19++ Cima anti money laundering regulations 2017 information

Home » money laundering Info » 19++ Cima anti money laundering regulations 2017 informationYour Cima anti money laundering regulations 2017 images are available. Cima anti money laundering regulations 2017 are a topic that is being searched for and liked by netizens today. You can Get the Cima anti money laundering regulations 2017 files here. Find and Download all free images.

If you’re searching for cima anti money laundering regulations 2017 pictures information connected with to the cima anti money laundering regulations 2017 keyword, you have pay a visit to the right site. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

Cima Anti Money Laundering Regulations 2017. 2 Regulations 2017made 12th December 2017. The Cayman Islands Anti-Money Laundering Regulations 2017 The Anti-Money Laundering Regulations 2017 AML Regulations which replace the Money Laundering Regulations 2015 Revision MLRs were gazetted on 20 September 2017 and came into force on 2 October 2017. Documented assessments policies controls and procedures Regulation 18 requires MiPs to perform and document a practice risk assessment which must take into. Her Majestys Government has implemented the Fifth Money Laundering Directive 5MLD through amendments to the Money Laundering Regulations 2017.

Levels Of Aml Disclosure Of Uae Banks Download Table From researchgate.net

Levels Of Aml Disclosure Of Uae Banks Download Table From researchgate.net

Guidance Notes on the Prevention and Detection of Money Laundering Terrorist Financing and Proliferation Financing in the Cayman Islands - 5 June 2020 View Notice of the issuance of this guidance was published in the Cayman Islands Extraordinary Gazette No. The Proceeds of Crime Law 2017 and the corresponding Anti Money Laundering Regulations 2017 the AML Regulations made a number of amendments to the anti-money laundering AML regime in the. The Money Laundering Regulations 2015 Revision have been repealed and the Guidance Notes on the Prevention and Detection of Money Laundering and Terrorist Financing in the Cayman Islands the Guidance Notes shall be updated in due course. Members in practice must meet the requirements of CIMAs Member in Practice Rules and confirm compliance on their initial application for a practising certificate and subsequent annual renewal of registration. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument and provides information about its policy objective and policy implications. 462020 on the 5th of June 2020 as required by section 345 of the Monetary Authority Act.

The Anti-Money Laundering Regulations 2017 made 19th September 2017.

CIMA will be contacting existing MiPs in due course with information on how to apply for the test. In June 2017 money laundering regulations will change across the EU following the transposition of the 4 th Money Laundering Directive. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Applicant for business means a person seeking to form a business relationship or carry out a one-off transaction with a person who is carrying out relevant financial business in the Islands. 1 In these Regulations - Anti-Money Laundering Compliance Officer means the person designated in accordance with regulation 31. Each member state is responsible for transposing the directive in the manner it sees fit.

Source: slideplayer.com

Source: slideplayer.com

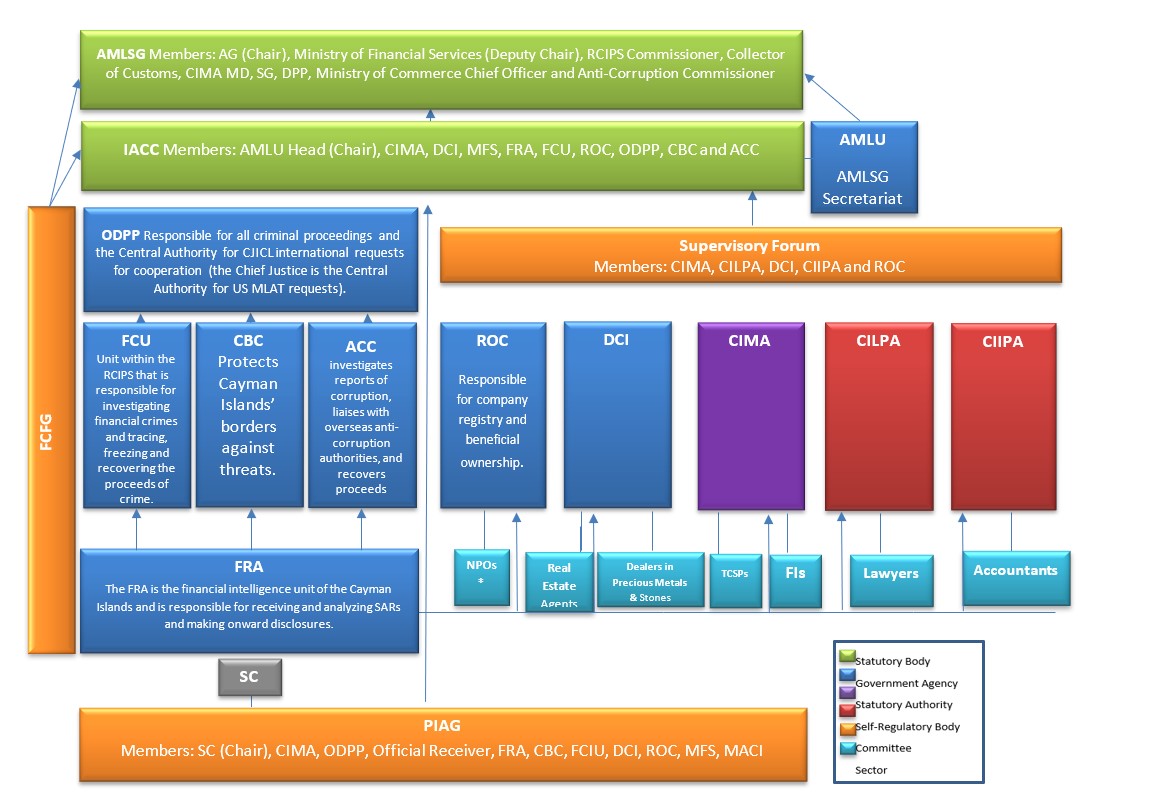

Anti-Money Laundering Regulations The Anti-Money Laundering Regulations AMLRs require all persons engaged in relevant financial businesses as defined in the Proceeds of Crime Law to have in place systems policies and procedures to implement a strong AMLCFTCPF framework in their organization including procedures for. Her Majestys Government has implemented the Fifth Money Laundering Directive 5MLD through amendments to the Money Laundering Regulations 2017. Each member state is responsible for transposing the directive in the manner it sees fit. The Anti-Money Laundering Regulations 2017 AML Regulations were gazetted on 20 September 2017 and come into force on 2 October 2017. Under Regulation 50 of the Money Laundering Regulations 2017 CIMA must actively co-operate and share intelligence with other supervisory authorities such as professional body supervisors HM Treasury.

Source: slideplayer.com

Source: slideplayer.com

Guidance Notes on the Prevention and Detection of Money Laundering Terrorist Financing and Proliferation Financing in the Cayman Islands - 5 June 2020 View Notice of the issuance of this guidance was published in the Cayman Islands Extraordinary Gazette No. This client briefing addresses recent changes to the Cayman anti-money laundering framework - in particular those made by the Anti-Money Laundering Regulations 2017 AML Regulations which came into force on 2 October 2017. 462020 on the 5th of June 2020 as required by section 345 of the Monetary Authority Act. The Anti-Money Laundering Regulations 2017 AML Regulations were gazetted on 20 September 2017 and come into force on 2 October 2017. Her Majestys Government has implemented the Fifth Money Laundering Directive 5MLD through amendments to the Money Laundering Regulations 2017.

Source: cima.ky

Source: cima.ky

2 Regulations 2017 made 12th December 2017 Anti-Money Laundering Amendment Regulations 2019 made. 1 In these Regulations - Anti-Money Laundering Compliance Officer means the person designated in accordance with regulation 31. Members in practice must meet the requirements of CIMAs Member in Practice Rules and confirm compliance on their initial application for a practising certificate and subsequent annual renewal of registration. The Anti-Money Laundering Regulations 2017 made 19th September 2017. CIMA will require new MiP applicants to pass the test from 26 June 2017.

Source: mondaq.com

Source: mondaq.com

Consolidated with Anti-Money Laundering Amendment Regulations 2017 made 1st November 2017 Anti-Money Laundering Designated Non-Financial Business and Professions Amendment No. 1 In these Regulations - Anti-Money Laundering Compliance Officer means the person designated in accordance with regulation 31. 462020 on the 5th of June 2020 as required by section 345 of the Monetary Authority Act. Members in practice must meet the requirements of CIMAs Member in Practice Rules and confirm compliance on their initial application for a practising certificate and subsequent annual renewal of registration. CIMA will be contacting existing MiPs in due course with information on how to apply for the test.

Source: pinterest.com

Source: pinterest.com

The Money Laundering Regulations 2015 Revision have been repealed and the Guidance Notes on the Prevention and Detection of Money Laundering and Terrorist Financing in the Cayman Islands the Guidance Notes shall be updated in due course. The Money Laundering Regulations 2015 Revision have been repealed and the Guidance Notes on the Prevention and Detection of Money Laundering and Terrorist Financing in the Cayman Islands the Guidance Notes shall be updated in due course. This client briefing addresses recent changes to the Cayman anti-money laundering framework - in particular those made by the Anti-Money Laundering Regulations 2017 AML Regulations which came into force on 2 October 2017. 2 Regulations 2017 made 12th December 2017 Anti-Money Laundering Amendment Regulations 2019 made. The Anti-Money Laundering Designated NonFinancial Business and - Professions Amendment No.

Source: slideshare.net

Source: slideshare.net

Cayman Islands - The Anti-Money Laundering Regulations 2017 Publication - 01112017 This client briefing addresses recent changes to the Cayman anti-money laundering framework - in particular those made by the Anti-Money Laundering Regulations 2017 AML Regulations which came into force on 2 October 2017. The Money Laundering Regulations 2015 Revision have been repealed and the Guidance Notes on the Prevention and Detection of Money Laundering and Terrorist Financing in the Cayman Islands the Guidance Notes shall be updated in due course. The Cayman anti-money laundering framework comprises. Consolidated with Anti-Money Laundering Amendment Regulations 2017 made 1st November 2017 Anti-Money Laundering Designated Non-Financial Business and Professions Amendment No. The Proceeds of Crime Law 2017 and the corresponding Anti Money Laundering Regulations 2017 the AML Regulations made a number of amendments to the anti-money laundering AML regime in the.

Source: lavca.org

Source: lavca.org

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument and provides information about its policy objective and policy implications. Applicant for business means a person seeking to form a business relationship or carry out a one-off transaction with a person who is carrying out relevant financial business in the Islands. 2 Regulations 2017made 12th December 2017. CIMA will require new MiP applicants to pass the test from 26 June 2017. Cayman Islands - The Anti-Money Laundering Regulations 2017 Publication - 01112017 This client briefing addresses recent changes to the Cayman anti-money laundering framework - in particular those made by the Anti-Money Laundering Regulations 2017 AML Regulations which came into force on 2 October 2017.

Source: pinterest.com

Source: pinterest.com

Guidance Notes on the Prevention and Detection of Money Laundering Terrorist Financing and Proliferation Financing in the Cayman Islands - 5 June 2020 View Notice of the issuance of this guidance was published in the Cayman Islands Extraordinary Gazette No. The Anti-Money Laundering Regulations 2017 AML Regulations were gazetted on 20 September 2017 and come into force on 2 October 2017. The obligation to appoint these AML Officers was reiterated by the Cayman Islands Monetary Authority CIMA in a notice published on 6 April 2018. In December 2017 the Cayman Islands Monetary Authority CIMA issued updated Guidance Notes under the new Anti-Money Laundering Regulations 2017 AML Regulations which came into force in October 2017. The Cayman Islands Anti-Money Laundering Regulations 2017 The Anti-Money Laundering Regulations 2017 AML Regulations which replace the Money Laundering Regulations 2015 Revision MLRs were gazetted on 20 September 2017 and came into force on 2 October 2017.

Source: in.pinterest.com

Source: in.pinterest.com

CIMA will require new MiP applicants to pass the test from 26 June 2017. This client briefing addresses recent changes to the Cayman anti-money laundering framework - in particular those made by the Anti-Money Laundering Regulations 2017 AML Regulations which came into force on 2 October 2017. As an anti-money laundering counter-terrorist financing AMLCTF supervisor CIMA is obliged to co-operate with external bodies in the fight against money laundering and terrorist financing. 462020 on the 5th of June 2020 as required by section 345 of the Monetary Authority Act. Consolidated with Anti-Money Laundering Amendment Regulations 2017 made 1st November 2017 Anti-Money Laundering Designated Non-Financial Business and Professions Amendment No.

Her Majestys Government has implemented the Fifth Money Laundering Directive 5MLD through amendments to the Money Laundering Regulations 2017. The Anti-Money Laundering Regulations 2017 AML Regulations were gazetted on 20 September 2017 and come into force on 2 October 2017. The Anti-Money Laundering Regulations 2017 AML Regulations were gazetted on 20 September 2017 and come into force on 2 October 2017. The Money Laundering Regulations 2015 Revision have been repealed and the Guidance Notes on the Prevention and Detection of Money Laundering and Terrorist Financing in the Cayman Islands the Guidance Notes shall be updated in due course. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument and provides information about its policy objective and policy implications.

Source:

2 Regulations 2017 made 12th December 2017 Anti-Money Laundering Amendment Regulations 2019 made. Cayman Islands - The Anti-Money Laundering Regulations 2017 Publication - 01112017 This client briefing addresses recent changes to the Cayman anti-money laundering framework - in particular those made by the Anti-Money Laundering Regulations 2017 AML Regulations which came into force on 2 October 2017. The obligation to appoint these AML Officers was reiterated by the Cayman Islands Monetary Authority CIMA in a notice published on 6 April 2018. 462020 on the 5th of June 2020 as required by section 345 of the Monetary Authority Act. The Money Laundering Regulations 2015 Revision have been repealed and the Guidance Notes on the Prevention and Detection of Money Laundering and Terrorist Financing in the Cayman Islands the Guidance Notes shall be updated in due course.

Source: researchgate.net

Source: researchgate.net

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument and provides information about its policy objective and policy implications. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Consolidated with Anti-Money Laundering Amendment Regulations 2017 made 1st November 2017 Anti-Money Laundering Designated Non-Financial Business and Professions Amendment No. In December 2017 the Cayman Islands Monetary Authority CIMA issued updated Guidance Notes under the new Anti-Money Laundering Regulations 2017 AML Regulations which came into force in October 2017. Guidance Notes on the Prevention and Detection of Money Laundering Terrorist Financing and Proliferation Financing in the Cayman Islands - 5 June 2020 View Notice of the issuance of this guidance was published in the Cayman Islands Extraordinary Gazette No.

Source: researchgate.net

Source: researchgate.net

Anti-Money Laundering Regulations The Anti-Money Laundering Regulations AMLRs require all persons engaged in relevant financial businesses as defined in the Proceeds of Crime Law to have in place systems policies and procedures to implement a strong AMLCFTCPF framework in their organization including procedures for. Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument and provides information about its policy objective and policy implications. Guidance Notes on the Prevention and Detection of Money Laundering Terrorist Financing and Proliferation Financing in the Cayman Islands - 5 June 2020 View Notice of the issuance of this guidance was published in the Cayman Islands Extraordinary Gazette No. Each member state is responsible for transposing the directive in the manner it sees fit. The statutory instrument was laid in Parliament on 20 December 2019 and the legislation came into force on 10 January 2020 in line with the transposition deadline.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cima anti money laundering regulations 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas