10+ Consequences of money laundering in south africa ideas

Home » money laundering Info » 10+ Consequences of money laundering in south africa ideasYour Consequences of money laundering in south africa images are available in this site. Consequences of money laundering in south africa are a topic that is being searched for and liked by netizens now. You can Get the Consequences of money laundering in south africa files here. Find and Download all free photos and vectors.

If you’re looking for consequences of money laundering in south africa images information related to the consequences of money laundering in south africa keyword, you have come to the right blog. Our site always gives you hints for seeing the highest quality video and image content, please kindly search and locate more informative video articles and images that match your interests.

Consequences Of Money Laundering In South Africa. The Financial Intelligence Centre Act 38 of 2001 FIC Act aims to make this. There will always be fraud and corruption. 121 of 1998 POCA The Financial Intelligence Centre Act No. Criminal offences in the Amendment Bill are reserved specifically for traditional money-laundering activityor terrorist financing.

Corruption And Money Laundering The Nexus Way Forward From intosaijournal.org

Corruption And Money Laundering The Nexus Way Forward From intosaijournal.org

38 of 2001 FICA as amended. While this may make transferring money a bit more time consuming it. Under South Africas primary anti-money laundering AML legislation POCA it is an offence to enter into a transaction so as conceal or disguise the nature or source of property including money which is deemed to be the proceeds of unlawful activity. 121 of 1998 POCA The Financial Intelligence Centre Act No. The Financial Intelligence Centre FIC was established in 2001 to act as the primary authority over Anti-Money Laundering AML efforts in South Africa. The leaked documents revealed information about 214.

In particular a bank that receives the benefits of crimes such as fraud or theft faces prosecution if it fails to heed FICAs money laundering control duties for example the filing of a suspicious transaction report.

Another important money laundering issue currently faced by South Africa is where domestic attempts to comply with international anti-money laundering requirements result in negative economic consequences. Money Laundering and KYC regulations in South Africa May 16 2018 Samantha S Learning 5 minutes Where there is money. The Financial Intelligence Centre Act 38 of 2001 FIC Act aims to make this. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. In particular a bank that receives the benefits of crimes such as fraud or theft faces prosecution if it fails to heed FICAs money laundering control duties for example the filing of a suspicious transaction report. 312 Aiding and Abetting.

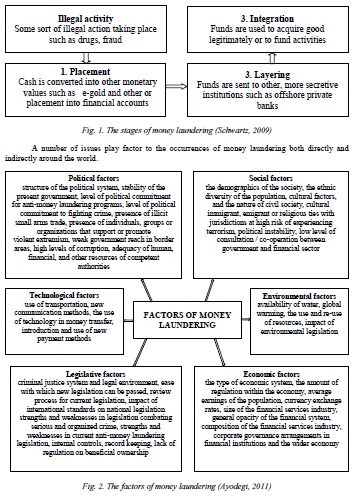

Source: researchgate.net

Source: researchgate.net

This is addressed in more detail in 313 Money Laundering below. For instance the higher profile accorded to banks in preventing money laundering is premised on the assumption that they occupy a front-line role in detecting transactions involving the proceeds of crime. In particular a bank that receives the benefits of crimes such as fraud or theft faces prosecution if it fails to heed FICAs money laundering control duties for example the filing of a suspicious transaction report. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks.

Source: slideshare.net

Source: slideshare.net

The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. While this may make transferring money a bit more time consuming it. Money laundering is considered a major crime in South Africa. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. Financial institutions aim to ensure AML compliance by making controls according to regulations.

Source: researchgate.net

Source: researchgate.net

This is addressed in more detail in 313 Money Laundering below. South Africa prevents financial crimes with the AML regulations they publish. Criminal offences in the Amendment Bill are reserved specifically for traditional money-laundering activityor terrorist financing. Money laundering is considered a major crime in South Africa. It is suggested that certain sections of FICA and POCA fail to find the required balance between protecting citizens from the harms of money laundering and protecting the fundamental rights of attorneys and their clients.

Source: researchgate.net

Source: researchgate.net

Criminal offences in the Amendment Bill are reserved specifically for traditional money-laundering activityor terrorist financing. For instance the higher profile accorded to banks in preventing money laundering is premised on the assumption that they occupy a front-line role in detecting transactions involving the proceeds of crime. Money laundering is considered a major crime in South Africa. South Africa is the only African country that is a member of the FATF which means they adhere to strict regulations to prevent money laundering and other criminal activity such as tax evasion. 312 Aiding and Abetting.

Source: infotaste.com

Source: infotaste.com

South Africa is the only African country that is a member of the FATF which means they adhere to strict regulations to prevent money laundering and other criminal activity such as tax evasion. Violation of this act carries a fine of up to rand 100 million or imprisonment for up to 30 years. Another important money laundering issue currently faced by South Africa is where domestic attempts to comply with international anti-money laundering requirements result in negative economic consequences. One of the lingering issues in anti-money laundering in South Africa is the degree of market penetration by financial institutions. The money laundering risk for financial institutions can be defined as the risk of non-detection of laundering of money through bank accounts or by using any p.

Source: researchgate.net

Source: researchgate.net

The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. Iii contains a general reporting obligation for businesses coming into. The Financial Intelligence Centre Act 38 of 2001 FIC Act aims to make this. In South Africa the requirement to apply appropriate risk based procedures to politically exposed persons has been limited to banks. Violation of this act carries a fine of up to rand 100 million or imprisonment for up to 30 years.

Source: intosaijournal.org

Source: intosaijournal.org

Idiosyncrasies of the South African anti-money laundering regime and forwards recommendations aimed at improving its structure. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. The leaked documents revealed information about 214. Money Laundering and KYC regulations in South Africa May 16 2018 Samantha S Learning 5 minutes Where there is money. Iii contains a general reporting obligation for businesses coming into.

Source: researchgate.net

Source: researchgate.net

The leaked documents revealed information about 214. Ii criminalises money laundering in general and also creates a number of serious offences in respect of laundering and racketeering. And Southern Africa Anti-Money laundering Group ESAAMLG in 1999. It is suggested that certain sections of FICA and POCA fail to find the required balance between protecting citizens from the harms of money laundering and protecting the fundamental rights of attorneys and their clients. Money laundering by terror organisations and organised crime syndicates is one of the biggest challenges facing governments world wide.

Source: slideplayer.com

Source: slideplayer.com

The leaked documents revealed information about 214. Idiosyncrasies of the South African anti-money laundering regime and forwards recommendations aimed at improving its structure. Money Laundering and KYC regulations in South Africa May 16 2018 Samantha S Learning 5 minutes Where there is money. Iii contains a general reporting obligation for businesses coming into. There will always be fraud and corruption.

Source: slideplayer.com

Source: slideplayer.com

The money laundering risk for financial institutions can be defined as the risk of non-detection of laundering of money through bank accounts or by using any p. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. The Financial Intelligence Centre FIC was established in 2001 to act as the primary authority over Anti-Money Laundering AML efforts in South Africa. Ii criminalises money laundering in general and also creates a number of serious offences in respect of laundering and racketeering. In addition if money laundering.

Source: researchgate.net

Source: researchgate.net

312 Aiding and Abetting. And Southern Africa Anti-Money laundering Group ESAAMLG in 1999. The leaked documents revealed information about 214. While this may make transferring money a bit more time consuming it. The advances in technology and particularly electronic funds transfers brought a dramatic increase in organised crime.

Source:

Money laundering is considered a major crime in South Africa. The money laundering risk for financial institutions can be defined as the risk of non-detection of laundering of money through bank accounts or by using any p. There will always be fraud and corruption. It is suggested that certain sections of FICA and POCA fail to find the required balance between protecting citizens from the harms of money laundering and protecting the fundamental rights of attorneys and their clients. The Financial Intelligence Centre Act 38 of 2001 FIC Act aims to make this.

Source: elibrary.imf.org

Source: elibrary.imf.org

The money laundering risk for financial institutions can be defined as the risk of non-detection of laundering of money through bank accounts or by using any p. The penalties for conviction of offences under sections 55 62A 62B 62C or 62D remain the same ie. In addition if money laundering. The investigation fundamentally reveals that money laundering control holds unforeseen consequences for banks. Violation of this act carries a fine of up to rand 100 million or imprisonment for up to 30 years.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title consequences of money laundering in south africa by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas