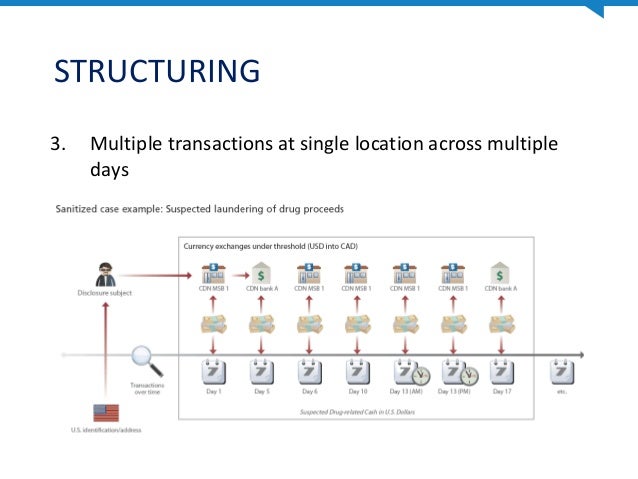

Bsa Structuring Money Laundering. The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits. This technique involves the use of many individuals thesmurfs who exchange illicit funds in smaller less conspicuous amounts for highly liquid items such as traveller cheques bank drafts or deposited directly into savings accounts. The Money Laundering Control Act of 1986 prohibited structuring made money laundering a federal crime and required banks to do a better job of establishing and monitoring their compliance programs. Under the BSA no person shall for the purpose of evading the CTR Currency Transaction Reporting.

How Well Do You Really Know Your Customers Ppt Download From slideplayer.com

How Well Do You Really Know Your Customers Ppt Download From slideplayer.com

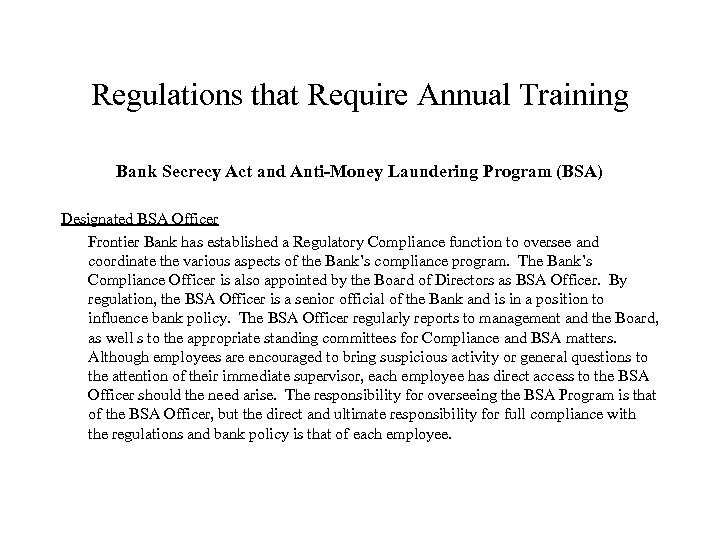

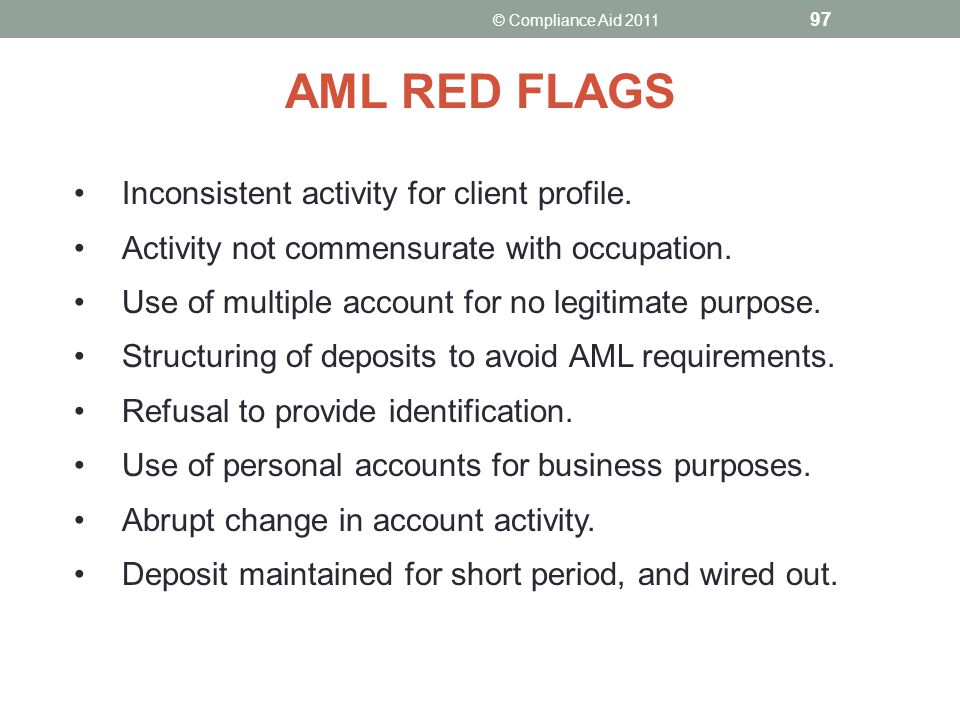

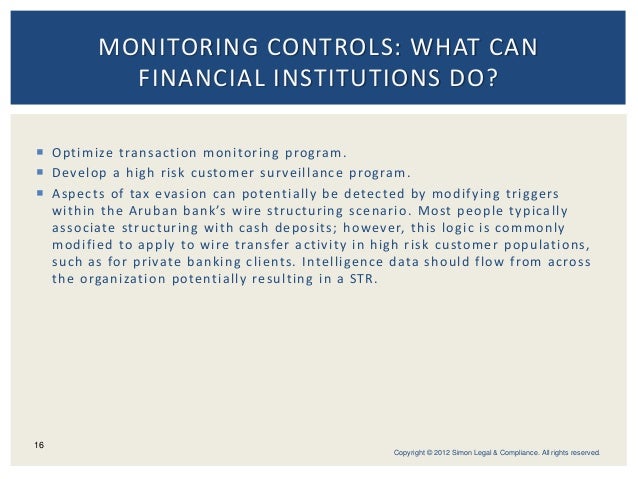

On the financial institutions SAR form the check box used for perceived structuring instances is titled Bank Secrecy Act Structuring Money Laundering So as you can see it is not a clean delineation. FinCEN issues advisories containing examples of red flags to inform and assist banks in reporting instances of suspected money laundering terrorist financing and fraud. Civil asset forfeiture allows law enforcement agents to take property they suspect of being tied to crime even if no criminal charges are filed. Through money laundering the monetary proceeds derived from criminal activity are transformed into funds with an apparently legal source. A financial institutions anti-money laundering program should be designed to detect and report both categories of structuring to guard against use of the institution for money laundering and ensure the institution is compliant with the suspicious activity reporting requirements of the Bank Secrecy Act. Reasonably designed to prevent the MSB from being used to facilitate money laundering and financing of terrorist activities.

In order to assist law enforcement in its efforts to target these activities FinCEN requests that banks check the appropriate boxes in the Suspicious Activity Information section and include certain key terms in the narrative.

This technique involves the use of many individuals thesmurfs who exchange illicit funds in smaller less conspicuous amounts for highly liquid items such as traveller cheques bank drafts or deposited directly into savings accounts. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. Frequent sometimes more than one a day cash deposits were made to an account followed by online transfers from the receiving account to another account ie moving funds electronically from a checking account to a money market account or from a savings account to a. The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. Structuring transactions to evade Bank Secrecy Act reporting and certain record-keeping requirements can result in civil and criminal penalties. The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits.

Source: slideserve.com

Source: slideserve.com

The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits. Smurfs - A popular method used to launder cash in the placement stage. Frequent sometimes more than one a day cash deposits were made to an account followed by online transfers from the receiving account to another account ie moving funds electronically from a checking account to a money market account or from a savings account to a. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. The definition of structuring as set forth in 31 CFR 1010100 xx which was implemented before a USA PATRIOT Act provision extended the prohibition on structuring to geographic targeting orders and BSA recordkeeping requirements states a person structures a transaction if that person acting alone or in conjunction with or on behalf of other persons conducts or attempts to conduct one or more transactions in currency.

Source: slideplayer.com

Source: slideplayer.com

Smurfs - A popular method used to launder cash in the placement stage. FinCEN issues advisories containing examples of red flags to inform and assist banks in reporting instances of suspected money laundering terrorist financing and fraud. Through money laundering the monetary proceeds derived from criminal activity are transformed into funds with an apparently legal source. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. Under the BSA 31 USC 5324 no person shall for the purpose of evading the Currency Transaction Report CTR or a geographic targeting order reporting requirement or certain BSA record-keeping requirements such as the monetary.

Source: pinterest.com

Source: pinterest.com

The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits. FinCEN issues advisories containing examples of red flags to inform and assist banks in reporting instances of suspected money laundering terrorist financing and fraud. Court exhibits of the transactions as well as testimony from witnesses helped a jury reach guilty verdicts on structuring and money laundering charges. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. Through money laundering the monetary proceeds derived from criminal activity are transformed into funds with an apparently legal source.

Source: goldinglawyers.com

Source: goldinglawyers.com

In order to assist law enforcement in its efforts to target these activities FinCEN requests that banks check the appropriate boxes in the Suspicious Activity Information section and include certain key terms in the narrative. Under the BSA no person shall for the purpose of evading the CTR Currency Transaction Reporting. 2 The extent and specific parameters under which a financial institution must monitor accounts. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA.

Source: taxcontroversy.com

Source: taxcontroversy.com

Court exhibits of the transactions as well as testimony from witnesses helped a jury reach guilty verdicts on structuring and money laundering charges. The mission of the BSA Program is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing the financial community top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. These laws are part of the Bank Secrecy Act discussed below. Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that they make in the legitimate economy. Smurfs - A popular method used to launder cash in the placement stage.

Source: slideshare.net

Source: slideshare.net

Structuring transactions to evade BSA Bank Secrecy Act reporting and certain recordkeeping requirements can result in civil and criminal penalties under the BSA. The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Under the BSA 31 USC 5324 no person shall for the purpose of evading the Currency Transaction Report CTR or a geographic targeting order reporting requirement or certain BSA record-keeping requirements such as the monetary. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program.

Source: present5.com

Source: present5.com

The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. This technique involves the use of many individuals thesmurfs who exchange illicit funds in smaller less conspicuous amounts for highly liquid items such as traveller cheques bank drafts or deposited directly into savings accounts. Civil asset forfeiture allows law enforcement agents to take property they suspect of being tied to crime even if no criminal charges are filed. The consumer has a large balance with the Bank. Reasonably designed to prevent the MSB from being used to facilitate money laundering and financing of terrorist activities.

Source: slideplayer.com

Source: slideplayer.com

Civil asset forfeiture allows law enforcement agents to take property they suspect of being tied to crime even if no criminal charges are filed. 2 The extent and specific parameters under which a financial institution must monitor accounts. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. The mission of the BSA Program is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing the financial community top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits.

Source: aml-assassin.com

Source: aml-assassin.com

These laws are part of the Bank Secrecy Act discussed below. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. FinCEN issues advisories containing examples of red flags to inform and assist banks in reporting instances of suspected money laundering terrorist financing and fraud. The remaining 32 percent of the BSAStructuringMoney Laundering SARs also reported primarily structured cash deposits. Smurfs - A popular method used to launder cash in the placement stage.

Source: slideshare.net

Source: slideshare.net

The Money Laundering Control Act of 1986 prohibited structuring made money laundering a federal crime and required banks to do a better job of establishing and monitoring their compliance programs. Court exhibits of the transactions as well as testimony from witnesses helped a jury reach guilty verdicts on structuring and money laundering charges. Smurfs - A popular method used to launder cash in the placement stage. FinCEN issues advisories containing examples of red flags to inform and assist banks in reporting instances of suspected money laundering terrorist financing and fraud. The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act BSA 31 CFR 1022210 requires that all MSBs establish and maintain an effective written AML program. The consumer has a large balance with the Bank. Structuring transactions to evade Bank Secrecy Act reporting and certain record-keeping requirements can result in civil and criminal penalties. Manager at a bank 21BUSA Good Morning- we have a consumer customer who over the course of one month has withdrawn 19000 8 transactions ranging from 500-5000. Reasonably designed to prevent the MSB from being used to facilitate money laundering and financing of terrorist activities.

Source: slideplayer.com

Source: slideplayer.com

Court exhibits of the transactions as well as testimony from witnesses helped a jury reach guilty verdicts on structuring and money laundering charges. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. The mission of the BSA Program BSA is to safeguard the financial system from the abuses of financial crime including terrorist financing money laundering and other illicit activity by providing financial institutions top quality service to help them understand their obligations under the BSA and to ensure BSA compliance with integrity and fairness to all. The consumer has a large balance with the Bank. On the financial institutions SAR form the check box used for perceived structuring instances is titled Bank Secrecy Act Structuring Money Laundering So as you can see it is not a clean delineation.

Source: slideshare.net

Source: slideshare.net

These records opened up avenues of prosecution for money laundering charges as the SARs detailed a series of transactions designed to evade the BSA reporting requirements. Under the BSA no person shall for the purpose of evading the CTR Currency Transaction Reporting. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. Review of BSAStructuringMoney Laundering Violation on SAR Forms. Smurfs - A popular method used to launder cash in the placement stage.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa structuring money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas