11+ Currency and foreign transactions reporting act of 1970 information

Home » money laundering Info » 11+ Currency and foreign transactions reporting act of 1970 informationYour Currency and foreign transactions reporting act of 1970 images are available in this site. Currency and foreign transactions reporting act of 1970 are a topic that is being searched for and liked by netizens today. You can Get the Currency and foreign transactions reporting act of 1970 files here. Get all free photos.

If you’re searching for currency and foreign transactions reporting act of 1970 pictures information related to the currency and foreign transactions reporting act of 1970 topic, you have pay a visit to the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

Currency And Foreign Transactions Reporting Act Of 1970. Financial institutions to assist US. Also called The Currency and Foreign Transactions Reporting Act of 1970 the BSA was initially adopted in 1970. AML rules in the United States which grew out of the Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act set strict requirements for the reporting and recordkeeping of foreign financial agency transactions the filing of reports on foreign currency exchange transactions and reporting of exporting and importing monetary instruments. Richard Nixon that requires banks and other financial entities in the United States to maintain records and file reports on currency transactions and.

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage From complyadvantage.com

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage From complyadvantage.com

Currency and Foreign Transactions Reporting Act. 26 1970 84 Stat. 5311 et seq is referred to as the Bank Secrecy Act BSA. Financial institutions to assist US. Legislation created in 1970 to prevent financial institutions from being used as tools by. Bank Secrecy Act also called Currency and Foreign Transactions Reporting Act US.

Richard Nixon that requires banks and other financial entities in the United States to maintain records and file reports on currency transactions and.

AML rules in the United States which grew out of the Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act set strict requirements for the reporting and recordkeeping of foreign financial agency transactions the filing of reports on foreign currency exchange transactions and reporting of exporting and importing monetary instruments. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Legislation created in 1970 to prevent financial institutions from being used as tools by. 301 a this act refers to only a portion of the Public Law. Rule 17a-8 – Financial Recordkeeping and Reporting of Currency and Foreign Transactions Every registered broker or dealer who is subject to the requirements of the Currency and Foreign Transactions Reporting Act of 1970 shall comply with the reporting recordkeeping and record retention requirements of part 103 of title 31 of the Code of Federal Regulations. Government uses to fight drug trafficking money laundering and other crimes.

Source: verafin.com

Source: verafin.com

Legislation created in 1970 to prevent financial institutions from being used as tools by. Treasury Department Office of Foreign Asset Control and ii applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transaction Reporting Act of 1970 as amended including the Money Laundering Control Act of 1986 as amended the rules and regulations thereunder and any related or similar money laundering statutes rules regulations or guidelines issued administered or enforced by any Federal governmental agency collectively the Money. Legislation signed into law in 1970 by Pres. Title III part J Sec. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a.

Source: nomadcapitalist.com

Source: nomadcapitalist.com

Treasury Department Office of Foreign Asset Control and ii applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transaction Reporting Act of 1970 as amended including the Money Laundering Control Act of 1986 as amended the rules and regulations thereunder and any related or similar money laundering statutes rules regulations or guidelines issued administered or enforced by any Federal governmental agency collectively the Money. Every registered broker or dealer who is subject to the requirements of the Currency and Foreign Transactions Reporting Act of 1970 shall comply with the reporting recordkeeping and record retention requirements of chapter X of title 31 of the Code of Federal Regulations. The law originally required banks to maintain certain records and to report large currency transactions. 371 et seq as added Pub. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a.

Source: complyadvantage.com

Source: complyadvantage.com

Rule 17a-8 – Financial Recordkeeping and Reporting of Currency and Foreign Transactions Every registered broker or dealer who is subject to the requirements of the Currency and Foreign Transactions Reporting Act of 1970 shall comply with the reporting recordkeeping and record retention requirements of part 103 of title 31 of the Code of Federal Regulations. 371 et seq as added Pub. 95-561 title III Sec. The Currency and Foreign Transactions Reporting Act of 1970 the Currency Act was enacted as a means of requiring certain financial institutions including broker-dealers to create records of currency transactions that may be useful in criminal tax or other regulatory investigations. 26 1970 84 Stat.

Source: boeshaarlaw.com

Source: boeshaarlaw.com

Government agencies to detect and prevent money laundering. 301 a this act refers to only a portion of the Public Law. 26 1970 84 Stat. 371 et seq as added Pub. Richard Nixon that requires banks and other financial entities in the United States to maintain records and file reports on currency transactions and.

Source: slideshare.net

Source: slideshare.net

The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. Bank Secrecy Act currency and foreign transactions reporting act of 1970 from MORTGAGE 101 at College of Staten Island CUNY. The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Also known as the Currency and Foreign Transactions Reporting Act the Bank Secrecy Act BSA is US.

Source: complyadvantage.com

Source: complyadvantage.com

The Currency and Foreign Transactions Reporting Act of 1970 as amended hereinafter the Bank Secrecy Act or BSA provides inter alia authority for the Secretary of the Treasury to require financial institutions to maintain effective anti-money laundering AML programs2 These AML. 91-508 title II Oct. AML rules in the United States which grew out of the Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act set strict requirements for the reporting and recordkeeping of foreign financial agency transactions the filing of reports on foreign currency exchange transactions and reporting of exporting and importing monetary instruments. Currency and Foreign Transactions Reporting Act. Also called The Currency and Foreign Transactions Reporting Act of 1970 the BSA was initially adopted in 1970.

Source: sygna.io

26 1970 84 Stat. 91-508 title II Oct. Treasury Department Office of Foreign Asset Control and ii applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transaction Reporting Act of 1970 as amended including the Money Laundering Control Act of 1986 as amended the rules and regulations thereunder and any related or similar money laundering statutes rules regulations or guidelines issued administered or enforced by any Federal governmental agency collectively the Money. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. Bank Secrecy Act also called Currency and Foreign Transactions Reporting Act US.

Source: assignmentpoint.com

Source: assignmentpoint.com

Congress enacted the BSA to prevent banks and other. AML rules in the United States which grew out of the Currency and Foreign Transactions Reporting Act of 1970 commonly referred to as the Bank Secrecy Act set strict requirements for the reporting and recordkeeping of foreign financial agency transactions the filing of reports on foreign currency exchange transactions and reporting of exporting and importing monetary instruments. Bank Secrecy Act also called Currency and Foreign Transactions Reporting Act US. Rule 17a-8 – Financial Recordkeeping and Reporting of Currency and Foreign Transactions Every registered broker or dealer who is subject to the requirements of the Currency and Foreign Transactions Reporting Act of 1970 shall comply with the reporting recordkeeping and record retention requirements of part 103 of title 31 of the Code of Federal Regulations. 26 1970 84 Stat.

Source:

Financial institutions to assist. Every registered broker or dealer who is subject to the requirements of the Currency and Foreign Transactions Reporting Act of 1970 shall comply with the reporting recordkeeping and record retention requirements of chapter X of title 31 of the Code of Federal Regulations. Congress enacted the BSA to prevent banks and other. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. 301 a this act refers to only a portion of the Public Law.

Source: verafin.com

Source: verafin.com

Legislation created in 1970 to prevent financial institutions from being used as tools by. The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US. The Currency and Foreign Transactions Reporting Act of 1970 as amended hereinafter the Bank Secrecy Act or BSA provides inter alia authority for the Secretary of the Treasury to require financial institutions to maintain effective anti-money laundering AML programs2 These AML. 95-561 title III Sec. 301 a this act refers to only a portion of the Public Law.

Source: forbes.com

Source: forbes.com

The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. Legislation created in 1970 to prevent financial institutions from being used as tools by. 1051 et seq is often referred to as The Bank Secrecy Act BSA. The Currency and Foreign Transactions Reporting Act of 1970 the Currency Act was enacted as a means of requiring certain financial institutions including broker-dealers to create records of currency transactions that may be useful in criminal tax or other regulatory investigations. Bank Secrecy Act currency and foreign transactions reporting act of 1970 from MORTGAGE 101 at College of Staten Island CUNY.

Source: forbes.com

Source: forbes.com

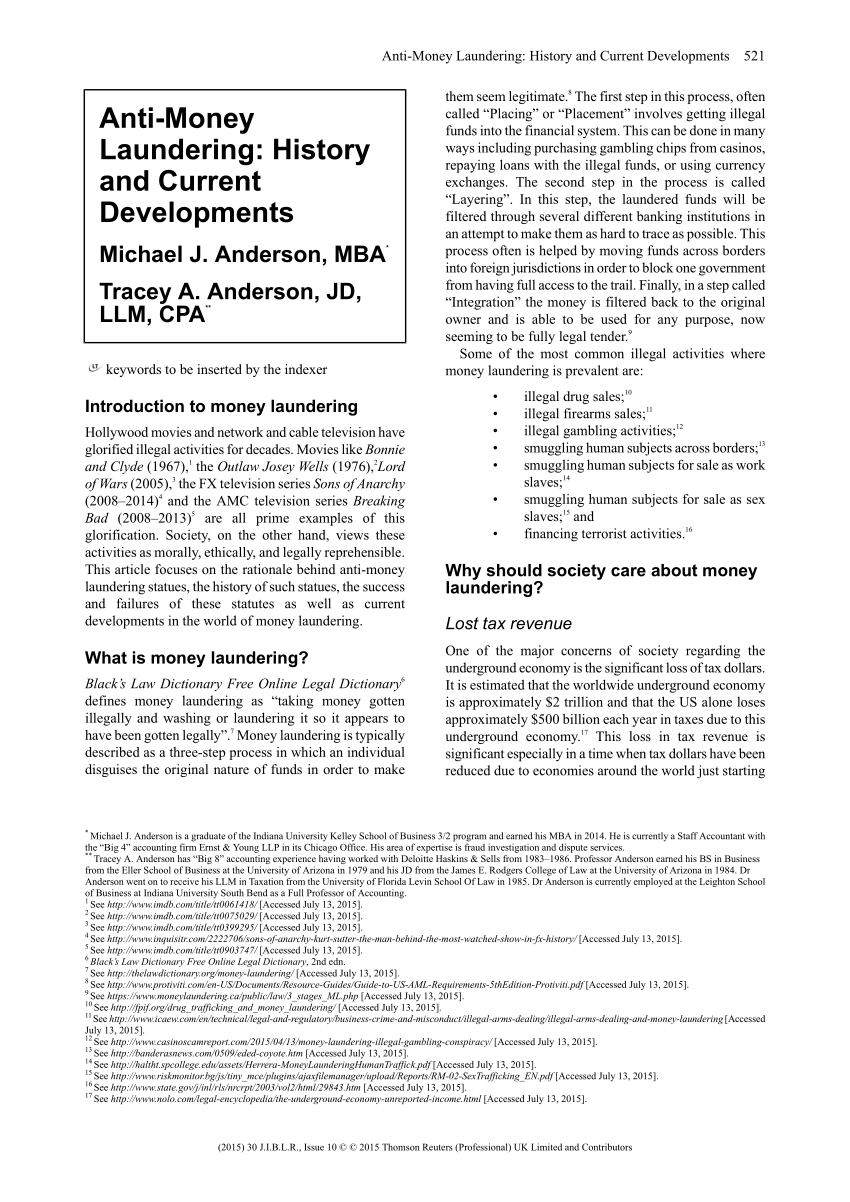

91-508 title II Oct. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. Reports led authorities to an extensive money laundering opera- tion that involved the transfer of tens of millions of dollars through banks and investment houses in New York City to finan-. Also called The Currency and Foreign Transactions Reporting Act of 1970 the BSA was initially adopted in 1970. Bank Secrecy Act also called Currency and Foreign Transactions Reporting Act US.

Source: researchgate.net

Source: researchgate.net

Where chapter X of title 31 of the Code of Federal Regulations and 24017a-4 of this chapter require the same records or reports. Financial institutions to assist US. 95-561 title III Sec. Currency and Foreign Transactions Reporting Act. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title currency and foreign transactions reporting act of 1970 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 19+ Aml definition finance ideas in 2021

- 17+ Bank negara malaysia nor shamsiah mohd yunus ideas in 2021

- 16++ How do you launder money by inflating expenses info

- 10+ Anti money laundering registration hmrc ideas

- 19++ Amld5 virtual currencies ideas

- 11++ How to apply for anti money laundering certificate information

- 20+ Anti money laundering for insurance agents ideas

- 10+ Currency and foreign transactions reporting act pdf ideas in 2021

- 13++ Commercial transactions exam notes info

- 14++ Explain term money laundering ideas