11+ Client risk rating factors ideas in 2021

Home » money laundering Info » 11+ Client risk rating factors ideas in 2021Your Client risk rating factors images are available. Client risk rating factors are a topic that is being searched for and liked by netizens now. You can Download the Client risk rating factors files here. Get all free images.

If you’re searching for client risk rating factors images information linked to the client risk rating factors interest, you have pay a visit to the right blog. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

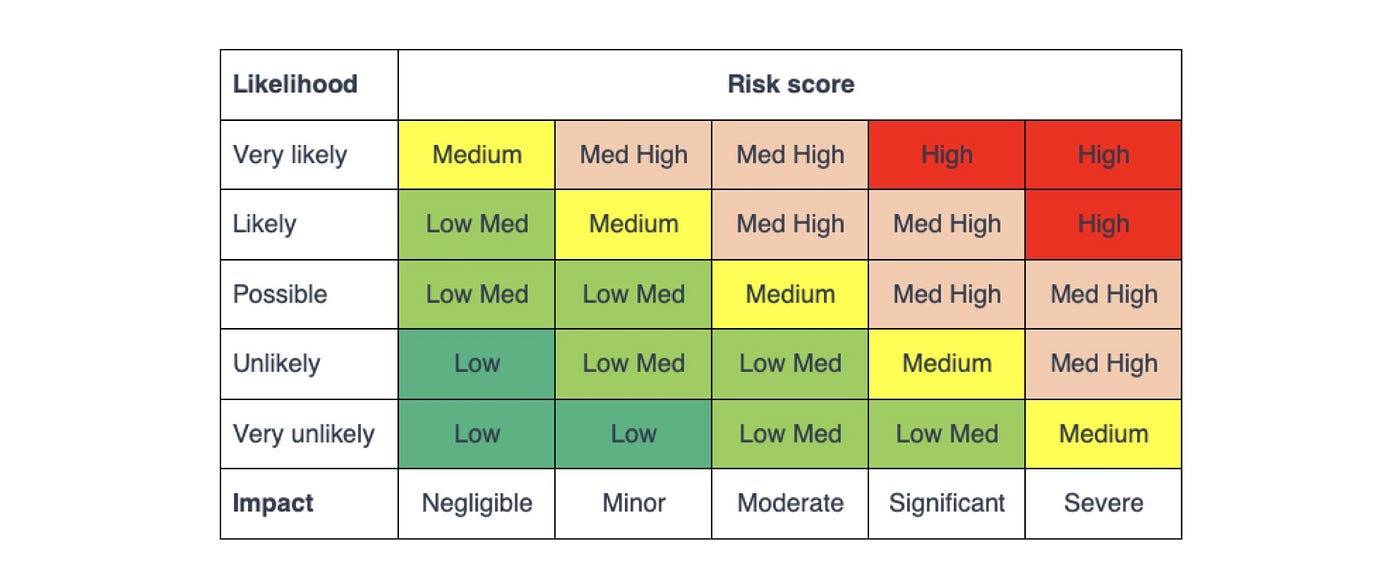

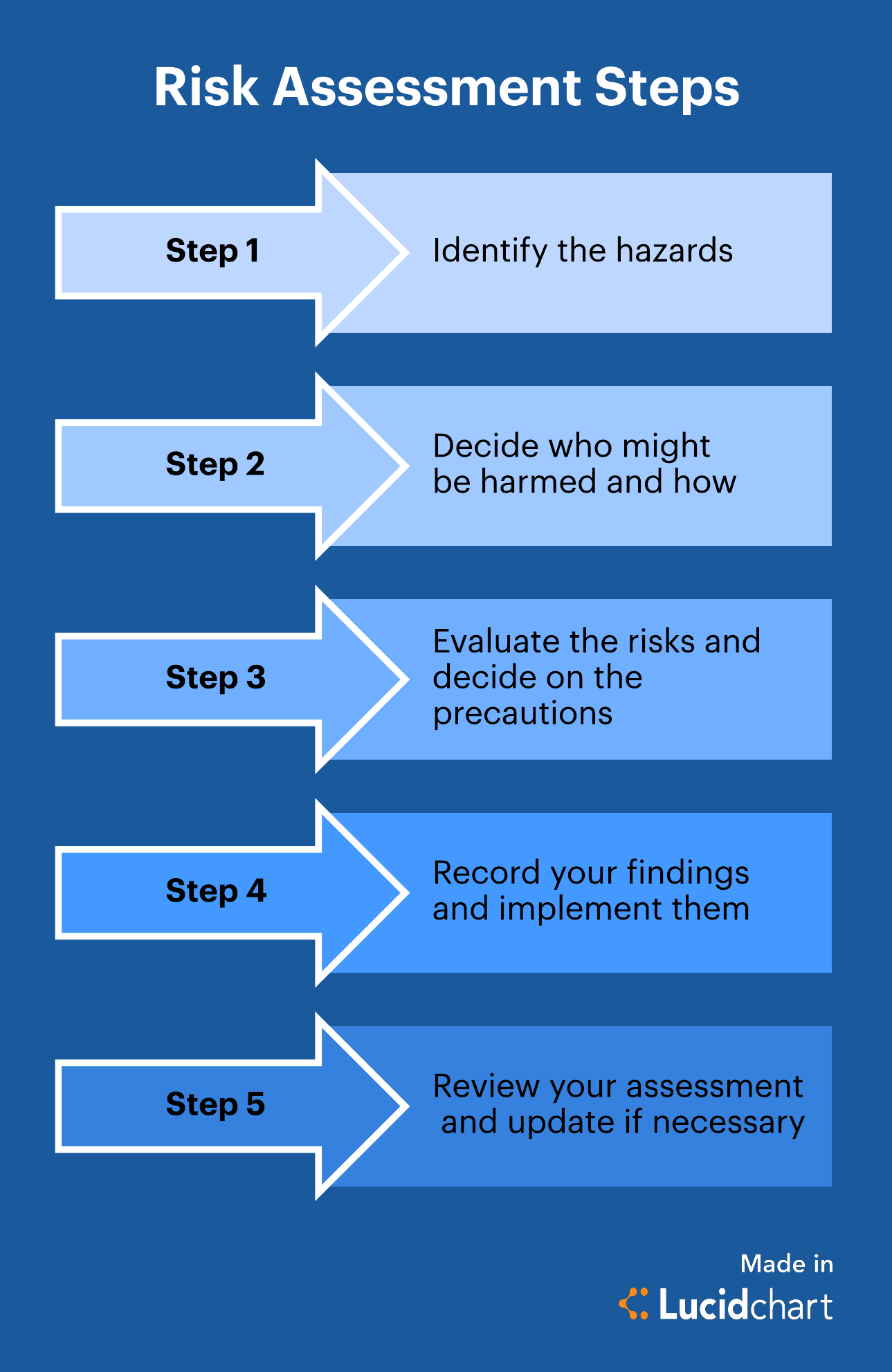

Client Risk Rating Factors. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk. Risk Required and Risk Capacity are financial characteristics calculated using a financial planning tool. Understanding the risk factors is really important so is understanding the factors on which risk buckets are categorised. If the risk rating is high that client will be consistently and closely monitored.

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq From advisoryhq.com

Aml Kyc Risk Rating Assessment Template Methodology Rating Matrix Download Template Advisoryhq From advisoryhq.com

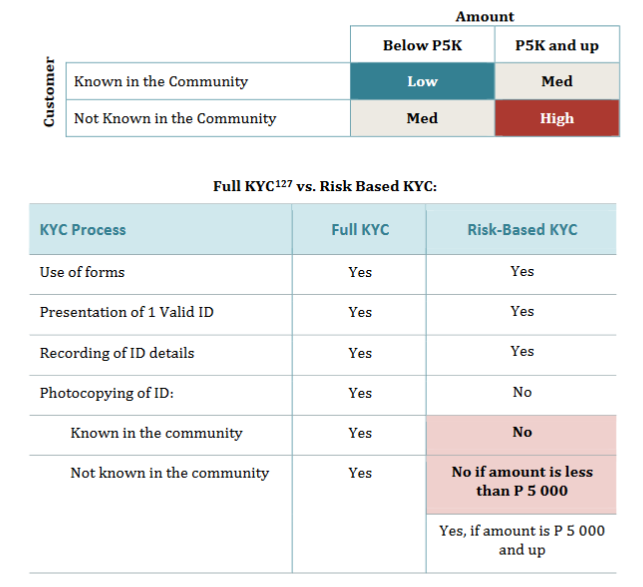

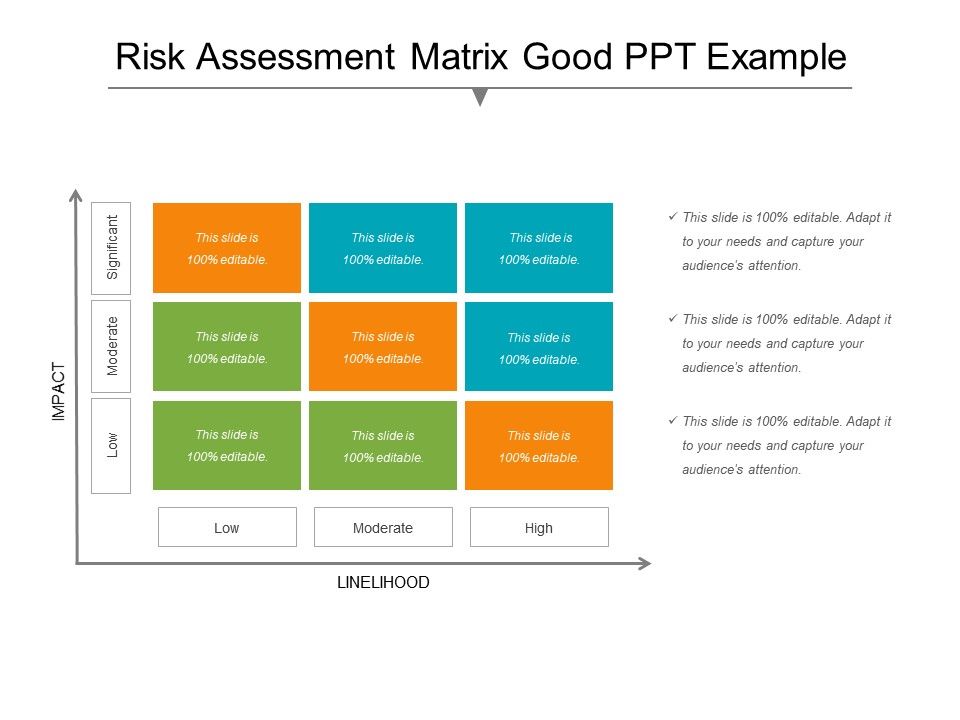

On every shift or prior to home visit etc. Low Medium or High The firm may also use a risk category of Low or High without the Medium rating When the risk rating tool generates a final rating the AML Compliance Officer will be sent a notification for approval. The models deployed by most institutions today are based on an assessment of risk factors such as the customers occupation salary and the banking products used. Add a comment Cancel reply. If the risk rating is high that client will be consistently and closely monitored. Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering.

When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk.

How much risk a client can afford to take without risking their objectives. If you have a client with blood pressure at or above the risk threshold below then proceed to exercise with caution and if other risk factors are also present then refer them to a doctor before starting an exercise programme. If the risk rating is high that client will be consistently and closely monitored. Once the portfolio is completed they closely analyse the information that they have obtained and they determine the KYC risk rating of that specific client. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk. As a successful financial advisor or financial consultant assessing a clients risk profile is a not-so-simple process of engaging the client in cost-benefit analysis.

Source: medium.com

Source: medium.com

Name Email Website. Add a comment Cancel reply. Generating a Customer Risk Rating. Some industries are considered to have a lower risk. To help you with the overall risk assessment of a client or group of clients you should also consider known risk factors that can increase a clients overall MLTF risk rating such as.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

If you have a client with blood pressure at or above the risk threshold below then proceed to exercise with caution and if other risk factors are also present then refer them to a doctor before starting an exercise programme. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk. You attempt to contact a client to recommend liquidating one of the clients holdings. Industry and occupation ratings are applied to clients to assess Activity Risk. It enables a business to look for control measures that would help in curing or mitigating the impact of the risk and in.

Source: advisoryhq.com

Source: advisoryhq.com

As a successful financial advisor or financial consultant assessing a clients risk profile is a not-so-simple process of engaging the client in cost-benefit analysis. Factoring companies consider your industry when determining how to structure a proposal. The client must decide how much hes willing to pay for protection. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk. Industry and occupation ratings are applied to clients to assess Activity Risk.

Source: pinterest.com

Source: pinterest.com

As a result the holding goes unsold. If you have a client with blood pressure at or above the risk threshold below then proceed to exercise with caution and if other risk factors are also present then refer them to a doctor before starting an exercise programme. For service-based businesses few things are more important than finding clients that are a good fit for the long haul. Age being confined to a bed requiring help to get around requiring aid getting around being widowed never married welfare as a payment source insurance as a payment source and perceived health status. Score the client at agreed times as outlined in the Organizations Procedures eg.

Source: service.betterregulation.com

Source: service.betterregulation.com

Factoring companies evaluate risk differently. As a result the holding goes unsold. Robert Glazer reveals the metrics he uses to find the best prospects early on. The models deployed by most institutions today are based on an assessment of risk factors such as the customers occupation salary and the banking products used. Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate.

Source: pinterest.com

Source: pinterest.com

Once the portfolio is completed they closely analyse the information that they have obtained and they determine the KYC risk rating of that specific client. Risk Capacity is the level of financial risk the client can afford to take and. Once the portfolio is completed they closely analyse the information that they have obtained and they determine the KYC risk rating of that specific client. 140 mmHg or greater. Some industries are considered to have a lower risk.

Source: lucidchart.com

Source: lucidchart.com

The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. For service-based businesses few things are more important than finding clients that are a good fit for the long haul. Understanding the risk factors is really important so is understanding the factors on which risk buckets are categorised. Risk Required and Risk Capacity are financial characteristics calculated using a financial planning tool. Risk Rating Scale Score Level of Risk Intervention 0 Low No intervention required 1-3 Moderate 1 is a low moderate.

Source: slideteam.net

Source: slideteam.net

As of May 17 2012 this guidance applies to federal savings associations in addition to national banks. 4 Unresponsive Clients. To help you with the overall risk assessment of a client or group of clients you should also consider known risk factors that can increase a clients overall MLTF risk rating such as. The below customer elements need to be risked assessed by entering into the risk rating tool to generate an overall customer risk rating of. Ratings should reflect the risks posed by both the borrowers expected performance and the transactions structure.

Source: slideteam.net

Source: slideteam.net

Understanding the risk factors is really important so is understanding the factors on which risk buckets are categorised. Once the portfolio is completed they closely analyse the information that they have obtained and they determine the KYC risk rating of that specific client. The client must decide how much hes willing to pay for protection. For service-based businesses few things are more important than finding clients that are a good fit for the long haul. When performing customer due diligence CDD we look at data points pertaining to the customer and weigh the customer risk based on certain criteria such as geographical risk industryoccupation risk and product risk.

Source: pinterest.com

Source: pinterest.com

Criminal history of the client in regards to a designated offence See Guideline 1. Add a comment Cancel reply. Risk Required and Risk Capacity are financial characteristics calculated using a financial planning tool. Behavioural risks are monitored via the output of the Banks surveillance. Industry and occupation ratings are applied to clients to assess Activity Risk.

Source: researchgate.net

Source: researchgate.net

Nine variables emerged as statistically significant predictors. How much risk a client can afford to take without risking their objectives. Using factors such as length of relationship and age of business. 140 mmHg or greater. A clients risk profile is the level of risk the client is willing to accept.

Source: researchgate.net

Source: researchgate.net

Name Email Website. Generating a Customer Risk Rating. If you have a client with blood pressure at or above the risk threshold below then proceed to exercise with caution and if other risk factors are also present then refer them to a doctor before starting an exercise programme. 140 mmHg or greater. Score the client at agreed times as outlined in the Organizations Procedures eg.

Source: pinterest.com

Source: pinterest.com

The position drops substantially and the client submits a complaint to your brokerdealer. Factoring companies evaluate risk differently. If the risk rating is low the client will still be monitored but not as diligently. Risk Tolerance is the level of risk the client is comfortable with. How much risk a client is willing to take in pursuit of better returns.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title client risk rating factors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas