17++ Bsa wire transfer requirements ideas in 2021

Home » money laundering Info » 17++ Bsa wire transfer requirements ideas in 2021Your Bsa wire transfer requirements images are available in this site. Bsa wire transfer requirements are a topic that is being searched for and liked by netizens now. You can Find and Download the Bsa wire transfer requirements files here. Find and Download all royalty-free photos and vectors.

If you’re looking for bsa wire transfer requirements images information related to the bsa wire transfer requirements keyword, you have visit the right blog. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

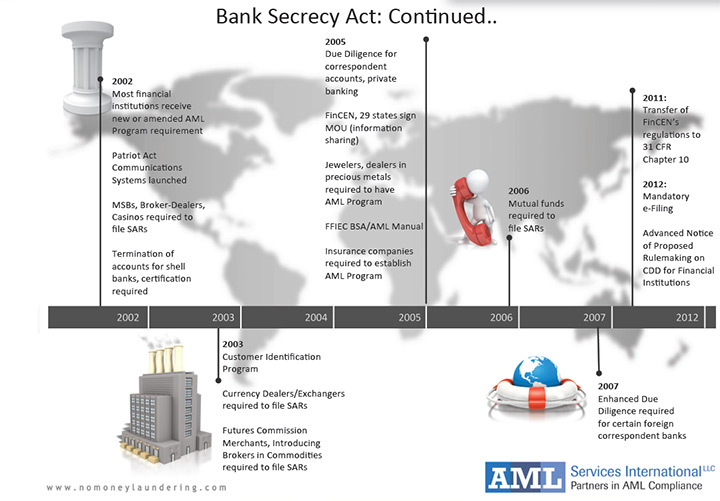

Bsa Wire Transfer Requirements. Assess the banks compliance with statutory and regulatory requirements for funds transfers. It also addresses how rules differ for established and non-established customers how the. Since we do not do wires for non-customers we would have on file their physical address. Does the BSA require the originating bank of a wire transfer over 300000 dollars to have both the name and address of the beneficiary.

Latest Lifan 125cc Wiring Diagram 110 Dirt Bike Diagrams Brilliant Inside Lifan 125 Wiring Diagram Motorcycle Wiring Chinese Scooters Electrical Wiring Diagram From pinterest.com

Latest Lifan 125cc Wiring Diagram 110 Dirt Bike Diagrams Brilliant Inside Lifan 125 Wiring Diagram Motorcycle Wiring Chinese Scooters Electrical Wiring Diagram From pinterest.com

The proposed modification would reduce this threshold from 3000 to 250 for funds. Refer to the expanded sections of this manual for discussions and procedures regarding specific money laundering risks for funds transfer activities. Refer to the expanded sections of this manual for discussions and procedures regarding specific money laundering risks for funds transfer. Is this rule limited to wire transfers. This information should help you understand when various types of transactions trigger recordkeeping requirements and what information must be collected and retained. Assess the banks compliance with statutory and regulatory requirements for funds transfers.

The recordkeeping regulations also include the requirement that a financial institutions records be sufficient to enable transactions and activity in customer accounts to be reconstructed if necessary.

The proposed modification would reduce this threshold from 3000 to 250 for funds. This section covers the regulatory requirements as set forth in the BSA. The Act prescribes regulations that mandate the reporting of specific activities including using wire transfers to send and receive money. Banks BSA recordkeeping requirements with respect to funds transfer vary based upon the role of a bank with respect to the funds transfer. These records and reports have a high degree. For each payment order that a bank accepts as the originators bank the bank must obtain and retain a.

Source: acamstoday.org

Source: acamstoday.org

As with domestic wires each credit union that sends an international wire transfer must comply with the OFAC requirements BEFORE it sends the wire transfer. For each payment order that a bank accepts as the originators bank the bank must obtain and retain a. Under the Bank Secrecy Act financial institutions must maintain appropriate records and file reports involving certain currency transactions. Assess the banks compliance with statutory and regulatory requirements for funds transfers. It also addresses how rules differ for established and non-established customers how the.

Source: pinterest.com

Source: pinterest.com

Outgoing Wire Transfer - Physical Address Required. Assess the banks compliance with statutory and regulatory requirements for funds transfers. Wire Transfer Reporting Requirements. Under the Bank Secrecy Act financial institutions must maintain appropriate records and file reports involving certain currency transactions. A banks BSA recordkeeping requirements with respect to funds transfer vary based upon the role of a bank with respect to the funds transfer.

Source: bankpolicies.com

Source: bankpolicies.com

Wire Transfer Reporting Requirements. Does the BSA require the originating bank of a wire transfer over 300000 dollars to have both the name and address of the beneficiary. In doing so a paper and audit trail is maintained. This section covers the regulatory requirements as set forth in the BSA. Satisfy the requirements of the BSA.

Source: tier1fin.com

Source: tier1fin.com

This course recommended for any personnel involved in funds transfers covers the rules and exceptions will help your institution play a key role in the prevention of money laundering. This section covers the regulatory requirements as set forth in the BSA. The regulation 31 CFR 10333 requires retention of several specific pieces of information and then atF. Under the Bank Secrecy Act financial institutions must maintain appropriate records and file reports involving certain currency transactions. The Act prescribes regulations that mandate the reporting of specific activities including using wire transfers to send and receive money.

Source: tier1fin.com

Source: tier1fin.com

Sometimes we are asked to contact the customer and ask for that information from the customer. Rule to modify the threshold in the rule implementing the Bank Secrecy Act BSA requiring financial institutions to collect and retain information on certain funds transfers and transmittals of funds. Wire Transfer Reporting Requirements. For each payment order that a bank accepts as the originators bank the bank must obtain and retain a. However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States.

Source: pinterest.com

Source: pinterest.com

BSAAML Recordkeeping Requirements For Wire Transfers Money Orders And Other Transactions Webinar. When BSA holds an incoming wire because they need more information such as invoices It is our procedure to send a service message to the originating bank and ask for that required info. Bank acting as an originators bank. Outgoing Wire Transfer - Physical Address Required. Why is it that most banks that originate outgoing wire transfers require a physical address no PO boxes for the beneficiary.

Source: tier1fin.com

Source: tier1fin.com

In doing so a paper and audit trail is maintained. The regulation 31 CFR 10333 requires retention of several specific pieces of information and then atF. As with domestic wires each credit union that sends an international wire transfer must comply with the OFAC requirements BEFORE it sends the wire transfer. This information should help you understand when various types of transactions trigger recordkeeping requirements and what information must be collected and retained. Assess the banks compliance with statutory and regulatory requirements for funds transfers.

Source: remitr.com

Source: remitr.com

A banks BSA recordkeeping requirements with respect to funds transfer vary based upon the role of a bank with respect to the funds transfer. Rule to modify the threshold in the rule implementing the Bank Secrecy Act BSA requiring financial institutions to collect and retain information on certain funds transfers and transmittals of funds. This course recommended for any personnel involved in funds transfers covers the rules and exceptions will help your institution play a key role in the prevention of money laundering. Does the BSA require the originating bank of a wire transfer over 300000 dollars to have both the name and address of the beneficiary. Wire Transfers and Recordkeeping Requirements.

Source: pinterest.com

Source: pinterest.com

This topic will provide an overview of the BSAs recordkeeping requirements and discuss the requirements for funds transfers monetary instruments and certain other types of transactions. Rule to modify the threshold in the rule implementing the Bank Secrecy Act BSA requiring financial institutions to collect and retain information on certain funds transfers and transmittals of funds. Satisfy the requirements of the BSA. The regulation 31 CFR 10333 requires retention of several specific pieces of information and then atF. Sometimes we are asked to contact the customer and ask for that information from the customer.

Source: slidetodoc.com

Source: slidetodoc.com

Is this a compliance requirement and if so where is it established. Remitter Information First and Last Name. Outgoing Wire Transfer - Physical Address Required. This section covers the regulatory requirements as set forth in the BSA. For each payment order that a bank accepts as the originators bank the bank must obtain and retain a.

Source: pinterest.com

Source: pinterest.com

For each payment order that a bank accepts as the originators bank the bank must obtain and retain a. Assess the banks compliance with statutory and regulatory requirements for funds transfers. The regulation 31 CFR 10333 requires retention of several specific pieces of information and then atF. Does the BSA require the originating bank of a wire transfer over 300000 dollars to have both the name and address of the beneficiary. BSAAML Recordkeeping Requirements For Wire Transfers Money Orders And Other Transactions Webinar.

Source: es.pinterest.com

Source: es.pinterest.com

However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. Refer to the expanded sections of this manual for discussions and procedures regarding specific money laundering risks for funds transfer activities. Outgoing Wire Transfer - Physical Address Required. This course recommended for any personnel involved in funds transfers covers the rules and exceptions will help your institution play a key role in the prevention of money laundering. Wire Transfer Reporting Requirements.

Source: pinterest.com

Source: pinterest.com

Wire Transfers and Recordkeeping Requirements. Bank acting as an originators bank. In doing so a paper and audit trail is maintained. Refer to the expanded sections of this manual for discussions and procedures regarding specific money laundering risks for funds transfer. The recordkeeping regulations also include the requirement that a financial institutions records be sufficient to enable transactions and activity in customer accounts to be reconstructed if necessary.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsa wire transfer requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas