11++ Bsaaml for non banking institutions ideas

Home » money laundering Info » 11++ Bsaaml for non banking institutions ideasYour Bsaaml for non banking institutions images are available. Bsaaml for non banking institutions are a topic that is being searched for and liked by netizens today. You can Download the Bsaaml for non banking institutions files here. Download all free photos and vectors.

If you’re looking for bsaaml for non banking institutions pictures information related to the bsaaml for non banking institutions interest, you have come to the right site. Our website always gives you hints for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that fit your interests.

Bsaaml For Non Banking Institutions. New Events in Non-Banking Financial Institution BSAAML Audit and Periphery will blow your MIND. To determine compliance with the BSA. The principal elements of an AML compliance program are as follows. Must comply with the principal US.

Anti Money Laundering Aml An Overview For Staff Prepared By Msm Compliance Services Pty Ltd Bank Secrecy Act Act Training Money Laundering From pinterest.com

Anti Money Laundering Aml An Overview For Staff Prepared By Msm Compliance Services Pty Ltd Bank Secrecy Act Act Training Money Laundering From pinterest.com

The OCC conducts regular examinations of national banks federal savings associations federal branches and agencies of foreign banks in the US. Risks Associated with Money Laundering and Terrorist Financing. Examination of adherence to BSAAML laws and regulations applicable to regulated financial institutions or non-bank financial institutions. AML RightSource is the leading firm solely focused on Anti-Money Laundering AMLBank Secrecy Act BSA and financial crimes compliance solutions. Nonbank Financial Institutions Overview FFIEC BSAAML Examination Manual 299 2272015V2 Nonbank Financial Institutions Overview Objective. The principal elements of an AML compliance program are as follows.

This inherent risk comes from a banks products and services customers and entities and the geographical locations in which the institution and its customers operate.

Services include transaction monitoring alert backlog. Services include transaction monitoring alert backlog. These apply broadly and can potentially result in. Each identified high risk entity that is a NBFI should be reviewed quarterly for activity that would. An effective BSA-AML compliance program should suit the unique needs of the financial institution it serves including the risk profile it faces. Review of agencys detailed written reports of deficiencies.

Source: pinterest.com

Source: pinterest.com

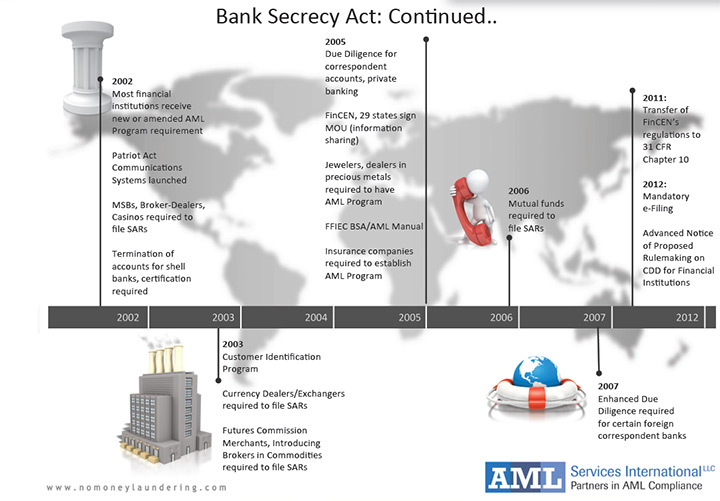

The BSA requires financial institutions to each develop an Anti Money Laundering AML program. Risks Associated with Money Laundering and Terrorist Financing. On August 13 federal banking agencies namely the Federal Reserve the Federal Deposit Insurance Corporation the National Credit Union Administration and the Office of the Comptroller of the Currency issued a Joint Statement on Enforcement of Bank Secrecy ActAnti-Money Laundering Requirements. The BSA requires financial institutions to each develop an Anti Money Laundering AML program. It is also known as money-laundering act or jointly referred to as BSAAML.

Source: pinterest.com

Source: pinterest.com

Published on June 17 2016 June 17 2016 4 Likes 0 Comments. The BSA requires financial institutions to each develop an Anti Money Laundering AML program. New Events in Non-Banking Financial Institution BSAAML Audit and Periphery will blow your MIND. Published on June 17 2016 June 17 2016 4 Likes 0 Comments. Review of agencys detailed written reports of deficiencies.

Source: bookstore.gpo.gov

Source: bookstore.gpo.gov

Assess the adequacy of the banks systems to manage the risks associated with accounts of. AML laws 18 USC. Services include transaction monitoring alert backlog. On July 15 2009 the Financial Crimes Enforcement Network FinCEN issued an advance notice of proposed rulemaking ANPRM to solicit public comment pertaining to the possible application of anti-money laundering AML program and suspicious activity report SAR regulations to a specific sub-set of loan and finance companies. Risks Associated with Money Laundering and Terrorist Financing.

Source: pinterest.com

Source: pinterest.com

On August 13 federal banking agencies namely the Federal Reserve the Federal Deposit Insurance Corporation the National Credit Union Administration and the Office of the Comptroller of the Currency issued a Joint Statement on Enforcement of Bank Secrecy ActAnti-Money Laundering Requirements. The OCC uses informal and formal enforcement actions to. Review of agencys detailed written reports of deficiencies. The Bank Secrecy Act BSA was originally enacted in 1970 and subsequently amended many times. The OCC conducts regular examinations of national banks federal savings associations federal branches and agencies of foreign banks in the US.

Source: pinterest.com

Source: pinterest.com

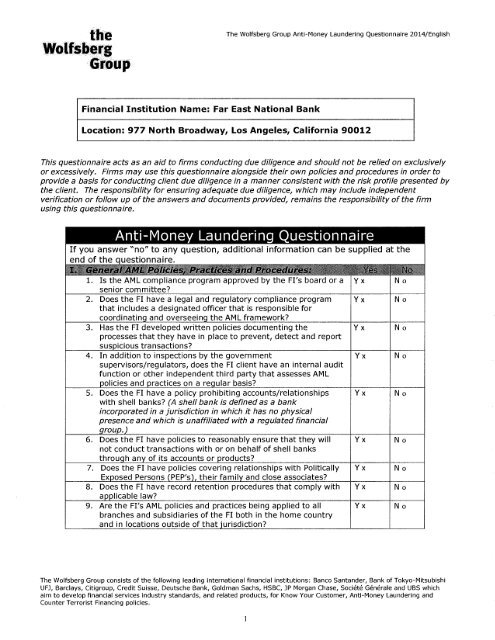

It is also known as money-laundering act or jointly referred to as BSAAML. AML RightSource is the leading firm solely focused on Anti-Money Laundering AMLBank Secrecy Act BSA and financial crimes compliance solutions. Assess the adequacy of the banks systems to manage the risks associated with accounts of nonbank financial institutions NBFI and managements ability to implement. Risks Associated with Money Laundering and Terrorist Financing. To be compliant with BSA requirements banks should also monitor transactions for Non- Bank Financial Institution NBFI and Money Services Business MSB customers.

Source: acamstoday.org

Source: acamstoday.org

Services include transaction monitoring alert backlog. An effective BSA-AML compliance program should suit the unique needs of the financial institution it serves including the risk profile it faces. The BSA requires financial institutions to each develop an Anti Money Laundering AML program. These apply broadly and can potentially result in. Examination of adherence to BSAAML laws and regulations applicable to regulated financial institutions or non-bank financial institutions.

Source: pinterest.com

Source: pinterest.com

The financial institutions are also required to report any suspicious activity that may show any signs of money laundering tax evasion etc. Assess the adequacy of the banks systems to manage the risks associated with accounts of. It is also known as money-laundering act or jointly referred to as BSAAML. The OCC conducts regular examinations of national banks federal savings associations federal branches and agencies of foreign banks in the US. Must comply with the principal US.

Source: yumpu.com

Source: yumpu.com

The BSA requires financial institutions to each develop an Anti Money Laundering AML program. We provide highly trained AMLBSA professionals to assist banks and non-bank financial institutions to meet day-to-day compliance tasks. The OCC conducts regular examinations of national banks federal savings associations federal branches and agencies of foreign banks in the US. Examination of adherence to BSAAML laws and regulations applicable to regulated financial institutions or non-bank financial institutions. Assess the adequacy of the banks systems to manage the risks associated with accounts of nonbank financial institutions NBFI and managements ability to implement.

Source: pinterest.com

Source: pinterest.com

The Bank Secrecy Act BSA was originally enacted in 1970 and subsequently amended many times. The financial institutions are also required to report any suspicious activity that may show any signs of money laundering tax evasion etc. Every community bank faces some degree of inherent Bank Secrecy ActAnti-Money Laundering BSAAML risk. Services include transaction monitoring alert backlog. The OCC uses informal and formal enforcement actions to.

Source: abrigo.com

Services include transaction monitoring alert backlog. It is also known as money-laundering act or jointly referred to as BSAAML. These apply broadly and can potentially result in. The Bank Secrecy Act BSA was originally enacted in 1970 and subsequently amended many times. New Events in Non-Banking Financial Institution BSAAML Audit and Periphery will blow your MIND.

Source: pinterest.com

Source: pinterest.com

Services include transaction monitoring alert backlog. AML laws 18 USC. AML RightSource is the leading firm solely focused on Anti-Money Laundering AMLBank Secrecy Act BSA and financial crimes compliance solutions. These apply broadly and can potentially result in. BSA Office of Foreign Assets Control OFAC Enforcement.

Source: businesslawtoday.org

Source: businesslawtoday.org

New Events in Non-Banking Financial Institution BSAAML Audit and Periphery will blow your MIND. While nonbanking companies are generally not regulated for BSAAML and sanctions compliance to the same degree that banks are they are widely perceived as vulnerable to illicit activity and therefore subject to significant. Review of agencys detailed written reports of deficiencies. The joint statement sets forth the agencies policy on the circumstances in which an agency will issue a mandatory cease and desist order to address non-compliance with the BSA. Risks Associated with Money Laundering and Terrorist Financing.

Source: pinterest.com

Source: pinterest.com

To determine compliance with the BSA. It is also known as money-laundering act or jointly referred to as BSAAML. Although the AML requirements in the BSA do not apply to companies other than financial institutions all companies operating in the US. We provide highly trained AMLBSA professionals to assist banks and non-bank financial institutions to meet day-to-day compliance tasks. Examination of adherence to BSAAML laws and regulations applicable to regulated financial institutions or non-bank financial institutions.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bsaaml for non banking institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas