19+ Countries with higher risk of money laundering ideas

Home » money laundering idea » 19+ Countries with higher risk of money laundering ideasYour Countries with higher risk of money laundering images are available in this site. Countries with higher risk of money laundering are a topic that is being searched for and liked by netizens today. You can Get the Countries with higher risk of money laundering files here. Get all free photos and vectors.

If you’re looking for countries with higher risk of money laundering images information connected with to the countries with higher risk of money laundering interest, you have pay a visit to the right site. Our site frequently gives you hints for seeing the highest quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

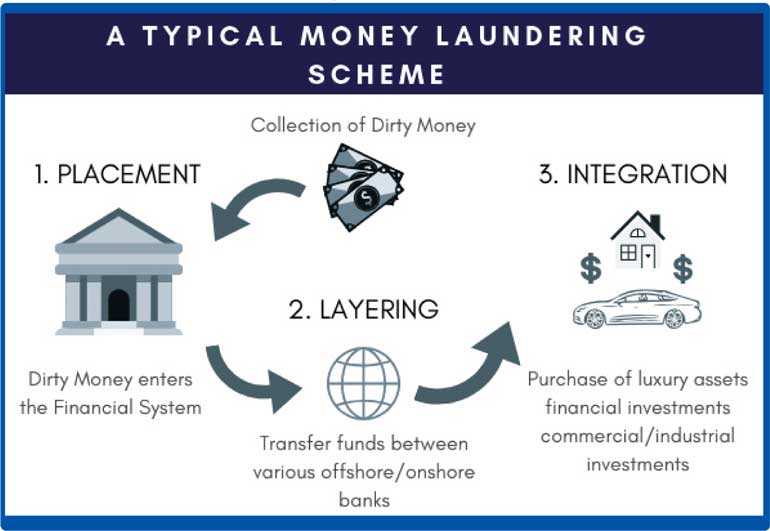

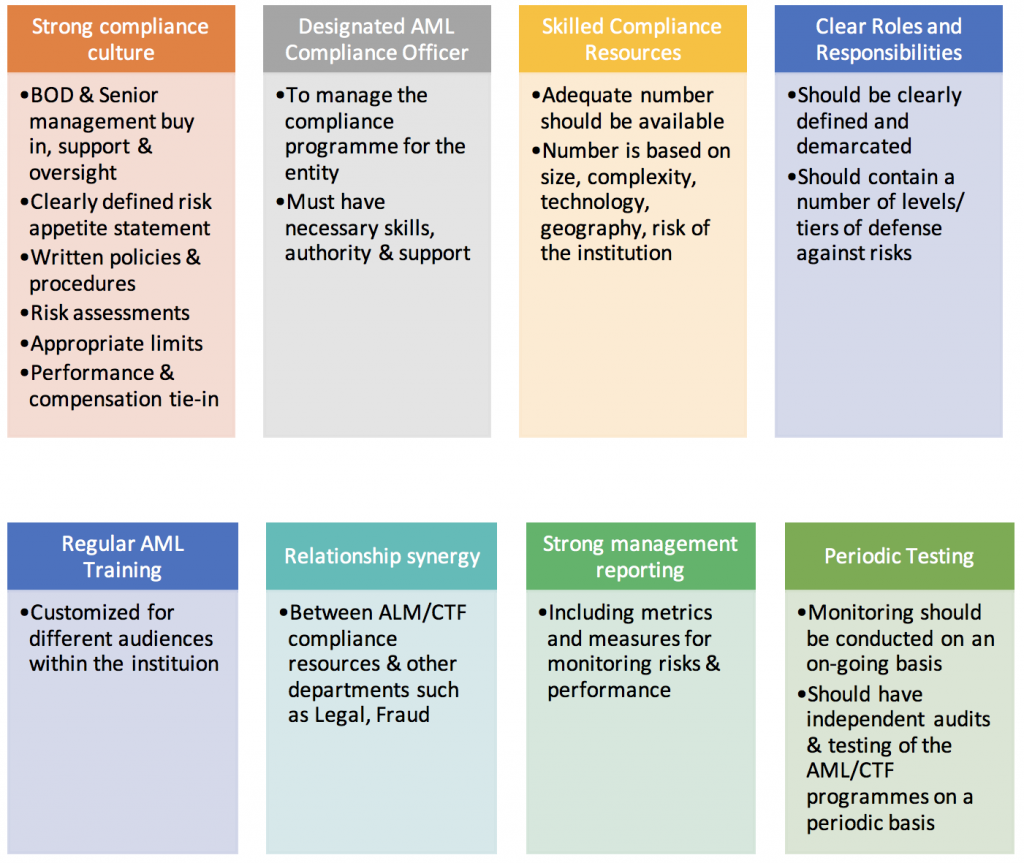

Countries With Higher Risk Of Money Laundering. As of October 2018 the FATF has reviewed over 80 countries and. Industries that involve certain products or services can also be a factor contributing to a higher risk of terrorist financing or money laundering. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included.

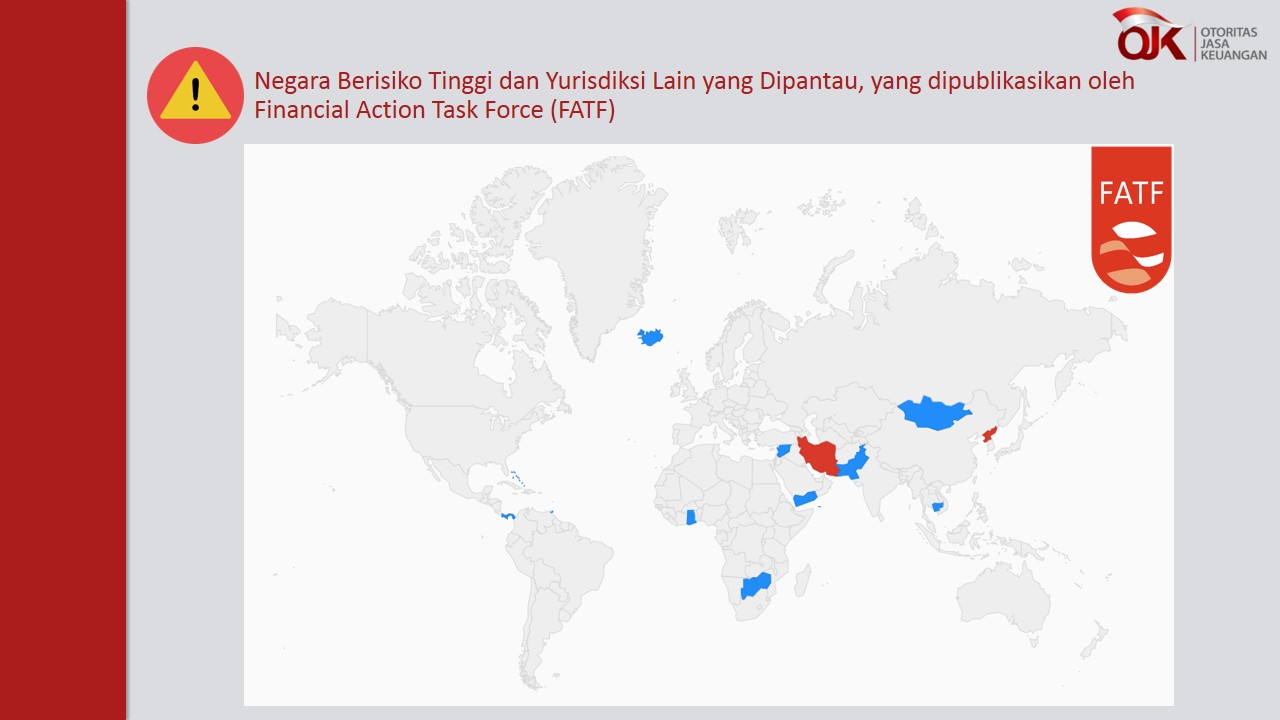

Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. EU list of high-risk third countries 13 February 2019 by eub2– last modified 13 February 2019 The EU Commission adopted on 13 February its new list of 23 third countries with strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks. You should have risk-based systems and controls in place for. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD.

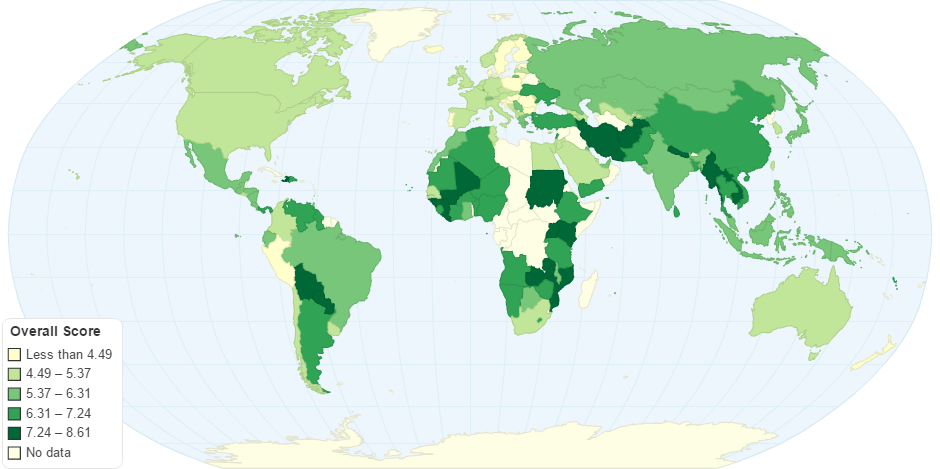

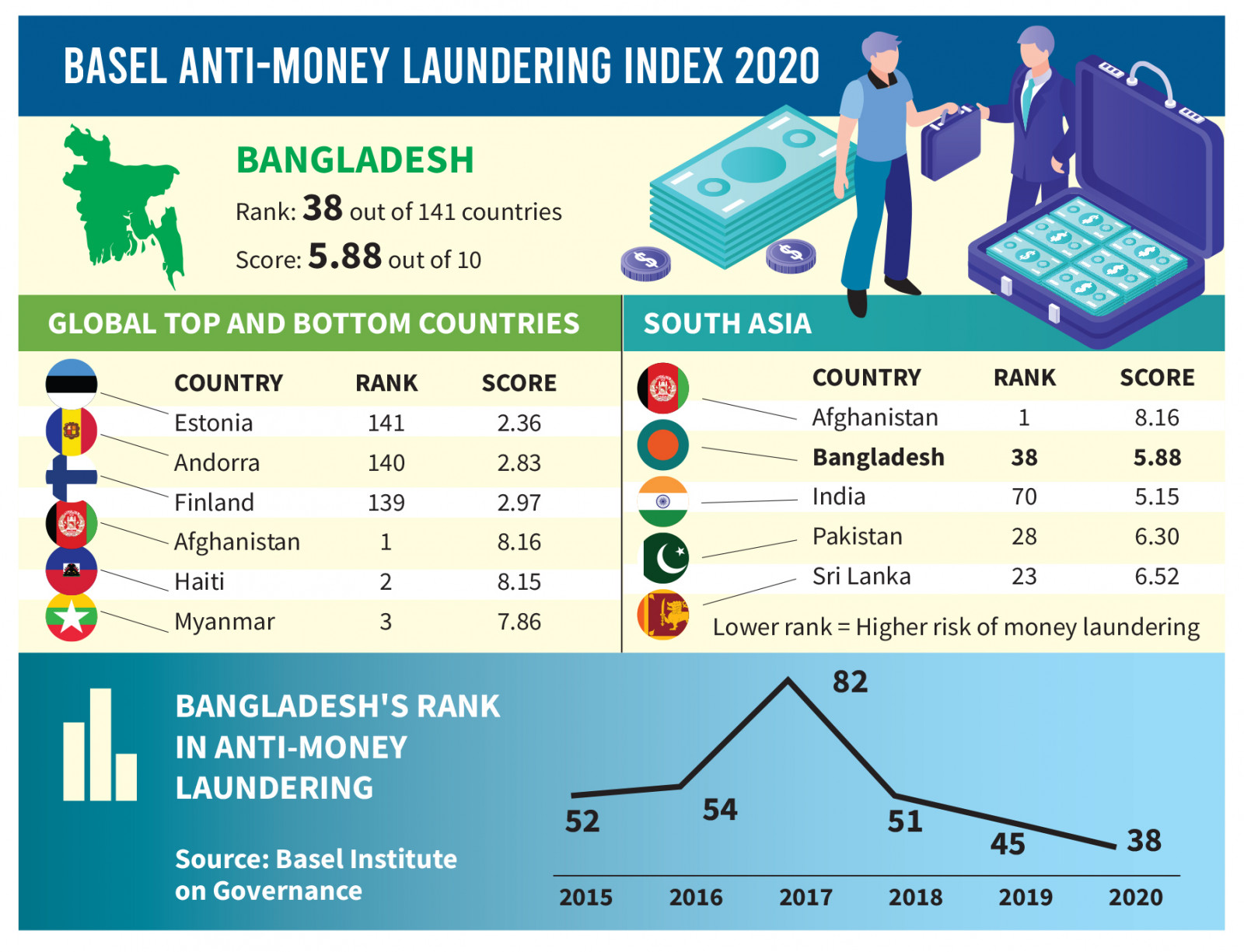

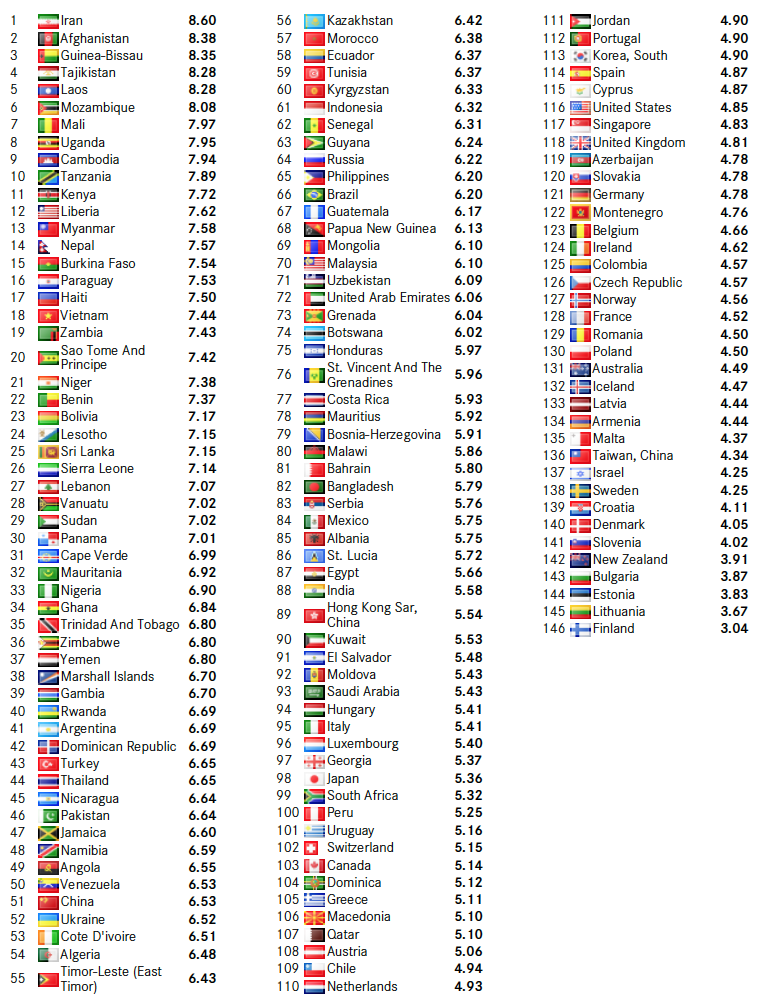

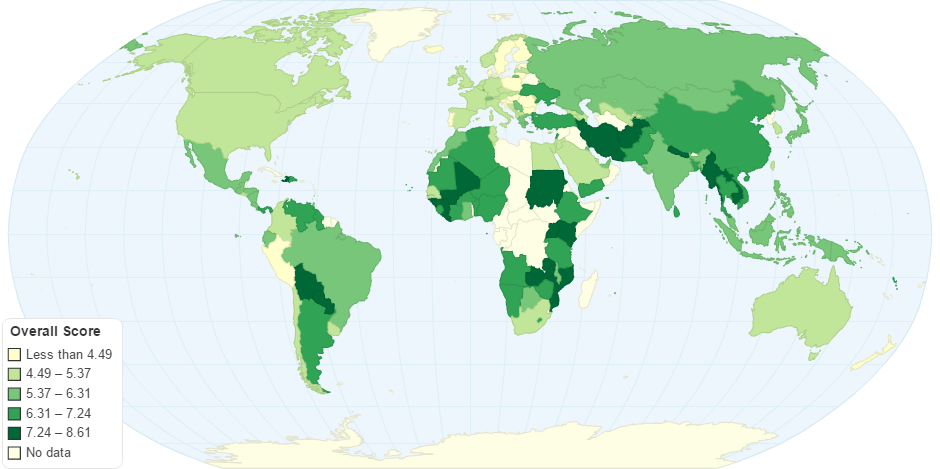

The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world.

Hong Kong Japan Singapore and Taiwan face the most massive issues with financial secrecy. As of October 2018 the FATF has reviewed over 80 countries and. Money Laundering Regulations. The Democratic Peoples Republic of Korea and Iran remain high-risk jurisdictions. As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing. The 24 high-risk third countries are.

Source: bi.go.id

Source: bi.go.id

Industries that involve certain products or services can also be a factor contributing to a higher risk of terrorist financing or money laundering. Hong Kong Japan Singapore and Taiwan face the most massive issues with financial secrecy. The Democratic Peoples Republic of Korea and Iran remain high-risk jurisdictions. These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants. The Money Laundering and Terrorist Financing AmendmentNo2High-Risk Countries Regulations 2021 substitutes the list of high-risk third countries specified in Schedule 3ZA of the MLRs with a.

Source: ft.lk

Source: ft.lk

New delegated act on high-risk third countries. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. New delegated act on high-risk third countries. A total of 14 indicators that deal with AMLCFT regulations corruption financial standards political disclosure and rule of law are aggregated into one overall risk. These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants.

Source: ojk.go.id

Source: ojk.go.id

High-Risk Products or Services. High Risk Third Countries Statement UK national risk assessment of money laundering and terrorist financing Money laundering. The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world. The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes.

Source: tbsnews.net

Source: tbsnews.net

These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants. High-risk countries and regions Customers from any of these places and transactions to or from these places require careful monitoring. What are considered higher risk customer types for money laundering. Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants.

Source: pinterest.com

Source: pinterest.com

As of October 2018 the FATF has reviewed over 80 countries and. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. The 24 high-risk third countries are. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum.

Source: ec.europa.eu

Source: ec.europa.eu

We list nearly half of all countries as major money-laundering destinations - China Hong Kong Indonesia Laos Macao Malaysia Myanmar Philippines Thailand and Vietnam. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 9 2 of the Fourth Money Laundering Directive 4MLD. What are considered higher risk customer types for money laundering. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing. A large volume of electronic payments like ACH wire transfers remittances.

Source: pinterest.com

Source: pinterest.com

Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. The 24 high-risk third countries are. We list nearly half of all countries as major money-laundering destinations - China Hong Kong Indonesia Laos Macao Malaysia Myanmar Philippines Thailand and Vietnam. You should have risk-based systems and controls in place for.

Source: bi.go.id

Source: bi.go.id

Financial sanctions listings found here countries identified by Financial Action Task Force as being high-risk jurisdictions found here European Unions High Risk Third Country List found here amended in. As part of your AMLCTF program and reporting obligations you should be aware of which countries regions and groups that may pose a high-risk of money laundering or terrorism financing. The Democratic Peoples Republic of Korea and Iran remain high-risk jurisdictions. The Basel AML Index measures the risk of money laundering and terrorist financing of countries based on publicly available sources. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing.

Source: baselgovernance.org

Source: baselgovernance.org

The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. Hong Kong Japan Singapore and Taiwan face the most massive issues with financial secrecy. The Money Laundering and Terrorist Financing Amendment High-Risk Countries Regulations 2021 will come into force on the 26 March 2021 and will amend the definition of a high risk third country. What are considered higher risk customer types for money laundering. A large volume of electronic payments like ACH wire transfers remittances.

Source: tbsnews.net

Source: tbsnews.net

This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. Industries that involve certain products or services can also be a factor contributing to a higher risk of terrorist financing or money laundering. The Democratic Peoples Republic of Korea and Iran remain high-risk jurisdictions. High-Risk Products or Services. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world.

Source: ctmfile.com

Source: ctmfile.com

High-Risk Countries for Money Laundering. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Industries that involve certain products or services can also be a factor contributing to a higher risk of terrorist financing or money laundering. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing. New delegated act on high-risk third countries.

The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money. These regimes are designed to build programs that identify trace and prevent financial support to criminals terrorists or fraudulent merchants. We list nearly half of all countries as major money-laundering destinations - China Hong Kong Indonesia Laos Macao Malaysia Myanmar Philippines Thailand and Vietnam. Money Laundering Regulations. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. The global fight against money laundering has led many countries to develop strict AMLCTF Anti-Money LaunderingCombating the Financing of Terrorism regimes. This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. A large volume of electronic payments like ACH wire transfers remittances.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title countries with higher risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information