13+ Current eu money laundering directive ideas

Home » money laundering idea » 13+ Current eu money laundering directive ideasYour Current eu money laundering directive images are available. Current eu money laundering directive are a topic that is being searched for and liked by netizens today. You can Get the Current eu money laundering directive files here. Download all royalty-free photos and vectors.

If you’re searching for current eu money laundering directive pictures information connected with to the current eu money laundering directive topic, you have visit the ideal blog. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

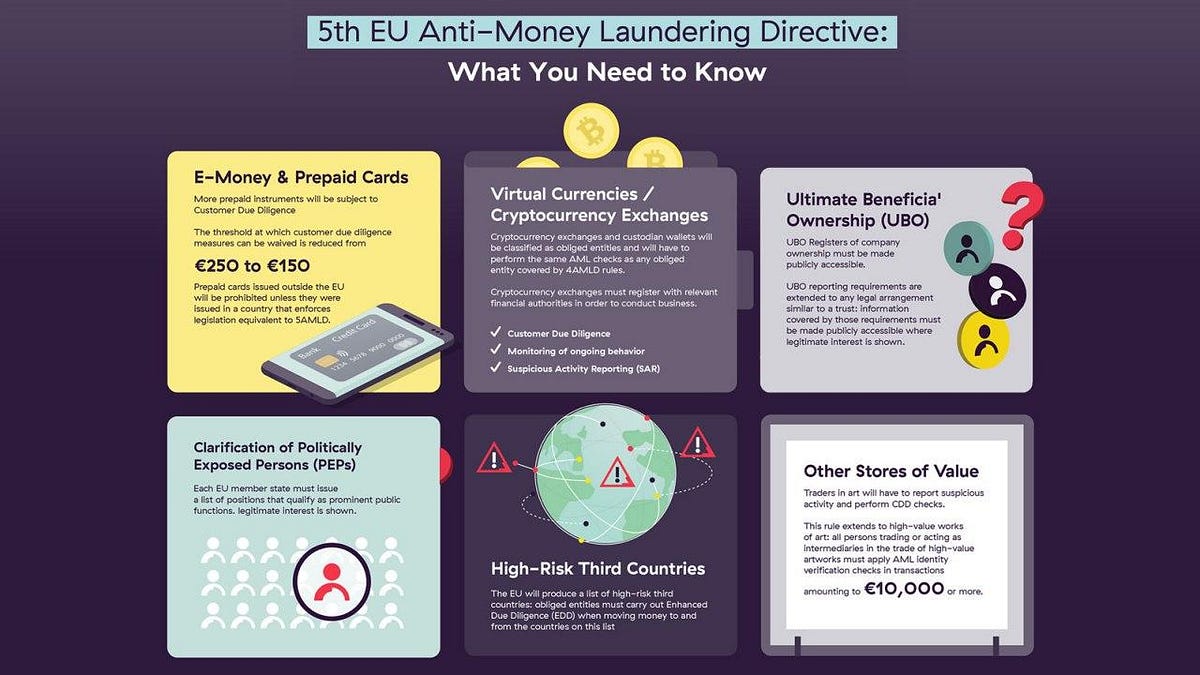

Current Eu Money Laundering Directive. Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and. The Fourth Anti Money Laundering Directive 4AMLD implemented the new recommendation by Financial Action Task Force 2012 FATF and revised the terms of the treaty once more to remove any ambiguities and improve consistency of AML and CTF. Regulated entities operating in the union will need to be compliant by June 3 2021. Professionals such as lawyers were finally included within the scope of the Directive.

Eu Policy On High Risk Third Countries European Commission From ec.europa.eu

Eu Policy On High Risk Third Countries European Commission From ec.europa.eu

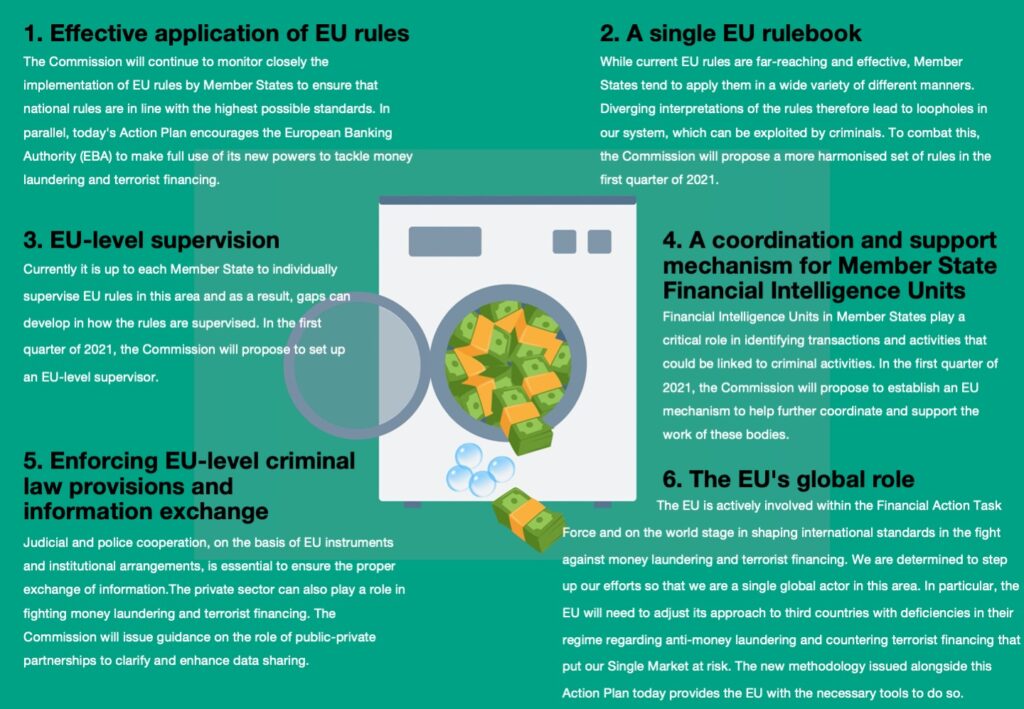

One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive. Following the entry into force of the Fourth Anti-Money Laundering Directive in 2015 the Commission published a first EU list of high-risk third countries based on the assessment of the. On 20 July 2021 the European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. The 6th Anti-Money Laundering Directive 6AMLD came into effect for all EU member states on 3 December 2020 and must be implemented by regulated businesses by 3 June 2021.

Like its predecessor this new directive is aimed to strengthen anti-money laundering AML rules in the union and place larger.

In the preceding 12 months a string of money laundering. The most recent EU anti money laundering directive is 6AMLD replacing 5AMLD and 4AMLD before that. This will bring Ireland in line with the current European anti-money laundering and countering the financing of. The 5 th Anti-Money Laundering Directive 1 AMLD to amend the current EU Anti-Money Laundering AML regime must be transposed into national law by 10 January 2020. On 8 September 2020 the Irish Government approved the Criminal Justice Money Laundering and Terrorist Financing Amendment Bill 2020 the Bill. The 6th Anti-Money Laundering Directive 6AMLD came into effect for all EU member states on 3 December 2020 and must be implemented by regulated businesses by 3 June 2021.

Source: lavenpartners.com

Source: lavenpartners.com

It carried out a number of modifications to the Third EU AML Directive. On 8 September 2020 the Irish Government approved the Criminal Justice Money Laundering and Terrorist Financing Amendment Bill 2020 the Bill. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive. The most recent EU anti money laundering directive is 6AMLD replacing 5AMLD and 4AMLD before that. This will bring Ireland in line with the current European anti-money laundering and countering the financing of.

Source: complyadvantage.com

Source: complyadvantage.com

In fact the Third Directive makes the regime applicable to lawyers notaries accountants real estate agents casinos and encompassing trust and company services exceeding 15000. On 20 July 2021 the European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. Like its predecessor this new directive is aimed to strengthen anti-money laundering AML rules in the union and place larger. The package also includes a proposal for the creation of a new EU authority to fight money laundering. This will bring Ireland in line with the current European anti-money laundering and countering the financing of.

Source: ec.europa.eu

Source: ec.europa.eu

The Bill will transpose the Fifth EU Money Laundering Directive the Directive. In view of the current three infringement proceedings for inadequate implementation of the provisions of the fourth anti-money laundering directive Directive EU 2015849. This will bring the country in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. It carried out a number of modifications to the Third EU AML Directive. Every directive adds to or updates regulatory obligations on member-state governments.

Source: branddocs.com

Source: branddocs.com

The package also includes a proposal for the creation of a new EU authority to fight money laundering. The 6th Anti-Money Laundering Directive 6AMLD came into effect for all EU member states on 3 December 2020 and must be implemented by regulated businesses by 3 June 2021. It follows on from the 4th and 5th MLDs and seeks to close certain loopholes in the EU Member States domestic legislation by harmonising the definition of money laundering. Like its predecessor this new directive is aimed to strengthen anti-money laundering AML rules in the union and place larger. The adoption of the Fourth in force since June 2015- and the Fifth Anti-Money Laundering Directives in force since 9 July 2018 - has considerably strengthened the EU regulatory framework.

Source: bankinghub.eu

Source: bankinghub.eu

According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. The Fourth Money Laundering Directive. The Amendment Act transposes the Fifth EU Money Laundering Directive the Directive into Irish law. In the preceding 12 months a string of money laundering. In view of the current three infringement proceedings for inadequate implementation of the provisions of the fourth anti-money laundering directive Directive EU 2015849.

Source: planetcompliance.com

Source: planetcompliance.com

Professionals such as lawyers were finally included within the scope of the Directive. The adoption of the Fourth in force since June 2015- and the Fifth Anti-Money Laundering Directives in force since 9 July 2018 - has considerably strengthened the EU regulatory framework. In view of the current three infringement proceedings for inadequate implementation of the provisions of the fourth anti-money laundering directive Directive EU 2015849. In the preceding 12 months a string of money laundering. On 20 July 2021 the European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules.

Source: dw.com

Source: dw.com

In fact the Third Directive makes the regime applicable to lawyers notaries accountants real estate agents casinos and encompassing trust and company services exceeding 15000. In the preceding 12 months a string of money laundering. The most recent EU anti money laundering directive is 6AMLD replacing 5AMLD and 4AMLD before that. The Amendment Act transposes the Fifth EU Money Laundering Directive the Directive into Irish law. On 8 September 2020 the Irish Government approved the Criminal Justice Money Laundering and Terrorist Financing Amendment Bill 2020 the Bill.

Source: branddocs.com

Source: branddocs.com

This will bring the country in line with the current European anti-money laundering and countering the financing of terrorism AMLCFT framework. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries. Like its predecessor this new directive is aimed to strengthen anti-money laundering AML rules in the union and place larger. Every directive adds to or updates regulatory obligations on member-state governments.

Source: tookitaki.ai

Source: tookitaki.ai

Money laundering is one of the EMPACT priorities Europols priority crime areas under the 20182021 EU Policy Cycle. Money laundering is one of the EMPACT priorities Europols priority crime areas under the 20182021 EU Policy Cycle. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive. As of December 3rd 2020 the European Unions Sixth Anti-Money Laundering Directive AMLD6 is in effect for all member states. In the preceding 12 months a string of money laundering.

Source: medium.com

Source: medium.com

Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and. Money laundering is an offence in its own right but it is also closely related to other forms of serious and organised crime as. The adoption of the Fourth in force since June 2015- and the Fifth Anti-Money Laundering Directives in force since 9 July 2018 - has considerably strengthened the EU regulatory framework. As of December 3rd 2020 the European Unions Sixth Anti-Money Laundering Directive AMLD6 is in effect for all member states. Professionals such as lawyers were finally included within the scope of the Directive.

Source: dw.com

Source: dw.com

One of the pillars of the European Unions legislation to combat money laundering and countering the financing of terrorism is Directive EU 2015849. Almost all criminal activities yield profits often in the form of cash that the criminals then seek to launder through various channels. On 8 September 2020 the Irish Government approved the Criminal Justice Money Laundering and Terrorist Financing Amendment Bill 2020 the Bill. Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and. In fact the Third Directive makes the regime applicable to lawyers notaries accountants real estate agents casinos and encompassing trust and company services exceeding 15000.

Source: fumagalli-usluge.hr

Source: fumagalli-usluge.hr

The Bill will transpose the Fifth EU Money Laundering Directive the Directive. On 20 July 2021 the European Commission presented an ambitious package of legislative proposals to strengthen the EUs anti-money laundering and countering the financing of terrorism AMLCFT rules. The approach of the EU is clear. Every directive adds to or updates regulatory obligations on member-state governments. Like its predecessor this new directive is aimed to strengthen anti-money laundering AML rules in the union and place larger.

Source: iclg.com

Source: iclg.com

As of December 3rd 2020 the European Unions Sixth Anti-Money Laundering Directive AMLD6 is in effect for all member states. The 6th Anti-Money Laundering Directive 6AMLD came into effect for all EU member states on 3 December 2020 and must be implemented by regulated businesses by 3 June 2021. In fact the Third Directive makes the regime applicable to lawyers notaries accountants real estate agents casinos and encompassing trust and company services exceeding 15000. Following the entry into force of the Fourth Anti-Money Laundering Directive in 2015 the Commission published a first EU list of high-risk third countries based on the assessment of the. According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third countries.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title current eu money laundering directive by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 11+ How is the money laundered in ozark information

- 12++ Dubai papers money laundering info

- 17+ 5amld bill ireland ideas in 2021

- 11+ Anti money laundering online course ideas in 2021

- 16+ Easiest university to get into australia ideas in 2021

- 10++ Hsbc money launder ideas in 2021

- 19++ Aml risk assessment report pdf information

- 19++ Anti corruption meaning in malayalam ideas

- 12++ Anti money laundering uk tax ideas

- 11+ 5th directive money laundering amendment information