19++ Crr customer risk rating information

Home » money laundering Info » 19++ Crr customer risk rating informationYour Crr customer risk rating images are ready. Crr customer risk rating are a topic that is being searched for and liked by netizens now. You can Get the Crr customer risk rating files here. Get all royalty-free photos.

If you’re searching for crr customer risk rating images information linked to the crr customer risk rating keyword, you have come to the right site. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and locate more informative video content and images that match your interests.

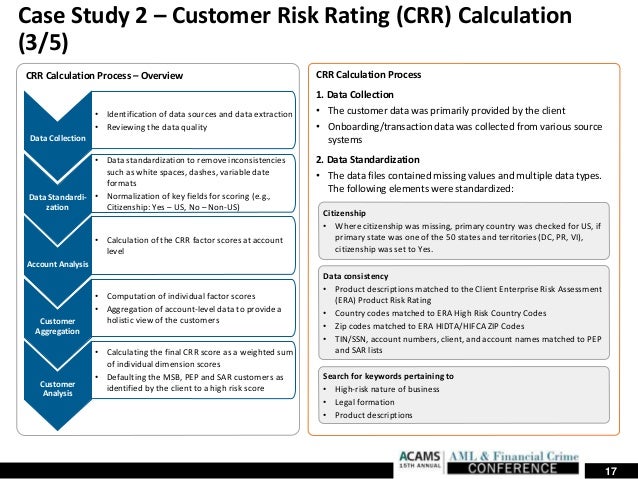

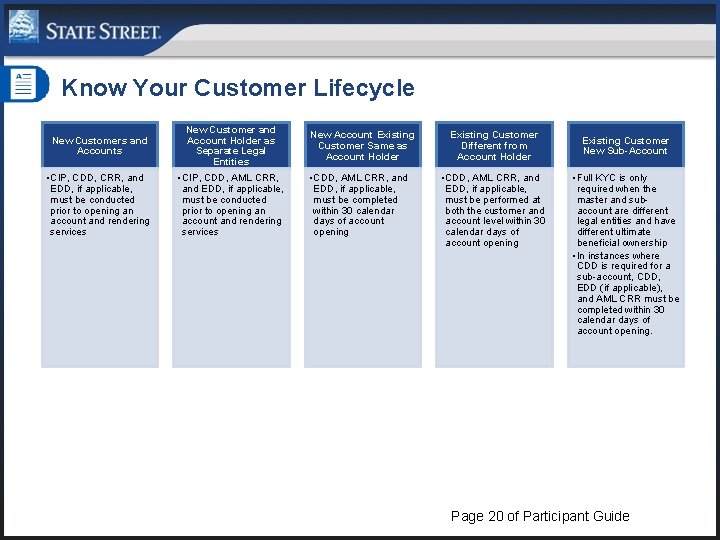

Crr Customer Risk Rating. Create a form that asks for all of the types and amounts of activities they will have on the account. Used in transaction risk scoring and fraud modelling. We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism. Customer Risk Rating CRR The following topics describe IBM Financial Crimes Alerts Insight FCAI Customer Risk Rating CRR functionality.

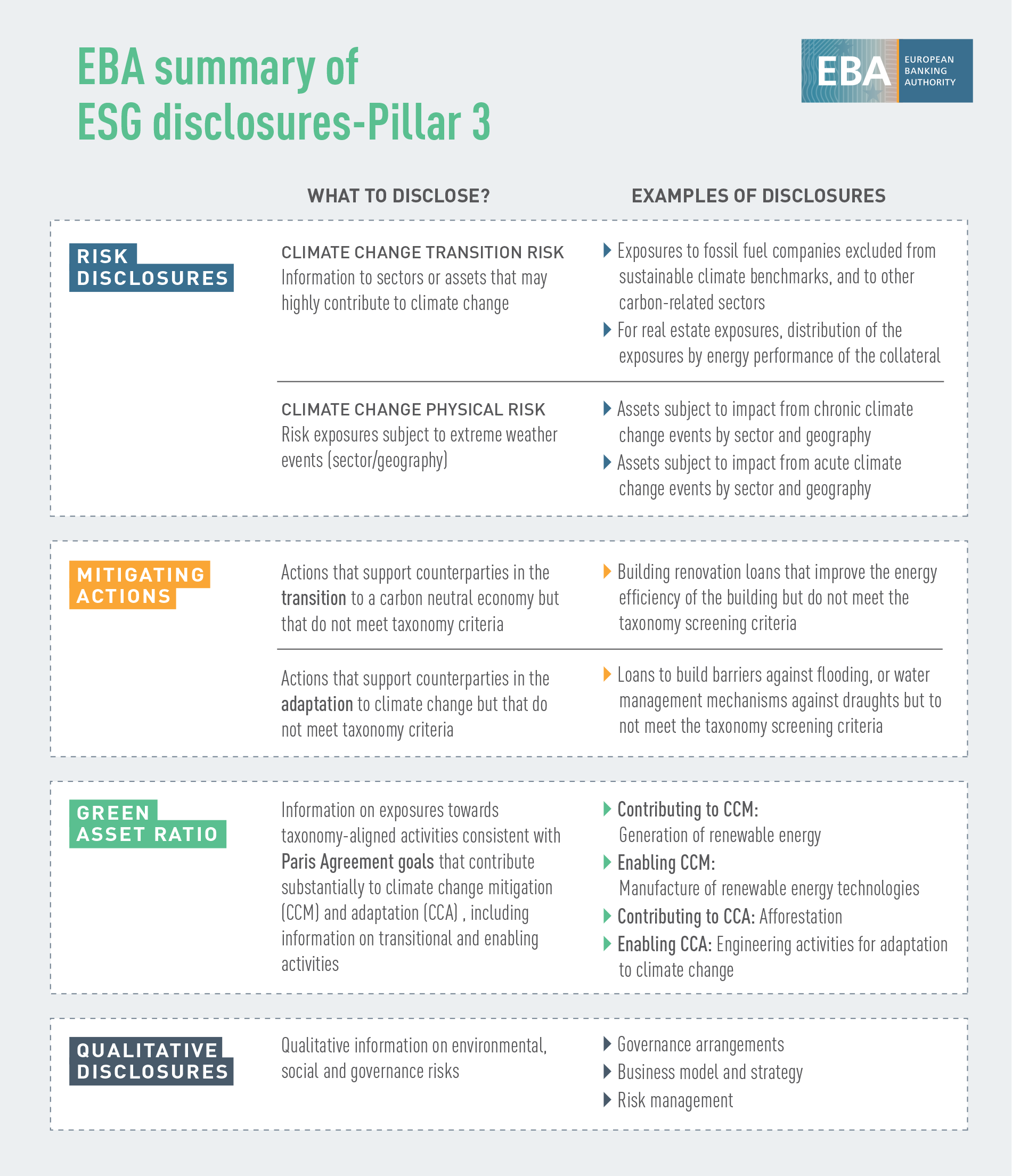

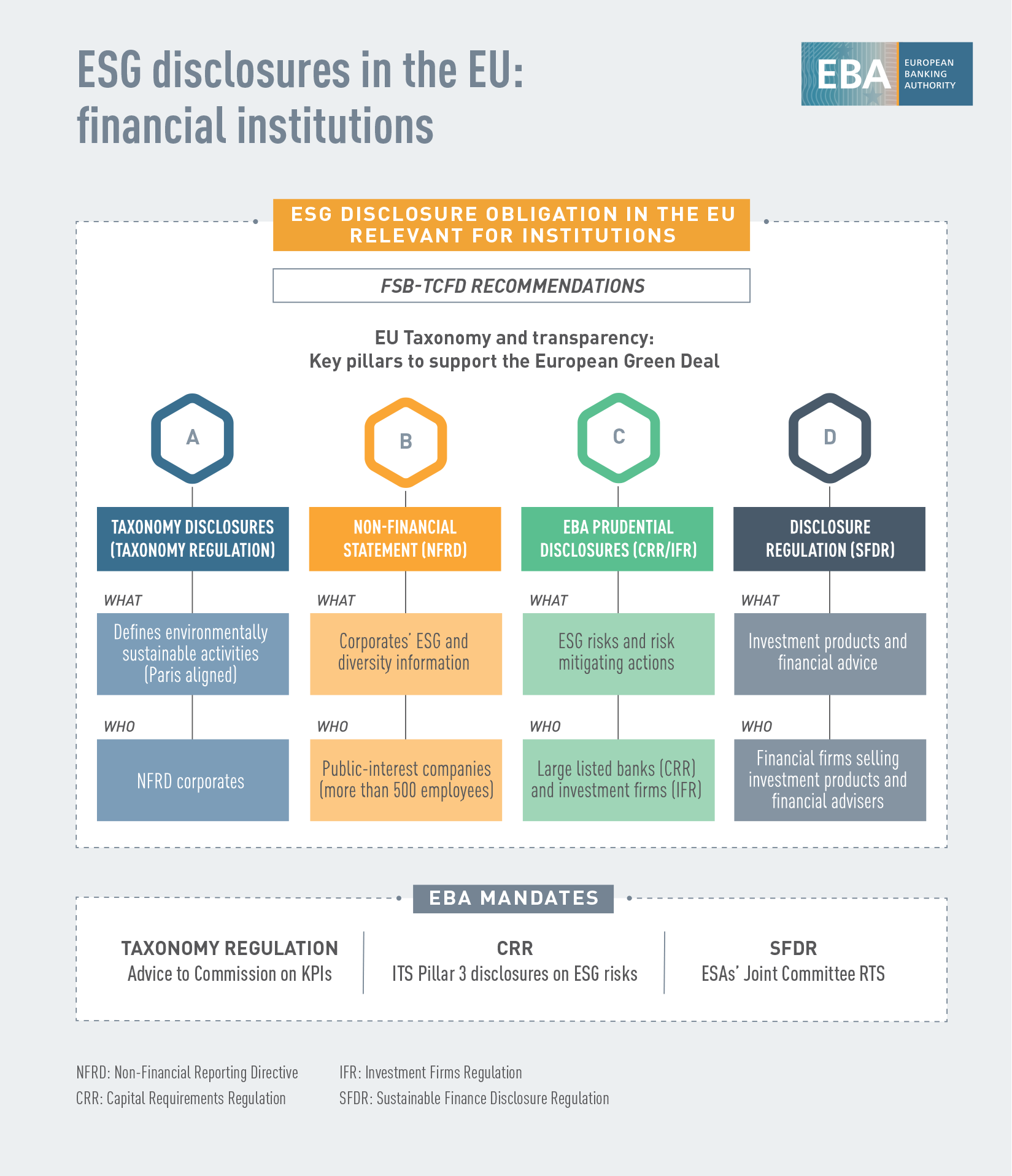

Article 261 European Banking Authority From eba.europa.eu

Article 261 European Banking Authority From eba.europa.eu

Configuring your CRR environment. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. Any customer account may be used for illicit purposes including money laundering or terrorist financing. Customer Risk Rating Workfusion can assign a customer risk rating score to a client or account based on the financial institutions internal model with connections to the core banking system transaction monitoring system negative news source and other systems to update. This functionality can be installed alone or along with Transaction List Screening TLS functionality. National bank where the customers are rated from Low to High over 13 time periods.

Used in transaction risk scoring and fraud modelling.

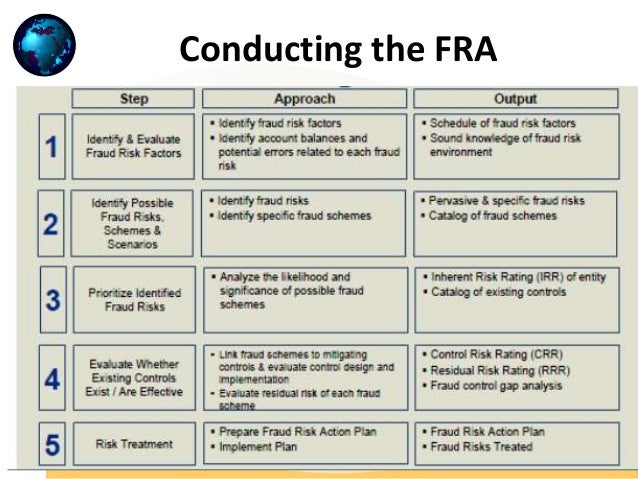

Customer retention rate CRR is simply defined as the ability of a company to retain its customers over a period of time. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers. Any customer account may be used for illicit purposes including money laundering or terrorist financing. The approach to customer risk rating described in this article which integrates aspects of two other important AML tools. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Statistical Approach to Customer Risk Rating By Mayank Johri Amin Ahmadi Michael Spieler Introduction The customer risk rating CRR models objective is to assess the AML risk of the Banks customers based on each customers profile.

Source:

It measures how many customers a company still keeps at the end of a fixed period relative to the number you had when the period started. The customer risk ratings data are described in the ensuing subsections. Customer Risk Rating Workfusion can assign a customer risk rating score to a client or account based on the financial institutions internal model with connections to the core banking system transaction monitoring system negative news source and other systems to update. Statistical Approach to Customer Risk Rating By Mayank Johri Amin Ahmadi Michael Spieler Introduction The customer risk rating CRR models objective is to assess the AML risk of the Banks customers based on each customers profile. Used at the time of issuing a credit card sanctioning loans and advances opening a new account for an existing customer or increasing limits.

Source: eba.europa.eu

Source: eba.europa.eu

Customer Risk Rating Workfusion can assign a customer risk rating score to a client or account based on the financial institutions internal model with connections to the core banking system transaction monitoring system negative news source and other systems to update. A national bank was able to establish a single consistent customer risk rating CRR methodology across its entire organization in a tight timeline without revising any lines of business. Application of stricter requirements by institutions. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. Create a form that asks for all of the types and amounts of activities they will have on the account.

Source: alamy.com

Source: alamy.com

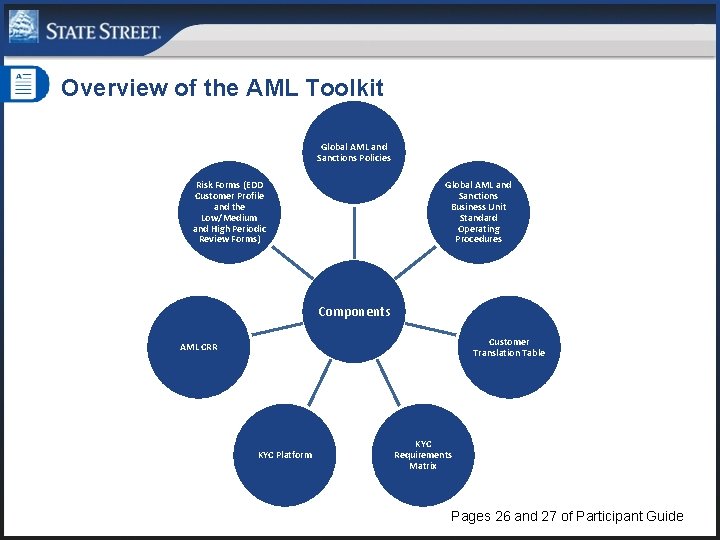

We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism. Transaction monitoring and customer screening. Configure key risk indicators and define Customer Risk Rating methodology CRR Methodology Static risk rating based on customer profile indicators. National bank where the customers are rated from Low to High over 13 time periods. We analyze data on a sample of 494 customers from a US.

Source: slideshare.net

Source: slideshare.net

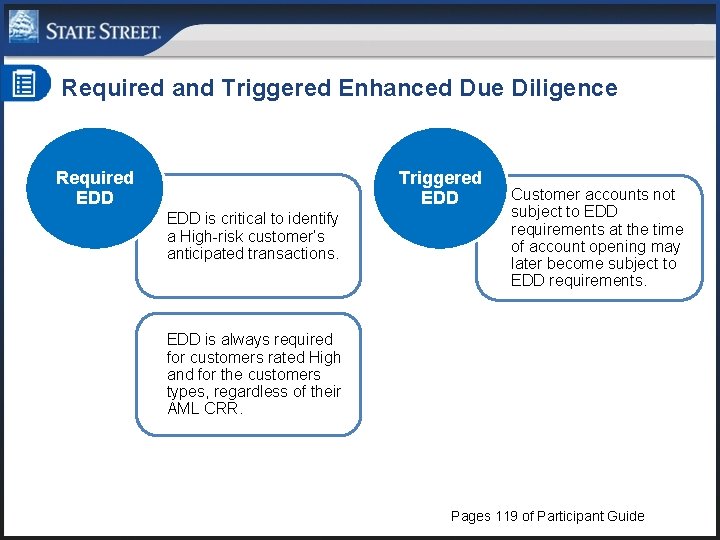

Employee at a bank 11BUSA Rating them at account opening is the easiest and then you have a baseline from which to work with gong forward. Customer Risk Rating CRR The following topics describe IBM Financial Crimes Alerts Insight FCAI Customer Risk Rating CRR functionality. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. The approach to customer risk rating described in this article which integrates aspects of two other important AML tools. Statistical Approach to Customer Risk Rating By Mayank Johri Amin Ahmadi Michael Spieler Introduction The customer risk rating CRR models objective is to assess the AML risk of the Banks customers based on each customers profile.

Source: slidetodoc.com

Source: slidetodoc.com

The approach to customer risk rating described in this article which integrates aspects of two other important AML tools. A customer risk rating tool or solution is normally utilized in conducting due diligence and risk assessment on each customer prior to opening the account. Definitions specific to capital requirements for credit risk. We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism. You can rate them based upon that information.

Source: eba.europa.eu

Source: eba.europa.eu

Customer Risk Rating CRR The following topics describe IBM Financial Crimes Alerts Insight FCAI Customer Risk Rating CRR functionality. This functionality can be installed alone or along with Transaction List Screening TLS functionality. Configuring your CRR environment. Since this would require major changes to its. Customer Risk Rating CRR The following topics describe IBM Financial Crimes Alerts Insight FCAI Customer Risk Rating CRR functionality.

Source: eba.europa.eu

Source: eba.europa.eu

Any customer account may be used for illicit purposes including money laundering or terrorist financing. Commonly referred to as the customer risk rating. A national bank was able to establish a single consistent customer risk rating CRR methodology across its entire organization in a tight timeline without revising any lines of business. The customer risk ratings data are described in the ensuing subsections. Establishing a sound customer risk rating methodology is one effective method for banks to monitor customers and accounts on an ongoing basis.

Source: slidetodoc.com

Source: slidetodoc.com

Dynamic risk rating based on transaction indicators. LEVEL OF APPLICATION OF REQUIREMENTS. The approach identifies high-risk customers far more effectively than the method used by most financial institutions today in some cases reducing the number of incorrectly labeled. Customer Risk Rating Workfusion can assign a customer risk rating score to a client or account based on the financial institutions internal model with connections to the core banking system transaction monitoring system negative news source and other systems to update. As these are sensitive data we are not able to fully disclose all characteristics of the dataset.

Source:

Used in transaction risk scoring and fraud modelling. The banks program for determining customer risk profiles should be sufficiently detailed to distinguish between. National bank where the customers are rated from Low to High over 13 time periods. Since this would require major changes to its. We analyze data on a sample of 494 customers from a US.

Source: researchgate.net

Source: researchgate.net

A statistical framework is presented to assess customer risk ratings used in anti-money laundering AML surveillance. The approach to customer risk rating described in this article which integrates aspects of two other important AML tools. A national bank was able to establish a single consistent customer risk rating CRR methodology across its entire organization in a tight timeline without revising any lines of business. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. As these are sensitive data we are not able to fully disclose all characteristics of the dataset.

Source: curentis.com

Source: curentis.com

It measures how many customers a company still keeps at the end of a fixed period relative to the number you had when the period started. Configure key risk indicators and define Customer Risk Rating methodology CRR Methodology Static risk rating based on customer profile indicators. Configuring your CRR environment. In most cases after developing a risk rating methodology it needs to be approved by both the firms Compliance and the Business senior management before it is configured into the risk rating tool. Used in transaction risk scoring and fraud modelling.

Source: slidetodoc.com

Source: slidetodoc.com

Application of stricter requirements by institutions. Transaction monitoring and customer screening. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers residence accounts and product holdings. We manipulate certain data elements to protect the identity of the bank the customers and the banks risk rating mechanism. A critical indicator is customer risk rating CRR which is a score or band assigned to a customer based on perceived financial-crime risk derived from parameters such as the customers.

Source: pt.slideshare.net

Source: pt.slideshare.net

The approach to customer risk rating described in this article which integrates aspects of two other important AML tools. LEVEL OF APPLICATION OF REQUIREMENTS. Statistical Approach to Customer Risk Rating By Mayank Johri Amin Ahmadi Michael Spieler Introduction The customer risk rating CRR models objective is to assess the AML risk of the Banks customers based on each customers profile. It measures how many customers a company still keeps at the end of a fixed period relative to the number you had when the period started. Definitions specific to capital requirements for credit risk.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title crr customer risk rating by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas