13+ Commercial transactions interest rate ideas

Home » money laundering Info » 13+ Commercial transactions interest rate ideasYour Commercial transactions interest rate images are available in this site. Commercial transactions interest rate are a topic that is being searched for and liked by netizens today. You can Download the Commercial transactions interest rate files here. Find and Download all free photos.

If you’re searching for commercial transactions interest rate pictures information connected with to the commercial transactions interest rate interest, you have come to the ideal blog. Our website frequently provides you with hints for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Commercial Transactions Interest Rate. Generally the Ministry of Finance shall review the interest rate every period of 3 years taking into account the interest rates of deposits and loans of commercial banks. 850 Belgian Official Journal of February 1st 2016 LEGAL BASIS. Article 306 of the Commercial Law 2005 provides for the application of the interest rate due to the delay of payment as follows. Therefore in case the Bill came into force the new default interest rate would be five percent 5 per annum ie the standard interest rate of.

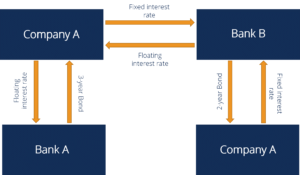

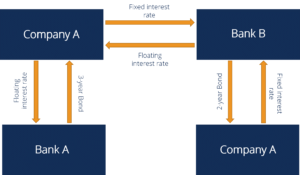

Interest Rate Swap Learn How Interest Rate Swaps Work From corporatefinanceinstitute.com

Interest Rate Swap Learn How Interest Rate Swaps Work From corporatefinanceinstitute.com

If there is no such agreement or if the commercial transaction is between an undertaking and a public authority the applicable interest rate is equal to the sum of the reference rate and at least 8. How to Determine Interest Rate for Late Payment Obligations in Commercial Transaction. Where late payment interest falls due the supplier is also entitled to the automatic payment of compensation costs. Once payments fall outside of the contractual payment terms interest is calculated at the equivalent daily rate. PROVISIONS RELATING TO SPECIFIC TYPES OF COMMERCIAL LOANS OR TRANSACTIONS. For the year 2017 it has been set at 20.

Statutory interest is 8 plus the Bank of England base rate for business to business transactions.

Description The interest rate for late payment of obligations in commercial business is applied according to the average interest rate on overdue debts in the market at the time of payment corresponding to the late payment period unless otherwise agreed or otherwise provided by law. How to Determine Interest Rate for Late Payment Obligations in Commercial Transaction. For example if the Bank of England base rate is 05 statutory interest for a recent debt would. Where a contract-breaching party delays making payment for goods or payment of service charges and other reasonable fees the aggrieved party may claim an interest on such delayed payment. Article 306 of the Commercial Law 2005 provides for the application of the interest rate due to the delay of payment as follows. Commercial bank lending interest rates in Uganda have persistently remained high.

Source: euro-area-statistics.org

Source: euro-area-statistics.org

Commercial Banks Foreign Currency Interest Rate Swap Transactions Classified by Counter Parties. You cant claim statutory interest if your customer is a consumer and not acting in the course of a business in this case you can only claim interest if the contract sets a contractual rate. As from the 13th of August 2012 the Directive 20117EU of the European Parliament and of the Council of 16th February 2011 on combating late payment in commercial. Enterprises are automatically entitled without the necessity of a reminder to interest for late payments. The legal interest rate for late payments in commercial transactions will be 8 as of January 1 2018 since the applicable ECB rate that would be added to this baseline rate is currently zero.

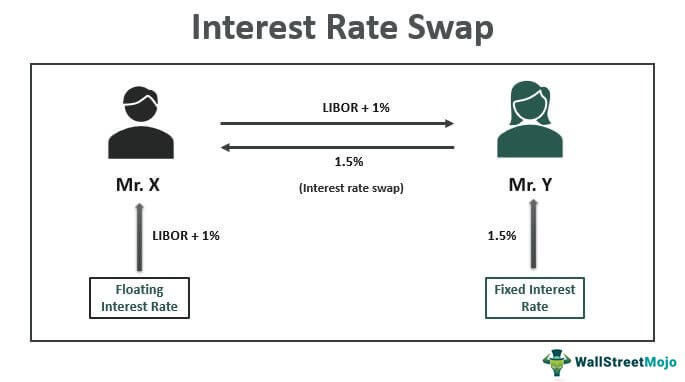

Source: wallstreetmojo.com

Source: wallstreetmojo.com

How to Determine Interest Rate for Late Payment Obligations in Commercial Transaction. The 3 interest rate can be changed to a lower or higher rate by a Royal Decree which may be issued from time to time in response to the prevailing economic conditions. B The parties to a qualified commercial loan agreement may. The study aimed at understanding the relationship between relationship lending transaction costs and lending interest rates. For example if the Bank of England base rate is 05 statutory interest for a recent debt would.

Source: dailyfx.com

Source: dailyfx.com

850 Belgian Official Journal of February 1st 2016 LEGAL BASIS. Interest rate applicable to commercial transactions In the same way as for civil and commercial matters the legal interest rate applicable in the event of late payment in commercial transactions applies only if the two parties have not agreed on another interest rate in the contract binding them. Once payments fall outside of the contractual payment terms interest is calculated at the equivalent daily rate. Article 306 of the Commercial Law 2005 provides for the application of the interest rate due to the delay of payment as follows. Statutory interest rate for late payment is 8 percentage points above the European Central Banks reference rate.

Source: educba.com

Source: educba.com

In the last years the statutory interest rate for. In the last years the statutory interest rate for. Statutory interest rate for late payment is 8 percentage points above the European Central Banks reference rate. Article 306 of the Commercial Law 2005 provides for the application of the interest rate due to the delay of payment as follows. B The parties to a qualified commercial loan agreement may.

Source: rbi.org.in

Source: rbi.org.in

Commercial Banks Thai Baht Interest Rate Swap Transactions Classified by Counter Parties. How to Determine Interest Rate for Late Payment Obligations in Commercial Transaction. You cant claim statutory interest if your customer is a consumer and not acting in the course of a business in this case you can only claim interest if the contract sets a contractual rate. Where interest is applied the rate can be matched to the ECB rate plus 8 unless another arrangement is pre-defined in contract. Therefore in case the Bill came into force the new default interest rate would be five percent 5 per annum ie the standard interest rate of.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Statutory interest is 8 plus the Bank of England base rate for business to business transactions. The legal interest rate for late payments in commercial transactions will be 8 as of January 1 2018 since the applicable ECB rate that would be added to this baseline rate is currently zero. You cant claim statutory interest if your customer is a consumer and not acting in the course of a business in this case you can only claim interest if the contract sets a contractual rate. Commercial Banks Thai Baht Interest Rate Swap Outstanding Classified by Counter Parties. Generally the Ministry of Finance shall review the interest rate every period of 3 years taking into account the interest rates of deposits and loans of commercial banks.

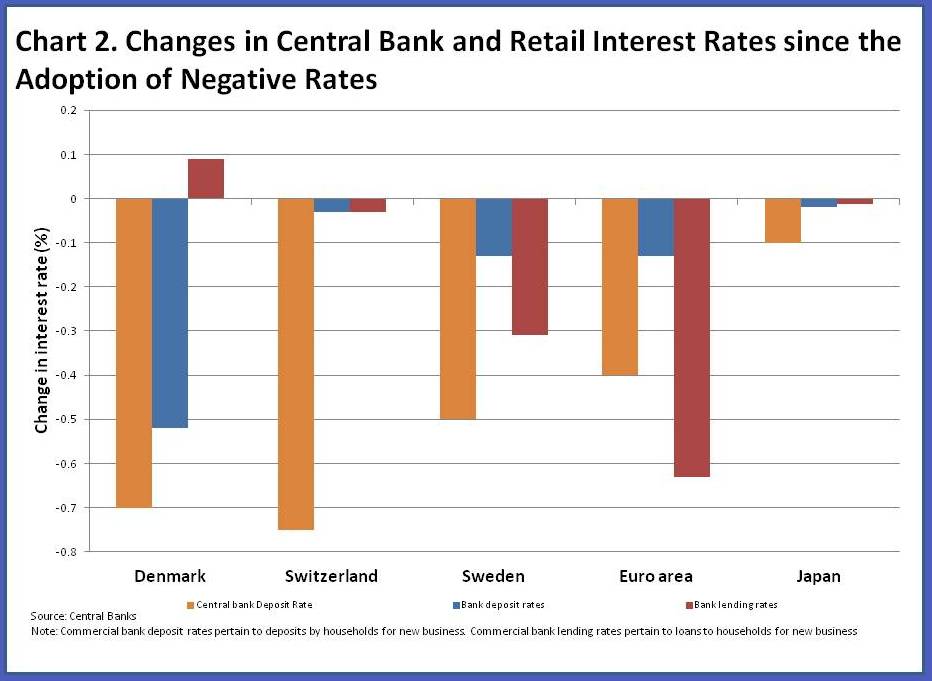

Source: blogs.imf.org

Source: blogs.imf.org

B The parties to a qualified commercial loan agreement may. Enterprises are automatically entitled without the necessity of a reminder to interest for late payments. Description The interest rate for late payment of obligations in commercial business is applied according to the average interest rate on overdue debts in the market at the time of payment corresponding to the late payment period unless otherwise agreed or otherwise provided by law. If there is no such agreement or if the commercial transaction is between an undertaking and a public authority the applicable interest rate is equal to the sum of the reference rate and at least 8. The Malta Association of Credit Management MACM informs the Maltese business community that the applicable legal interest rate in the event of late payment in commercial transactions in force on 1 st July 2020 is 800.

Source: investopedia.com

Source: investopedia.com

Enterprises are automatically entitled without the necessity of a reminder to interest for late payments. As from the 13th of August 2012 the Directive 20117EU of the European Parliament and of the Council of 16th February 2011 on combating late payment in commercial. In the event of a default at a commercial transaction after 01122002 a creditor could impose an interest of eight percent in January 2019. Statutory interest rate for late payment is 8 percentage points above the European Central Banks reference rate. Where late payment interest falls due the supplier is also entitled to the automatic payment of compensation costs.

Source: bi.go.id

You cant claim statutory interest if your customer is a consumer and not acting in the course of a business in this case you can only claim interest if the contract sets a contractual rate. Where a contract-breaching party delays making payment for goods or payment of service charges and other reasonable fees the aggrieved party may claim an interest on such delayed payment. PROVISIONS RELATING TO SPECIFIC TYPES OF COMMERCIAL LOANS OR TRANSACTIONS. Therefore in case the Bill came into force the new default interest rate would be five percent 5 per annum ie the standard interest rate of. Article 306 of the Commercial Law 2005 provides for the application of the interest rate due to the delay of payment as follows.

Source: rba.gov.au

Source: rba.gov.au

In the last years the statutory interest rate for. Article 306 of the Commercial Law 2005 provides for the application of the interest rate due to the delay of payment as follows. This rate equates to a daily rate of 0022. For the year 2017 it has been set at 20. Description The interest rate for late payment of obligations in commercial business is applied according to the average interest rate on overdue debts in the market at the time of payment corresponding to the late payment period unless otherwise agreed or otherwise provided by law.

Source: sharesansar.com

Source: sharesansar.com

The study aimed at understanding the relationship between relationship lending transaction costs and lending interest rates. Interest rate applicable to commercial transactions In the same way as for civil and commercial matters the legal interest rate applicable in the event of late payment in commercial transactions applies only if the two parties have not agreed on another interest rate in the contract binding them. Statutory interest rate for late payment is 8 percentage points above the European Central Banks reference rate. PROVISIONS RELATING TO SPECIFIC TYPES OF COMMERCIAL LOANS OR TRANSACTIONS. The Malta Association of Credit Management MACM informs the Maltese business community that the applicable legal interest rate in the event of late payment in commercial transactions in force on 1 st July 2020 is 800.

Source: rbi.org.in

Source: rbi.org.in

In the event of a default at a commercial transaction after 01122002 a creditor could impose an interest of eight percent in January 2019. 225 Belgian Official Journal of January 18th 2016 -Second half of the year 2016. Generally the Ministry of Finance shall review the interest rate every period of 3 years taking into account the interest rates of deposits and loans of commercial banks. Once payments fall outside of the contractual payment terms interest is calculated at the equivalent daily rate. For example if the Bank of England base rate is 05 statutory interest for a recent debt would.

Source: educba.com

Source: educba.com

As from the 13th of August 2012 the Directive 20117EU of the European Parliament and of the Council of 16th February 2011 on combating late payment in commercial. A The parties to a qualified commercial loan agreement may contract for a rate or amount of interest that does not exceed the applicable rate ceiling. Statutory interest rate for late payment is 8 percentage points above the European Central Banks reference rate. The Malta Association of Credit Management MACM informs the Maltese business community that the applicable legal interest rate in the event of late payment in commercial transactions in force on 1 st July 2020 is 800. With effect from 1 January 2021 the late payment interest rate is 800 per annum that is based on the ECB rate as at 1 January 2021 of 000 plus the margin of 8.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial transactions interest rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas