16++ Bsaaml transaction monitoring process ideas

Home » money laundering idea » 16++ Bsaaml transaction monitoring process ideasYour Bsaaml transaction monitoring process images are ready. Bsaaml transaction monitoring process are a topic that is being searched for and liked by netizens today. You can Find and Download the Bsaaml transaction monitoring process files here. Download all free images.

If you’re searching for bsaaml transaction monitoring process pictures information linked to the bsaaml transaction monitoring process keyword, you have come to the ideal site. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Bsaaml Transaction Monitoring Process. Typically implemented through a TMS identification of cases is automated for further investigation. According to ACAMS the following reports from core banking systems or transaction monitoring systems are potential sources to identify suspicious transactions. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by. Automatically boost transaction rates without increasing chargebacks or friendly fraud.

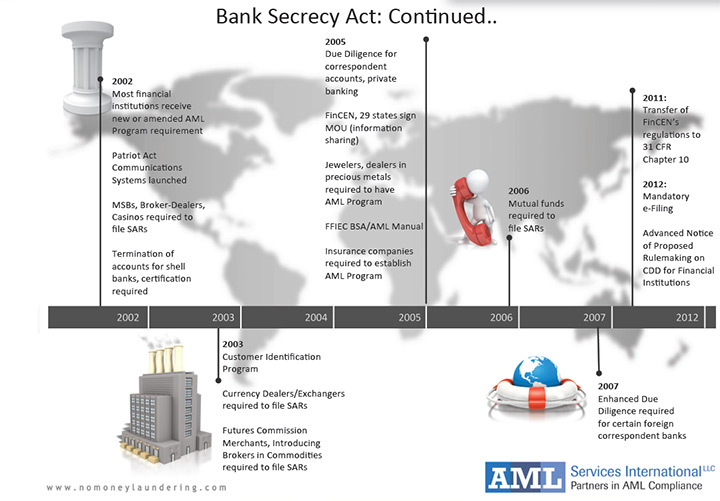

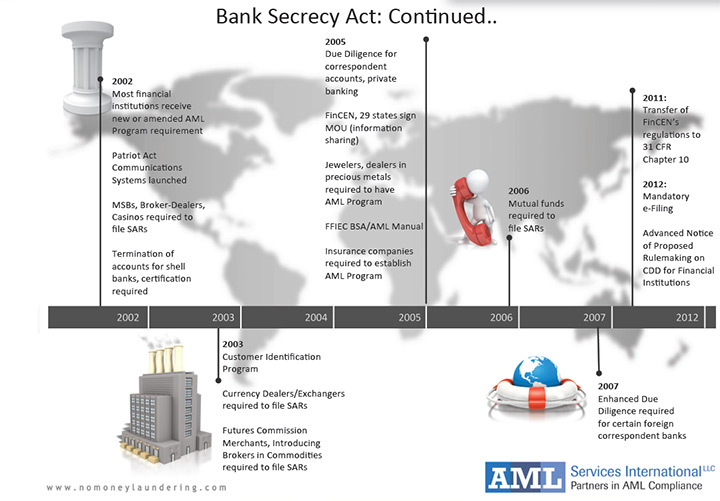

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Automatically boost transaction rates without increasing chargebacks or friendly fraud. According to ACAMS the following reports from core banking systems or transaction monitoring systems are potential sources to identify suspicious transactions. Failing to update AML risk assessment based on trends identified in ongoing monitoring process resulting in transaction monitoring gaps. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Smaller financial institutions often think they can manually handle the daily transaction monitoring required by the Bank Secrecy Act BSA but the truth is those institutions are bigger targets for financial crime.

A tool on the other hand provides outputs which do not qualify as quantitative estimates.

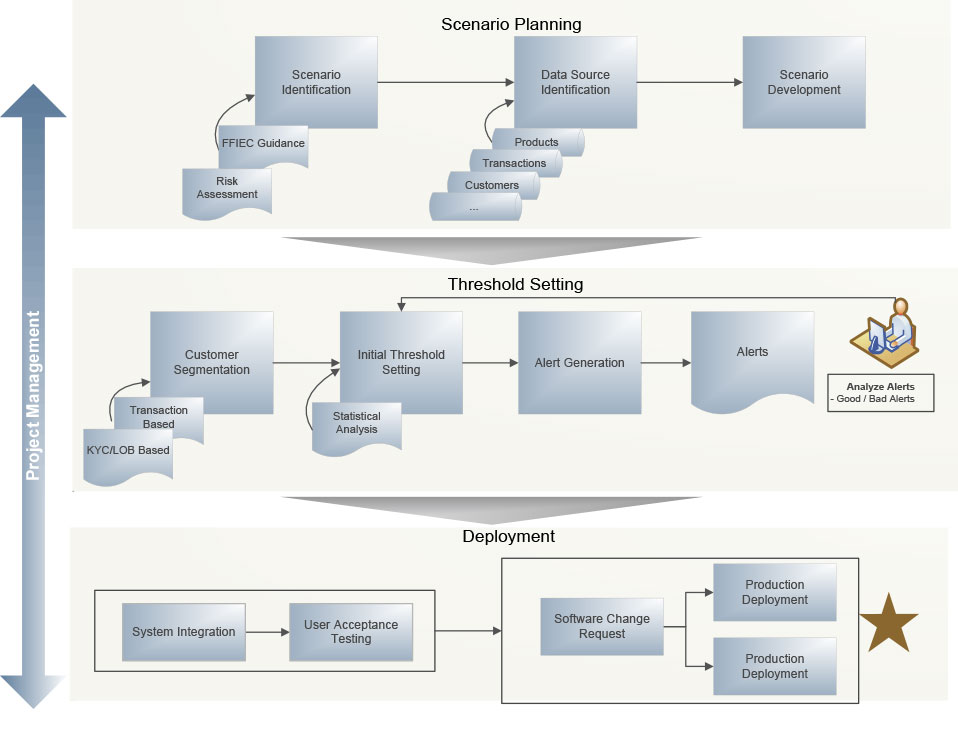

A tool on the other hand provides outputs which do not qualify as quantitative estimates. Some banks are becoming increasingly sophisticated in their approaches to identifying suspicious activity. TRANSACTION MONITORING PROGRAM 5043a BSAAML RISK ASSESSMENTS 5043a 1-3 The Federal Financial Institutions Examination Council FFIEC BSAAML Examination Manual does not state that an institution is required to have a BSAAML risk assessment. Uspicious transaction monitoring systems enable financial institutions to monitor their customers transaction behavior systematically by providing relevant scenariosrules that analyze the underlying customer transactions and generate automated alerts of activity that may be unusual and indicative of potential money laundering. Typically implemented through a TMS identification of cases is automated for further investigation. Smaller financial institutions often think they can manually handle the daily transaction monitoring required by the Bank Secrecy Act BSA but the truth is those institutions are bigger targets for financial crime.

Source: e-elgar.com

Source: e-elgar.com

Fewer false positives mean less work for your team. Typically implemented through a TMS identification of cases is automated for further investigation. A national bank faced resource and effectiveness challenges with its manual transaction monitoring processes. Continuously monitor for fraudulent activities. Sensors and analyzers that reduce maintenance efforts and improve process control.

Source: pinterest.com

Source: pinterest.com

A national bank faced resource and effectiveness challenges with its manual transaction monitoring processes. Sensors and analyzers that reduce maintenance efforts and improve process control. Recent mergers acquisitions or other significant organizational changes. Relying on a manual BSAAML solution and missing suspicious activity. Weaknesses in the account monitoring systems.

Source: acamstoday.org

Source: acamstoday.org

The banks overall BSAAML risk profile eg number and type of higher-risk products services customers entities and geographies. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by. Stay BSA and AML compliant without extra burden. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Uspicious transaction monitoring systems enable financial institutions to monitor their customers transaction behavior systematically by providing relevant scenariosrules that analyze the underlying customer transactions and generate automated alerts of activity that may be unusual and indicative of potential money laundering.

![]() Source: adiconsulting.com

Source: adiconsulting.com

A national bank faced resource and effectiveness challenges with its manual transaction monitoring processes. Sensors and analyzers that reduce maintenance efforts and improve process control. The investigation process has significant operational implications from a risk and cost perspective. Relying on a manual BSAAML solution and missing suspicious activity. Failing to update AML risk assessment based on trends identified in ongoing monitoring process resulting in transaction monitoring gaps.

Source: qa.nonprod.trulioo.com

Source: qa.nonprod.trulioo.com

Relying on a manual BSAAML solution and missing suspicious activity. Smaller financial institutions often think they can manually handle the daily transaction monitoring required by the Bank Secrecy Act BSA but the truth is those institutions are bigger targets for financial crime. The investigation process has significant operational implications from a risk and cost perspective. Uspicious transaction monitoring systems enable financial institutions to monitor their customers transaction behavior systematically by providing relevant scenariosrules that analyze the underlying customer transactions and generate automated alerts of activity that may be unusual and indicative of potential money laundering. Ad Automated tools to reduce chargeback rates and boost business profits in record time.

Banks should establish policies procedures and processes for identifying subjects of law enforcement requests monitoring the transaction activity of those subjects when appropriate identifying unusual or potentially suspicious activity related to those subjects and filing as. Innovation has the potential to augment aspects of banks BSAAML compliance programs such as risk identification transaction monitoring and suspicious activity reporting. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Recent mergers acquisitions or other significant organizational changes. Ad Automated tools to reduce chargeback rates and boost business profits in record time.

Source: abrigo.com

Sensors and analyzers that reduce maintenance efforts and improve process control. Relying on a manual BSAAML solution and missing suspicious activity. Ad Sensors for DO pHORP conductivity turbidity CO2 TOC microbial detection and more. A national bank faced resource and effectiveness challenges with its manual transaction monitoring processes. Sensors and analyzers that reduce maintenance efforts and improve process control.

Source: acamstoday.org

Source: acamstoday.org

According to ACAMS the following reports from core banking systems or transaction monitoring systems are potential sources to identify suspicious transactions. According to ACAMS the following reports from core banking systems or transaction monitoring systems are potential sources to identify suspicious transactions. Quality and extent of review by audit or independent parties. In fact it states. Transactions should be monitored for patterns that may be indicative of attempts to evade NACHA limitations on returned entries.

Source: acamstoday.org

Source: acamstoday.org

Alacer analyzed manual detection sources and mapped them to known AML risk typologies and historical Case and SAR rates in order to build the case with data for scenario retirement and revisions. Automatically boost transaction rates without increasing chargebacks or friendly fraud. Ad Sensors for DO pHORP conductivity turbidity CO2 TOC microbial detection and more. The banks overall BSAAML risk profile eg number and type of higher-risk products services customers entities and geographies. Sensors and analyzers that reduce maintenance efforts and improve process control.

Source: calameo.com

Source: calameo.com

Quality and extent of review by audit or independent parties. Ad Automated tools to reduce chargeback rates and boost business profits in record time. Efficiently fine-tuning AML Transaction Monitoring can help financial firms compliance teams to increase productivity while carefully avoiding pointless investigations by. Uspicious transaction monitoring systems enable financial institutions to monitor their customers transaction behavior systematically by providing relevant scenariosrules that analyze the underlying customer transactions and generate automated alerts of activity that may be unusual and indicative of potential money laundering. Risk Controls Implement procedures to update AML risk assessment based on unexplained changes in alert volumes related to certain geographic areas or activity types as indicators emerging risks.

Source: finextra.com

Source: finextra.com

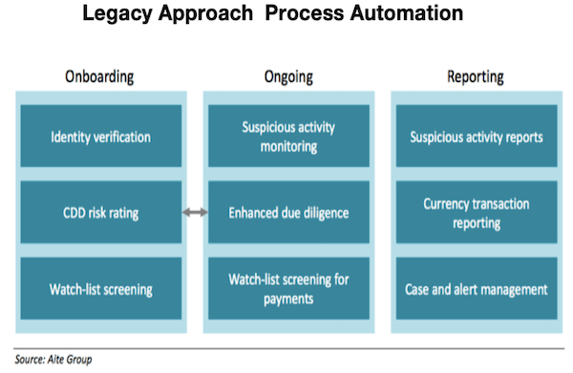

To simplify this applies to a BSA departments transaction monitoring system customer risk rating system sanctions and watchlist scanning currency transaction reporting systems and the institutions CECL automation because they use quantitative data to produce outcomes. Transaction Monitoring Manual Transaction Monitoring A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports. Sensors and analyzers that reduce maintenance efforts and improve process control. Ad Sensors for DO pHORP conductivity turbidity CO2 TOC microbial detection and more. Failing to update AML risk assessment based on trends identified in ongoing monitoring process resulting in transaction monitoring gaps.

Source: youtube.com

Source: youtube.com

A national bank faced resource and effectiveness challenges with its manual transaction monitoring processes. Transaction monitoring processes involve analyzing transactional data and identifying suspicious activities that are potential indicators of money laundering or terrorist financing activity. After a customer is approved Transaction Monitoring takes over to continuously review their financial activity flagging risky behaviors for review. Risk Controls Implement procedures to update AML risk assessment based on unexplained changes in alert volumes related to certain geographic areas or activity types as indicators emerging risks. Weaknesses in the account monitoring systems.

![]() Source: adiconsulting.com

Source: adiconsulting.com

Failing to update AML risk assessment based on trends identified in ongoing monitoring process resulting in transaction monitoring gaps. Transaction Monitoring Manual Transaction Monitoring A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions eg those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports. Sensors and analyzers that reduce maintenance efforts and improve process control. TRANSACTION MONITORING PROGRAM 5043a BSAAML RISK ASSESSMENTS 5043a 1-3 The Federal Financial Institutions Examination Council FFIEC BSAAML Examination Manual does not state that an institution is required to have a BSAAML risk assessment. Smaller financial institutions often think they can manually handle the daily transaction monitoring required by the Bank Secrecy Act BSA but the truth is those institutions are bigger targets for financial crime.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bsaaml transaction monitoring process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information