20+ Bsaaml customer due diligence ideas

Home » money laundering idea » 20+ Bsaaml customer due diligence ideasYour Bsaaml customer due diligence images are ready. Bsaaml customer due diligence are a topic that is being searched for and liked by netizens today. You can Download the Bsaaml customer due diligence files here. Get all royalty-free vectors.

If you’re looking for bsaaml customer due diligence images information linked to the bsaaml customer due diligence topic, you have visit the right site. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

Bsaaml Customer Due Diligence. Customer Due Diligence Overview FFIEC BSAAML Examination Manual 4 05052018 requirements specified in the beneficial ownership rule. BSAAML Program Expectations. This supervisory letter provides information about the Bank Secrecy Act BSA customer due diligence CDD and beneficial ownership rules and establishes a consistent framework for the examination and supervision processes used to evaluate credit union compliance. Assessing the BSAAML Compliance Program.

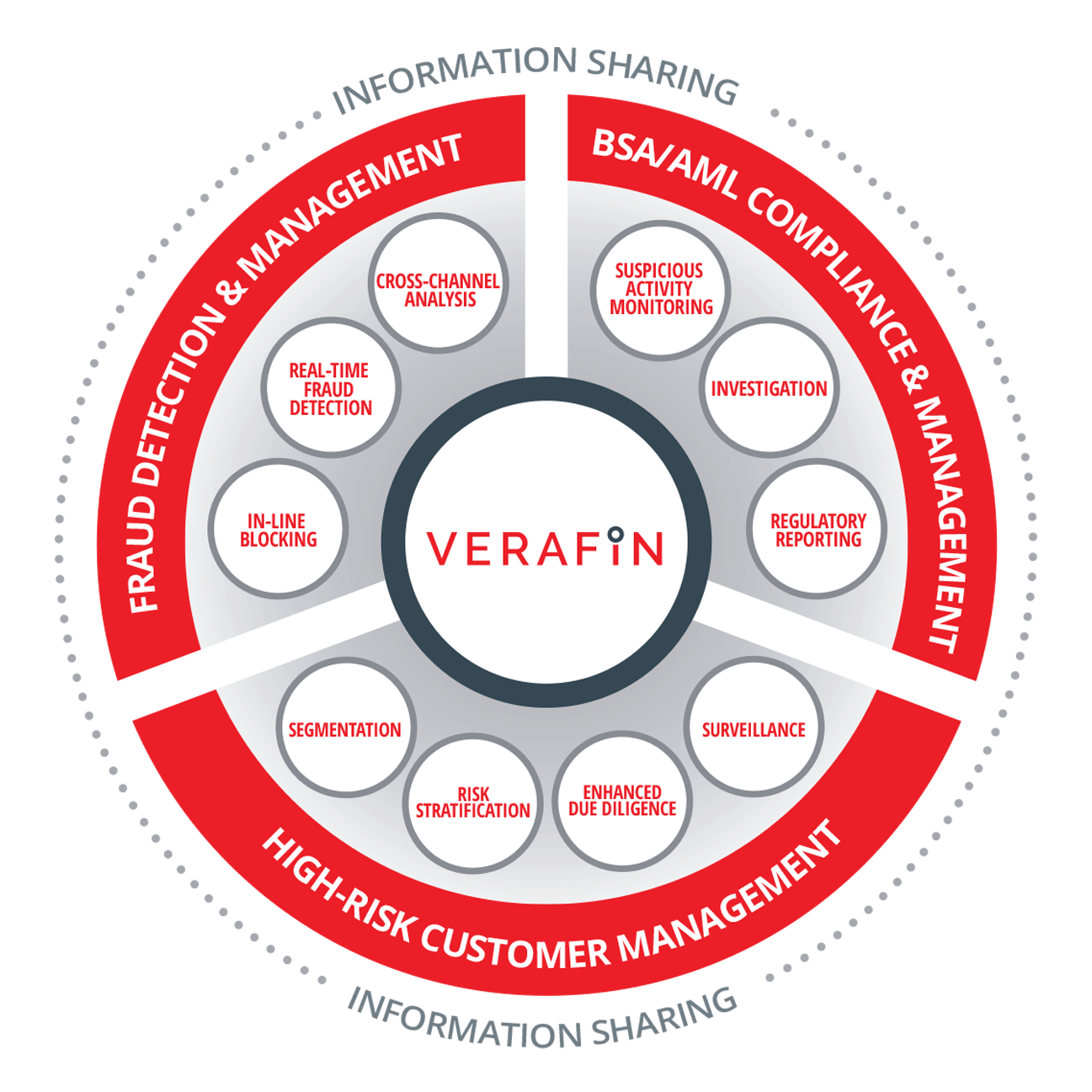

Verafin Financial Crime Management Solutions For Financial Institutions From verafin.com

Verafin Financial Crime Management Solutions For Financial Institutions From verafin.com

Beneficial Ownership and Customer Due Diligence Provides information on FinCENs CDD Rule that amends existing BSA regulations and requirements to identify and verify the identity of beneficial owners of legal entity customers subject to certain exclusions and exemptions. The CDD Rule which amends Bank Secrecy Act regulations aims to improve financial transparency and prevent criminals and terrorists from misusing companies to disguise their illicit activities and launder their ill-gotten gains. Assessing Compliance with BSA Regulatory Requirements. Customer Due Diligence Overview FFIEC BSAAML Examination Manual 4 05052018 requirements specified in the beneficial ownership rule. Conducting customer due diligence or CDD is a skill every Anti-Money LaunderingCountering the Financing of Terrorism AMLCFT analyst should have. FFIEC BSAAML Appendices - Appendix K Customer Risk Versus Due Diligence and Suspicious Activity Monitoring.

Assess the banks compliance with the regulatory requirements for customer due diligence CDD.

We will cover key definitions and procedural issues for compliance and highlight areas of risk for enhanced due diligence. The fifth pillar of Bank Secrecy ActAnti-Money Laundering BSAAML compliance is now fully in effect. Focuses on how to identify the risks and assesses the impact and implements measures and controls to reduce and manage the risk. Explores the factors that affect a banks BSA risk profile and explains the importance of proper risk analysis steps and factors to consider. Financial institutions must conduct customer due diligence CDD for all customers including hemp-related businesses. We will cover key definitions and procedural issues for compliance and highlight areas of risk for enhanced due diligence.

Source: abrigo.com

The beneficial ownership rule requires the bank to collect beneficial ownership information at the 25 percent ownership threshold regardless of the customers risk profile. The examination procedures replace those in the current. The Fifth Pillar of BSAAML Compliance is Now in Place. Conducting customer due diligence or CDD is a skill every Anti-Money LaunderingCountering the Financing of Terrorism AMLCFT analyst should have. Global Financial Crimes Compliance.

Source: advisoryhq.com

Source: advisoryhq.com

The purpose of adding more customer due diligence requirements is to reduce risks associated with shell companies and anonymous companies. Customer Due Diligence Overview FFIEC BSAAML Examination Manual 4 05052018 requirements specified in the beneficial ownership rule. The beneficial ownership rule requires the bank to collect beneficial ownership information at the 25 percent ownership threshold regardless of the customers risk profile. This material will provide an overview of BSAAMLKnow Your Customer KYC components including the Customer Identification Program CIP and beneficial owner Customer Due Diligence CDD Rule. Financial institutions must conduct customer due diligence CDD for all customers including hemp-related businesses.

Source: verafin.com

Source: verafin.com

Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. The fifth pillar of Bank Secrecy ActAnti-Money Laundering BSAAML compliance is now fully in effect. Financial institutions should obtain basic identifying information about hemp-related businesses through the application of the financial institutions customer. BSAAML Program Expectations. Developing Conclusions and Finalizing the Exam.

Source: amazon.ca

Source: amazon.ca

Developing Conclusions and Finalizing the Exam. FFIEC BSAAML Appendices - Appendix K Customer Risk Versus Due Diligence and Suspicious Activity Monitoring. The BSA establishes recordkeeping requirements related to various types of records including. Assessing Compliance with BSA Regulatory Requirements. On May 11 2018 the Federal Financial Institutions Examination Council FFIEC issued new examination procedures for the final rule Customer Due Diligence Requirements for Financial Institutions issued by the Financial Crimes Enforcement Network FinCEN on May 11 2016.

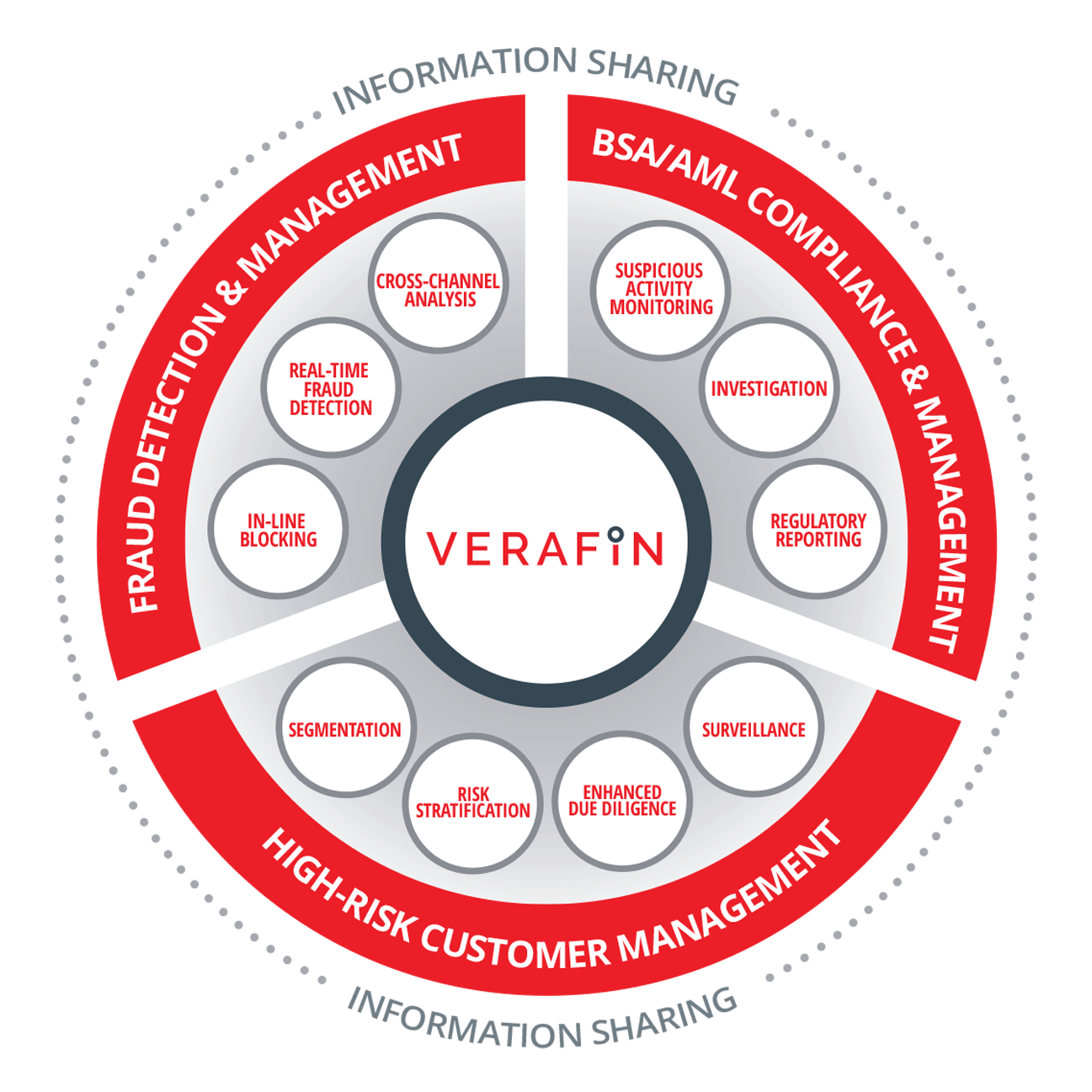

Source: yumpu.com

Source: yumpu.com

Assessing Compliance with BSA Regulatory Requirements. The beneficial ownership rule requires the bank to collect beneficial ownership information at the 25 percent ownership threshold regardless of the customers risk profile. The purpose of adding more customer due diligence requirements is to reduce risks associated with shell companies and anonymous companies. Assessing Compliance with BSA Regulatory Requirements. Financial institutions should obtain basic identifying information about hemp-related businesses through the application of the financial institutions customer.

![]() Source: acams.digitellinc.com

Source: acams.digitellinc.com

Assessing Compliance with BSA Regulatory Requirements. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. FFIEC BSAAML Appendices - Appendix K Customer Risk Versus Due Diligence and Suspicious Activity Monitoring. Financial institutions must conduct customer due diligence CDD for all customers including hemp-related businesses. Beneficial Ownership and Customer Due Diligence Provides information on FinCENs CDD Rule that amends existing BSA regulations and requirements to identify and verify the identity of beneficial owners of legal entity customers subject to certain exclusions and exemptions.

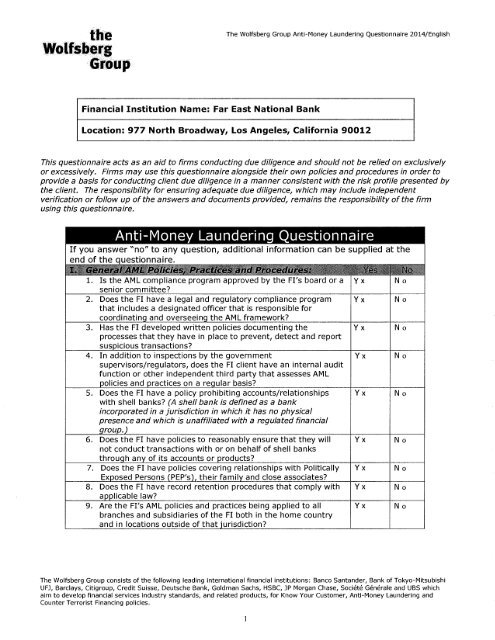

Source: slideplayer.com

Source: slideplayer.com

The examination procedures replace those in the current. Customer Due Diligence Customer due diligence is the fifth pillar of a BSA compliance program. Beneficial Ownership and Customer Due Diligence Provides information on FinCENs CDD Rule that amends existing BSA regulations and requirements to identify and verify the identity of beneficial owners of legal entity customers subject to certain exclusions and exemptions. The Fifth Pillar of BSAAML Compliance is Now in Place. In general the BSA requires that.

Source: bkd.com

Source: bkd.com

Assess the banks compliance with the regulatory requirements for customer due diligence CDD. We will cover key definitions and procedural issues for compliance and highlight areas of risk for enhanced due diligence. Assessing Compliance with BSA Regulatory Requirements. This supervisory letter provides information about the Bank Secrecy Act BSA customer due diligence CDD and beneficial ownership rules and establishes a consistent framework for the examination and supervision processes used to evaluate credit union compliance. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA.

Source: tookitaki.ai

Source: tookitaki.ai

Assessing Compliance with BSA Regulatory Requirements. In general the BSA requires that. In most countries with a robust AMLCFT framework it is compul. Developing Conclusions and Finalizing the Exam. Customer Due Diligence Overview FFIEC BSAAML Examination Manual 4 05052018 requirements specified in the beneficial ownership rule.

Source: slideshare.net

Source: slideshare.net

A typical investigation into a potential suspicious transaction will begin with CDD. The CDD Rule clarifies and strengthens. In most countries with a robust AMLCFT framework it is compul. Assess the banks compliance with the regulatory requirements for customer due diligence CDD. Financial institutions must conduct customer due diligence CDD for all customers including hemp-related businesses.

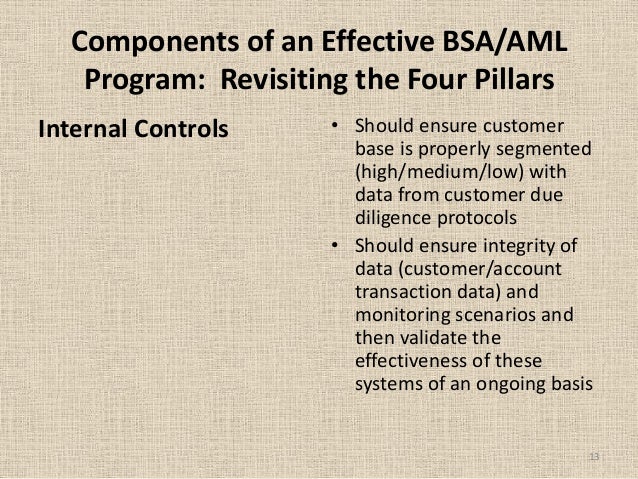

Source: slideplayer.com

Source: slideplayer.com

On May 11 2018 the Federal Financial Institutions Examination Council FFIEC issued new examination procedures for the final rule Customer Due Diligence Requirements for Financial Institutions issued by the Financial Crimes Enforcement Network FinCEN on May 11 2016. Global Financial Crimes Compliance. Assess the banks compliance with the regulatory requirements for customer due diligence CDD. Which customer due diligence measure includes the scrutiny of transactions undertaken throughout the course of that relationship to ensure that the transactions being conducted are consistent with the institutions knowledge of the customer their business and risk profile including where necessary the source of funds. The Fifth Pillar of BSAAML Compliance is Now in Place.

Source: amltrainer.com

Source: amltrainer.com

Assessing Compliance with BSA Regulatory Requirements. Assessing the BSAAML Compliance Program. This material will provide an overview of BSAAMLKnow Your Customer KYC components including the Customer Identification Program CIP and beneficial owner Customer Due Diligence CDD Rule. Global Financial Crimes Compliance. Assessing Compliance with BSA Regulatory Requirements.

Source: slidetodoc.com

Source: slidetodoc.com

Focuses on how to identify the risks and assesses the impact and implements measures and controls to reduce and manage the risk. In general the BSA requires that. Conducting customer due diligence or CDD is a skill every Anti-Money LaunderingCountering the Financing of Terrorism AMLCFT analyst should have. Customer accounts eg loan deposit or trust BSA filing requirements and records that document a banks compliance with the BSA. BSAAML Program Expectations.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsaaml customer due diligence by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information